As global markets grapple with AI concerns and fluctuating economic indicators, investors are increasingly seeking stability amidst volatility. In such an environment, dividend stocks can offer a reliable income stream while potentially providing some cushion against market swings.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.36% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.66% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.83% | ★★★★★★ |

| NCD (TSE:4783) | 4.52% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.15% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.18% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.53% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.77% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.80% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.56% | ★★★★★★ |

Click here to see the full list of 1322 stocks from our Top Global Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Tokyo Printing Ink Mfg (TSE:4635)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tokyo Printing Ink Mfg. Co., Ltd. manufactures and sells specialty chemicals both in Japan and internationally, with a market cap of ¥17.81 billion.

Operations: Tokyo Printing Ink Mfg. Co., Ltd. generates revenue through the production and sale of specialty chemicals across domestic and international markets.

Dividend Yield: 3.3%

Tokyo Printing Ink Mfg. offers a stable dividend yield of 3.31%, supported by a low payout ratio of 20.3% and a cash payout ratio of 44.1%, indicating strong coverage by earnings and cash flows. Over the past decade, dividends have been reliable with consistent growth, although the yield is slightly below Japan's top dividend payers at 3.65%. Recent guidance projects net sales of ¥47.30 billion and profits of ¥1.80 billion for FY2026, supporting continued dividend stability.

- Dive into the specifics of Tokyo Printing Ink Mfg here with our thorough dividend report.

- Our valuation report here indicates Tokyo Printing Ink Mfg may be undervalued.

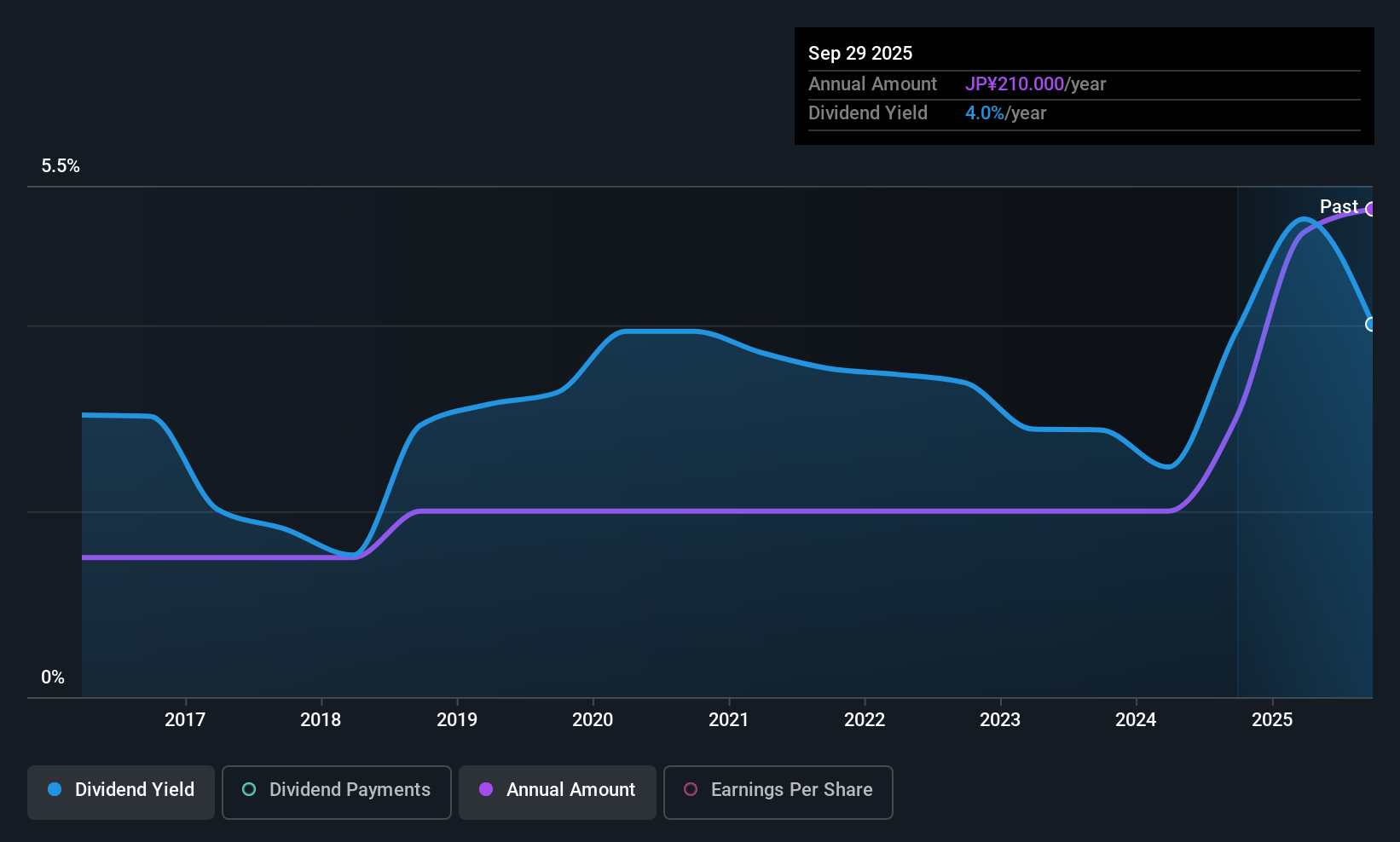

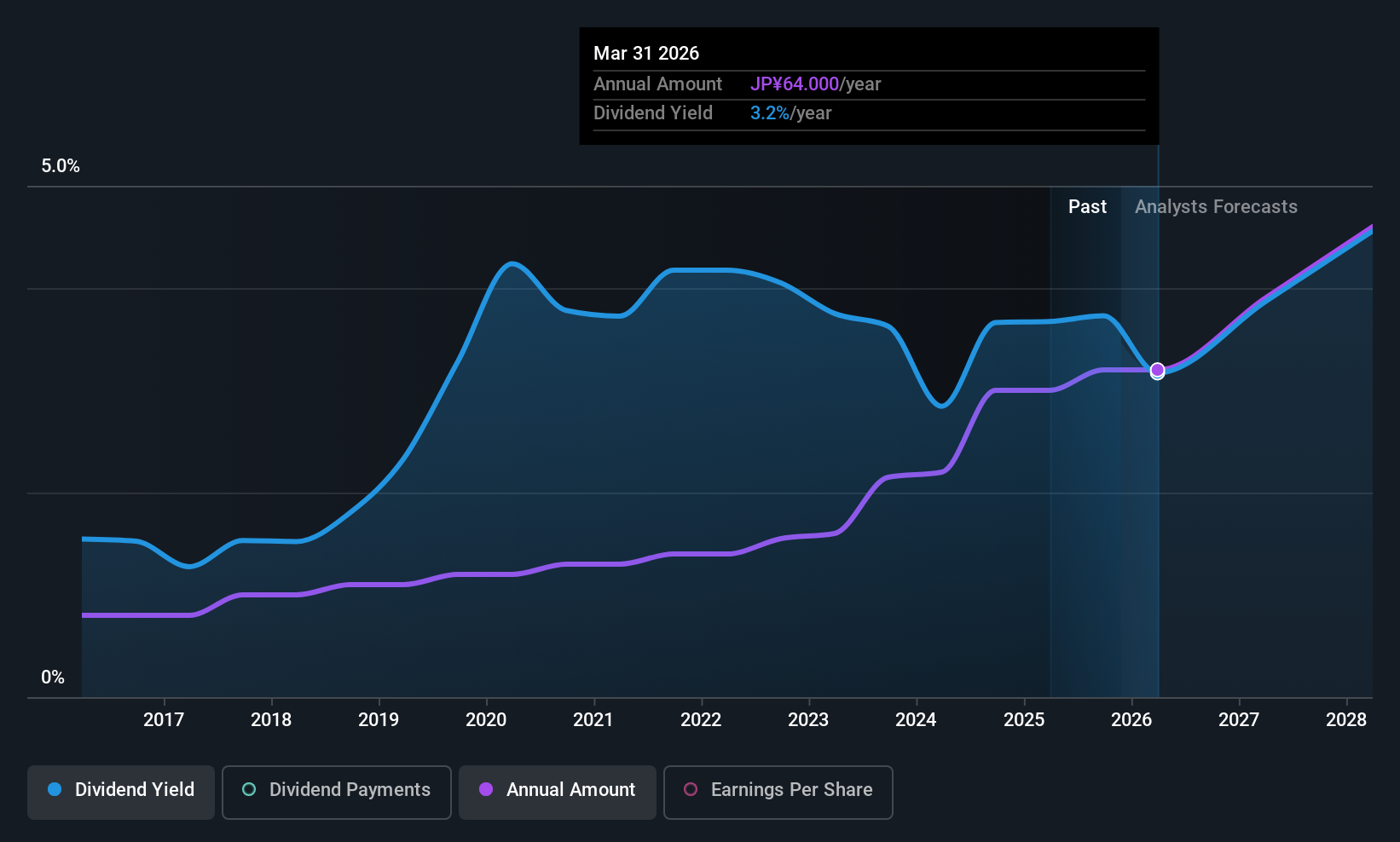

Yamaguchi Financial Group (TSE:8418)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yamaguchi Financial Group, Inc., along with its subsidiaries, offers a range of banking products and services in Japan and has a market cap of approximately ¥384.79 billion.

Operations: Yamaguchi Financial Group, Inc. generates revenue primarily from its Banking Business segment, which accounts for ¥171.74 billion.

Dividend Yield: 3.2%

Yamaguchi Financial Group's dividend payments have been stable and reliable over the past decade, supported by a low payout ratio of 32.2%, indicating strong coverage by earnings. Despite offering a dividend yield of 3.18%, which is below Japan's top payers, the company trades at a good value with a P/E ratio of 10.4x compared to the market average of 14.1x. Recent buyback announcements aim to enhance shareholder returns and capital efficiency, further supporting its dividend strategy.

- Get an in-depth perspective on Yamaguchi Financial Group's performance by reading our dividend report here.

- Our valuation report unveils the possibility Yamaguchi Financial Group's shares may be trading at a discount.

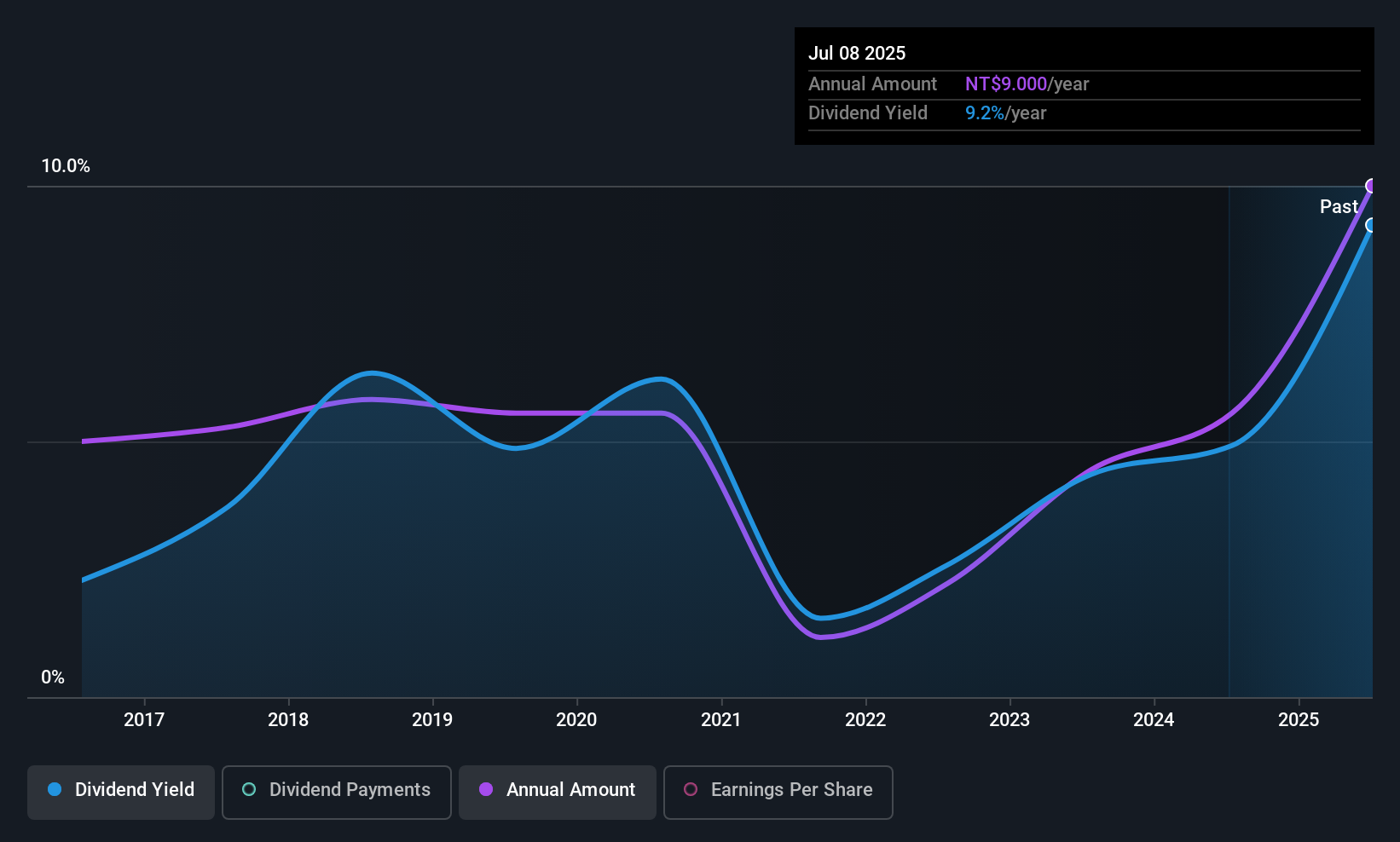

Iron Force Industrial (TWSE:2228)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Iron Force Industrial Co., Ltd. manufactures and trades airbag inflators for automotive safety systems in Taiwan and internationally, with a market cap of NT$7.43 billion.

Operations: Iron Force Industrial Co., Ltd.'s revenue segments include NT$762.63 million from Europe, NT$2.06 billion from Taiwan, and NT$2.23 billion from the Mainland Area.

Dividend Yield: 8.8%

Iron Force Industrial's dividend yield of 8.82% ranks in the top 25% of Taiwan's market, yet it's not well-covered by earnings with a payout ratio of 132.4%. Despite a decade-long growth in dividends, payments have been volatile and unreliable. The recent financials show declining sales and net income for Q3 2025, impacting earnings sustainability. Although trading slightly below fair value, high volatility and large one-off items challenge its dividend stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Iron Force Industrial.

- Our expertly prepared valuation report Iron Force Industrial implies its share price may be lower than expected.

Summing It All Up

- Investigate our full lineup of 1322 Top Global Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8418

Yamaguchi Financial Group

Provides various banking products and services in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success