- Saudi Arabia

- /

- Chemicals

- /

- SASE:2310

December 2024's Noteworthy Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

As global markets continue to reach new heights, with major indices like the Dow Jones and S&P 500 hitting record intraday highs, investors are navigating a landscape influenced by domestic policy shifts and geopolitical developments. In this environment of rising market optimism and economic complexity, identifying stocks that may be undervalued relative to their intrinsic value can offer potential opportunities for those seeking to balance growth prospects with prudent investment strategies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.12 | US$99.93 | 49.8% |

| DO & CO (WBAG:DOC) | €160.00 | €317.77 | 49.6% |

| Stille (OM:STIL) | SEK220.00 | SEK437.81 | 49.7% |

| Mobvista (SEHK:1860) | HK$8.00 | HK$15.99 | 50% |

| Nidaros Sparebank (OB:NISB) | NOK100.00 | NOK198.62 | 49.7% |

| Charter Hall Group (ASX:CHC) | A$15.50 | A$31.22 | 50.4% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$27.25 | HK$54.31 | 49.8% |

| EQL Pharma (OM:EQL) | SEK77.00 | SEK153.58 | 49.9% |

| Hd Hyundai MipoLtd (KOSE:A010620) | ₩125600.00 | ₩249514.81 | 49.7% |

| Hesai Group (NasdaqGS:HSAI) | US$8.18 | US$16.30 | 49.8% |

Let's dive into some prime choices out of the screener.

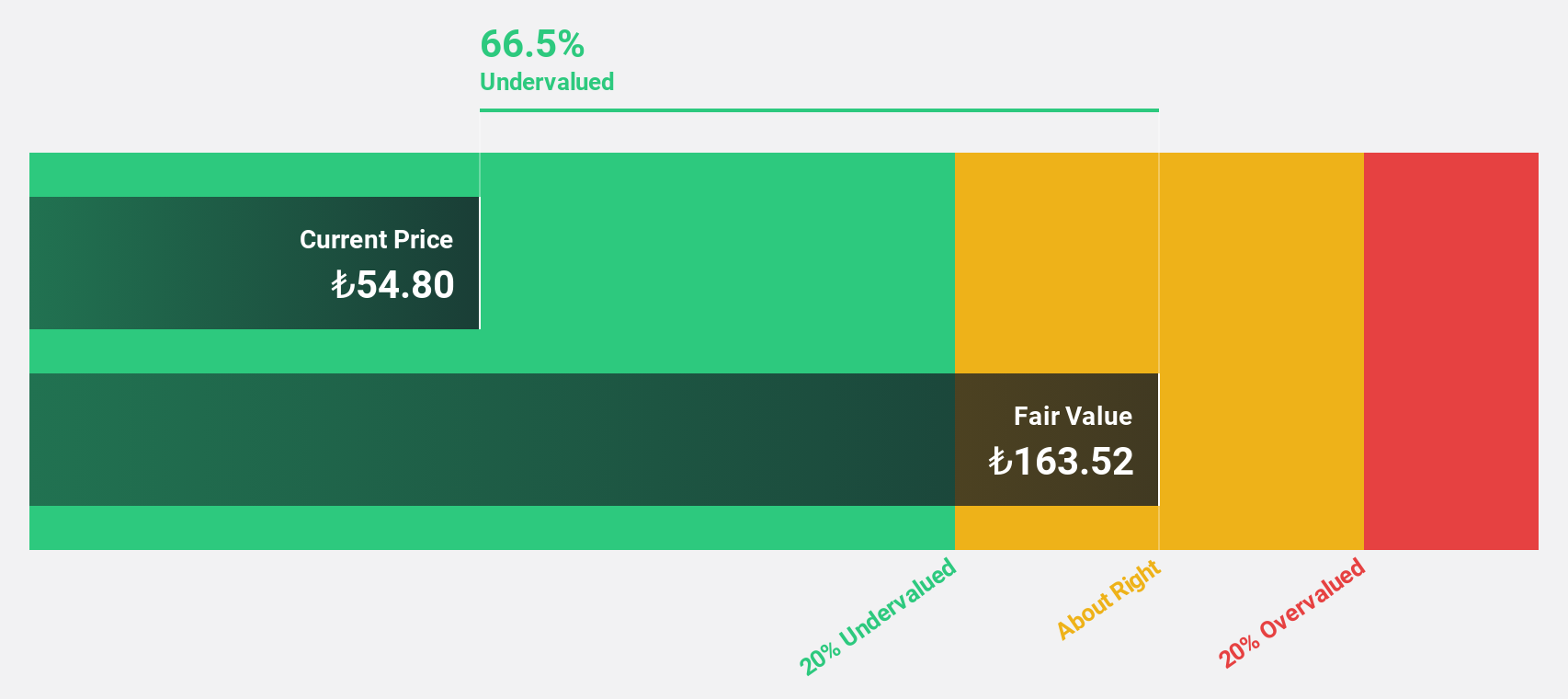

Enerjisa Enerji (IBSE:ENJSA)

Overview: Enerjisa Enerji A.S. operates in Turkey, providing electricity distribution, retail sales, and customer solutions through its subsidiaries, with a market cap of TRY73.82 billion.

Operations: The company's revenue segments include Retail at TRY59.22 billion, Customer Solutions at TRY5.56 billion, and Distribution/Retail at TRY56.18 billion.

Estimated Discount To Fair Value: 29.5%

Enerjisa Enerji is trading at TRY 62.5, which is over 20% below its estimated fair value of TRY 88.62, indicating potential undervaluation based on cash flows. Despite recent financial challenges with a third-quarter net loss of TRY 934.96 million, earnings are forecast to grow significantly by 182% annually and the company is expected to become profitable within three years. However, interest payments aren't well covered by earnings and dividends lack coverage from free cash flows.

- The analysis detailed in our Enerjisa Enerji growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Enerjisa Enerji.

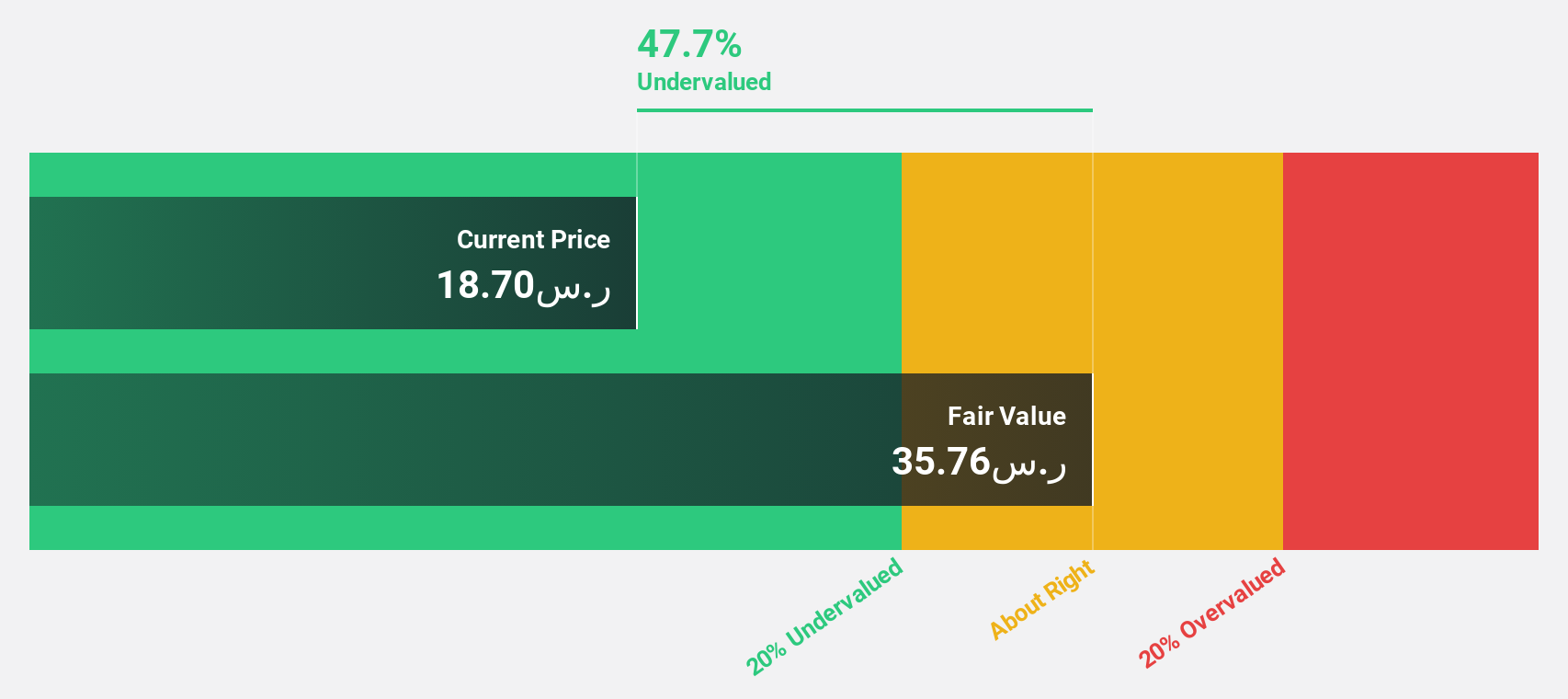

Sahara International Petrochemical (SASE:2310)

Overview: Sahara International Petrochemical Company operates and manages industrial projects in the chemical and petrochemical sectors within Saudi Arabia, with a market capitalization of SAR18.03 billion.

Operations: The company's revenue segments consist of Polymers (SAR2.30 billion), Marketing (SAR4.93 billion), Basic Chemicals (SAR2.41 billion), and Intermediate Chemicals (SAR2.31 billion).

Estimated Discount To Fair Value: 35.4%

Sahara International Petrochemical is trading at SAR 24.86, significantly below its estimated fair value of SAR 38.48, suggesting potential undervaluation based on cash flows. Despite a decline in profit margins and net income compared to last year, earnings are forecast to grow substantially by 35.9% annually over the next three years. The recent digital transformation with SAP S/4HANA enhances operational efficiency but dividend payouts remain inadequately covered by earnings, presenting a mixed outlook for investors.

- In light of our recent growth report, it seems possible that Sahara International Petrochemical's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Sahara International Petrochemical stock in this financial health report.

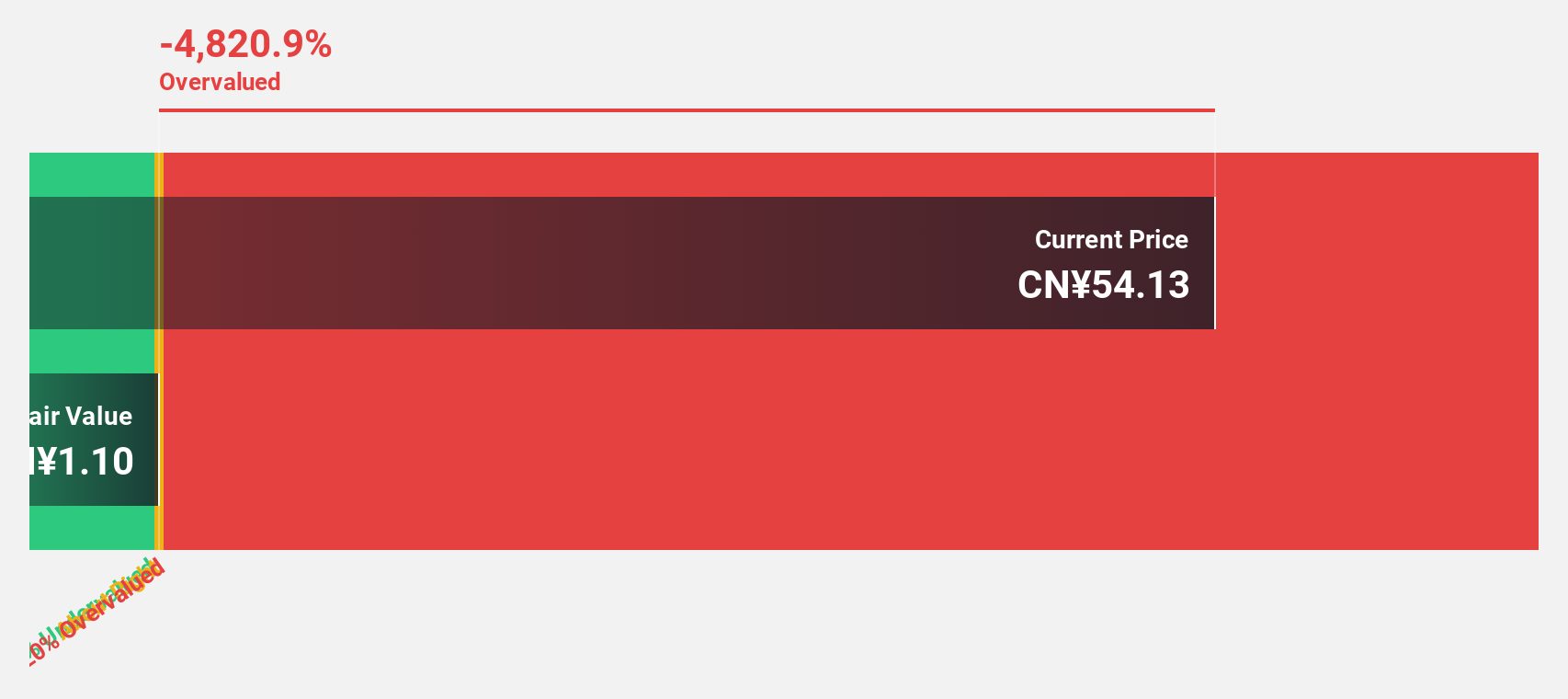

Thunder Software TechnologyLtd (SZSE:300496)

Overview: Thunder Software Technology Co., Ltd. offers operating-system products across China, Europe, the United States, Japan, and other international markets with a market cap of CN¥25.32 billion.

Operations: Revenue Segments (in millions of CN¥):

Estimated Discount To Fair Value: 42.1%

Thunder Software Technology is trading at CN¥55.05, significantly below its estimated fair value of CN¥95.05, indicating potential undervaluation based on cash flows. Despite a sharp drop in net income and profit margins over the past year, earnings are projected to grow significantly by 74.6% annually over the next three years. The strategic partnership with HERE Technologies could enhance revenue growth through advanced intelligent navigation solutions, although share price volatility remains a concern for investors.

- Our earnings growth report unveils the potential for significant increases in Thunder Software TechnologyLtd's future results.

- Click to explore a detailed breakdown of our findings in Thunder Software TechnologyLtd's balance sheet health report.

Next Steps

- Discover the full array of 920 Undervalued Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2310

Sahara International Petrochemical

Owns, establishes, operates, and manages industrial projects related to chemical and petrochemical industries in the Kingdom of Saudi Arabia.

Flawless balance sheet and undervalued.