- Taiwan

- /

- Auto Components

- /

- TWSE:1587

Cryomax Cooling System Corp.'s (TWSE:1587) 26% Share Price Plunge Could Signal Some Risk

To the annoyance of some shareholders, Cryomax Cooling System Corp. (TWSE:1587) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Looking at the bigger picture, even after this poor month the stock is up 79% in the last year.

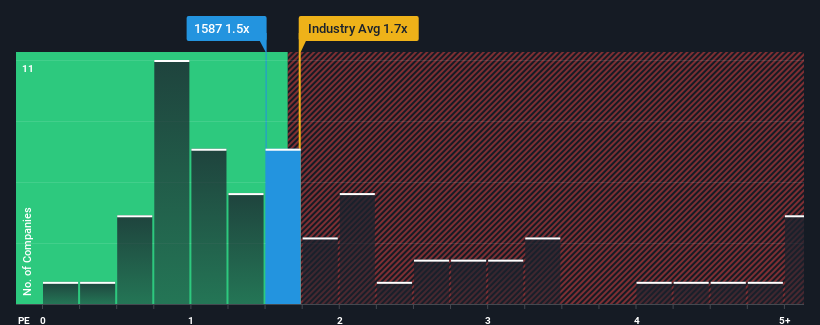

Although its price has dipped substantially, it's still not a stretch to say that Cryomax Cooling System's price-to-sales (or "P/S") ratio of 1.5x right now seems quite "middle-of-the-road" compared to the Auto Components industry in Taiwan, where the median P/S ratio is around 1.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Cryomax Cooling System

What Does Cryomax Cooling System's Recent Performance Look Like?

For instance, Cryomax Cooling System's receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Cryomax Cooling System, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Cryomax Cooling System?

The only time you'd be comfortable seeing a P/S like Cryomax Cooling System's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 8.9% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

This is in contrast to the rest of the industry, which is expected to grow by 8.5% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Cryomax Cooling System is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Cryomax Cooling System looks to be in line with the rest of the Auto Components industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Cryomax Cooling System revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Cryomax Cooling System (at least 2 which are potentially serious), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1587

Cryomax Cooling System

Engages in the manufacturing, processing, and trading of metal water storage tanks for various vehicles in Taiwan, the United States, Asia, Europe, and internationally.

Slight risk with imperfect balance sheet.

Market Insights

Community Narratives