- Turkey

- /

- Wireless Telecom

- /

- IBSE:TCELL

November 2024's Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

In the midst of a turbulent week marked by lower major indexes and mixed economic signals, global markets are navigating a complex landscape. With growth stocks lagging behind value shares and manufacturing activity continuing its slump, investors are increasingly on the lookout for opportunities that may be trading below their estimated value. In such an environment, identifying undervalued stocks becomes crucial as these equities might offer potential for appreciation when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| First National (NasdaqCM:FXNC) | US$22.50 | US$44.83 | 49.8% |

| Harmony Gold Mining (JSE:HAR) | ZAR180.36 | ZAR359.54 | 49.8% |

| Lindab International (OM:LIAB) | SEK226.80 | SEK450.91 | 49.7% |

| West Bancorporation (NasdaqGS:WTBA) | US$23.49 | US$46.79 | 49.8% |

| Ligand Pharmaceuticals (NasdaqGM:LGND) | US$129.90 | US$258.67 | 49.8% |

| Redcentric (AIM:RCN) | £1.1775 | £2.35 | 50% |

| DoubleVerify Holdings (NYSE:DV) | US$19.72 | US$39.40 | 49.9% |

| Laboratorio Reig Jofre (BME:RJF) | €2.89 | €5.74 | 49.6% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | US$272.22 | US$544.40 | 50% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.24 | €16.38 | 49.7% |

Here's a peek at a few of the choices from the screener.

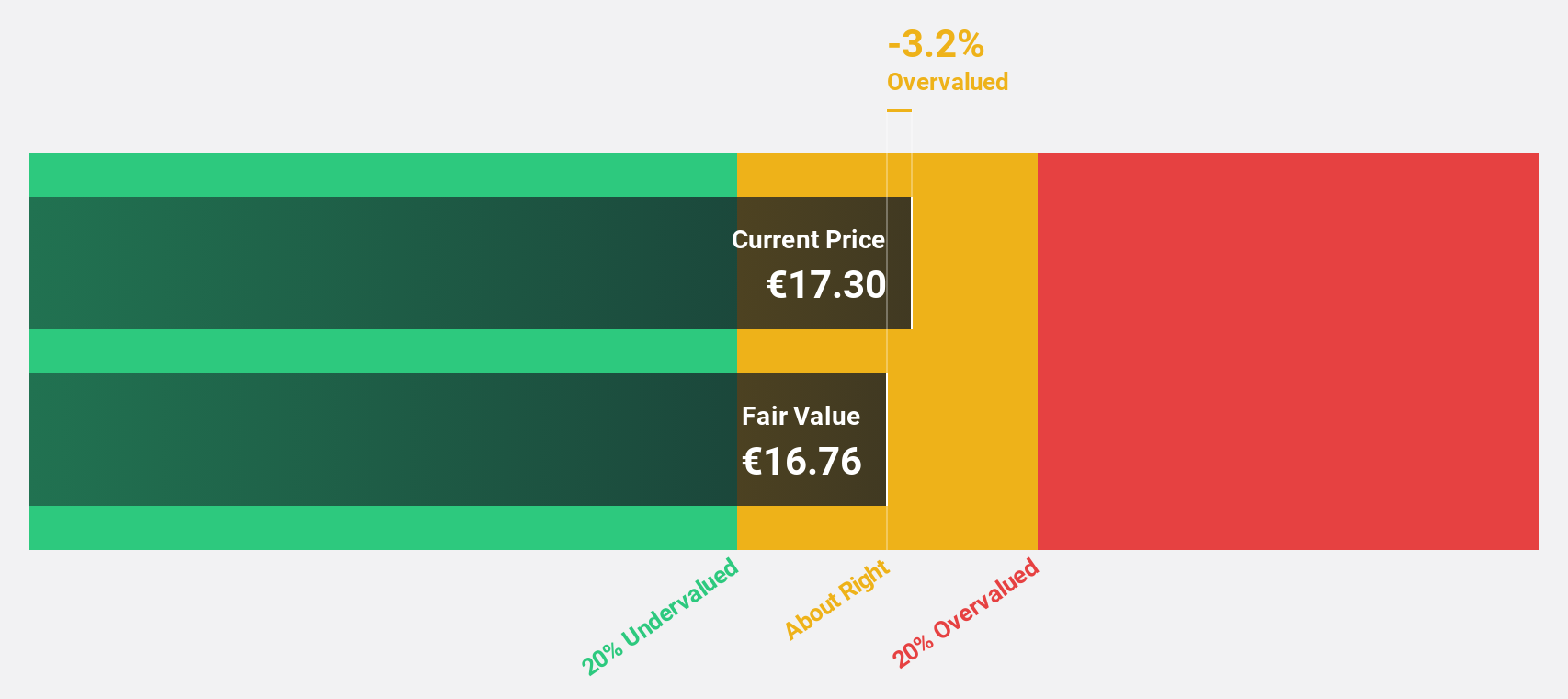

Iveco Group (BIT:IVG)

Overview: Iveco Group N.V. is involved in the design, production, marketing, sale, servicing, and financing of trucks, commercial vehicles, buses, and specialty vehicles for various applications globally with a market cap of approximately €2.70 billion.

Operations: The company's revenue segments include Powertrain generating €3.96 billion and Financial Services contributing €565 million.

Estimated Discount To Fair Value: 32.8%

Iveco Group is trading at €10.2, significantly below its estimated fair value of €15.18, highlighting potential undervaluation based on cash flows. Despite high debt levels and recent volatility in share price, the company's earnings are projected to grow substantially at 31.9% annually, outpacing the Italian market's growth rate. Recent strategic alliances and steady net income improvements further bolster its financial position despite slower revenue growth compared to peers in the Italian market.

- In light of our recent growth report, it seems possible that Iveco Group's financial performance will exceed current levels.

- Navigate through the intricacies of Iveco Group with our comprehensive financial health report here.

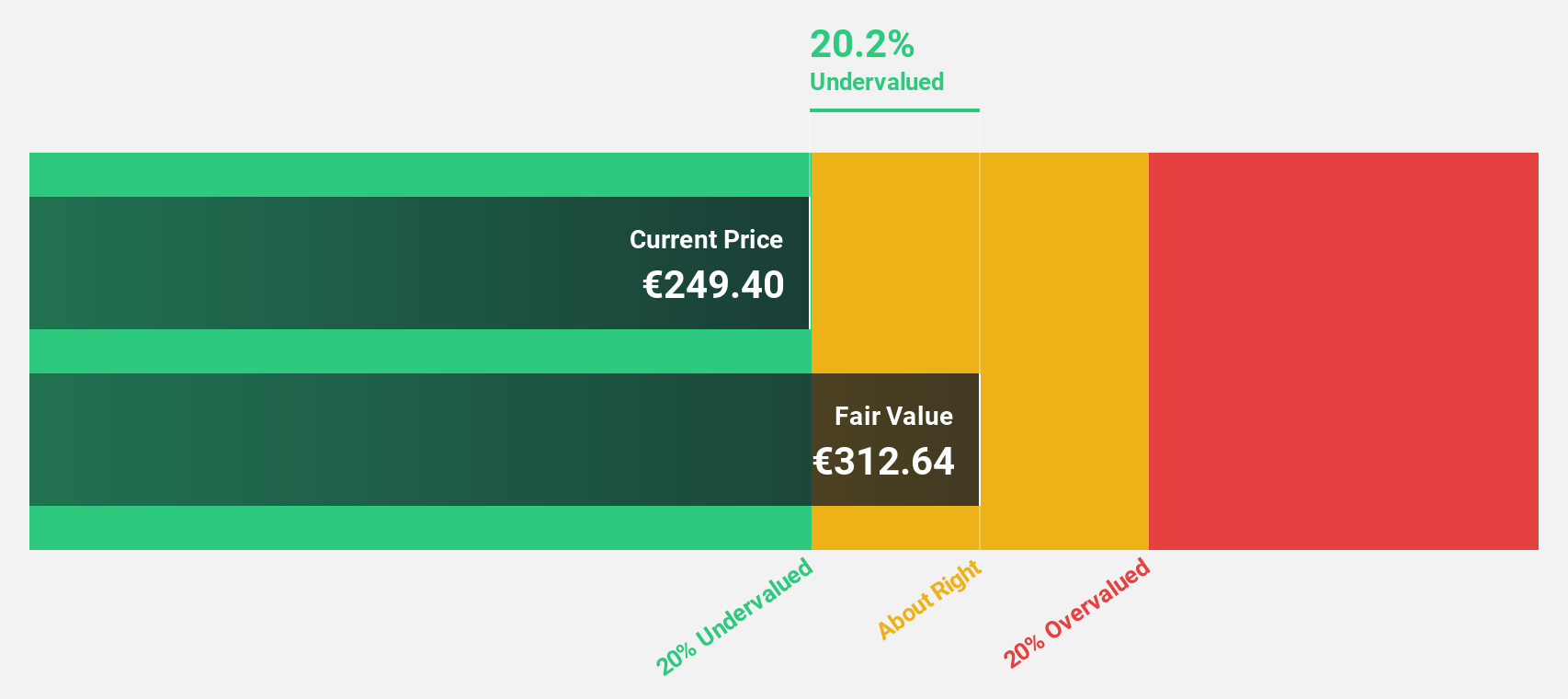

Thales (ENXTPA:HO)

Overview: Thales S.A. is a global company offering solutions in defence and security, aerospace and space, digital identity and security, and transport markets, with a market cap of €32.95 billion.

Operations: The company's revenue segments include Aerospace (€5.49 billion), Digital Identity and Security (€3.69 billion), and Defence & Security (excluding Digital I&S) (€10.56 billion).

Estimated Discount To Fair Value: 49.6%

Thales is trading at €160.45, significantly below its estimated fair value of €318.43, suggesting potential undervaluation based on cash flows. Despite a high debt level and an unstable dividend history, earnings are projected to grow annually by 19.9%, surpassing the French market's growth rate of 12.3%. Recent strategic partnerships, like with Adani Airport Holdings Limited for advanced airport solutions, enhance Thales' operational capabilities and market position despite one-off financial impacts.

- Our growth report here indicates Thales may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Thales.

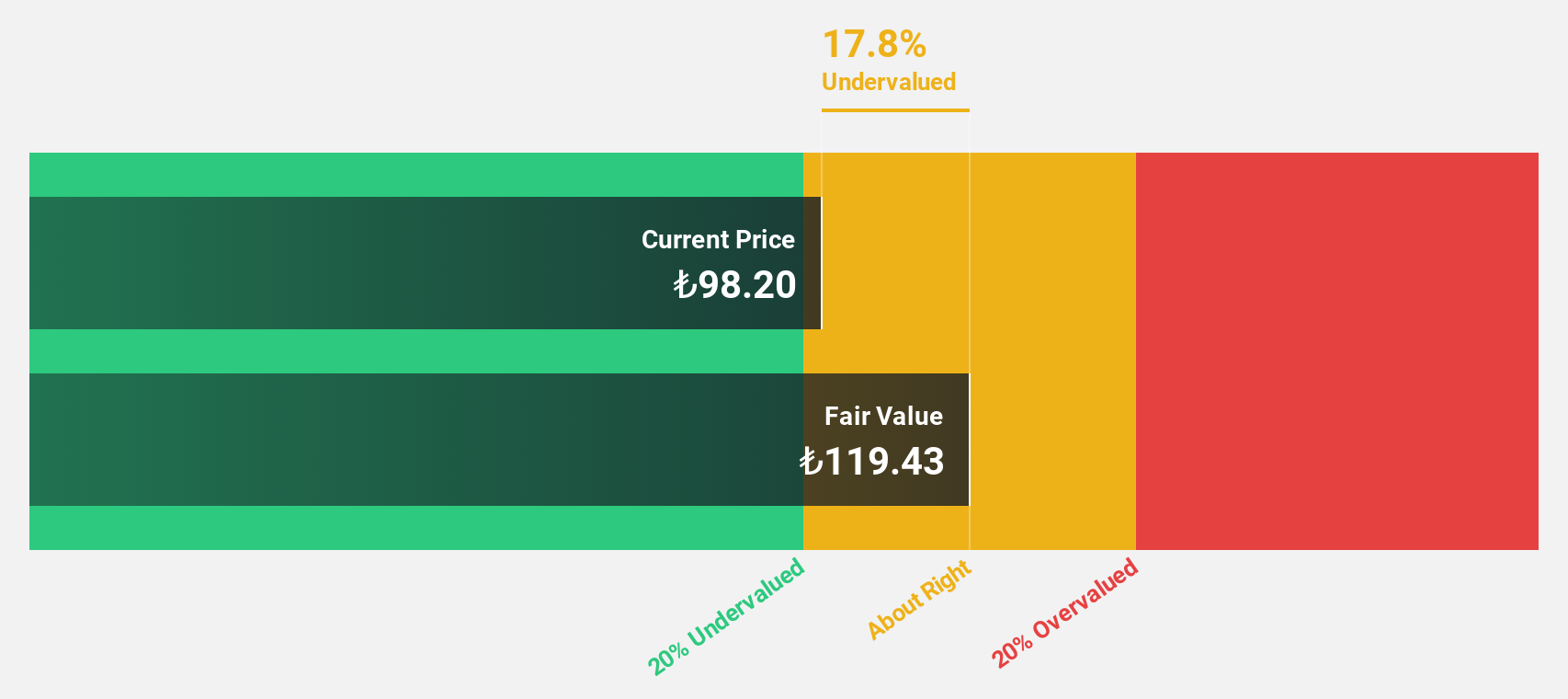

Turkcell Iletisim Hizmetleri (IBSE:TCELL)

Overview: Turkcell Iletisim Hizmetleri A.S. offers digital services in Turkey, Belarus, the Turkish Republic of Northern Cyprus, and the Netherlands with a market cap of TRY193.94 billion.

Operations: The company's revenue segments include Turkcell Turkey at TRY95.74 billion, Techfin at TRY5.40 billion, and Turkcell International at TRY2.67 billion.

Estimated Discount To Fair Value: 42.5%

Turkcell Iletisim Hizmetleri is trading at TRY 89, well below its estimated fair value of TRY 154.85, highlighting potential undervaluation based on cash flows. The company's earnings grew significantly by a very large percentage over the past year and are forecast to grow annually by 31.16%. Despite an unstable dividend history, Turkcell's recent collaboration with ZTE Corporation on high-speed optical transmission technology underscores its commitment to advancing network capabilities amidst growing demand for digital services.

- Insights from our recent growth report point to a promising forecast for Turkcell Iletisim Hizmetleri's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Turkcell Iletisim Hizmetleri.

Make It Happen

- Delve into our full catalog of 922 Undervalued Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Turkcell Iletisim Hizmetleri might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:TCELL

Turkcell Iletisim Hizmetleri

Provides digital services in Turkey, Belarus, Turkish Republic of Northern Cyprus, and the Netherlands.

Very undervalued with flawless balance sheet and pays a dividend.