- United Arab Emirates

- /

- Insurance

- /

- DFM:DNIR

Middle Eastern Penny Stocks Under US$700M Market Cap: 3 Promising Picks

Reviewed by Simply Wall St

The Middle Eastern stock markets have been buoyant, with Gulf shares rising as geopolitical tensions ease and Dubai's index hitting a 17-year high. This positive market sentiment creates an interesting backdrop for exploring investment opportunities in lesser-known stocks. Penny stocks, though an outdated term, still represent smaller or newer companies that can offer surprising value; by focusing on those with strong financials and growth potential, investors may uncover promising opportunities in the region.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Terminal X Online (TASE:TRX) | ₪4.929 | ₪626.01M | ✅ 2 ⚠️ 0 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR4.04 | SAR1.62B | ✅ 2 ⚠️ 1 View Analysis > |

| Amanat Holdings PJSC (DFM:AMANAT) | AED1.07 | AED2.64B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.722 | ₪331.42M | ✅ 3 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.12 | AED2.28B | ✅ 3 ⚠️ 2 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.78 | TRY1.92B | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.14 | AED386.93M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.52 | AED10.76B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.846 | AED515.19M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.53 | ₪188.09M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 78 stocks from our Middle Eastern Penny Stocks screener.

Let's dive into some prime choices out of the screener.

E7 Group PJSC (ADX:E7)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: E7 Group PJSC operates in the commercial printing, packaging, and distribution sectors within the United Arab Emirates, with a market capitalization of AED2.28 billion.

Operations: The company's revenue is derived from its printing segment, which generated AED611.25 million, and its distribution segment, contributing AED78.65 million.

Market Cap: AED2.28B

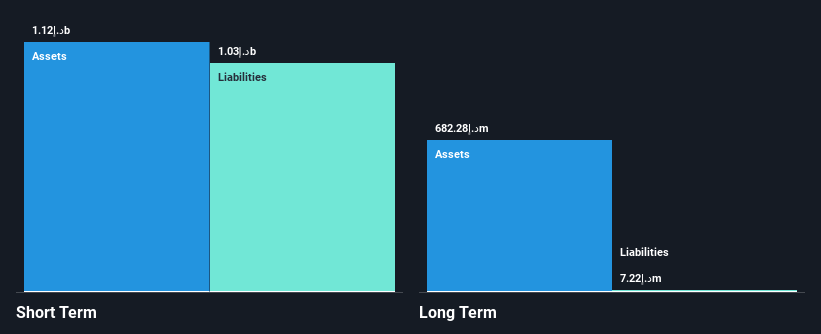

E7 Group PJSC, operating in the commercial printing and packaging sectors, has demonstrated financial stability with short-term assets of AED2 billion exceeding liabilities. Despite a decline in Q1 2025 sales to AED113.68 million from AED126.05 million the previous year, E7 remains debt-free and maintains a favorable price-to-earnings ratio of 10.1x compared to the market average. The company recently approved a cash dividend distribution of AED147.1 million, equating to approximately 70% of its distributable net profits for 2024, although this dividend is not well covered by free cash flows. Earnings growth has been significant over five years at an annual rate of over 40%.

- Click here and access our complete financial health analysis report to understand the dynamics of E7 Group PJSC.

- Assess E7 Group PJSC's future earnings estimates with our detailed growth reports.

Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dubai National Insurance & Reinsurance (P.S.C.) operates as a provider of insurance and reinsurance services, with a market cap of AED 386.93 million.

Operations: The company's revenue is derived from two main segments: Investments, contributing AED 37.56 million, and Underwriting, which accounts for AED 269.43 million.

Market Cap: AED386.93M

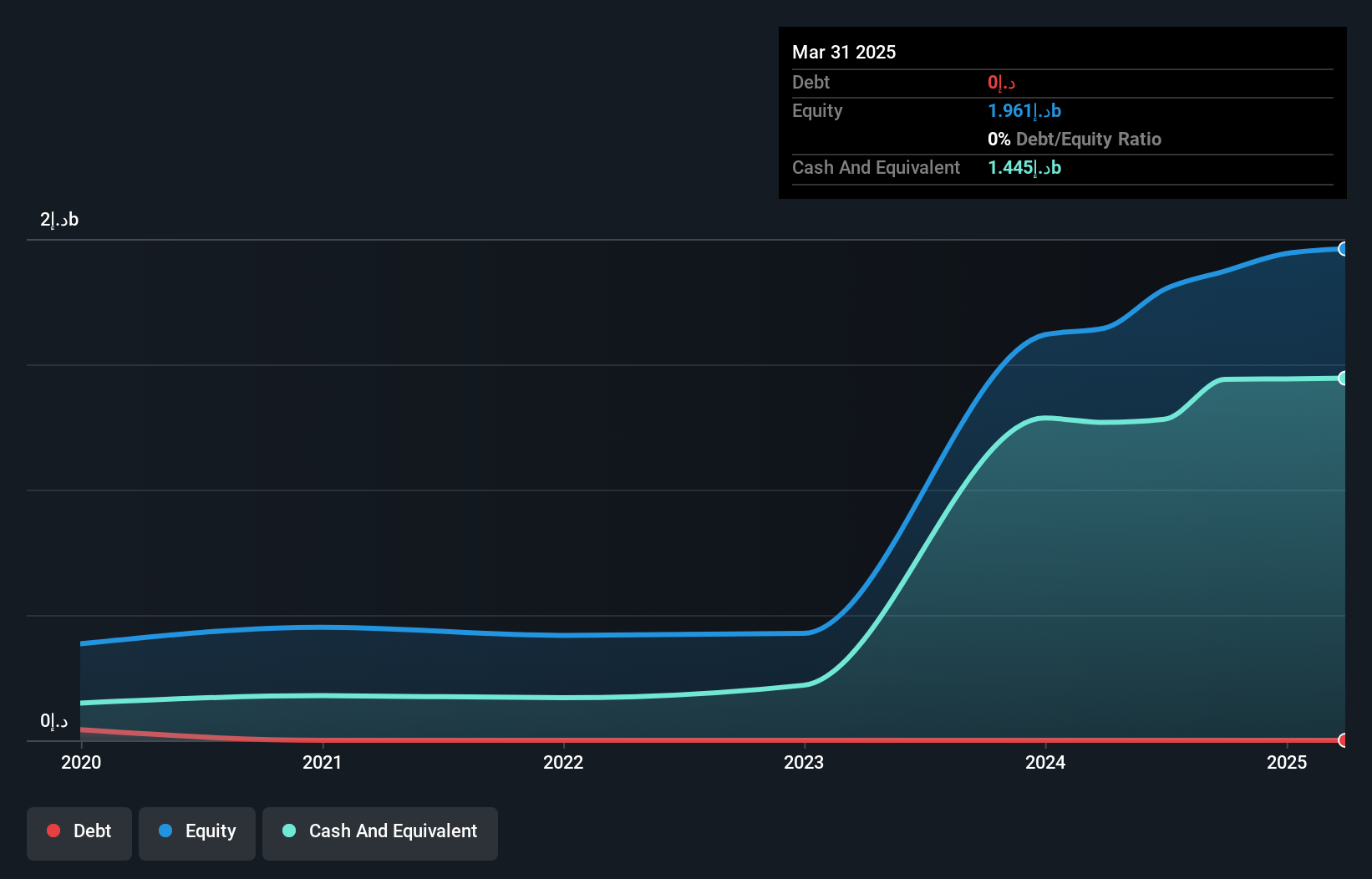

Dubai National Insurance & Reinsurance (P.S.C.) presents a mixed picture for investors considering penny stocks. It operates debt-free with short-term assets of AED 956.6 million surpassing liabilities, indicating financial stability. Despite recent earnings growth of 13.6%, the company’s five-year performance shows a decline of 6.1% annually, and its return on equity is low at 6.7%. The price-to-earnings ratio stands attractively below the market average at 7.2x, yet dividend sustainability is questionable due to inadequate free cash flow coverage. Additionally, management and board experience are limited with tenures averaging under three years each.

- Click to explore a detailed breakdown of our findings in Dubai National Insurance & Reinsurance (P.S.C.)'s financial health report.

- Explore historical data to track Dubai National Insurance & Reinsurance (P.S.C.)'s performance over time in our past results report.

Escort Teknoloji Yatirim (IBSE:ESCOM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Escort Teknoloji Yatirim A.S. offers technology-based products, solutions, and services both in Turkey and internationally, with a market cap of TRY2.20 billion.

Operations: The company's revenue is primarily derived from its operations in Turkey, amounting to TRY369.27 million.

Market Cap: TRY2.2B

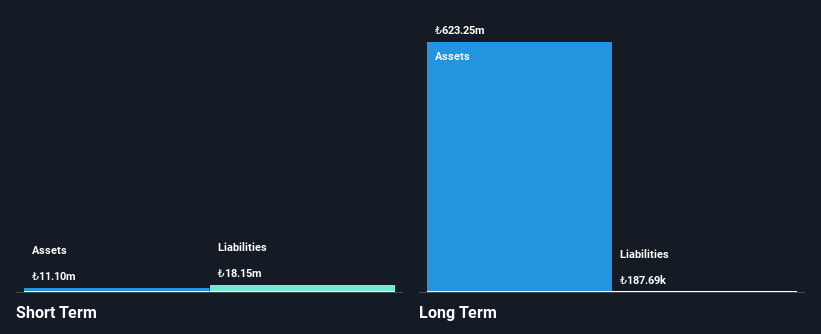

Escort Teknoloji Yatirim A.S. presents a complex picture for penny stock investors. With no debt, the company avoids interest concerns, and its short-term assets of TRY26.3 million exceed long-term liabilities of TRY1.8 million. However, short-term liabilities remain uncovered, posing potential liquidity challenges. Recent earnings show a decline in net income to TRY4.49 million from TRY59.4 million year-on-year, highlighting profitability issues despite reduced losses over five years at 23.9% annually. Shareholder dilution has been minimal recently, yet the company remains unprofitable with negative return on equity and limited management data available for assessment.

- Take a closer look at Escort Teknoloji Yatirim's potential here in our financial health report.

- Assess Escort Teknoloji Yatirim's previous results with our detailed historical performance reports.

Where To Now?

- Take a closer look at our Middle Eastern Penny Stocks list of 78 companies by clicking here.

- Ready To Venture Into Other Investment Styles? Outshine the giants: these 22 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:DNIR

Dubai National Insurance & Reinsurance (P.S.C.)

Dubai National Insurance & Reinsurance Co.

Flawless balance sheet slight.

Market Insights

Community Narratives