- Taiwan

- /

- Auto Components

- /

- TWSE:2105

Do Cheng Shin Rubber Ind's (TWSE:2105) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Cheng Shin Rubber Ind (TWSE:2105), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Cheng Shin Rubber Ind with the means to add long-term value to shareholders.

Check out our latest analysis for Cheng Shin Rubber Ind

Cheng Shin Rubber Ind's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's easy to see why many investors focus in on EPS growth. Cheng Shin Rubber Ind's EPS shot up from NT$2.02 to NT$2.61; a result that's bound to keep shareholders happy. That's a impressive gain of 29%.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It was a year of stability for Cheng Shin Rubber Ind as both revenue and EBIT margins remained have been flat over the past year. While this doesn't ring alarm bells, it may not meet the expectations of growth-minded investors.

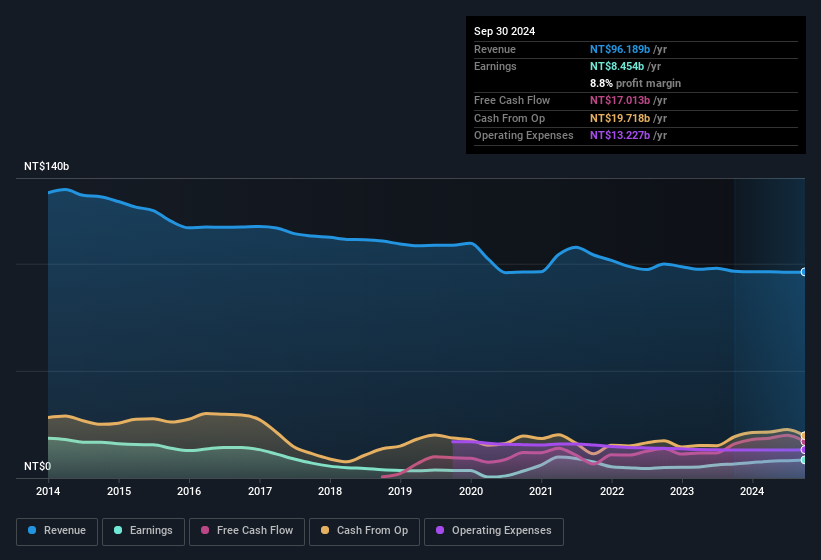

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Cheng Shin Rubber Ind's future EPS 100% free.

Are Cheng Shin Rubber Ind Insiders Aligned With All Shareholders?

Owing to the size of Cheng Shin Rubber Ind, we wouldn't expect insiders to hold a significant proportion of the company. But we are reassured by the fact they have invested in the company. Indeed, they have a considerable amount of wealth invested in it, currently valued at NT$51b. That equates to 31% of the company, making insiders powerful and aligned with other shareholders. Looking very optimistic for investors.

Does Cheng Shin Rubber Ind Deserve A Spot On Your Watchlist?

You can't deny that Cheng Shin Rubber Ind has grown its earnings per share at a very impressive rate. That's attractive. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Cheng Shin Rubber Ind's continuing strength. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Cheng Shin Rubber Ind that you should be aware of.

Although Cheng Shin Rubber Ind certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Taiwanese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2105

Cheng Shin Rubber Ind

Together with subsidiaries, processes, manufactures, and trades in bicycle and electrical vehicle tires, reclaimed rubbers, rubbers and resins, and other rubber products.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives