- Taiwan

- /

- Auto Components

- /

- TPEX:1586

The China Fineblanking TechnologyLtd (GTSM:1586) Share Price Is Up 62% And Shareholders Are Holding On

The main point of investing for the long term is to make money. But more than that, you probably want to see it rise more than the market average. But China Fineblanking Technology Co.,Ltd. (GTSM:1586) has fallen short of that second goal, with a share price rise of 62% over five years, which is below the market return. Over the last twelve months the stock price has risen a very respectable 19%.

View our latest analysis for China Fineblanking TechnologyLtd

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

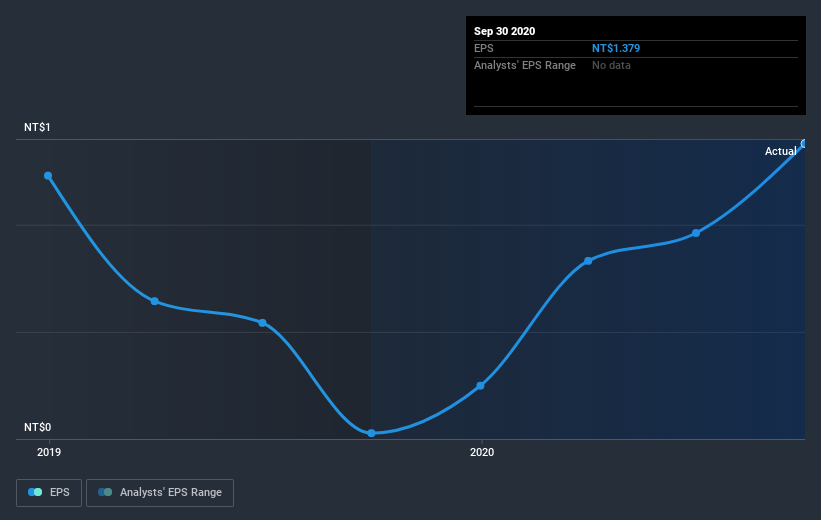

During the five years of share price growth, China Fineblanking TechnologyLtd moved from a loss to profitability. That's generally thought to be a genuine positive, so we would expect to see an increasing share price. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. We can see that the China Fineblanking TechnologyLtd share price is up 19% in the last three years. During the same period, EPS grew by 46% each year. This EPS growth is higher than the 6% average annual increase in the share price over the same three years. So you might conclude the market is a little more cautious about the stock, these days.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into China Fineblanking TechnologyLtd's key metrics by checking this interactive graph of China Fineblanking TechnologyLtd's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of China Fineblanking TechnologyLtd, it has a TSR of 70% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

China Fineblanking TechnologyLtd shareholders are up 19% for the year (even including dividends). But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 11% over half a decade It is possible that returns will improve along with the business fundamentals. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with China Fineblanking TechnologyLtd .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

When trading China Fineblanking TechnologyLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:1586

China Fineblanking TechnologyLtd

Manufactures and sells computer hard drives, automobiles, and metal parts in Taiwan and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.