- Taiwan

- /

- Auto Components

- /

- TPEX:4570

Top Dividend Stocks Including Meier Tobler Group For Your Portfolio

Reviewed by Simply Wall St

As global markets continue to navigate a landscape of rising inflation and interest rate uncertainties, U.S. stock indexes have climbed toward record highs, with growth stocks leading the charge. Amidst this backdrop, dividend stocks offer a compelling opportunity for investors seeking income stability, making them an attractive consideration in today's volatile economic environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.41% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.88% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.01% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.42% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.15% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.21% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.33% | ★★★★★★ |

Click here to see the full list of 1989 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

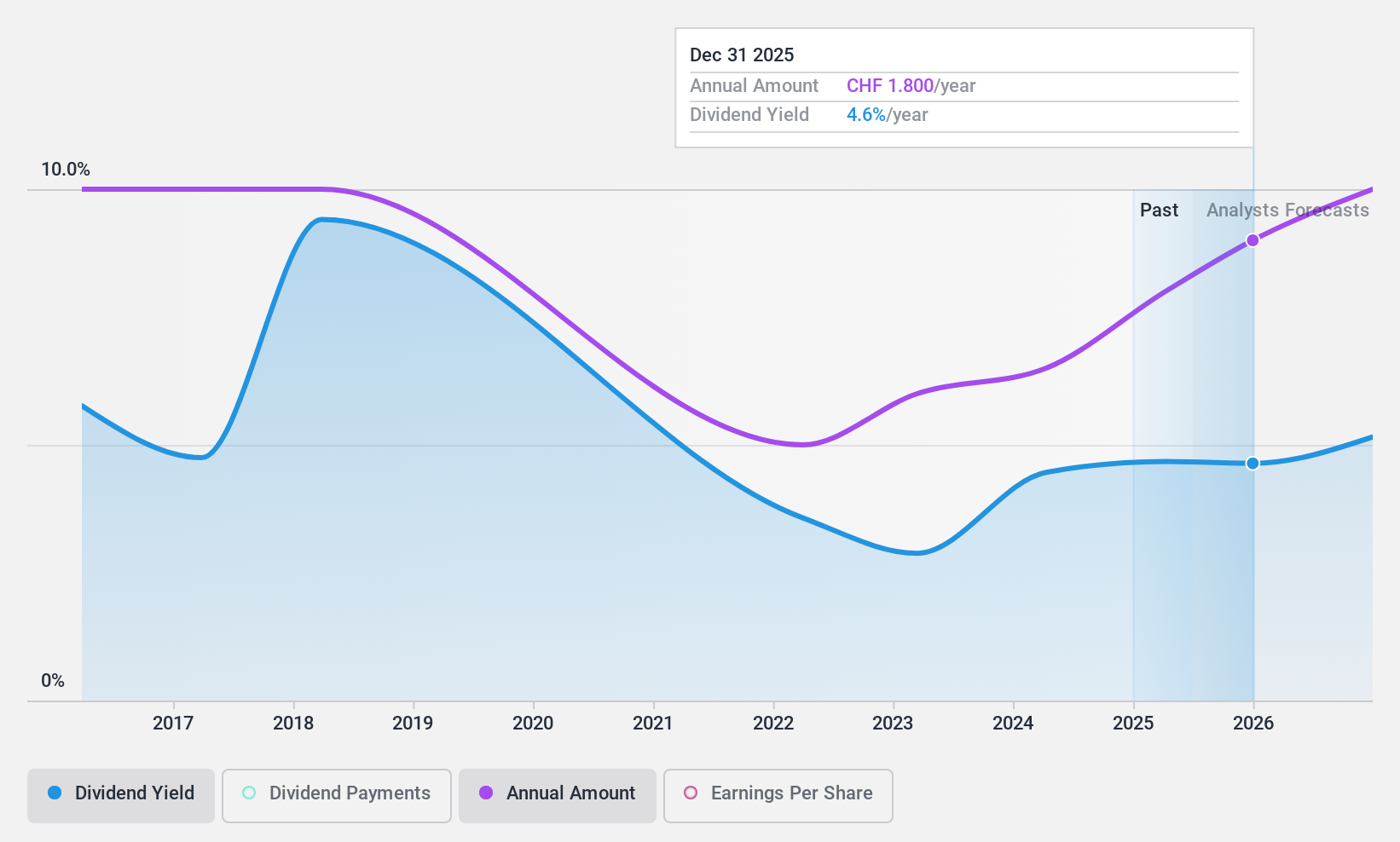

Meier Tobler Group (SWX:MTG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Meier Tobler Group AG operates as a trading and services company specializing in heat generation and air conditioning systems, with a market cap of CHF321.71 million.

Operations: Meier Tobler Group AG generates revenue through two primary segments: Service, contributing CHF104.01 million, and Distribution, accounting for CHF404.27 million.

Dividend Yield: 4.6%

Meier Tobler Group's dividend yield of 4.56% ranks in the top 25% of Swiss market payers; however, its sustainability is questionable due to a high cash payout ratio (179.3%) and volatile payment history over the past decade. Despite trading at a good value relative to peers, profit margins have decreased from 6.1% to 3.8%. Earnings cover the current payout ratio (76.3%), but dividends are not well supported by free cash flows or consistent earnings growth forecasts.

- Take a closer look at Meier Tobler Group's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Meier Tobler Group shares in the market.

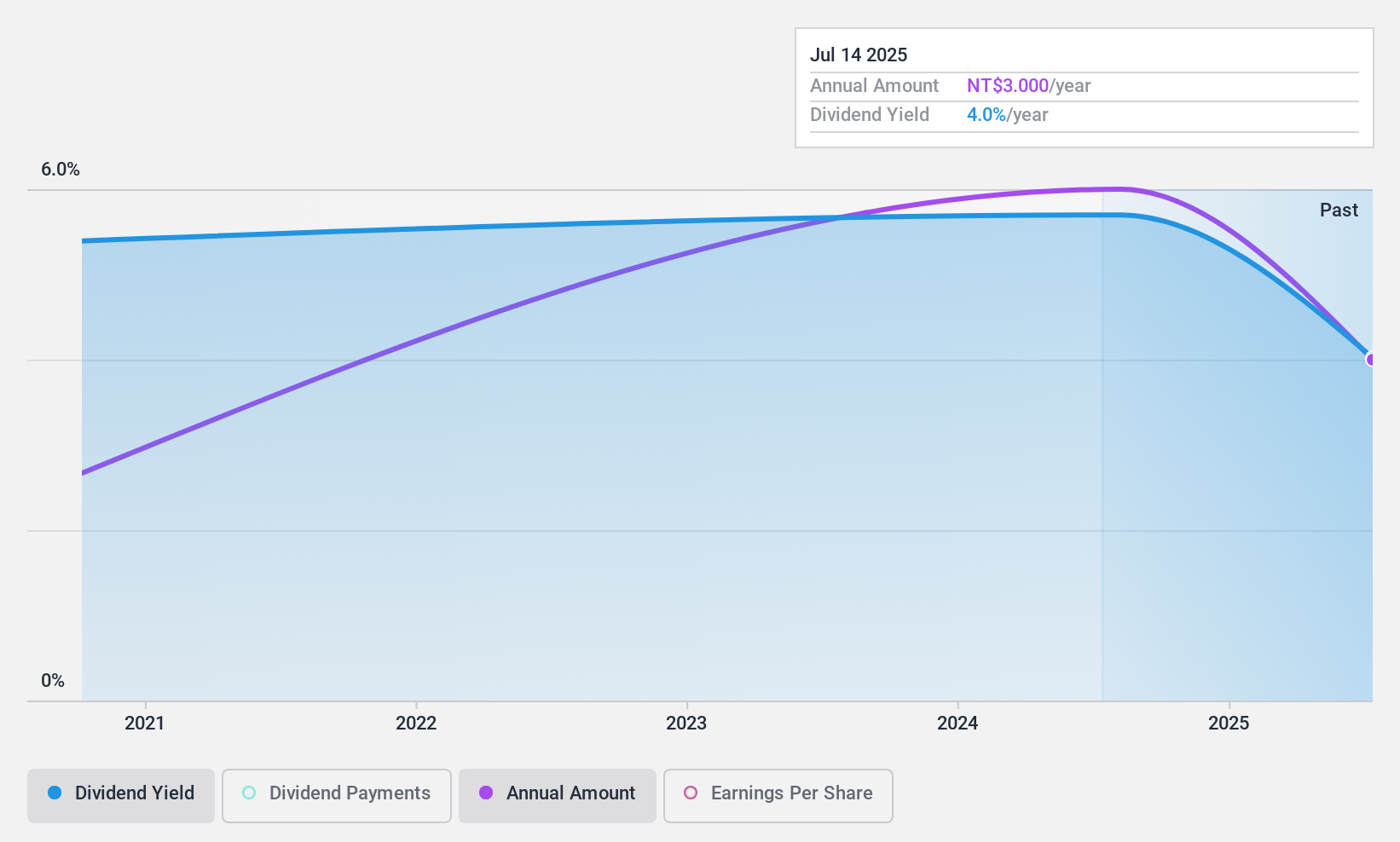

Jason (TPEX:4570)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jason Co., Ltd. manufactures and sells steering and suspension products in Taiwan, with a market cap of NT$3.49 billion.

Operations: Jason Co., Ltd.'s revenue is primarily derived from its FAST and Jielun segment, which generates NT$1.07 billion, and its Jason and Checheng segment, contributing NT$2.01 billion.

Dividend Yield: 5.7%

Jason's dividend yield of 5.67% is among the top 25% in the TW market, supported by a sustainable payout ratio of 63.8% and a cash payout ratio of 52.4%. Though dividends have been stable and growing with minimal volatility, they have only been paid for five years. Trading at a significant discount to its estimated fair value, Jason presents an attractive option for dividend investors seeking reliable income streams backed by solid earnings and cash flow coverage.

- Delve into the full analysis dividend report here for a deeper understanding of Jason.

- Our comprehensive valuation report raises the possibility that Jason is priced lower than what may be justified by its financials.

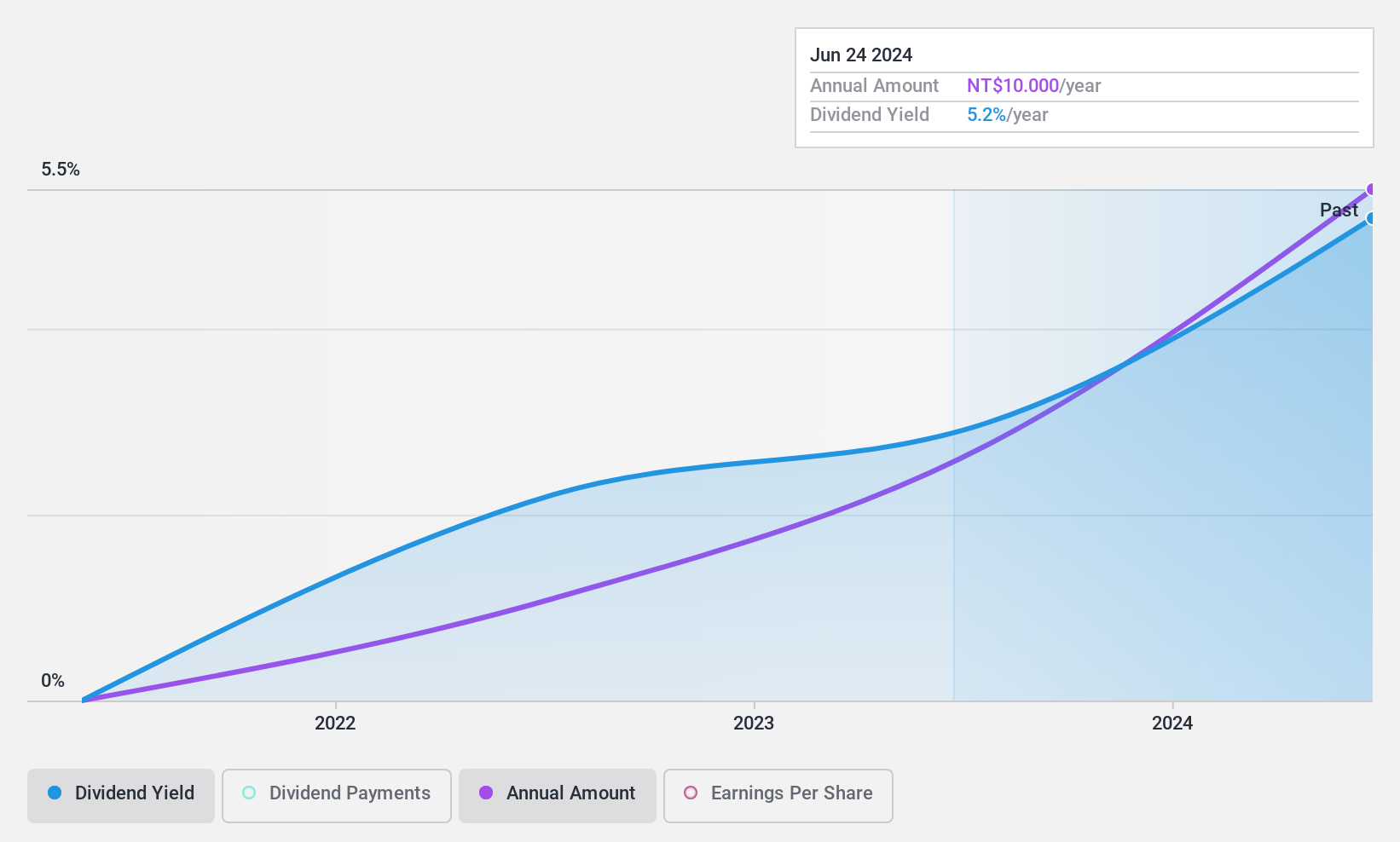

Taiwan Puritic (TPEX:6826)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taiwan Puritic Corp. specializes in the sale and maintenance of integrated circuit semiconductors, electronics, and computer equipment products in Taiwan, with a market capitalization of NT$12.40 billion.

Operations: Taiwan Puritic Corp.'s revenue segment includes NT$15.99 billion from the installation of gas equipment.

Dividend Yield: 4.9%

Taiwan Puritic offers a compelling dividend profile with a yield of 4.9%, placing it in the top 25% within the TW market. Despite only four years of dividend history, payments have been stable and growing, supported by a low payout ratio of 44.1% and cash payout coverage at 69.2%. The stock's price-to-earnings ratio of 9x suggests it is trading favorably compared to the TW market average, enhancing its appeal for value-focused dividend investors.

- Get an in-depth perspective on Taiwan Puritic's performance by reading our dividend report here.

- Our valuation report here indicates Taiwan Puritic may be overvalued.

Taking Advantage

- Gain an insight into the universe of 1989 Top Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:4570

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)