- Turkey

- /

- Infrastructure

- /

- IBSE:EGGUB

Undiscovered Gems In The Middle East To Explore In August 2025

Reviewed by Simply Wall St

In recent months, Middle Eastern markets have shown resilience, with most Gulf shares gaining momentum on expectations of U.S. Federal Reserve interest rate cuts, despite challenges like weaker oil prices and mixed corporate earnings. As investors navigate these dynamic conditions, identifying stocks with strong fundamentals and growth potential becomes crucial for uncovering promising opportunities in the region's evolving economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 1.05% | 36.24% | 62.23% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 18.21% | 4.16% | 13.75% | ★★★★★☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Ege Gübre Sanayii (IBSE:EGGUB)

Simply Wall St Value Rating: ★★★★★★

Overview: Ege Gübre Sanayii A.S., along with its subsidiary TCE EGE Konteyner Terminal Isletmeleri A.S., operates in the port services sector in Turkey and has a market capitalization of TRY10.31 billion.

Operations: Ege Gübre Sanayii generates revenue primarily from port services, amounting to TRY2.46 billion, with a minor contribution from chemical fertilizers at TRY25.12 million.

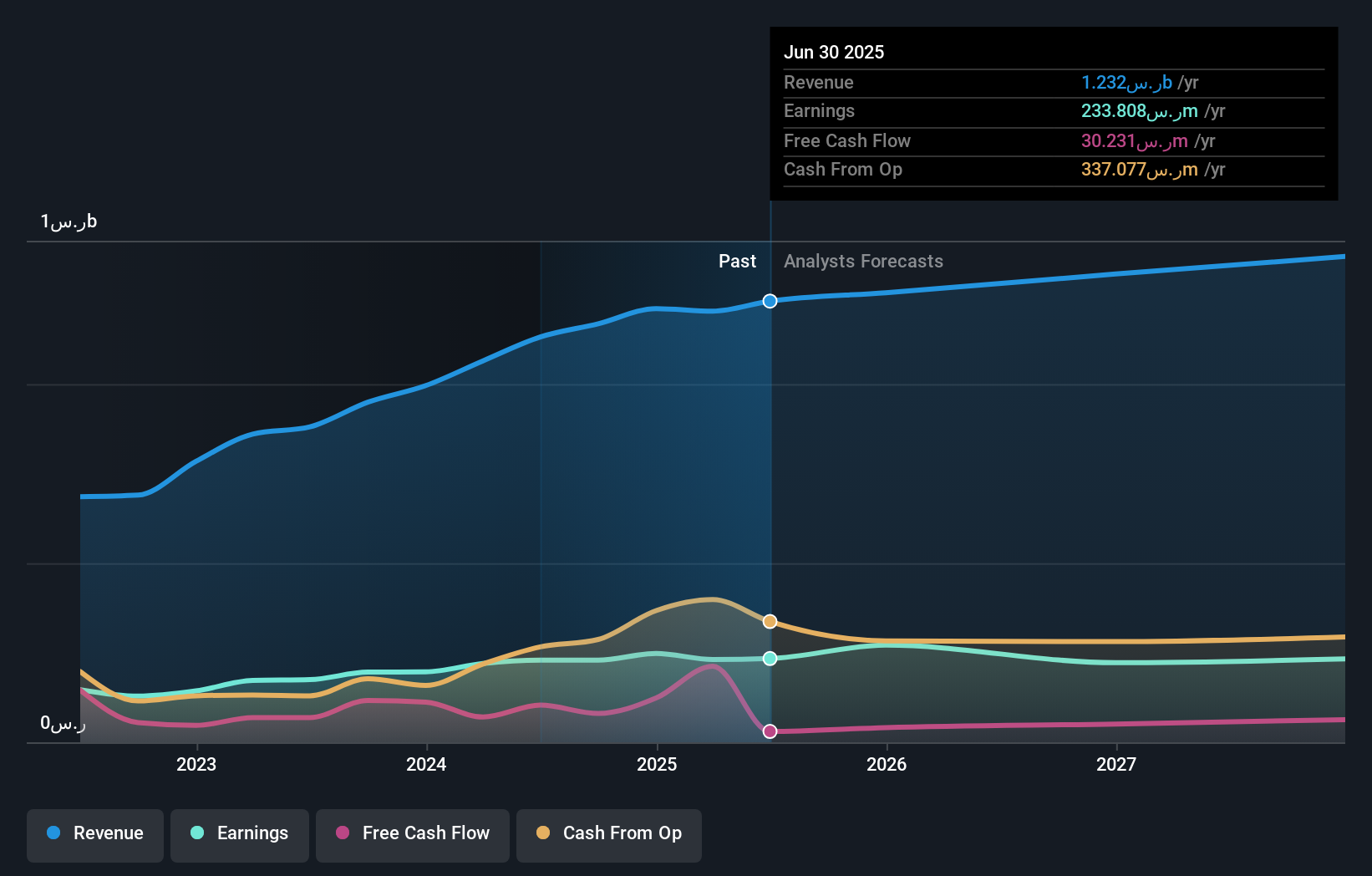

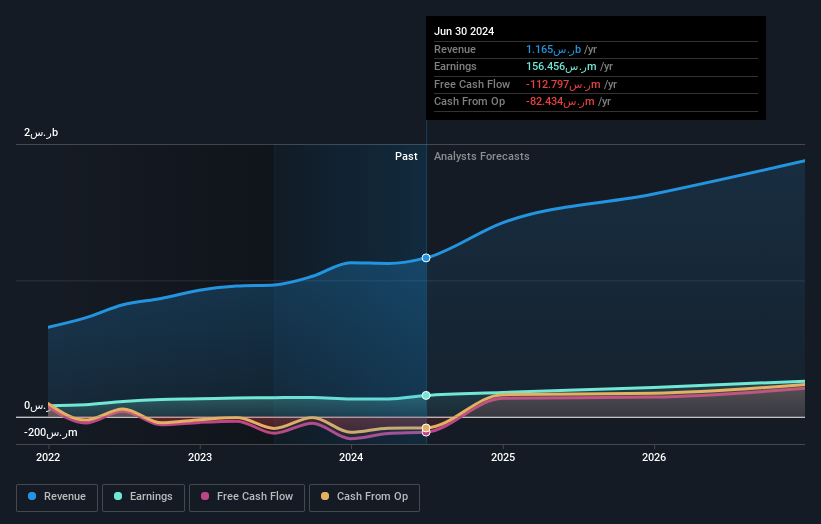

Ege Gübre Sanayii, a notable player in the Middle East, has shown promising financial health with its debt to equity ratio dropping from 58.8% to 14.5% over five years. The company’s earnings have grown at an impressive annual rate of 35.5%, although recent growth at 3.5% lagged behind the industry average of 9.6%. With a price-to-earnings ratio of 20.3x, it trades below the TR market average of 20.8x, suggesting potential value for investors seeking opportunities in this sector despite not being free cash flow positive yet showing high-quality earnings and strong interest coverage capabilities.

- Dive into the specifics of Ege Gübre Sanayii here with our thorough health report.

Explore historical data to track Ege Gübre Sanayii's performance over time in our Past section.

Eastern Province Cement (SASE:3080)

Simply Wall St Value Rating: ★★★★★★

Overview: Eastern Province Cement Company engages in the production and sale of clinker and cement both domestically in Saudi Arabia and internationally, with a market capitalization of SAR2.45 billion.

Operations: The company's primary revenue streams are derived from the sale of cement, contributing SAR876 million, and precast concrete, adding SAR332.10 million.

Eastern Province Cement's recent earnings report for Q1 2025 showed sales of SAR 298.52 million, down from SAR 305.69 million the previous year, with net income at SAR 62.08 million compared to SAR 79.01 million a year ago. Despite this dip, the company trades at a favorable price-to-earnings ratio of 10.6x against the SA market's average of 20.2x and boasts high-quality earnings with no debt concerns over the past five years. While earnings have grown by an average of 1% annually over five years, future forecasts suggest a decline in earnings by about 2% per year for three years ahead.

- Click here to discover the nuances of Eastern Province Cement with our detailed analytical health report.

Understand Eastern Province Cement's track record by examining our Past report.

Perfect Presentation for Commercial Services (SASE:7204)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Perfect Presentation for Commercial Services Company is an ICT services and technology solutions provider based in the Kingdom of Saudi Arabia, with a market capitalization of SAR 3.27 billion.

Operations: Revenue streams for Perfect Presentation are primarily derived from Maintenance and Operation Services (SAR 373.83 million), Call Centre Services (SAR 313.34 million), and Software Licenses and Development Services (SAR 309.24 million). Managed Services contribute SAR 116.24 million, while Mother Services Social adds SAR 28.33 million to the overall revenue mix.

Perfect Presentation for Commercial Services, a relatively small player in the IT sector, has been making waves with its impressive earnings growth of 27% over the past year, surpassing the industry average of 17%. Despite carrying a high net debt to equity ratio at 71%, it has managed to reduce this from 78% over five years. The company recently secured significant contracts such as a SAR 67 million project with the Ministry of Commerce and another worth SAR 87 million for operating contact center operations. Its price-to-earnings ratio stands attractively at 20x compared to the industry’s average of 29x, hinting at potential value.

- Click to explore a detailed breakdown of our findings in Perfect Presentation for Commercial Services' health report.

Learn about Perfect Presentation for Commercial Services' historical performance.

Summing It All Up

- Click here to access our complete index of 224 Middle Eastern Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ege Gübre Sanayii might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:EGGUB

Ege Gübre Sanayii

Together with its subsidiary, TCE EGE Konteyner Terminal Isletmeleri A.S., provides port services in Turkey.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives