- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6946

Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with major indices like the S&P 500 and Nasdaq Composite closing out a strong 2024 despite recent fluctuations, investors are paying close attention to economic indicators such as the Chicago PMI and GDP forecasts. In this environment of cautious optimism, identifying promising stocks requires a keen eye for companies that demonstrate resilience and potential growth amid broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Mendelson Infrastructures & Industries | 32.64% | 6.72% | 15.39% | ★★★★★★ |

| Payton Industries | NA | 9.27% | 15.41% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Chang Wah Technology (TPEX:6548)

Simply Wall St Value Rating: ★★★★★★

Overview: Chang Wah Technology Co., Ltd. focuses on developing, manufacturing, and selling LED lead frame and molding compound materials across Taiwan, Asia, and globally with a market cap of NT$31.45 billion.

Operations: Chang Wah Technology's revenue is primarily driven by its Chang Wah Technology segment at NT$6.39 billion, followed by Shanghai Chang Wah at NT$2.58 billion and MSHE at NT$2.28 billion. The company also generates significant income from Suzhou Xingsheng and Chengdu Xingsheng, contributing NT$1.99 billion and NT$1.31 billion respectively, while adjustments and eliminations account for a reduction of NT$4.15 billion in total revenue figures.

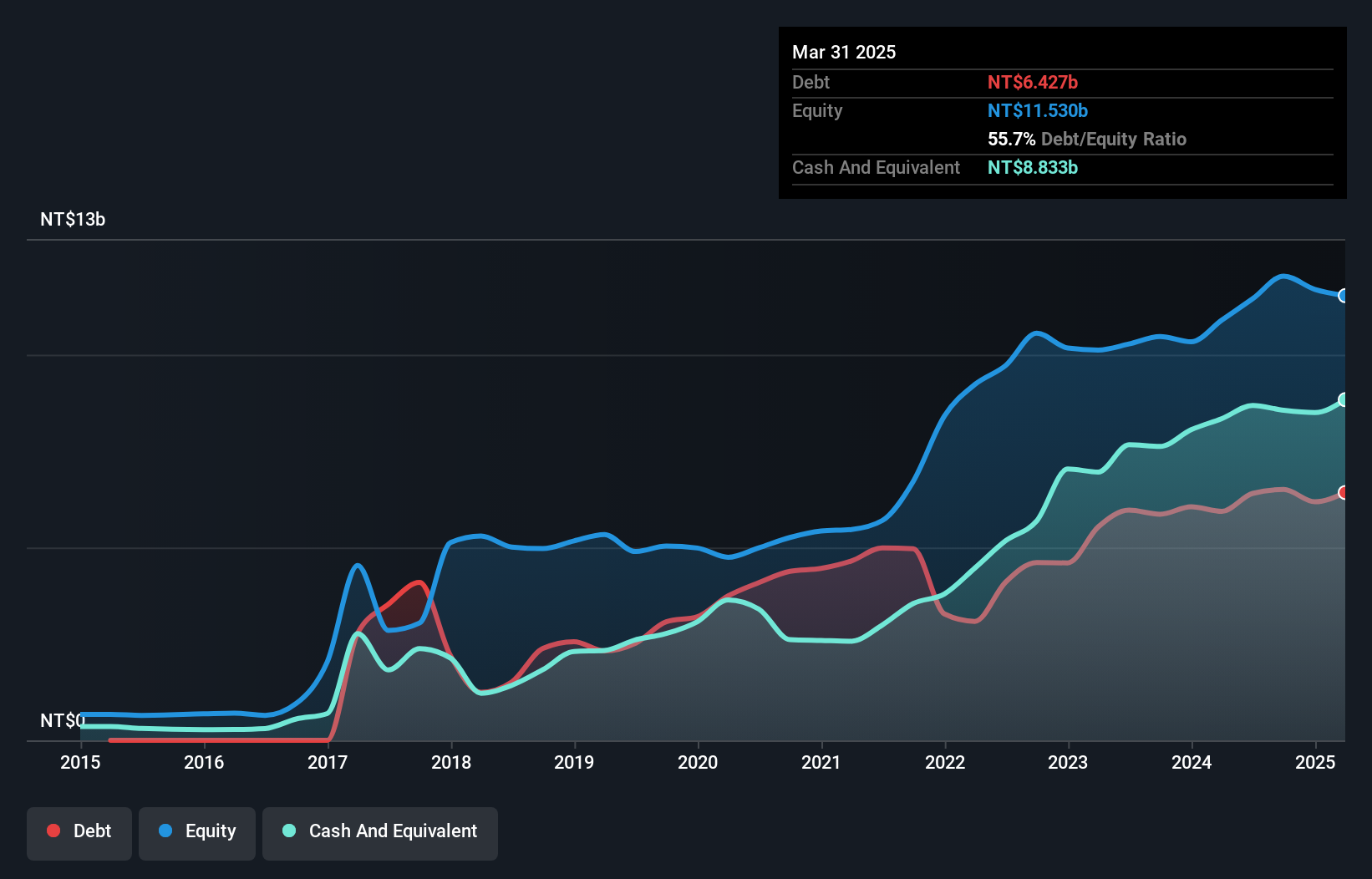

Chang Wah Technology shows potential, with recent sales hitting TWD 3.13 billion for Q3, up from TWD 2.84 billion last year, and net income at TWD 424.59 million compared to TWD 420.45 million previously. Despite a slight negative earnings growth of -1.5% over the past year, it trades at a favorable price-to-earnings ratio of 19.1x against the TW market's 20.8x and has reduced its debt to equity ratio from 61% to 54% in five years, indicating prudent financial management and positioning for future growth with projected earnings increasing by about 16% annually.

- Delve into the full analysis health report here for a deeper understanding of Chang Wah Technology.

Assess Chang Wah Technology's past performance with our detailed historical performance reports.

Nippon Avionics (TSE:6946)

Simply Wall St Value Rating: ★★★★★★

Overview: Nippon Avionics Co., Ltd. specializes in the manufacturing and sale of micro joining equipment in Japan, with a market capitalization of ¥39.59 billion.

Operations: Nippon Avionics generates revenue primarily from its Information Systems and Electronic Systems segments, with the former contributing ¥14.72 billion and the latter ¥3.77 billion. The company's focus on these segments highlights its strategic emphasis on technology-driven solutions in Japan's market.

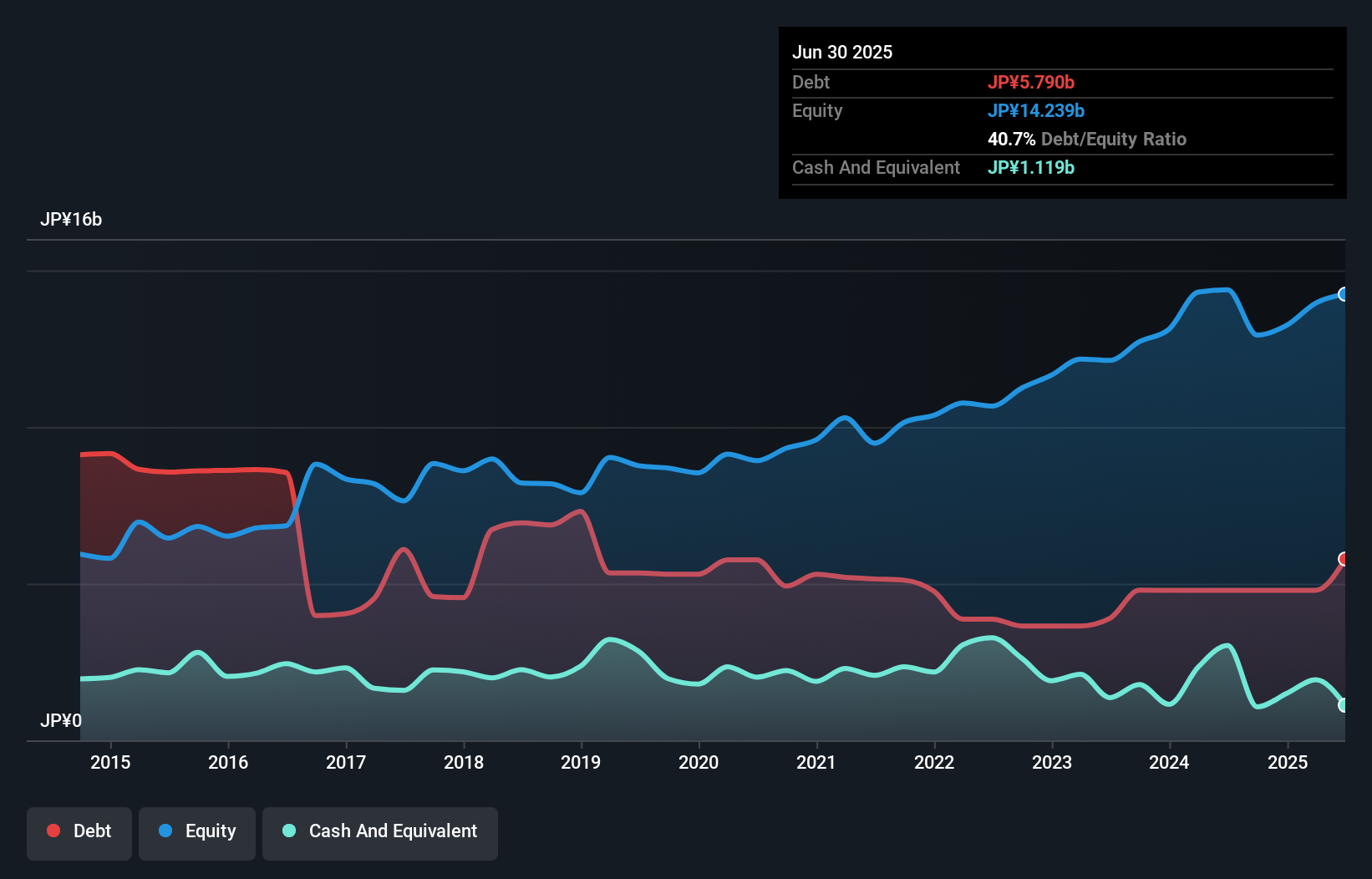

With a net debt to equity ratio of 28.8%, Nippon Avionics appears financially sound, which is considered satisfactory. Over the past year, earnings grew by 5.3%, surpassing the electronic industry's -1.1%. This growth trajectory is expected to continue at 13.87% annually, highlighting its potential in an otherwise challenging sector. The company also boasts high-quality earnings and free cash flow positivity, suggesting robust financial health despite recent share price volatility over three months. Interest payments are comfortably covered by EBIT at a multiple of 67x, indicating effective debt management and operational efficiency in this niche market player.

- Click here to discover the nuances of Nippon Avionics with our detailed analytical health report.

Understand Nippon Avionics' track record by examining our Past report.

Eurocharm Holdings (TWSE:5288)

Simply Wall St Value Rating: ★★★★★★

Overview: Eurocharm Holdings Co., Ltd. manufactures and sells motorcycle and auto equipment parts, medical equipment, and machine parts in Taiwan, Vietnam, and internationally with a market cap of NT$14.06 billion.

Operations: Eurocharm Holdings generates revenue primarily from the manufacturing and sales of automobile, locomotive parts, and medical equipment, amounting to NT$7.31 billion.

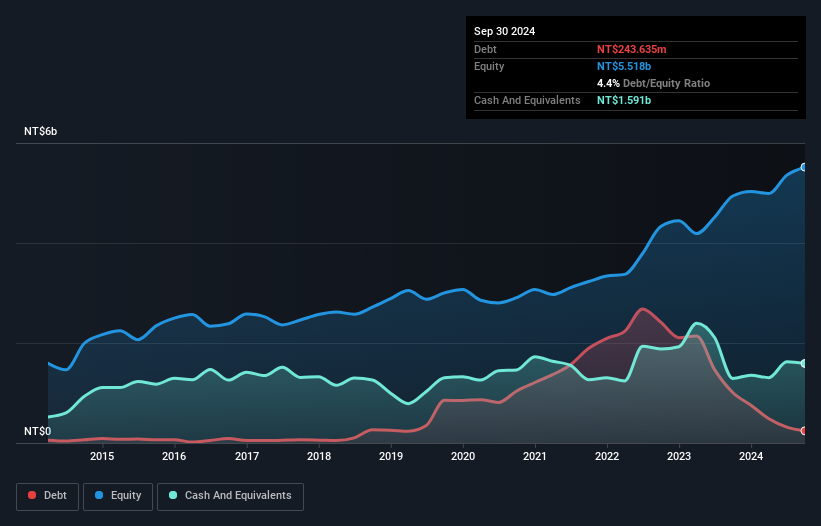

Eurocharm Holdings, a compact player in the auto components sector, is trading at 52% below its estimated fair value, suggesting potential upside. Despite high-quality earnings and a reduction in debt to equity from 28.4% to 4.4% over five years, recent performance shows mixed results. For Q3 2024, sales slightly increased to TWD 1.74 billion from TWD 1.73 billion last year; however, net income decreased to TWD 166 million compared to TWD 268 million previously. Earnings per share also dipped with basic EPS at TWD 2.47 versus TWD 4.04 a year ago, indicating some challenges ahead despite forecasted growth of over ten percent annually.

Make It Happen

- Gain an insight into the universe of 4667 Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Avionics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6946

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives