- United Arab Emirates

- /

- Consumer Services

- /

- ADX:ALEFEDT

Undiscovered Gems in Middle East Stocks for October 2025

Reviewed by Simply Wall St

As Middle Eastern markets experience gains driven by robust corporate earnings and rising oil prices, investors are increasingly attentive to the potential of small-cap stocks in the region. In this environment, identifying promising stocks often involves looking for companies with strong financial performance and strategic positioning that can capitalize on favorable economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.53% | 16.38% | 21.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

We'll examine a selection from our screener results.

Alef Education Holding (ADX:ALEFEDT)

Simply Wall St Value Rating: ★★★★★★

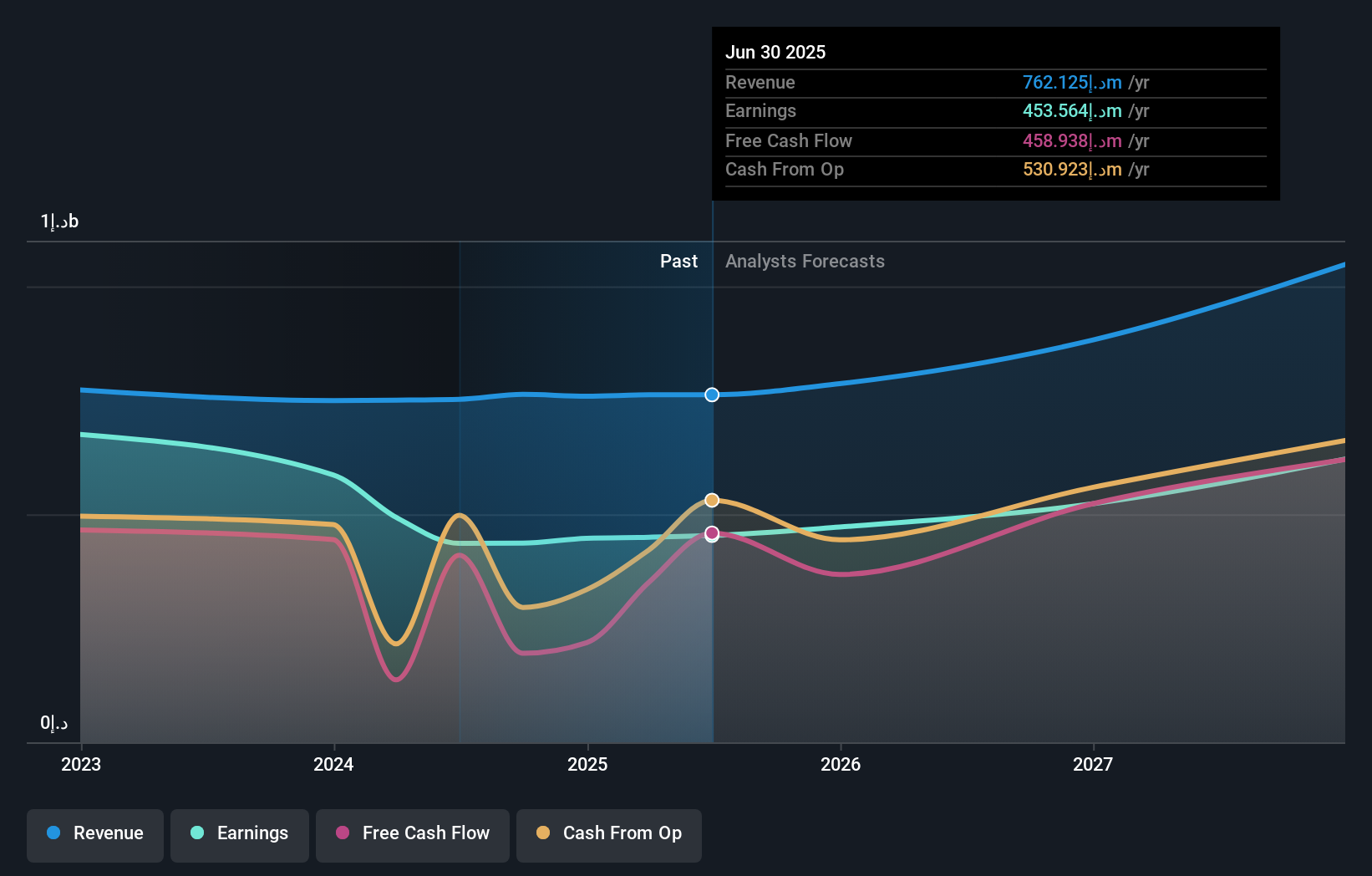

Overview: Alef Education Holding plc, along with its subsidiary, offers AI-driven educational solutions across the United Arab Emirates, Indonesia, the United States, and Saudi Arabia with a market capitalization of AED6.79 billion.

Operations: The company's revenue primarily comes from its Education Solution segment, generating AED662.50 million, while Support and Services contribute AED99.63 million.

Alef Education Holding, a nimble player in the education sector, has been making waves with its recent collaboration with Liquid AI to enhance educational workflows for over 1.5 million students globally. Despite being debt-free for five years and trading at 23.7% below estimated fair value, its earnings growth of 3.9% last year lagged behind the industry average of 8%. The company reported a net income increase to AED 116.98 million in Q2 from AED 113.13 million last year and maintains high-quality earnings while offering dividends totaling AED 0.02986 per share this year.

- Take a closer look at Alef Education Holding's potential here in our health report.

Learn about Alef Education Holding's historical performance.

Torunlar Gayrimenkul Yatirim Ortakligi (IBSE:TRGYO)

Simply Wall St Value Rating: ★★★★★★

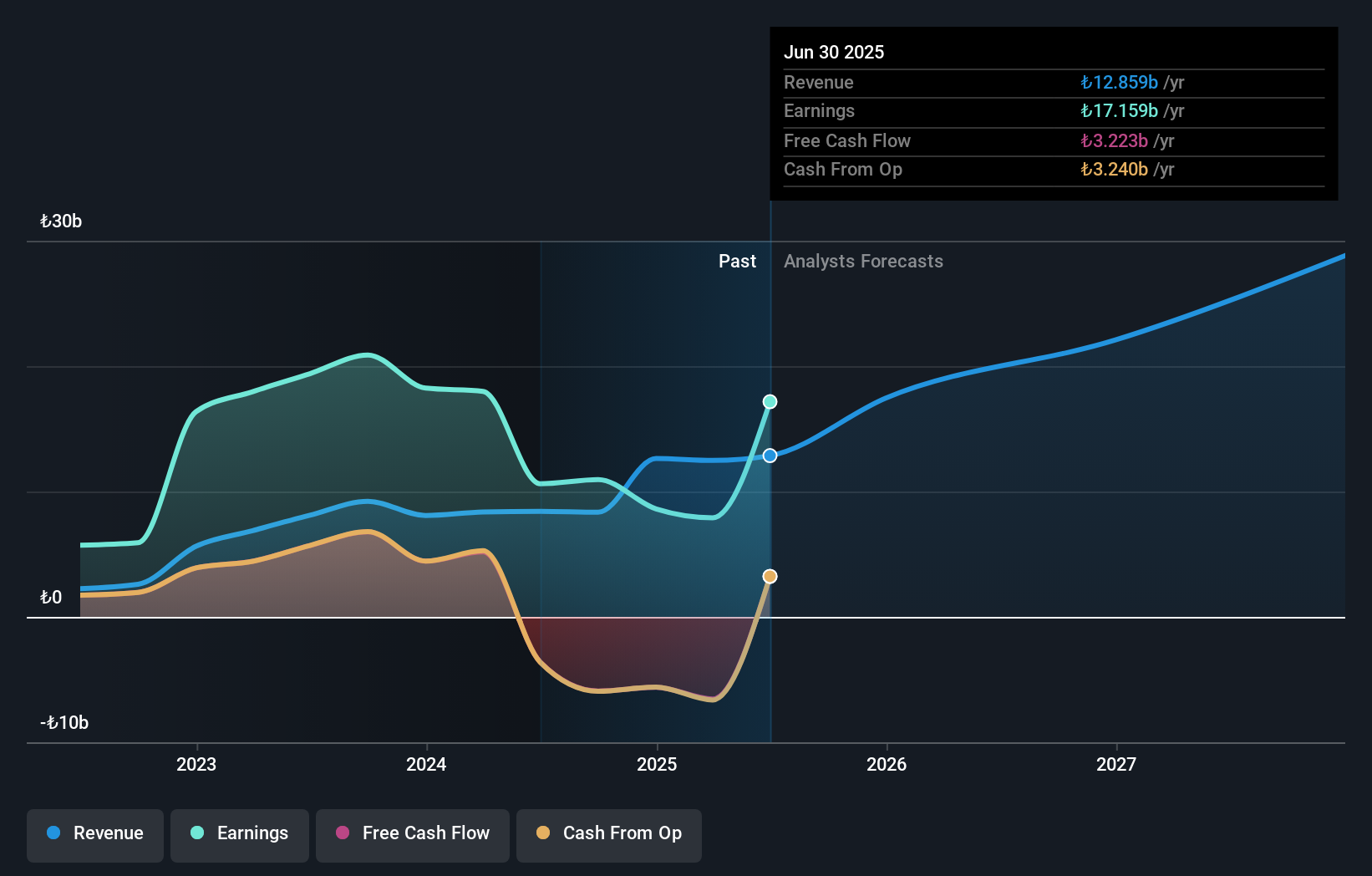

Overview: Torunlar Gayrimenkul Yatirim Ortakligi is a real estate investment company involved in the development and management of shopping malls, office spaces, and residential projects, with a market capitalization of TRY 75.35 billion.

Operations: Torunlar GYO generates revenue primarily from its Office for Rent and Shopping Malls segment, with significant contributions from properties like Mall of Istanbul AVM (TRY 2.80 billion) and the 5. Levent Project (TRY 5.65 billion). The company's diverse portfolio also includes residential and office projects, contributing to its overall income. Net profit margin trends can provide insights into the company's financial health over time.

Torunlar Gayrimenkul Yatirim Ortakligi, a promising player in the real estate sector, has shown impressive financial resilience. With cash exceeding total debt and a reduced debt to equity ratio from 60% to 1.1% over five years, financial stability is evident. The company's earnings growth of 61.6% last year outpaced the REITs industry average of -11.2%. Recent earnings reports highlight a net income of TRY 3,464 million for Q2 2025, reversing a previous loss of TRY 5,789 million. Additionally, its price-to-earnings ratio stands at an attractive 4.4x against the TR market's average of 21.4x.

Diplomat Holdings (TASE:DIPL)

Simply Wall St Value Rating: ★★★★★★

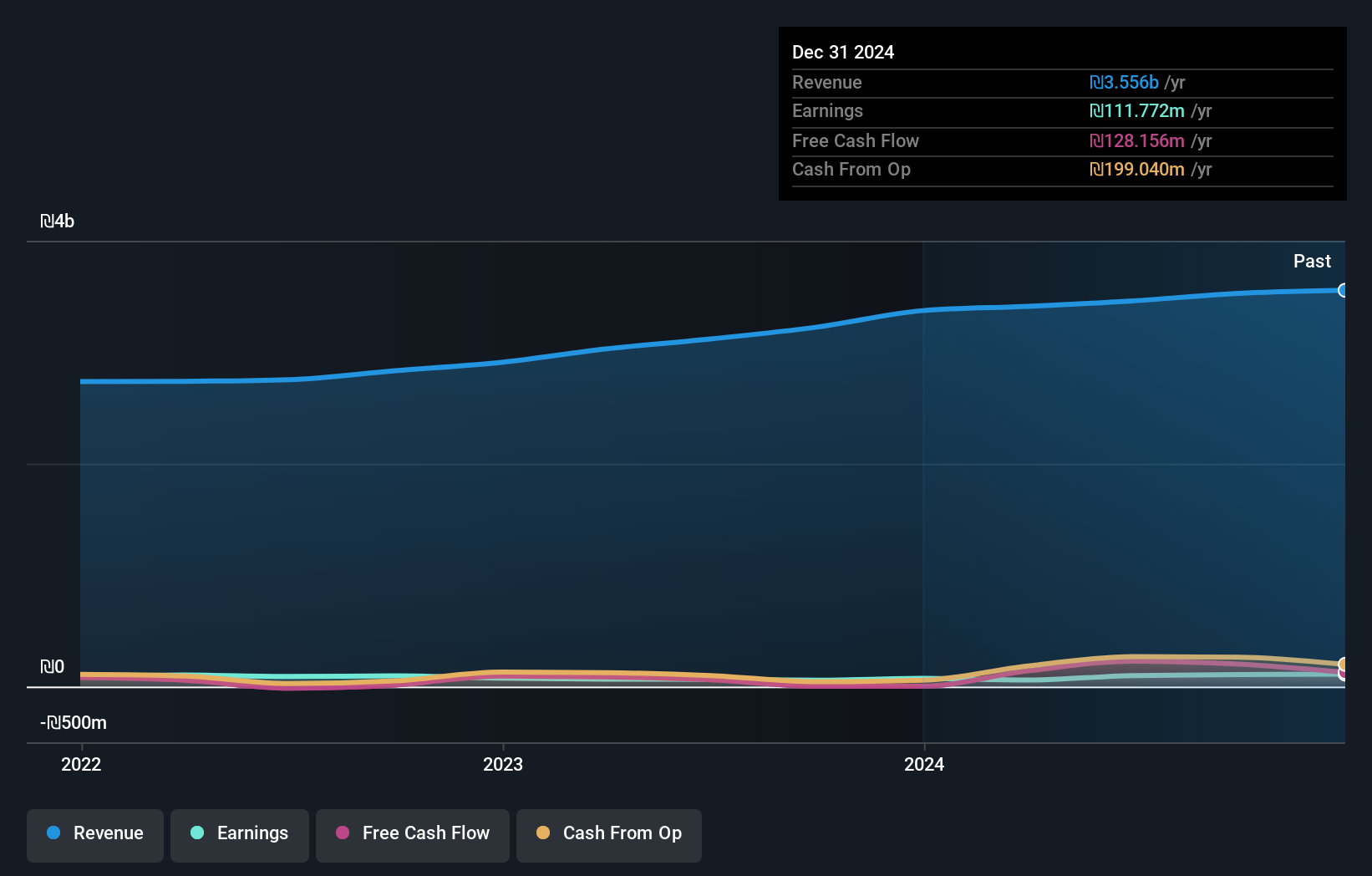

Overview: Diplomat Holdings Ltd. is a sales and distribution company in the fast-moving consumer goods sector with a market cap of ₪1.43 billion.

Operations: Diplomat Holdings generates revenue primarily through sales in the fast-moving consumer goods sector. The company reported a net profit margin of 3.5%, reflecting its ability to manage costs effectively within its operations.

Diplomat Holdings, a Middle Eastern company, has seen its debt to equity ratio improve from 79.4% to 52.4% over five years, signaling stronger financial health. Despite a one-off gain of ₪34.9 million affecting recent results, the firm's net debt to equity remains satisfactory at 30.9%. Its price-to-earnings ratio of 11.9x is attractive compared to the IL market's average of 15.4x, suggesting potential undervaluation. Recent earnings showed sales rising to ₪958 million for Q2 from ₪863 million last year, although net income slightly decreased from ₪56 million to ₪54 million during the same period due partly to strategic acquisitions and expenses related thereto.

- Get an in-depth perspective on Diplomat Holdings' performance by reading our health report here.

Gain insights into Diplomat Holdings' past trends and performance with our Past report.

Key Takeaways

- Discover the full array of 203 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:ALEFEDT

Alef Education Holding

Together with its subsidiary, provides AI-powered learning solutions in the United Arab Emirates, Indonesia, the United States, and the Kingdom of Saudi Arabia.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives