- Taiwan

- /

- Auto Components

- /

- TWSE:2241

The Amulaire Thermal Technology (TPE:2241) Share Price Is Up 52% And Shareholders Are Holding On

Vanguard founder Jack Bogle helped spearhead the low-cost index fund, putting average returns within reach of every investor. But you can make superior returns by picking better-than average stocks. Notably, the Amulaire Thermal Technology, Inc. (TPE:2241) share price has gained 52% in three years, which is better than the average market return. It's also good to see a healthy gain of 21% in the last year.

View our latest analysis for Amulaire Thermal Technology

While Amulaire Thermal Technology made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

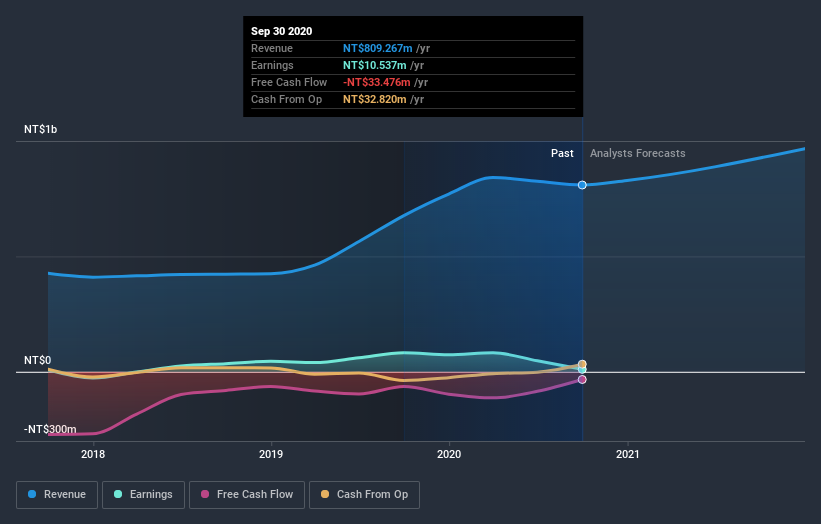

In the last 3 years Amulaire Thermal Technology saw its revenue grow at 30% per year. That's much better than most loss-making companies. While the compound gain of 15% per year over three years is pretty good, you might argue it doesn't fully reflect the strong revenue growth. If that's the case, now might be the time to take a close look at Amulaire Thermal Technology. If the company is trending towards profitability then it could be very interesting.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Amulaire Thermal Technology's financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Amulaire Thermal Technology the TSR over the last 3 years was 54%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Over the last year Amulaire Thermal Technology shareholders have received a TSR of 23%. It's always nice to make money but this return falls short of the market return which was about 46% for the year. On the other hand, the TSR over three years was worse, at just 15% per year. This suggests the company's position is improving. If the share price is up as a result of improved business performance, then this kind of improvement may be sustained. It's always interesting to track share price performance over the longer term. But to understand Amulaire Thermal Technology better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Amulaire Thermal Technology (of which 1 makes us a bit uncomfortable!) you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

When trading Amulaire Thermal Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:2241

Amulaire Thermal Technology

Engages in the manufacturing and sales of vehicles and electronic components in Taiwan, Germany, China, Poland, Japan, and internationally.

Flawless balance sheet with minimal risk.

Market Insights

Community Narratives