- Taiwan

- /

- Auto Components

- /

- TPEX:4535

Looking For Steady Income For Your Dividend Portfolio? Is Fine Blanking & Tool Co., Ltd (GTSM:4535) A Good Fit?

Today we'll take a closer look at Fine Blanking & Tool Co., Ltd (GTSM:4535) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

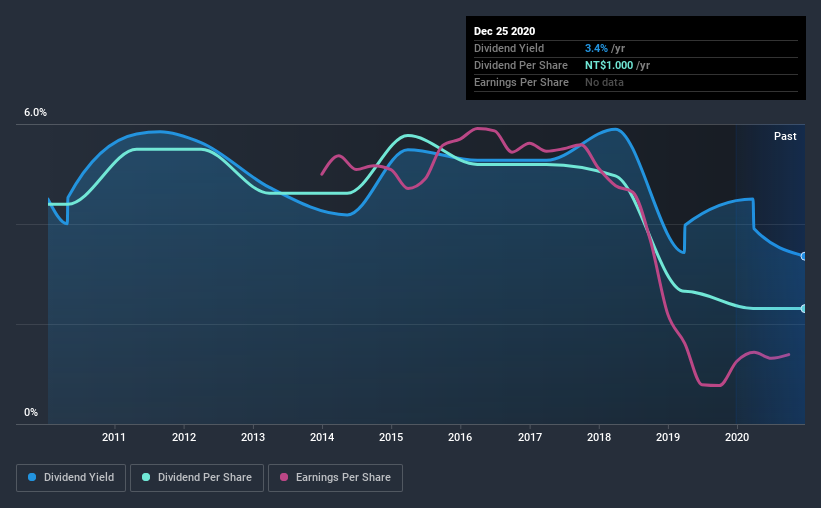

In this case, Fine Blanking & Tool likely looks attractive to investors, given its 3.4% dividend yield and a payment history of over ten years. It would not be a surprise to discover that many investors buy it for the dividends. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on Fine Blanking & Tool!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Fine Blanking & Tool paid out 124% of its profit as dividends, over the trailing twelve month period. Unless there are extenuating circumstances, from the perspective of an investor who hopes to own the company for many years, a payout ratio of above 100% is definitely a concern.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Fine Blanking & Tool paid out 54% of its free cash flow last year, which is acceptable, but is starting to limit the amount of earnings that can be reinvested into the business. It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Fine Blanking & Tool fortunately did generate enough cash to fund its dividend. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

While the above analysis focuses on dividends relative to a company's earnings, we do note Fine Blanking & Tool's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Remember, you can always get a snapshot of Fine Blanking & Tool's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. For the purpose of this article, we only scrutinise the last decade of Fine Blanking & Tool's dividend payments. This dividend has been unstable, which we define as having been cut one or more times over this time. During the past 10-year period, the first annual payment was NT$1.9 in 2010, compared to NT$1.0 last year. This works out to be a decline of approximately 6.2% per year over that time. Fine Blanking & Tool's dividend hasn't shrunk linearly at 6.2% per annum, but the CAGR is a useful estimate of the historical rate of change.

When a company's per-share dividend falls we question if this reflects poorly on either external business conditions, or the company's capital allocation decisions. Either way, we find it hard to get excited about a company with a declining dividend.

Dividend Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Fine Blanking & Tool's earnings per share have shrunk at 24% a year over the past five years. With this kind of significant decline, we always wonder what has changed in the business. Dividends are about stability, and Fine Blanking & Tool's earnings per share, which support the dividend, have been anything but stable.

Conclusion

To summarise, shareholders should always check that Fine Blanking & Tool's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. We're a bit uncomfortable with its high payout ratio, although at least the dividend was covered by free cash flow. Earnings per share have been falling, and the company has cut its dividend at least once in the past. From a dividend perspective, this is a cause for concern. In this analysis, Fine Blanking & Tool doesn't shape up too well as a dividend stock. We'd find it hard to look past the flaws, and would not be inclined to think of it as a reliable dividend-payer.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come accross 3 warning signs for Fine Blanking & Tool you should be aware of, and 1 of them is a bit concerning.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

When trading Fine Blanking & Tool or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:4535

Fine Blanking & Tool

Manufactures and trades automobiles, motorcycle parts, and various molds in Taiwan.

Flawless balance sheet and fair value.

Market Insights

Community Narratives