3 Middle Eastern Penny Stocks With At Least US$50M Market Cap

Reviewed by Simply Wall St

The Middle Eastern stock markets have shown mixed performances recently, with Dubai rebounding as oil prices ticked up and investors focused on the Federal Reserve's rate path. Despite the vintage feel of the term 'penny stock,' these smaller or newer companies can still present valuable opportunities for investors, particularly when they are built on solid financials. This article explores three such penny stocks in the Middle East that combine balance sheet strength with potential for growth, offering a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.29 | SAR1.32B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.495 | ₪178.88M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.02 | AED2.08B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.52 | AED228M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.24 | AED670.68M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR4.91 | SAR982M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.22 | AED386.93M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.70 | AED15.86B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.871 | AED523.71M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.553 | ₪200.41M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 80 stocks from our Middle Eastern Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Apex Investment PSC (ADX:APEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Apex Investment PSC manufactures, distributes, and sells clinkers and cement products in the United Arab Emirates and internationally, with a market cap of AED13.50 billion.

Operations: The company's revenue is primarily derived from its Catering segment at AED594.16 million, followed by Manufacturing at AED238.21 million, Facility Management Services at AED110.42 million, Contracting at AED28.73 million, and Investments contributing AED0.13 million.

Market Cap: AED13.5B

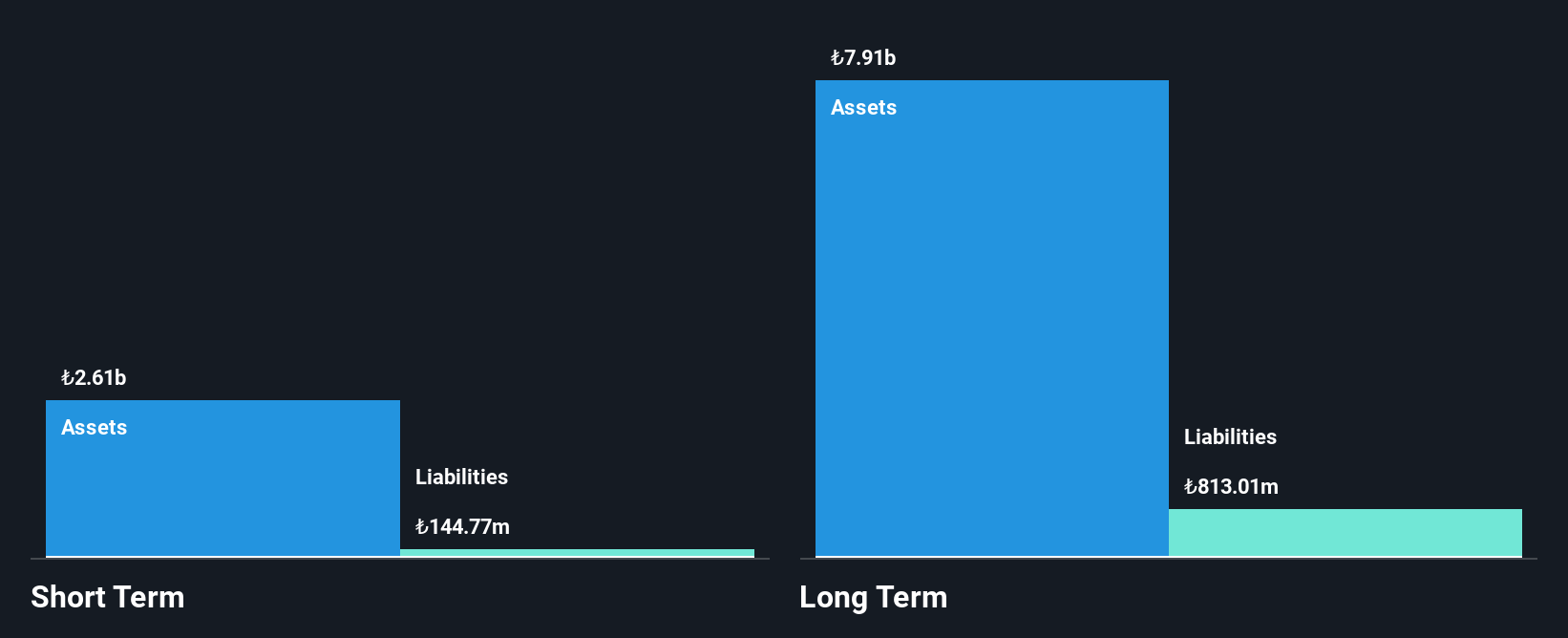

Apex Investment PSC, with a market cap of AED13.50 billion, shows significant growth in its earnings over the past year, far exceeding industry averages. Despite reporting a net loss of AED 17.16 million in Q3 2025 due to a large one-off loss of AED29.2 million, the company remains debt-free and has strong asset coverage for both short-term and long-term liabilities. Its revenue streams are diverse, primarily from catering and manufacturing segments. Apex's board is experienced with an average tenure of 3.8 years, yet its return on equity remains low at 3.8%.

- Unlock comprehensive insights into our analysis of Apex Investment PSC stock in this financial health report.

- Learn about Apex Investment PSC's historical performance here.

Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi (IBSE:ARSAN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi, along with its subsidiaries, is involved in the production and sale of cotton and synthetic yarn both in Turkey and internationally, with a market cap of TRY5.67 billion.

Operations: The company's revenue is derived from its Textile segment, contributing TRY42.69 million, and its Tourism segment, which accounts for TRY63.66 million.

Market Cap: TRY5.67B

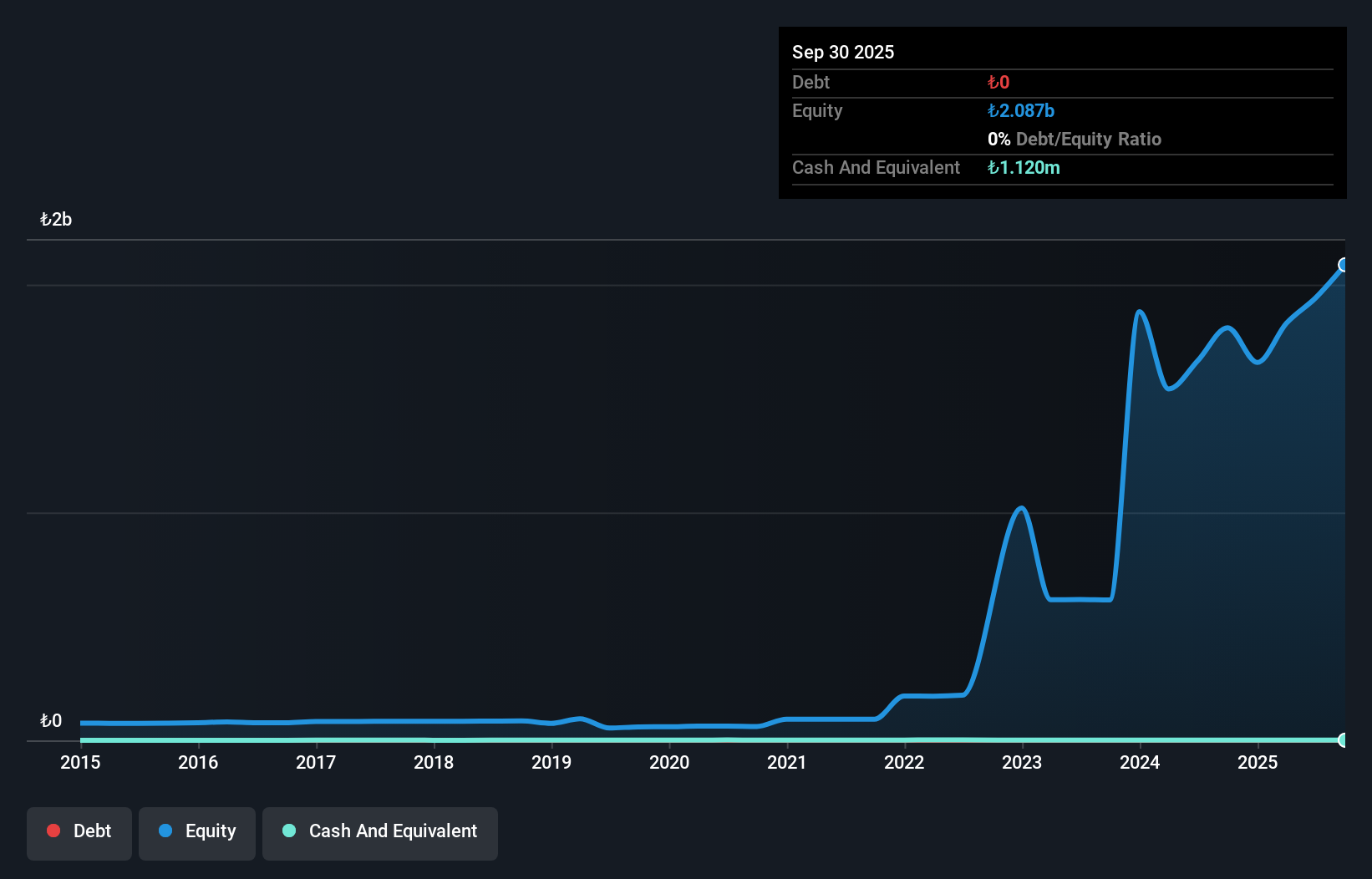

Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi, with a market cap of TRY5.67 billion, is currently unprofitable but has reduced losses over the past five years by 20% annually. Despite reporting a net loss of TRY290.9 million in Q3 2025, the company maintains strong financial health with cash exceeding total debt and short-term assets covering both short-term and long-term liabilities. Its debt to equity ratio has significantly decreased from 23.4% to 0.3% over five years, indicating improved financial stability. However, it lacks meaningful revenue generation at TRY106 million and faces challenges in profitability compared to industry standards.

- Click here and access our complete financial health analysis report to understand the dynamics of Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi.

- Explore historical data to track Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi's performance over time in our past results report.

Escort Teknoloji Yatirim (IBSE:ESCOM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Escort Teknoloji Yatirim A.S. offers technology-based products, solutions, and services both in Turkey and internationally, with a market cap of TRY2.29 billion.

Operations: The company generates revenue from its operations in Turkey, amounting to TRY369.24 million.

Market Cap: TRY2.29B

Escort Teknoloji Yatirim A.S., with a market cap of TRY2.29 billion, remains unprofitable and has seen its earnings decline by 4.5% annually over the past five years. Recent quarterly results show a decrease in sales to TRY0.43 million from TRY0.47 million year-on-year, though net losses have narrowed significantly to TRY0.20 million from TRY7.11 million previously, indicating some operational improvement despite ongoing challenges in revenue generation and profitability compared to industry standards. The company is debt-free with short-term assets of TRY27.8 million but faces liquidity issues as these do not cover its short-term liabilities of TRY65.4 million.

- Click to explore a detailed breakdown of our findings in Escort Teknoloji Yatirim's financial health report.

- Review our historical performance report to gain insights into Escort Teknoloji Yatirim's track record.

Where To Now?

- Unlock our comprehensive list of 80 Middle Eastern Penny Stocks by clicking here.

- Ready For A Different Approach? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ARSAN

Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi

Engages in the production and sale of cotton and synthetic yarn in Turkey and internationally.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion