- New Zealand

- /

- Software

- /

- NZSE:SKO

Exploring High Growth Tech Stocks for December 2024

Reviewed by Simply Wall St

As 2024 draws to a close, global markets have experienced a mixed bag of economic indicators, with the U.S. seeing moderate stock gains despite declining consumer confidence and manufacturing orders, while European stocks rose slightly amid political changes and revised economic growth estimates. In this environment of fluctuating market conditions, identifying high-growth tech stocks requires careful consideration of factors such as innovation potential, market demand for technology solutions, and resilience in the face of shifting economic trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1269 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Logo Yazilim Sanayi ve Ticaret (IBSE:LOGO)

Simply Wall St Growth Rating: ★★★★★☆

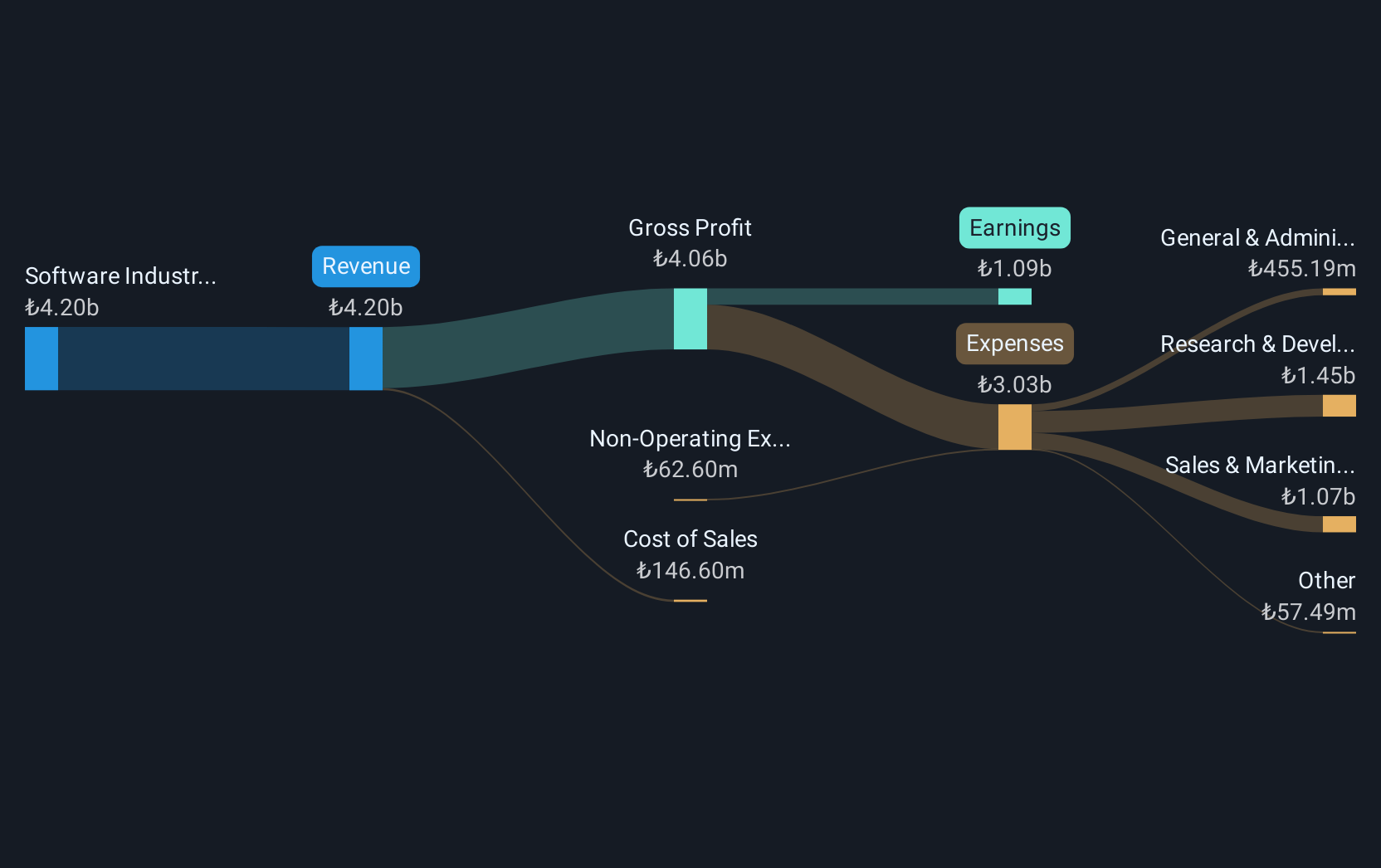

Overview: Logo Yazilim Sanayi ve Ticaret A.S. is a company that develops and markets software solutions in Turkey and Romania, with a market capitalization of TRY11.52 billion.

Operations: The company generates revenue primarily from the software industry, amounting to TRY3.56 billion. It operates in Turkey and Romania, focusing on developing and marketing software solutions.

Logo Yazilim Sanayi ve Ticaret has demonstrated a robust recovery and growth trajectory, as evidenced by its recent financial performance. In the third quarter of 2024, the company reported a significant turnaround with sales reaching TRY 1.17 billion, up from TRY 974 million in the previous year, and net income improving to TRY 111.31 million from a loss of TRY 148.98 million year-over-year. This resurgence is underscored by an impressive annualized earnings growth rate of 94.7%, outpacing the Turkish market's average of 34.8%. Additionally, Logo's commitment to innovation is reflected in its R&D investments which are crucial for maintaining competitive edge and driving future revenue streams in the rapidly evolving tech landscape. The company's strategic focus on expanding its software solutions while adapting to market demands has positioned it well for sustained growth; this approach is further validated by an expected revenue increase at an annual rate of 28.3%, surpassing broader market projections of 26.3%. With these factors combined—strong earnings recovery, strategic R&D allocation, and superior market growth forecasts—Logo Yazilim is shaping up as a dynamic contender within Turkey's tech sector despite previous volatility.

Serko (NZSE:SKO)

Simply Wall St Growth Rating: ★★★★★☆

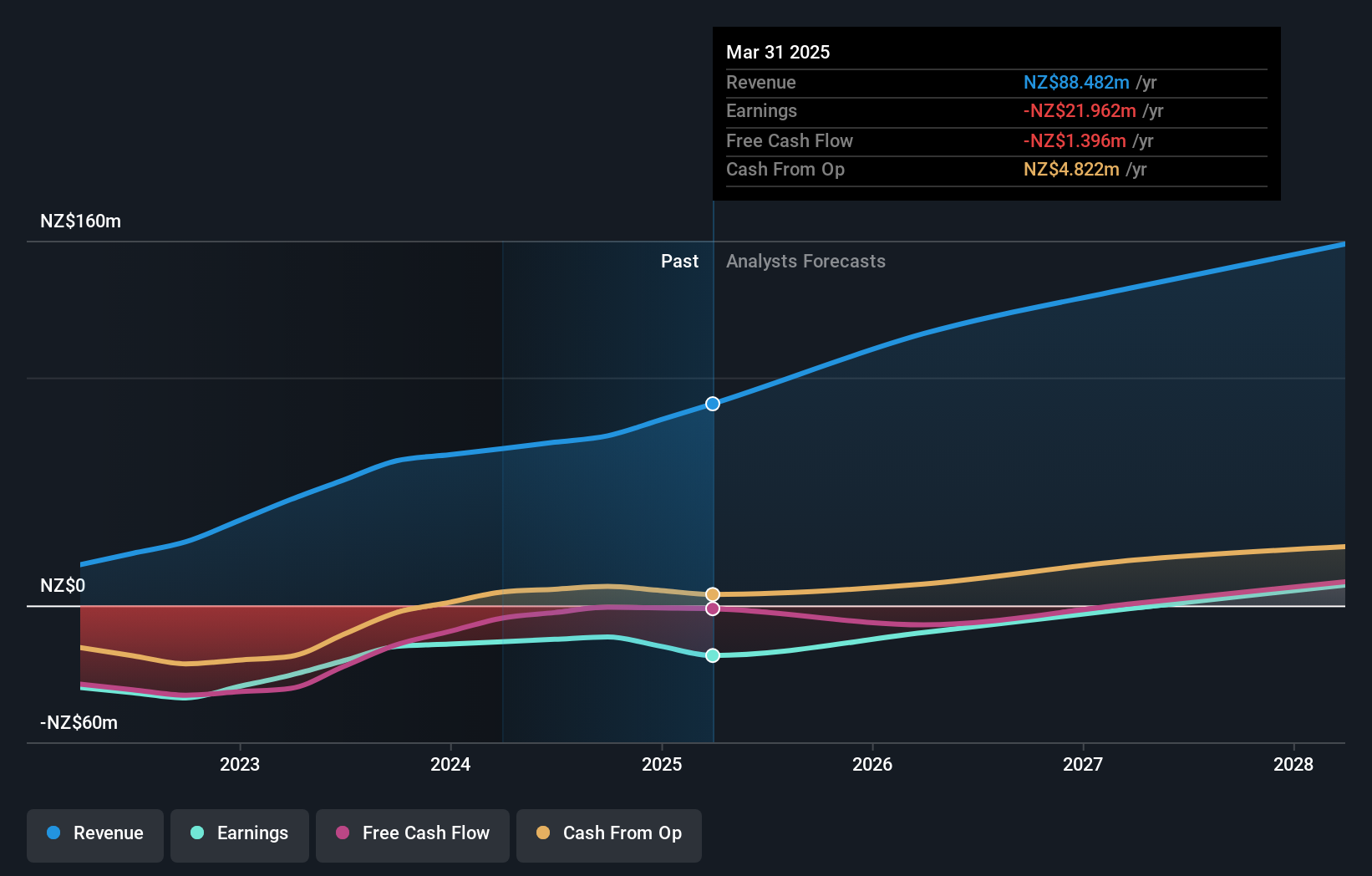

Overview: Serko Limited is a Software-as-a-Service technology company that offers online travel booking software solutions and expense management services across New Zealand, Australia, North America, Europe, and other international markets with a market cap of NZ$456.98 million.

Operations: Serko generates revenue primarily from its software solutions, amounting to NZ$74.45 million. The company's focus is on providing technology-driven travel booking and expense management services across multiple regions.

Serko's integration with Amadeus to enhance its Zeno platform marks a strategic pivot towards advanced airline retailing, reflecting an innovative approach in the travel tech sector. Despite recent executive changes and a net loss reported for the half year ending September 2024, Serko shows resilience with a revenue increase to NZD 42.72 million from NZD 36.35 million year-over-year. This growth aligns with their forward-looking R&D investments aimed at enriching client experiences and expanding market reach, particularly in Australia and New Zealand following Qantas's new distribution strategy set for mid-2025.

- Click to explore a detailed breakdown of our findings in Serko's health report.

Assess Serko's past performance with our detailed historical performance reports.

Ningbo Yunsheng (SHSE:600366)

Simply Wall St Growth Rating: ★★★★★☆

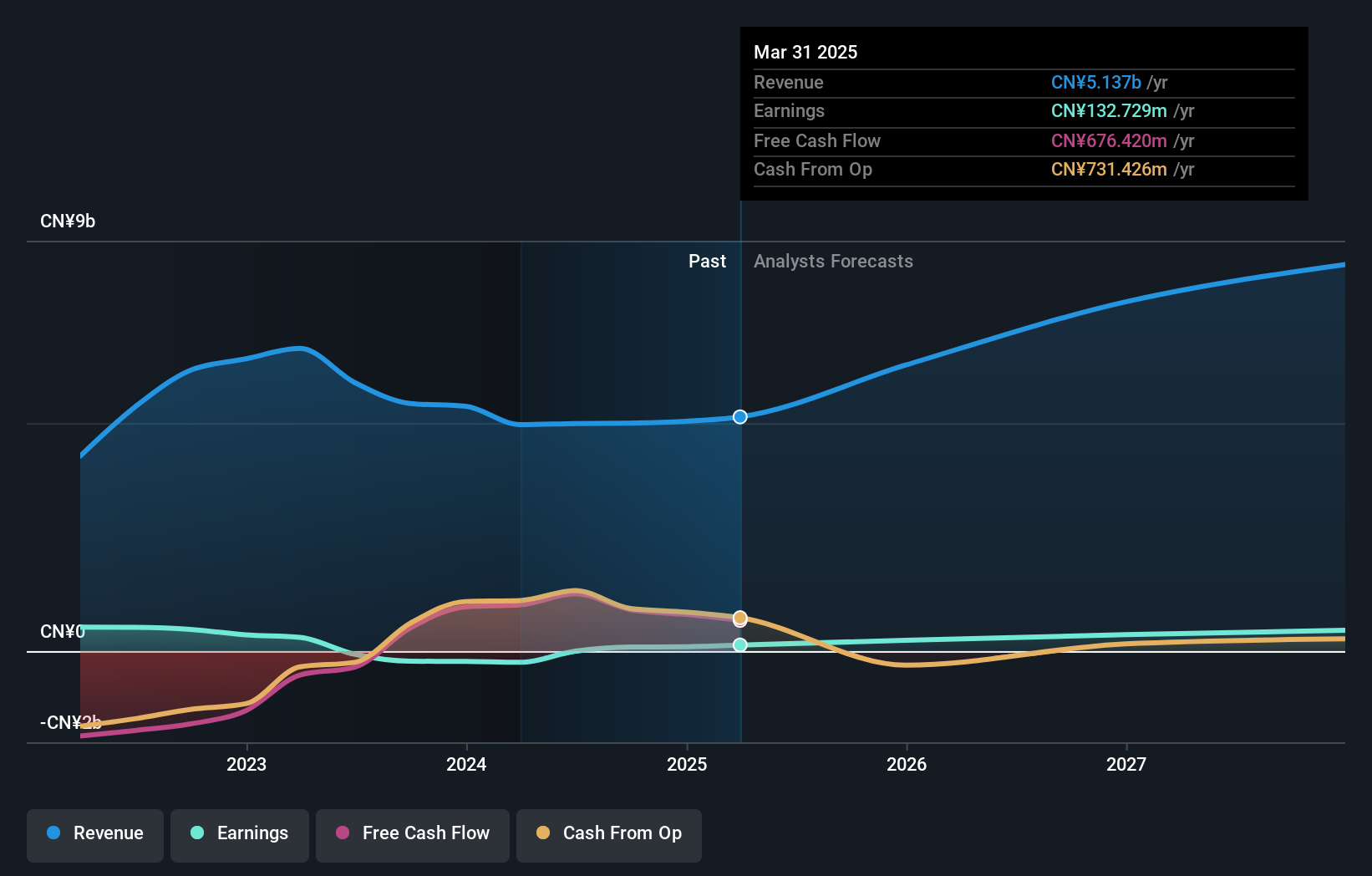

Overview: Ningbo Yunsheng Co., Ltd. focuses on the research, development, manufacture, and sale of rare earth permanent magnet materials in China and has a market capitalization of CN¥8.03 billion.

Operations: The company generates revenue primarily from its Neodymium Iron Boron segment, amounting to CN¥4.99 billion. Its operations are centered around the production and sale of rare earth permanent magnet materials in China.

Amid a challenging backdrop, Ningbo Yunsheng has demonstrated notable resilience and potential for growth within the tech sector. The company's turnaround to a profit with net income reaching CNY 69.14 million from a previous loss highlights effective management and strategic realignment. Particularly impressive is the forecasted revenue growth at 23.5% annually, outpacing the broader Chinese market's average of 13.7%. This performance is underpinned by robust R&D investments that not only fuel innovation but also align with industry trends towards enhanced technological offerings. Moreover, the recent completion of a share buyback program underscores confidence in its financial health and commitment to shareholder value, positioning Ningbo Yunsheng favorably as it navigates future tech landscapes.

- Take a closer look at Ningbo Yunsheng's potential here in our health report.

Examine Ningbo Yunsheng's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Access the full spectrum of 1269 High Growth Tech and AI Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:SKO

Serko

Provides online travel booking and expense management services in New Zealand, Australia, the United States, Europe, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives