- Taiwan

- /

- Auto Components

- /

- TWSE:2250

Earnings Not Telling The Story For IKKA Holdings (Cayman) Limited (TWSE:2250) After Shares Rise 27%

IKKA Holdings (Cayman) Limited (TWSE:2250) shares have continued their recent momentum with a 27% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 64% in the last year.

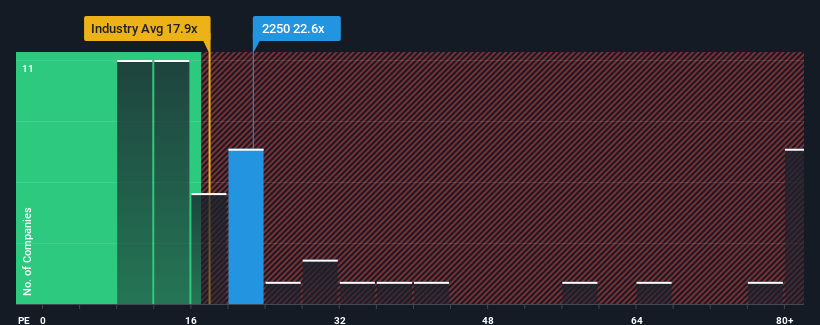

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about IKKA Holdings (Cayman)'s P/E ratio of 22.6x, since the median price-to-earnings (or "P/E") ratio in Taiwan is also close to 21x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been quite advantageous for IKKA Holdings (Cayman) as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for IKKA Holdings (Cayman)

How Is IKKA Holdings (Cayman)'s Growth Trending?

The only time you'd be comfortable seeing a P/E like IKKA Holdings (Cayman)'s is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 74%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 2.7% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 25% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that IKKA Holdings (Cayman) is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Bottom Line On IKKA Holdings (Cayman)'s P/E

IKKA Holdings (Cayman) appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of IKKA Holdings (Cayman) revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 1 warning sign for IKKA Holdings (Cayman) that you should be aware of.

You might be able to find a better investment than IKKA Holdings (Cayman). If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2250

IKKA Holdings (Cayman)

Manufactures, and develops plastic automotive parts and modules in Japan, China, Vietnam, Malaysia, and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives