- Israel

- /

- Wireless Telecom

- /

- TASE:PTNR

Undiscovered Gems In The Middle East To Explore This April 2025

Reviewed by Simply Wall St

As the Middle Eastern markets continue to navigate through global trade tensions and fluctuating oil prices, recent developments such as potential U.S. tariff exemptions have bolstered investor sentiment, with most Gulf indices ending higher. In this dynamic environment, identifying promising stocks requires a keen eye for companies that demonstrate resilience and adaptability in the face of economic shifts—qualities that may reveal hidden opportunities within the region's evolving landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Amir Marketing and Investments in Agriculture | 13.05% | 5.82% | 3.78% | ★★★★★★ |

| Payton Industries | NA | 8.38% | 15.66% | ★★★★★★ |

| Formula Systems (1985) | 34.50% | 9.19% | 12.63% | ★★★★★★ |

| Terminal X Online | 18.34% | 17.80% | 32.47% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 23.69% | 28.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Malam - Team | 91.23% | 12.11% | -6.38% | ★★★★★☆ |

| C. Mer Industries | 114.92% | 13.32% | 73.44% | ★★★★☆☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| Aura Investments | 180.44% | 9.48% | 43.42% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Batiçim Bati Anadolu Çimento Sanayii Anonim Sirketi (IBSE:BTCIM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Batiçim Bati Anadolu Çimento Sanayii Anonim Sirketi is a company engaged in the cement industry both within Turkey and internationally, with a market capitalization of TRY27.47 billion.

Operations: Batiçim generates revenue primarily from Stone and Soil Based Products at TRY4.84 billion, followed by Ready Mixed Concrete at TRY2.93 billion. The company also earns from Electricity Production and Port Services, contributing TRY1.21 billion and TRY837.89 million respectively to its revenue streams.

Batiçim Bati Anadolu Çimento Sanayii Anonim Sirketi, a notable player in the cement industry, demonstrates robust financial health with earnings surging by 547% over the past year. This growth significantly outpaces the Basic Materials industry's performance of -34%. With a price-to-earnings ratio of 10.2x, it stands as an attractive value compared to the TR market's 17.8x. The company's debt management is commendable; its debt to equity ratio has impressively decreased from 145.2% to 26.3% over five years, indicating prudent financial strategies and positioning it well for future opportunities in its sector.

- Click here and access our complete health analysis report to understand the dynamics of Batiçim Bati Anadolu Çimento Sanayii Anonim Sirketi.

Learn about Batiçim Bati Anadolu Çimento Sanayii Anonim Sirketi's historical performance.

Almawarid Manpower (SASE:1833)

Simply Wall St Value Rating: ★★★★★★

Overview: Almawarid Manpower Company offers professional manpower services to individuals and businesses in Saudi Arabia, with a market cap of SAR2.22 billion.

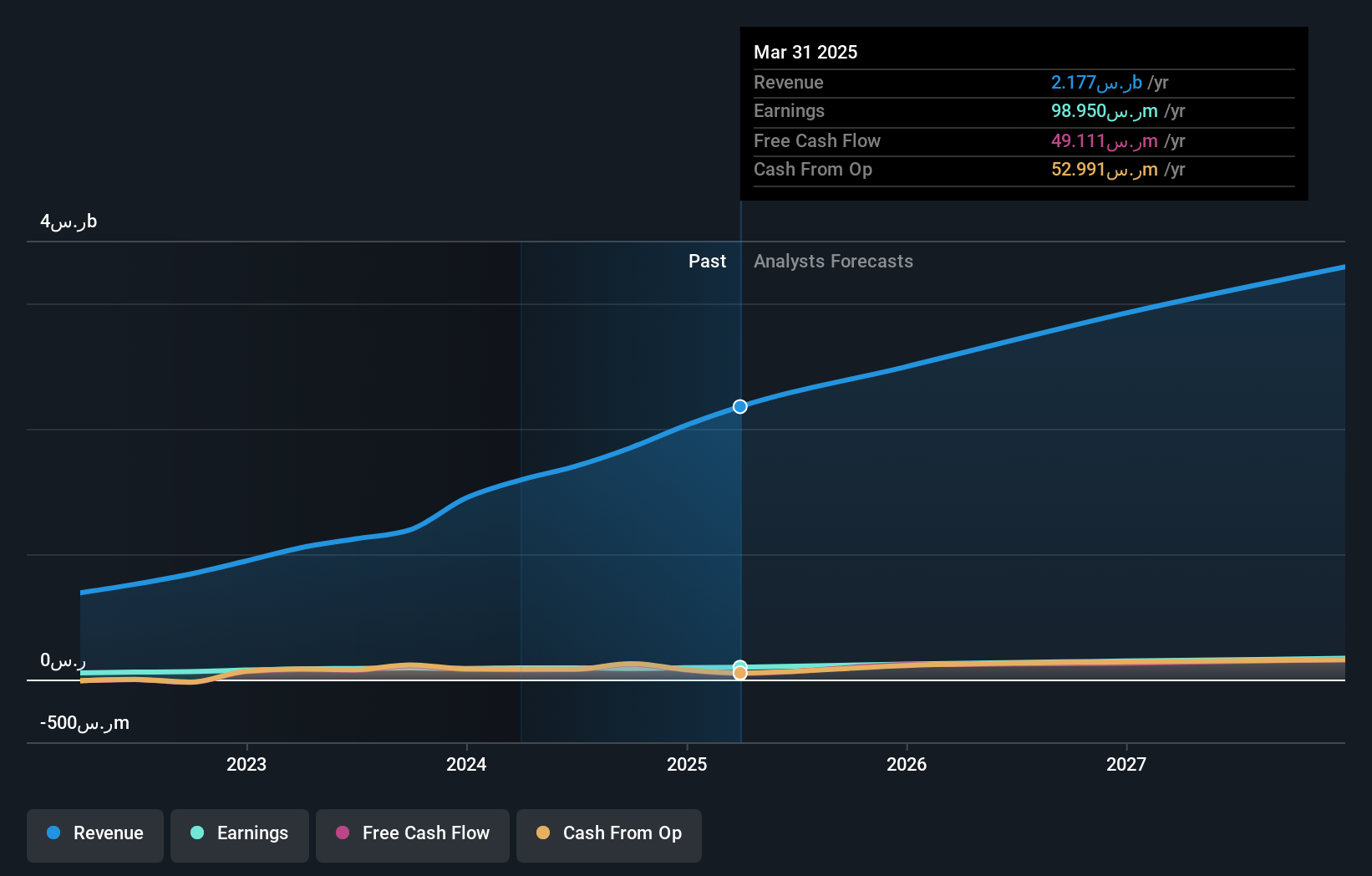

Operations: Almawarid Manpower generates revenue primarily from providing professional manpower services in Saudi Arabia. The company's financial performance is characterized by its net profit margin, which has shown variability over recent periods.

Almawarid Manpower showcases a compelling narrative with its recent performance. Over the past year, sales surged to SAR 2.03 billion from SAR 1.45 billion, while net income rose to SAR 95.42 million from SAR 88.77 million, reflecting robust growth dynamics in the manpower sector. Despite a dip in profit margins to 4.7% from last year's 7%, the company remains debt-free and has maintained high-quality earnings over five years with an annual growth rate of 17.8%. Earnings per share increased to SAR 6.36, indicating solid shareholder returns amidst market volatility and promising future earnings growth forecasted at over 15% annually.

Partner Communications (TASE:PTNR)

Simply Wall St Value Rating: ★★★★★★

Overview: Partner Communications Company Ltd. offers a range of communication services in Israel, with a market capitalization of ₪4.87 billion.

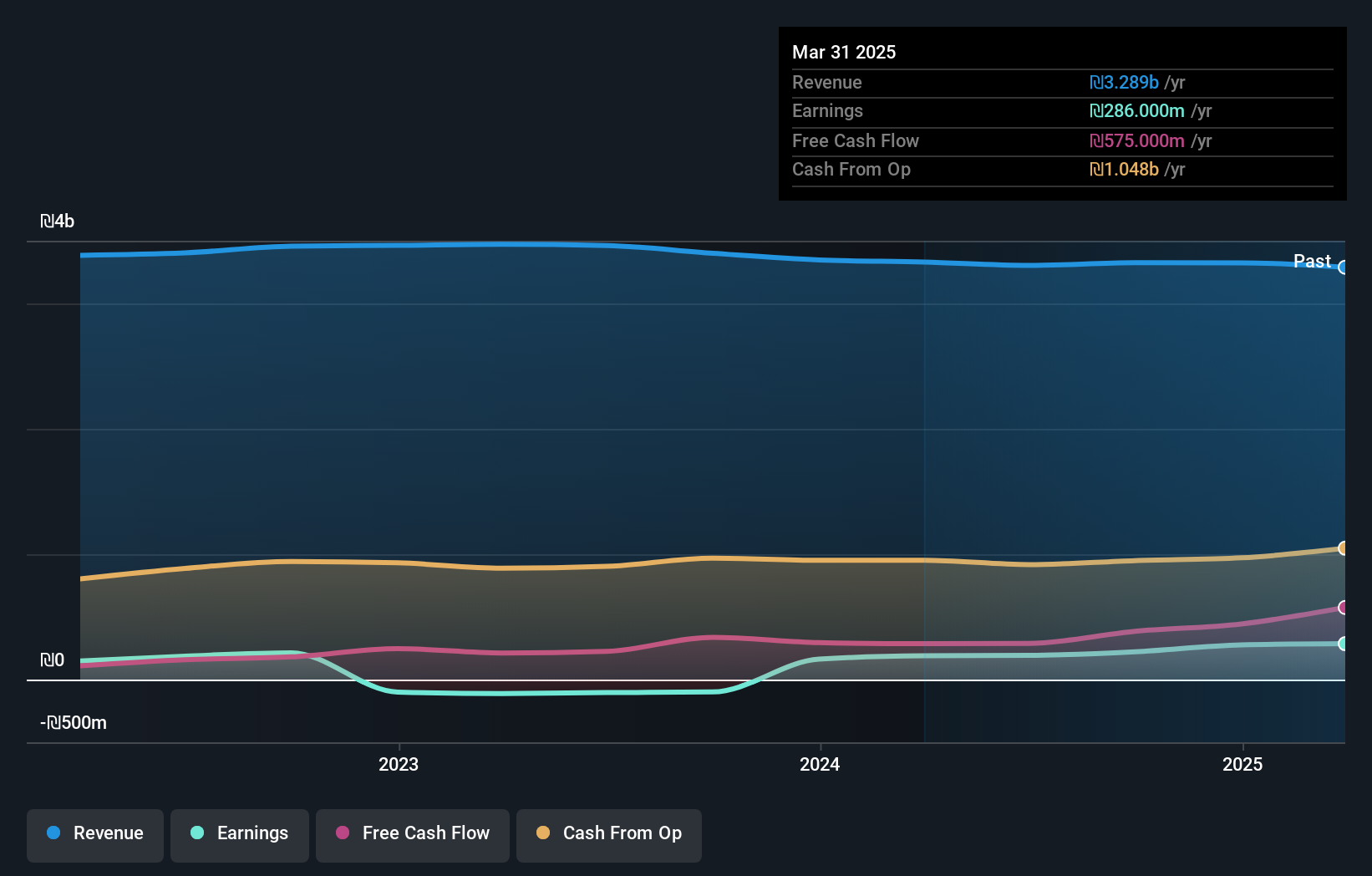

Operations: Partner Communications generates revenue primarily from its Cellular Segment, contributing ₪2.07 billion, and its Stationary Segment, adding ₪1.35 billion.

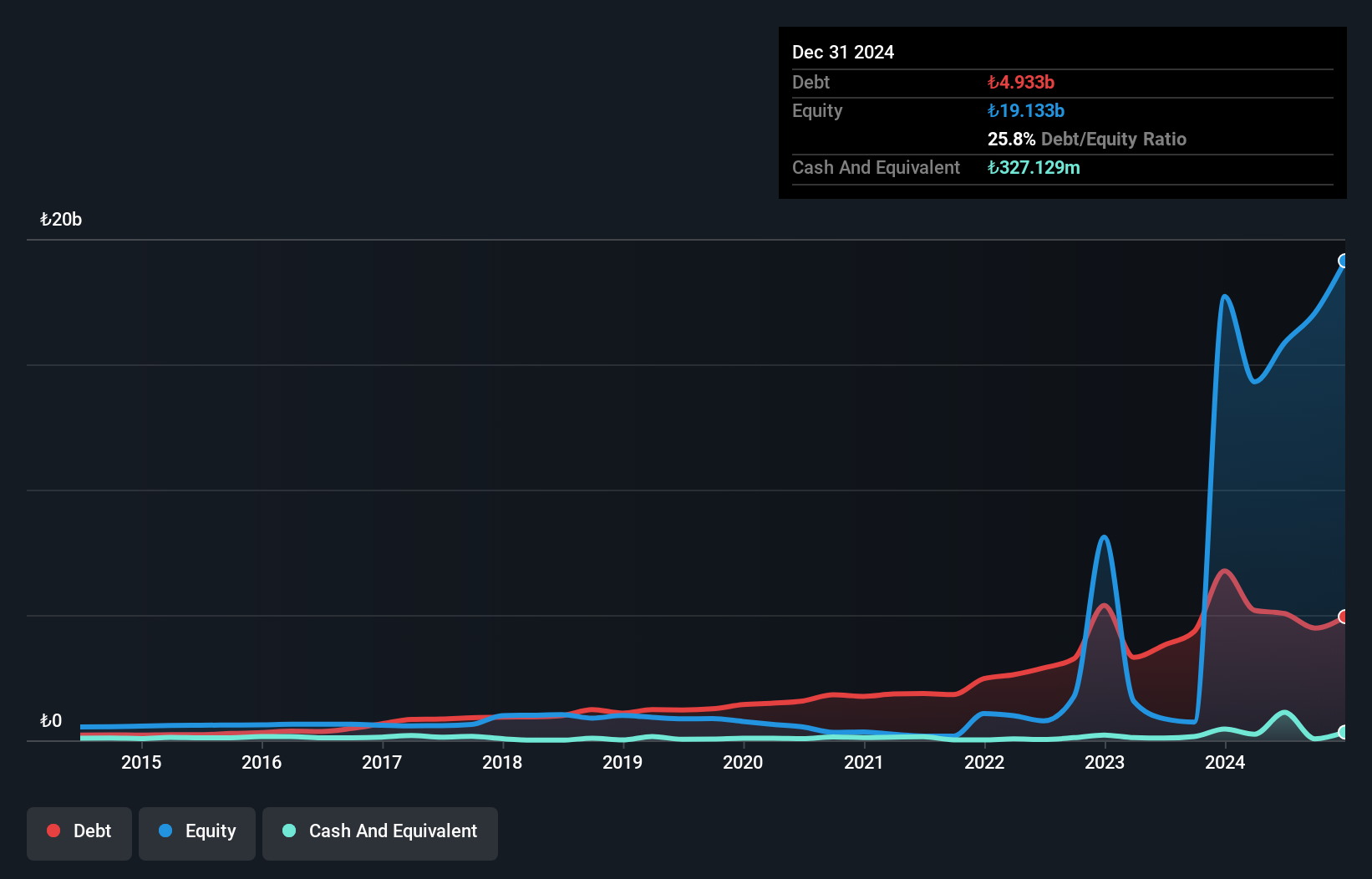

Partner Communications, a player in the Middle East telecom sector, showcases robust financial health with a net debt to equity ratio of 11.3%, indicating satisfactory leverage management. Over the past year, earnings surged by 69.9%, significantly outpacing the industry's growth rate of 11.7%. The company trades at an attractive valuation, approximately 36.6% below estimated fair value, suggesting potential upside for investors. Despite sales dipping slightly to ILS 3.32 billion from ILS 3.35 billion last year, net income jumped to ILS 277 million from ILS 163 million previously, reflecting improved profitability and operational efficiency in its core business activities.

- Dive into the specifics of Partner Communications here with our thorough health report.

Explore historical data to track Partner Communications' performance over time in our Past section.

Next Steps

- Explore the 244 names from our Middle Eastern Undiscovered Gems With Strong Fundamentals screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:PTNR

Partner Communications

Provides various communication services in Israel.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives