- Turkey

- /

- Capital Markets

- /

- IBSE:ISMEN

Discovering Undiscovered Gems in the Middle East This November 2025

Reviewed by Simply Wall St

In November 2025, the Middle East market is experiencing mixed performances across Gulf bourses, influenced by weak earnings reports and uncertainty surrounding U.S. interest rate cuts. As investors navigate these fluctuating conditions, identifying stocks with strong fundamentals and growth potential becomes crucial in uncovering undiscovered gems within this dynamic region.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 19.37% | 17.10% | 23.35% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Is Yatirim Menkul Degerler Anonim Sirketi (IBSE:ISMEN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Is Yatirim Menkul Degerler Anonim Sirketi operates by offering capital market services to both individual and corporate investors in Turkey and internationally, with a market capitalization of TRY 68.01 billion.

Operations: Is Yatirim Menkul Degerler Anonim Sirketi generates revenue primarily through its Asset Management/Asset Leasing segment, which accounts for TRY 975.03 billion. Other significant revenue streams include Venture Capital at TRY 7.63 billion and Portfolio Management at TRY 2.80 billion. The company's net profit margin reflects the efficiency of its operations and profitability in the competitive capital market sector.

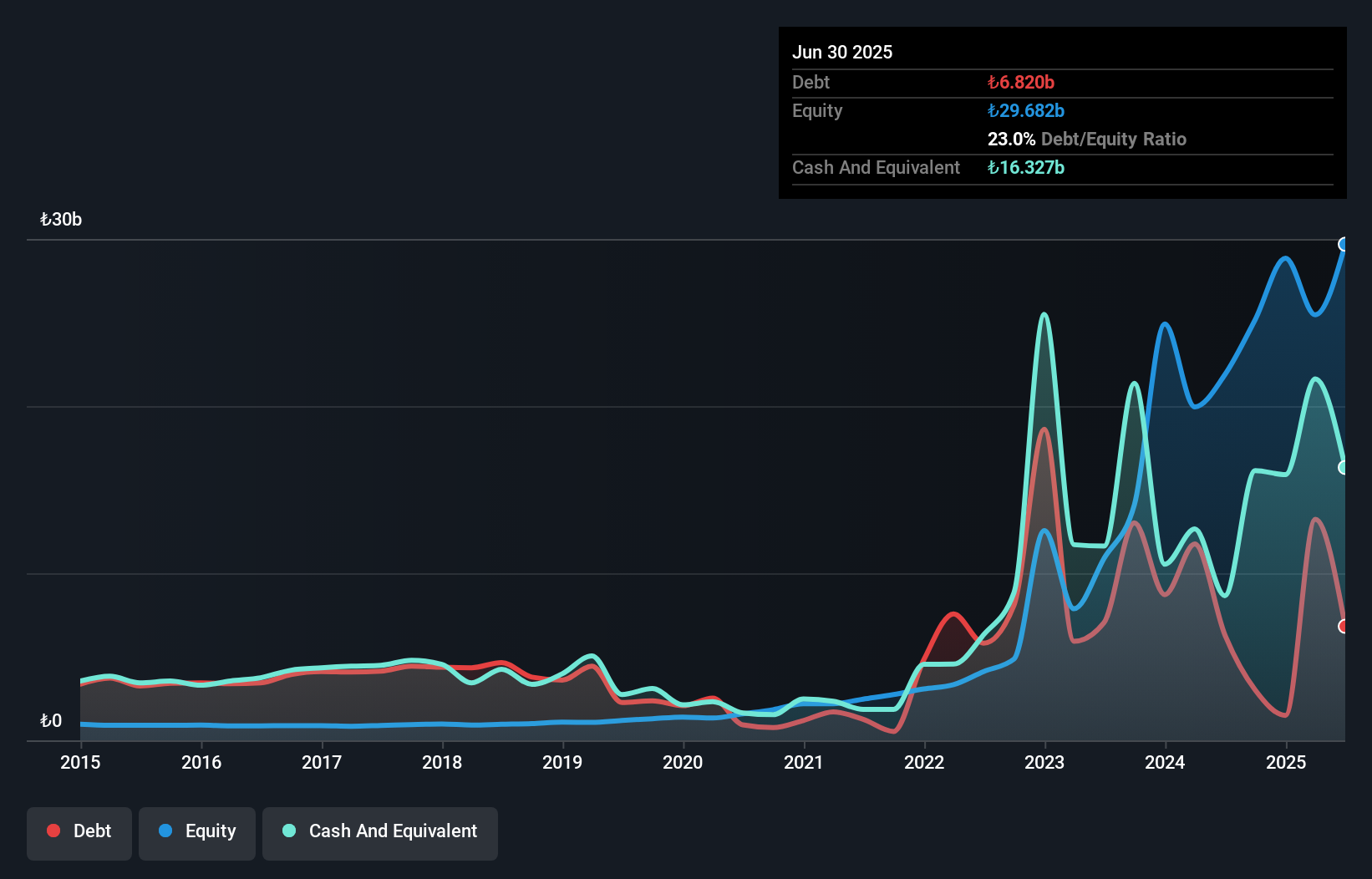

Is Yatirim Menkul Degerler Anonim Sirketi, a financial firm in Turkey, has shown notable resilience in the capital markets sector. Over the past year, its earnings growth of 11.5% outpaced the industry average of -5.6%. The company's debt-to-equity ratio impressively decreased from 58.4% to 23% over five years, indicating effective debt management. With a price-to-earnings ratio of 11.8x compared to the market's 22.7x and high-quality earnings reported, it seems attractively valued for potential investors seeking opportunities in emerging markets like Turkey's financial sector.

Ozak Gayrimenkul Yatirim Ortakligi (IBSE:OZKGY)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ozak Gayrimenkul Yatirim Ortakligi A.S. is a real estate investment trust with a market capitalization of TRY20.59 billion, focusing on various real estate and tourism hotel business operations.

Operations: Ozak Gayrimenkul Yatirim Ortakligi generates revenue primarily from its real estate investment trust activities, contributing TRY3.79 billion, and its tourism hotel business, adding TRY2.15 billion. The company experiences a financial impact due to consolidation and TERS arrangements amounting to -TRY502.05 million.

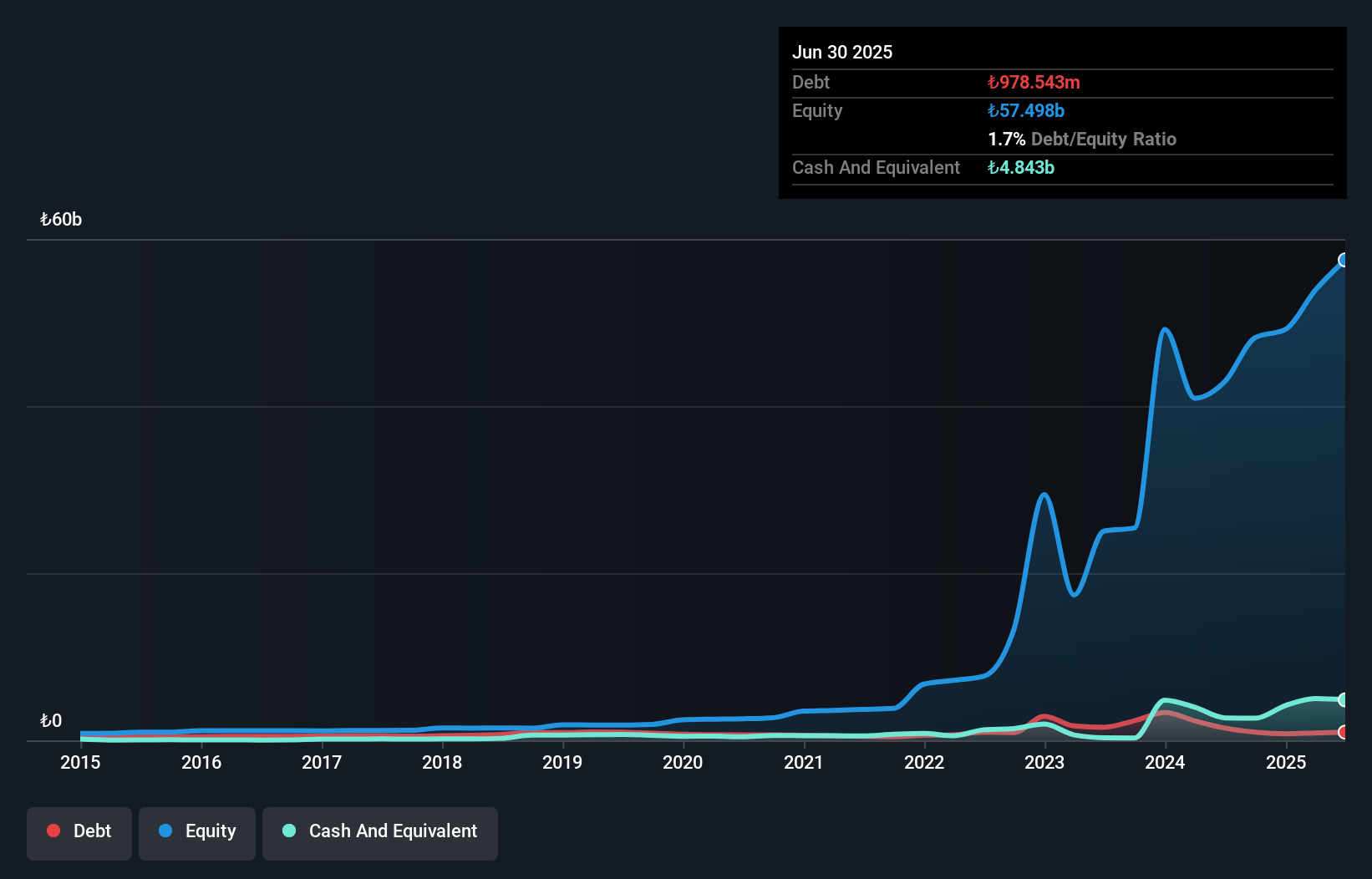

OZKGY has shown significant financial improvement, with its debt to equity ratio dropping from 25.1% to 1.7% over five years, indicating a strong balance sheet position. The company boasts a price-to-earnings ratio of 17x, which is more attractive than the TR market average of 22.7x. Despite a large one-off gain of TRY315M impacting recent results, earnings grew by an impressive 76.6%, outpacing the REITs industry average decline of -25.4%. Although not free cash flow positive, OZKGY's profitability and ability to cover interest payments suggest stability in operations moving forward.

- Click here and access our complete health analysis report to understand the dynamics of Ozak Gayrimenkul Yatirim Ortakligi.

Understand Ozak Gayrimenkul Yatirim Ortakligi's track record by examining our Past report.

East Pipes Integrated Company for Industry (SASE:1321)

Simply Wall St Value Rating: ★★★★★★

Overview: East Pipes Integrated Company for Industry specializes in providing coating services for customer-supplied pipes and has a market capitalization of SAR4.54 billion.

Operations: East Pipes generates revenue primarily from its Machinery - Pumps segment, amounting to SAR1.85 billion. The company's financial performance is influenced by its cost structure and market dynamics, with a notable focus on optimizing operational efficiency to impact profitability.

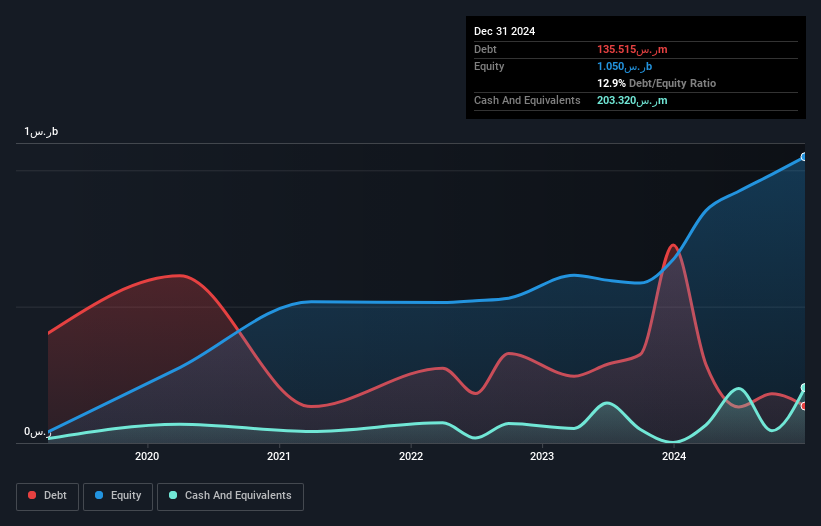

East Pipes Integrated Company for Industry stands out with a price-to-earnings ratio of 11.3x, notably below the South African market average of 20x, suggesting potential value. Over the past year, its earnings grew by 12.3%, surpassing the Metals and Mining industry growth of 9.1%. The company has reduced its debt-to-equity ratio from 146.6% to just 5.4% over five years, indicating improved financial health. Recent events include a cash dividend distribution totaling SAR 63 million for H1 FY2025-2026 and strategic board changes enhancing governance structure with experienced members like Mr. Walid Al-Zakri as audit committee chairman.

Where To Now?

- Unlock our comprehensive list of 212 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ISMEN

Is Yatirim Menkul Degerler Anonim Sirketi

Provides capital market services to individual and corporate investors in Turkey and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives