As rising U.S. Treasury yields continue to exert pressure on global markets, the S&P 500 Index has seen a recent dip after weeks of gains, with large-cap stocks holding up better than their small-cap counterparts. Amidst this backdrop of cautious economic growth and fluctuating market dynamics, identifying promising small-cap stocks can be particularly rewarding as these companies often have the potential to outperform in evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Anadolu Anonim Türk Sigorta Sirketi (IBSE:ANSGR)

Simply Wall St Value Rating: ★★★★★★

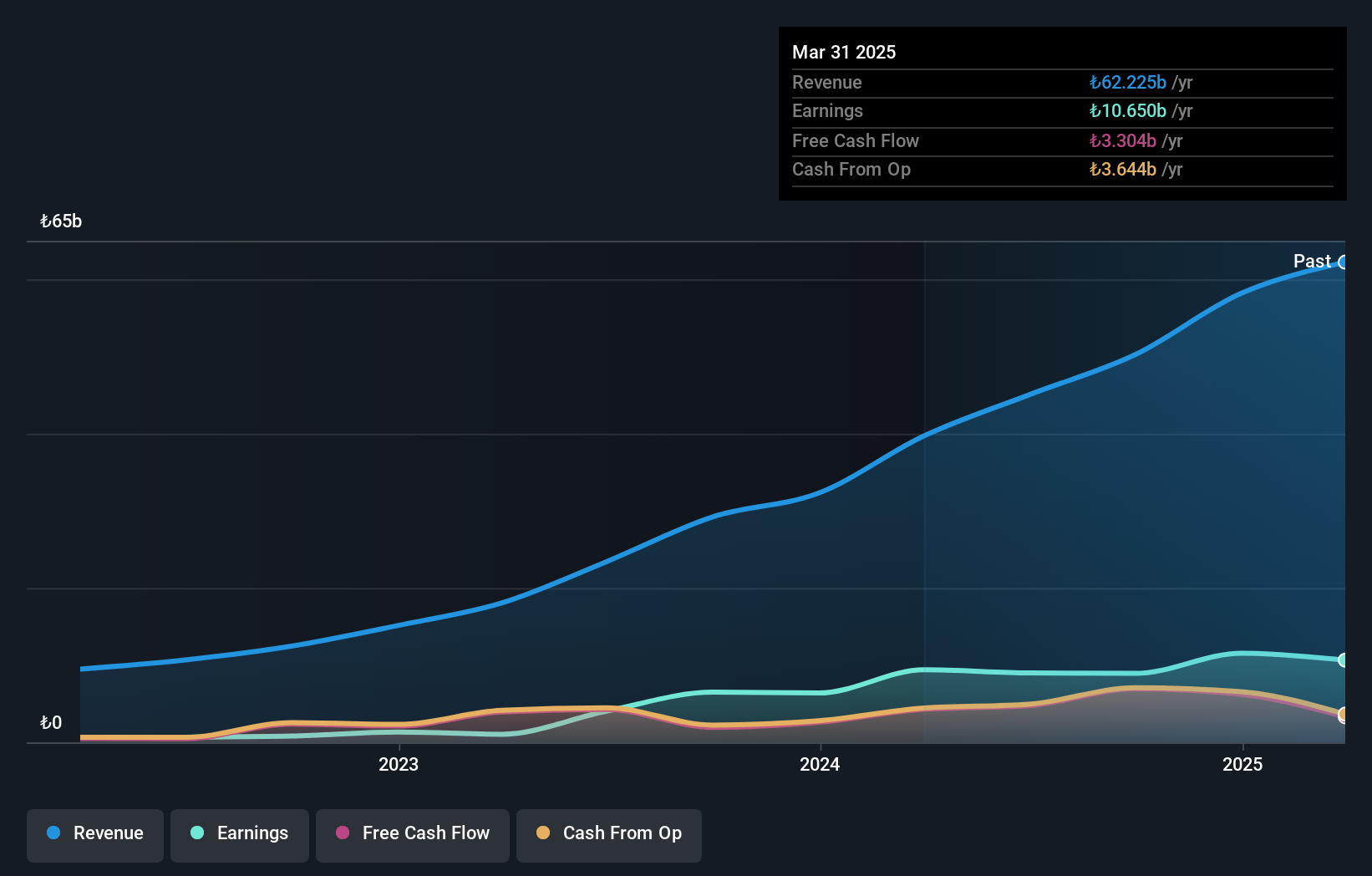

Overview: Anadolu Anonim Türk Sigorta Sirketi provides non-life insurance products in Turkey and has a market capitalization of TRY42.50 billion.

Operations: The company generates revenue primarily through its non-life insurance products. It has a market capitalization of TRY42.50 billion, indicating significant scale in the Turkish insurance sector.

Anadolu Sigorta, a player in the insurance sector, showcases a robust financial profile with no debt, contrasting its past 18.9% debt-to-equity ratio five years ago. Its price-to-earnings ratio of 4.8x suggests potential value against the TR market's 15x benchmark. Despite trailing industry earnings growth at 37.5% versus 52.2%, its high-quality earnings and consistent annual growth rate of 67.9% over five years paint a promising picture. Recent results indicate net income for nine months surged to TRY 8,278 million from TRY 5,734 million last year, though quarterly figures dipped slightly to TRY 2,597 million from TRY 2,660 million year-on-year.

- Navigate through the intricacies of Anadolu Anonim Türk Sigorta Sirketi with our comprehensive health report here.

Learn about Anadolu Anonim Türk Sigorta Sirketi's historical performance.

Nuh Çimento Sanayi (IBSE:NUHCM)

Simply Wall St Value Rating: ★★★★★★

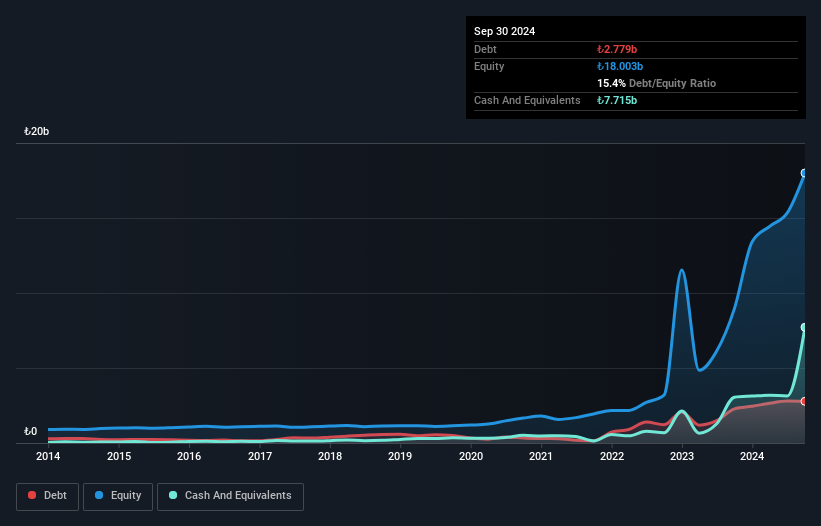

Overview: Nuh Çimento Sanayi A.S. is a Turkish company engaged in the production and sale of cement, clinker, and mineral additives, with a market capitalization of TRY40.86 billion.

Operations: Nuh Çimento Sanayi generates revenue primarily from its Construction and Construction Materials segment, amounting to TRY12.78 billion, alongside an Energy segment contributing TRY25.11 million. The company experiences consolidation adjustments of -TRY1.43 billion impacting overall financials.

Nuh Çimento Sanayi, a notable player in the cement industry, has seen its financial landscape shift recently. Despite a robust cash position exceeding total debt and positive free cash flow of TRY 2.33 billion as of June 2024, earnings have struggled with a net income drop to TRY 125 million for Q2 compared to TRY 698 million the previous year. The company's debt-to-equity ratio improved significantly over five years from 49.8% to 18.3%, yet its negative earnings growth of -31.8% contrasts sharply with the industry's average growth of 56.5%. This paints a complex picture for potential investors considering its future trajectory amidst industry challenges and internal adjustments.

- Click here to discover the nuances of Nuh Çimento Sanayi with our detailed analytical health report.

Gain insights into Nuh Çimento Sanayi's past trends and performance with our Past report.

Migdal Insurance and Financial Holdings (TASE:MGDL)

Simply Wall St Value Rating: ★★★★★☆

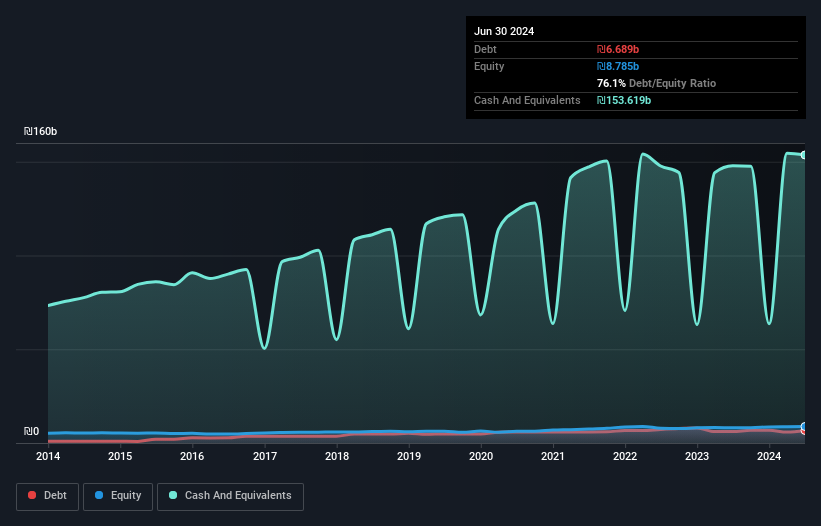

Overview: Migdal Insurance and Financial Holdings Ltd. operates in Israel, offering insurance, pension, and financial services to both private and corporate clients with a market capitalization of ₪6.34 billion.

Operations: Migdal generates revenue primarily from its life insurance and long-term savings segment, contributing ₪22.79 billion, followed by general insurance with automobile property insurance at ₪860.62 million. Health insurance also adds significantly with revenues of ₪2.26 billion. The company's net profit margin is a crucial metric to monitor for insights into profitability trends over time.

Migdal Insurance, a smaller player in the insurance sector, has demonstrated impressive earnings growth of 207.4% over the past year, outpacing the industry average of 170%. The company seems to be in a strong financial position with cash exceeding its total debt and interest payments well covered by EBIT at 8.8 times coverage. Trading at 67.3% below its estimated fair value suggests potential undervaluation. Recent results showed net income of ILS 459 million for Q2 compared to a loss last year, highlighting an improved performance trajectory that could attract investor attention moving forward.

Key Takeaways

- Click here to access our complete index of 4739 Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ANSGR

Anadolu Anonim Türk Sigorta Sirketi

Offers non-life insurance products in Turkey.

Flawless balance sheet with acceptable track record.