As the Middle East markets experience a positive shift, driven by steady oil prices and a rebound in key Gulf indices, investors are keeping a close eye on emerging opportunities within the region. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial for those looking to capitalize on the evolving market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Payton Industries | NA | 3.44% | 14.24% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

E7 Group PJSC (ADX:E7)

Simply Wall St Value Rating: ★★★★★★

Overview: E7 Group PJSC operates in the commercial printing, packaging, and distribution sectors within the United Arab Emirates with a market capitalization of AED2.08 billion.

Operations: E7 Group PJSC generates revenue primarily from its printing segment, contributing AED599.21 million, and distribution, adding AED76.53 million. The company's financial performance is influenced by these core segments with a market capitalization of approximately AED2.08 billion.

E7 Group PJSC, a promising player in the identity solutions sector, has shown significant earnings growth of 814.6% over the past year, outpacing the industry average of 7.1%. Despite trading at 20.7% below its estimated fair value, E7 remains debt-free and focuses on strategic partnerships like its recent collaboration with 7I Holding to enhance R&D and expand market reach. Although sales for Q3 2025 were AED 173.64 million compared to AED 190.9 million a year ago, their strategic initiatives aim to bolster future growth in secure printing and identity management services globally.

- Unlock comprehensive insights into our analysis of E7 Group PJSC stock in this health report.

Review our historical performance report to gain insights into E7 Group PJSC's's past performance.

Pasifik Teknoloji (IBSE:PATEK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Pasifik Teknoloji A.S. supplies computer hardware, electronic products, and software to corporate clients in Turkey, with a market cap of TRY15 billion.

Operations: Pasifik Teknoloji generates revenue primarily from the sale of computer hardware, electronic products, and software to corporate clients in Turkey. The company's net profit margin is observed at 7%.

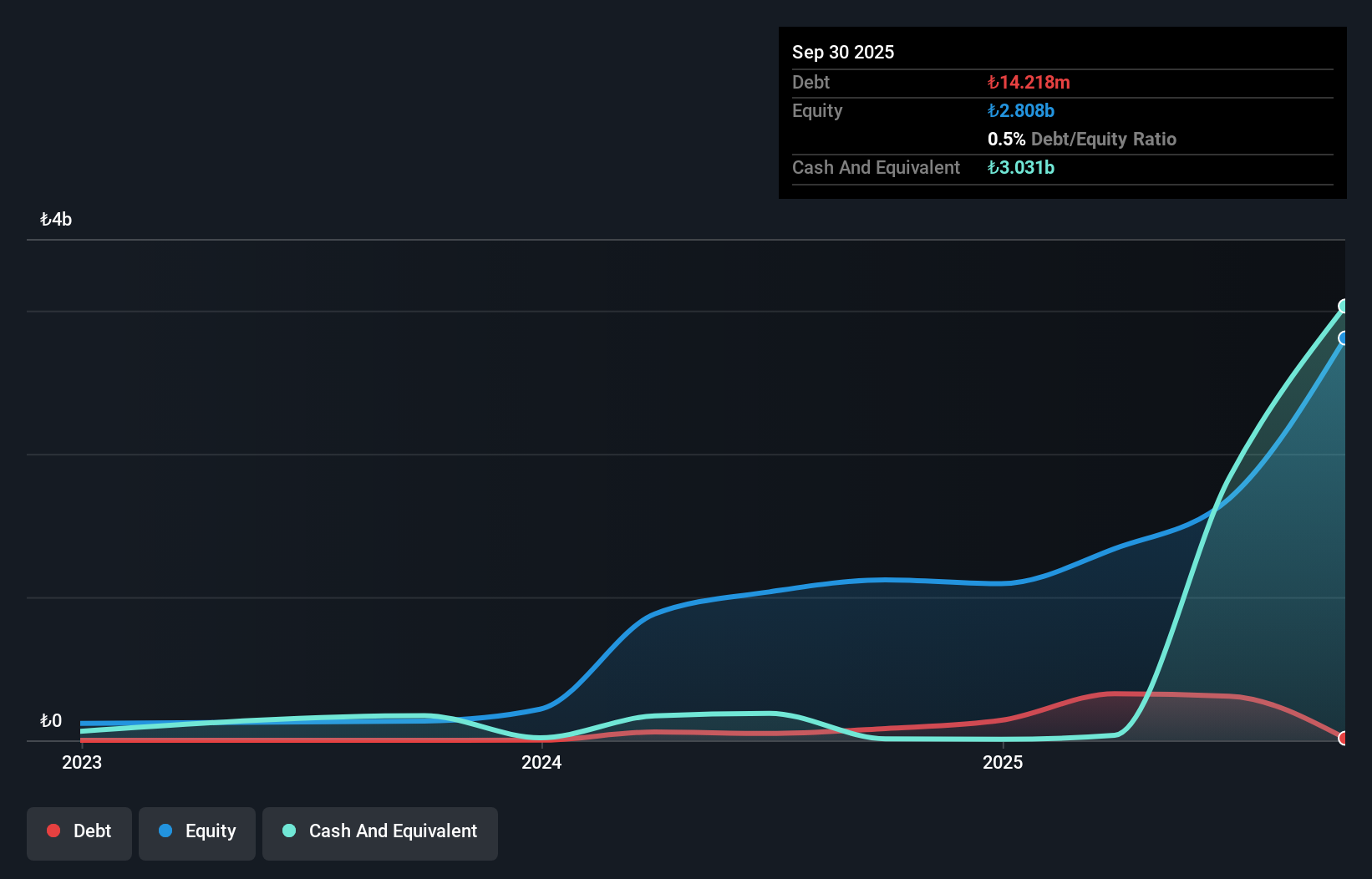

Pasifik Teknoloji, a notable player in the Middle East's tech scene, has shown significant growth with sales reaching TRY 528.74 million in Q3 2025 from TRY 329.66 million the previous year. Net income skyrocketed to TRY 616.29 million compared to TRY 38.08 million a year ago, highlighting its profitability surge and high-quality earnings. The company also reported basic earnings per share of TRY 1.0272 for Q3, up from TRY 0.0635 last year, reflecting robust financial health despite volatile share prices recently observed over three months and being added to the S&P Global BMI Index suggests increased market recognition.

Gas Arabian Services (SASE:4146)

Simply Wall St Value Rating: ★★★★★★

Overview: Gas Arabian Services Company operates in the Kingdom of Saudi Arabia, offering products and services in automation, instrumentation, field services, mechanical, and piping fields with a market capitalization of SAR2.13 billion.

Operations: Gas Arabian Services generates revenue primarily from three segments: Trading (SAR521.52 million), Manufacturing (SAR39.08 million), and Technical Services (SAR793.69 million).

Gas Arabian Services, a promising player in the Middle East, showcases a compelling investment narrative. With its price-to-earnings ratio at 15.1x, it stands attractively below the SA market average of 17.8x. The company has impressively reduced its debt over five years from a debt-to-equity ratio of 12.3% to being completely debt-free today, highlighting strong financial management. Its earnings growth rate of 35% over the past year outpaces the Trade Distributors industry average of 7%, indicating robust performance and potential for future expansion. Recent inclusion in major indices like S&P Pan Arab Composite further underscores its growing market recognition and credibility.

Seize The Opportunity

- Access the full spectrum of 183 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:PATEK

Pasifik Teknoloji

Provides computer hardware, electronic products, and software products to corporate companies in Turkey.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion