- Taiwan

- /

- Auto Components

- /

- TWSE:2105

Risks To Shareholder Returns Are Elevated At These Prices For Cheng Shin Rubber Ind. Co., Ltd. (TWSE:2105)

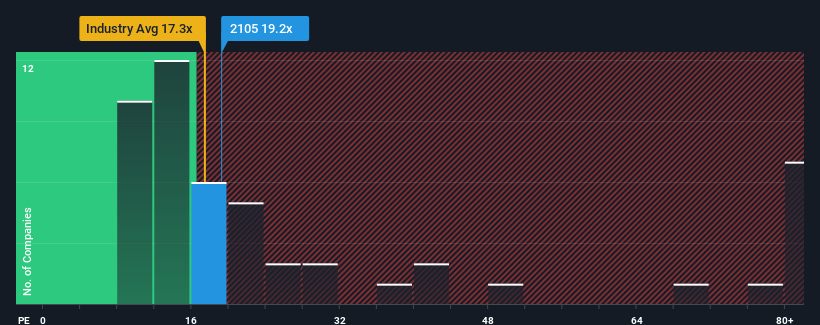

It's not a stretch to say that Cheng Shin Rubber Ind. Co., Ltd.'s (TWSE:2105) price-to-earnings (or "P/E") ratio of 19.2x right now seems quite "middle-of-the-road" compared to the market in Taiwan, where the median P/E ratio is around 21x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been advantageous for Cheng Shin Rubber Ind as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Cheng Shin Rubber Ind

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Cheng Shin Rubber Ind's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 29%. EPS has also lifted 12% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 11% as estimated by the four analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 25%, which is noticeably more attractive.

With this information, we find it interesting that Cheng Shin Rubber Ind is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Cheng Shin Rubber Ind's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 1 warning sign for Cheng Shin Rubber Ind that you should be aware of.

Of course, you might also be able to find a better stock than Cheng Shin Rubber Ind. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2105

Cheng Shin Rubber Ind

Together with subsidiaries, processes, manufactures, and trades in bicycle and electrical vehicle tires, reclaimed rubbers, rubbers and resins, and other rubber products.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives