- Taiwan

- /

- Auto Components

- /

- TWSE:1587

Cryomax Cooling System (TWSE:1587) Will Pay A Smaller Dividend Than Last Year

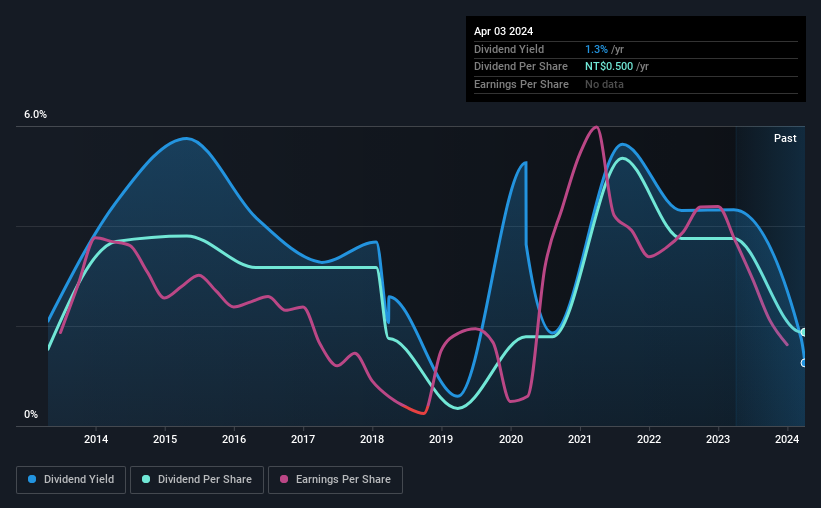

Cryomax Cooling System Corp. (TWSE:1587) has announced that on 28th of June, it will be paying a dividend ofNT$0.5004, which a reduction from last year's comparable dividend. This means that the annual payment is 1.3% of the current stock price, which is lower than what the rest of the industry is paying.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Cryomax Cooling System's stock price has increased by 75% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

View our latest analysis for Cryomax Cooling System

Cryomax Cooling System's Dividend Is Well Covered By Earnings

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. The last dividend made up quite a large portion of free cash flows, and this was made worse by the lack of free cash flows. We think that this practice can make the dividend quite risky in the future.

EPS is set to grow by 2.0% over the next year if recent trends continue. If recent patterns in the dividend continue, the payout ratio in 12 months could be 81% which is a bit high but can definitely be sustainable.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. The dividend has gone from an annual total of NT$0.41 in 2014 to the most recent total annual payment of NT$0.5. This means that it has been growing its distributions at 2.0% per annum over that time. It's encouraging to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth anyway, which makes this less attractive as an income investment.

Dividend Growth May Be Hard To Achieve

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Earnings have grown at around 2.0% a year for the past five years, which isn't massive but still better than seeing them shrink. Cryomax Cooling System's earnings per share has barely grown, which is not ideal - perhaps this is why the company pays out the majority of its earnings to shareholders. When a company prefers to pay out cash to its shareholders instead of reinvesting it, this can often say a lot about that company's dividend prospects.

The Dividend Could Prove To Be Unreliable

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. The payments are bit high to be considered sustainable, and the track record isn't the best. We would probably look elsewhere for an income investment.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For example, we've identified 4 warning signs for Cryomax Cooling System (1 shouldn't be ignored!) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1587

Cryomax Cooling System

Engages in the manufacturing, processing, and trading of metal water storage tanks for various vehicles in Taiwan, the United States, Asia, Europe, and internationally.

Slight risk with imperfect balance sheet.

Market Insights

Community Narratives