- Taiwan

- /

- Auto Components

- /

- TPEX:2235

Would Shareholders Who Purchased I Yuan Precision Industrial's (GTSM:2235) Stock Five Years Be Happy With The Share price Today?

Statistically speaking, long term investing is a profitable endeavour. But along the way some stocks are going to perform badly. For example, after five long years the I Yuan Precision Industrial Co., Ltd. (GTSM:2235) share price is a whole 64% lower. That is extremely sub-optimal, to say the least. There was little comfort for shareholders in the last week as the price declined a further 2.4%.

View our latest analysis for I Yuan Precision Industrial

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

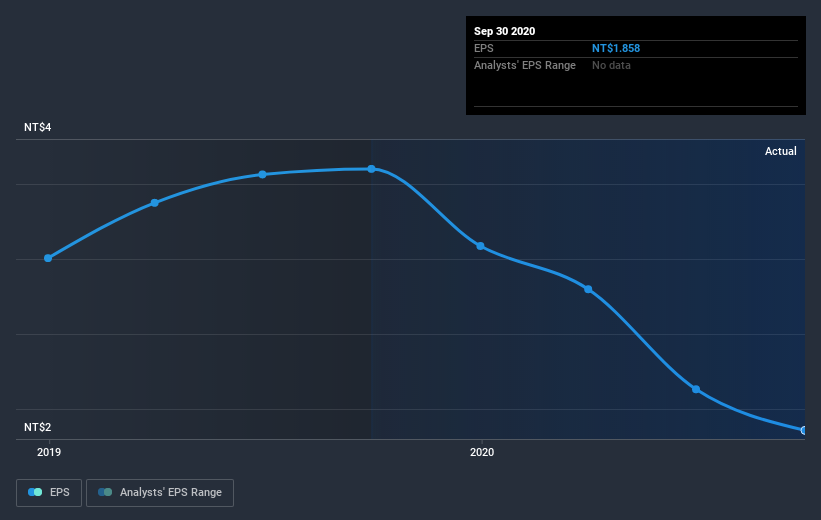

During the five years over which the share price declined, I Yuan Precision Industrial's earnings per share (EPS) dropped by 22% each year. Notably, the share price has fallen at 19% per year, fairly close to the change in the EPS. This suggests that market participants have not changed their view of the company all that much. Rather, the share price has approximately tracked EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into I Yuan Precision Industrial's key metrics by checking this interactive graph of I Yuan Precision Industrial's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, I Yuan Precision Industrial's TSR for the last 5 years was -54%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

I Yuan Precision Industrial shareholders are down 20% for the year (even including dividends), but the market itself is up 33%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that I Yuan Precision Industrial is showing 4 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

But note: I Yuan Precision Industrial may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade I Yuan Precision Industrial, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:2235

I Yuan Precision Industrial

Manufactures, processes, trades in, imports, and exports auto parts and components in Taiwan, Asia, America, and Europe.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives