- Taiwan

- /

- Auto Components

- /

- TWSE:1525

Introducing Kian Shen (TPE:1525), A Stock That Climbed 34% In The Last Year

It's always best to build a diverse portfolio of shares, since any stock business could lag the broader market. Of course, in an ideal world, all your stocks would beat the market. One such company is Kian Shen Corporation (TPE:1525), which saw its share price increase 34% in the last year, slightly above the market return of around 33% (not including dividends). Unfortunately the longer term returns are not so good, with the stock falling 17% in the last three years.

View our latest analysis for Kian Shen

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the last twelve months, Kian Shen actually shrank its EPS by 17%.

So we don't think that investors are paying too much attention to EPS. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

Kian Shen's revenue actually dropped 19% over last year. So the fundamental metrics don't provide an obvious explanation for the share price gain.

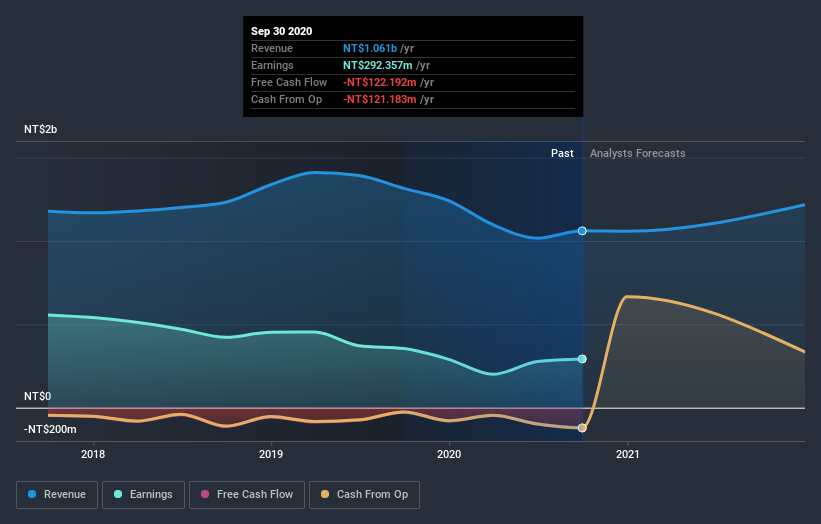

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Kian Shen, it has a TSR of 39% for the last year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Kian Shen provided a TSR of 39% over the year (including dividends). That's fairly close to the broader market return. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 1.1% over the last five years. While 'turnarounds seldom turn' there are green shoots for Kian Shen. It's always interesting to track share price performance over the longer term. But to understand Kian Shen better, we need to consider many other factors. For example, we've discovered 2 warning signs for Kian Shen (1 doesn't sit too well with us!) that you should be aware of before investing here.

Of course Kian Shen may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

When trading Kian Shen or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kian Shen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1525

Kian Shen

Kian Shen Corporation manufacturing and sales of automobile body beams, stamping molds, and woodworking products in Taiwan.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion