- Taiwan

- /

- Auto Components

- /

- TPEX:3552

The Tung Thih Electronic (GTSM:3552) Share Price Has Soared 438%, Delighting Many Shareholders

Active investing isn't easy, but for those that do it, the aim is to find the best companies to buy, and to profit handsomely. While not every stock performs well, when investors win, they can win big. For example, the Tung Thih Electronic Co., Ltd. (GTSM:3552) share price rocketed moonwards 438% in just one year. It's also good to see the share price up 119% over the last quarter. And shareholders have also done well over the long term, with an increase of 124% in the last three years.

See our latest analysis for Tung Thih Electronic

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Tung Thih Electronic went from making a loss to reporting a profit, in the last year.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

Tung Thih Electronic's revenue actually dropped 6.6% over last year. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

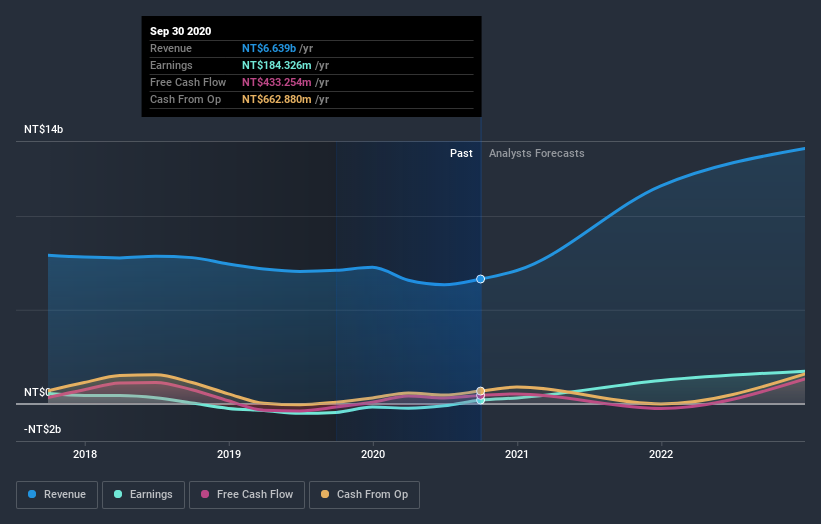

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Tung Thih Electronic has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Tung Thih Electronic

A Different Perspective

We're pleased to report that Tung Thih Electronic shareholders have received a total shareholder return of 438% over one year. Notably the five-year annualised TSR loss of 3% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Tung Thih Electronic better, we need to consider many other factors. Take risks, for example - Tung Thih Electronic has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade Tung Thih Electronic, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tung Thih Electronic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3552

Tung Thih Electronic

Researches, develops, designs, manufactures, and sells automotive electronics products in Taiwan, Asia, and the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives