As most Gulf markets have recently ended higher, buoyed by favorable earnings reports and U.S. Federal Reserve rate cuts, the Middle Eastern stock landscape presents intriguing opportunities for investors. In such a dynamic environment, identifying stocks with solid fundamentals and growth potential can be particularly rewarding, especially as regional economies continue to navigate global economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 19.37% | 17.10% | 23.35% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Anadolu Anonim Türk Sigorta Sirketi (IBSE:ANSGR)

Simply Wall St Value Rating: ★★★★★★

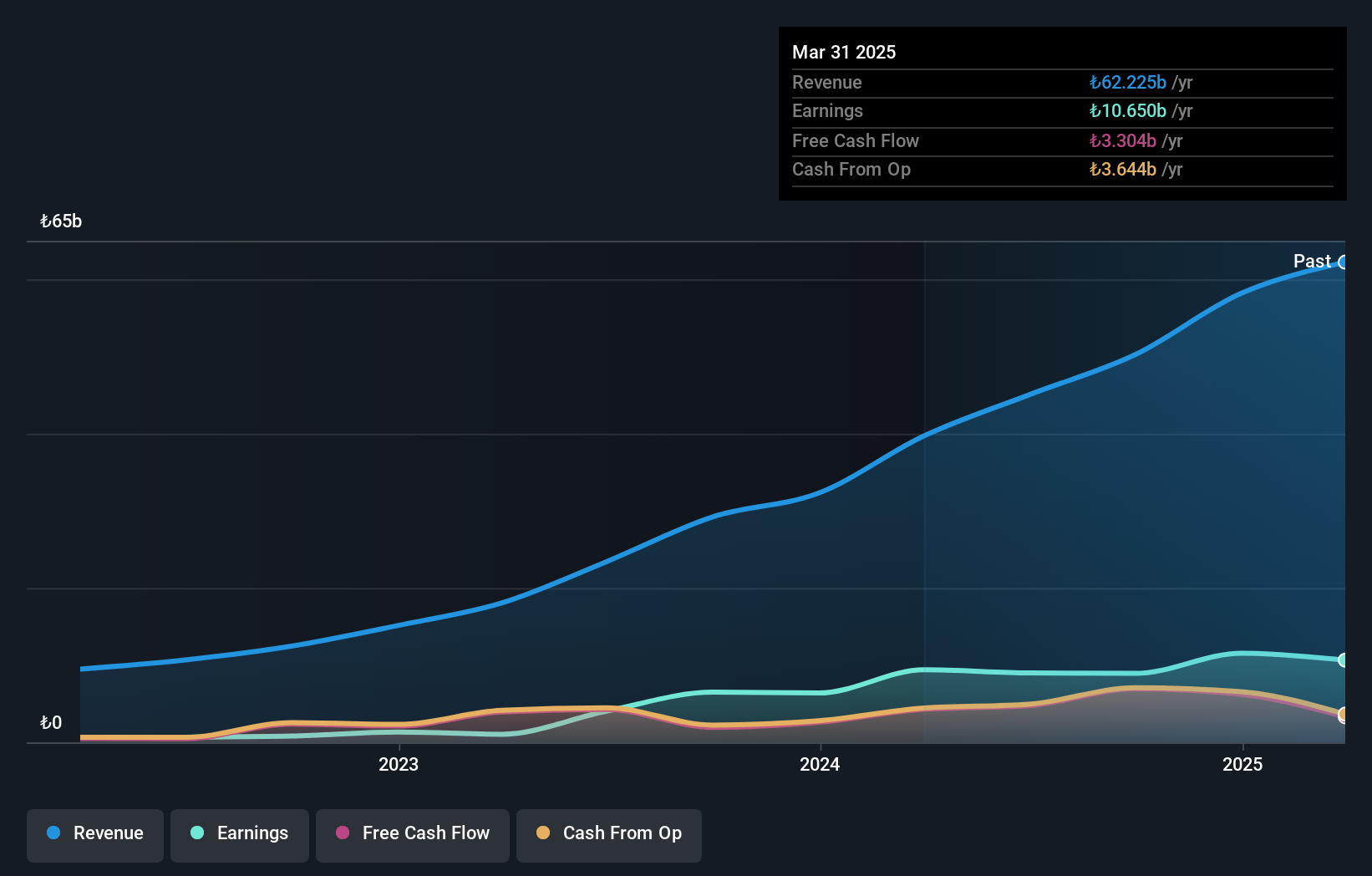

Overview: Anadolu Anonim Türk Sigorta Sirketi operates as an insurance company in Turkey, with a market capitalization of TRY46.56 billion.

Operations: Anadolu Anonim Türk Sigorta Sirketi generates revenue primarily from segments such as Motor Vehicles (TRY15.85 billion), Sickness/Health (TRY14.74 billion), and Motor Vehicles Liability (TRY11.46 billion). The Fire and Natural Disasters segment also contributes with TRY6.56 billion in revenue.

Anadolu Sigorta, a notable player in the Middle Eastern insurance market, stands out with its strong financial performance. Over the past five years, earnings have surged by 59% annually, showcasing robust growth despite not surpassing industry averages. The company is debt-free and trades at approximately 32% below its estimated fair value, hinting at potential undervaluation. Recent reports reveal a net income of TRY 3.74 billion for Q3 2025 compared to TRY 2.60 billion last year, alongside basic earnings per share rising from TRY 1.30 to TRY 1.87 year-over-year—indicative of solid profitability and high-quality earnings without free cash flow positivity concerns.

Tera Yatirim Menkul Degerler (IBSE:TERA)

Simply Wall St Value Rating: ★★★★☆☆

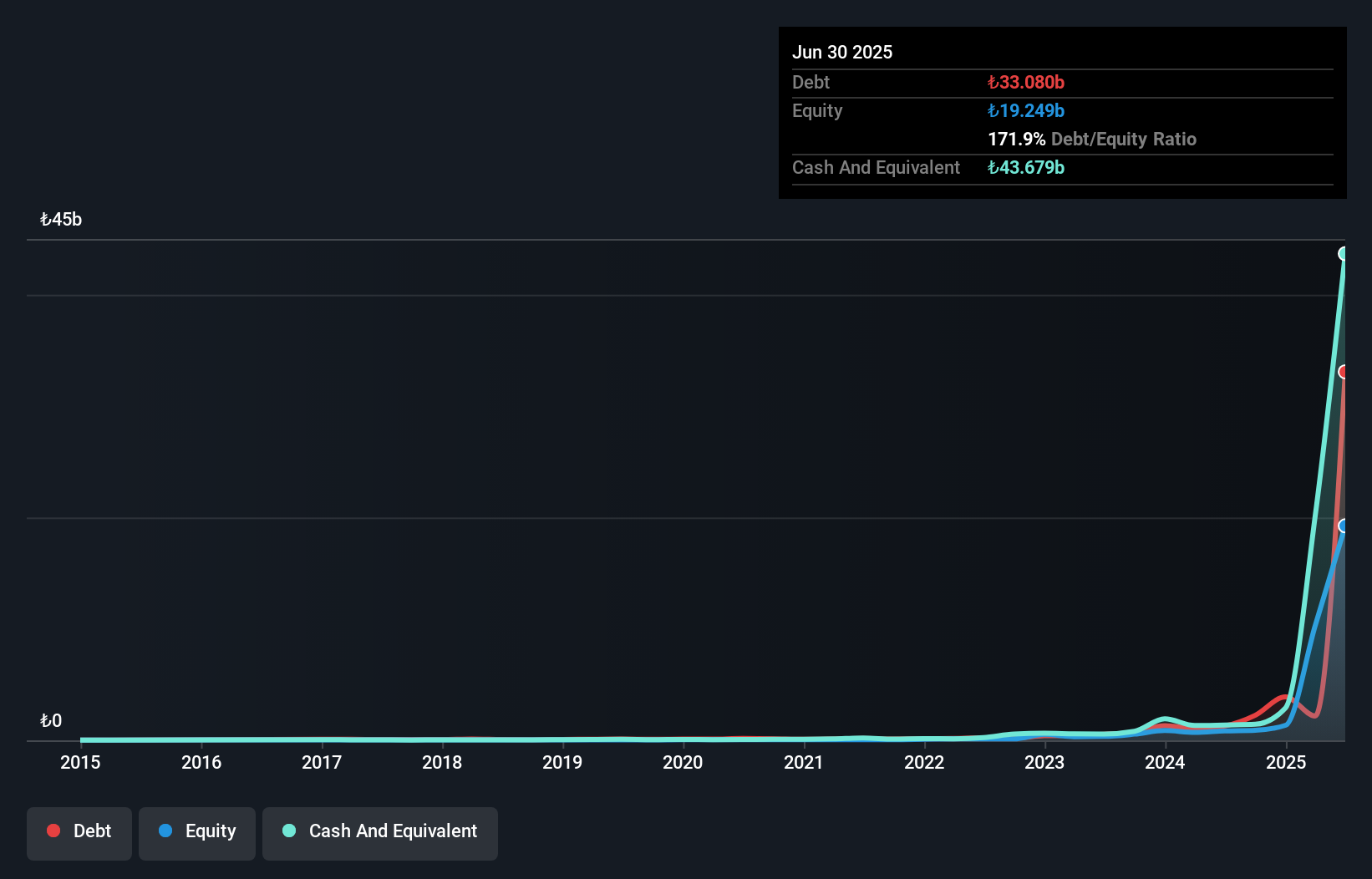

Overview: Tera Yatirim Menkul Degerler A.S. operates in Turkey, focusing on investment banking and brokerage services, with a market capitalization of TRY33.96 billion.

Operations: Tera Yatirim generates revenue primarily from investment banking and brokerage services in Turkey. The company has a market capitalization of TRY33.96 billion.

Tera Yatirim's recent inclusion in the S&P Global BMI and FTSE All-World Indexes marks a significant milestone, reflecting its impressive earnings growth of 9359.9% over the past year. With a price-to-earnings ratio of just 1.8x, it stands out as an attractive value compared to the TR market average of 22.6x. The company's debt management has improved significantly, with its debt-to-equity ratio dropping from 280.5% to 171.9% over five years, and it now holds more cash than total debt, suggesting financial resilience amidst rapid growth in net income from TRY 66 million to TRY 9204 million year-on-year for Q2.

- Take a closer look at Tera Yatirim Menkul Degerler's potential here in our health report.

Learn about Tera Yatirim Menkul Degerler's historical performance.

Aryt Industries (TASE:ARYT)

Simply Wall St Value Rating: ★★★★★★

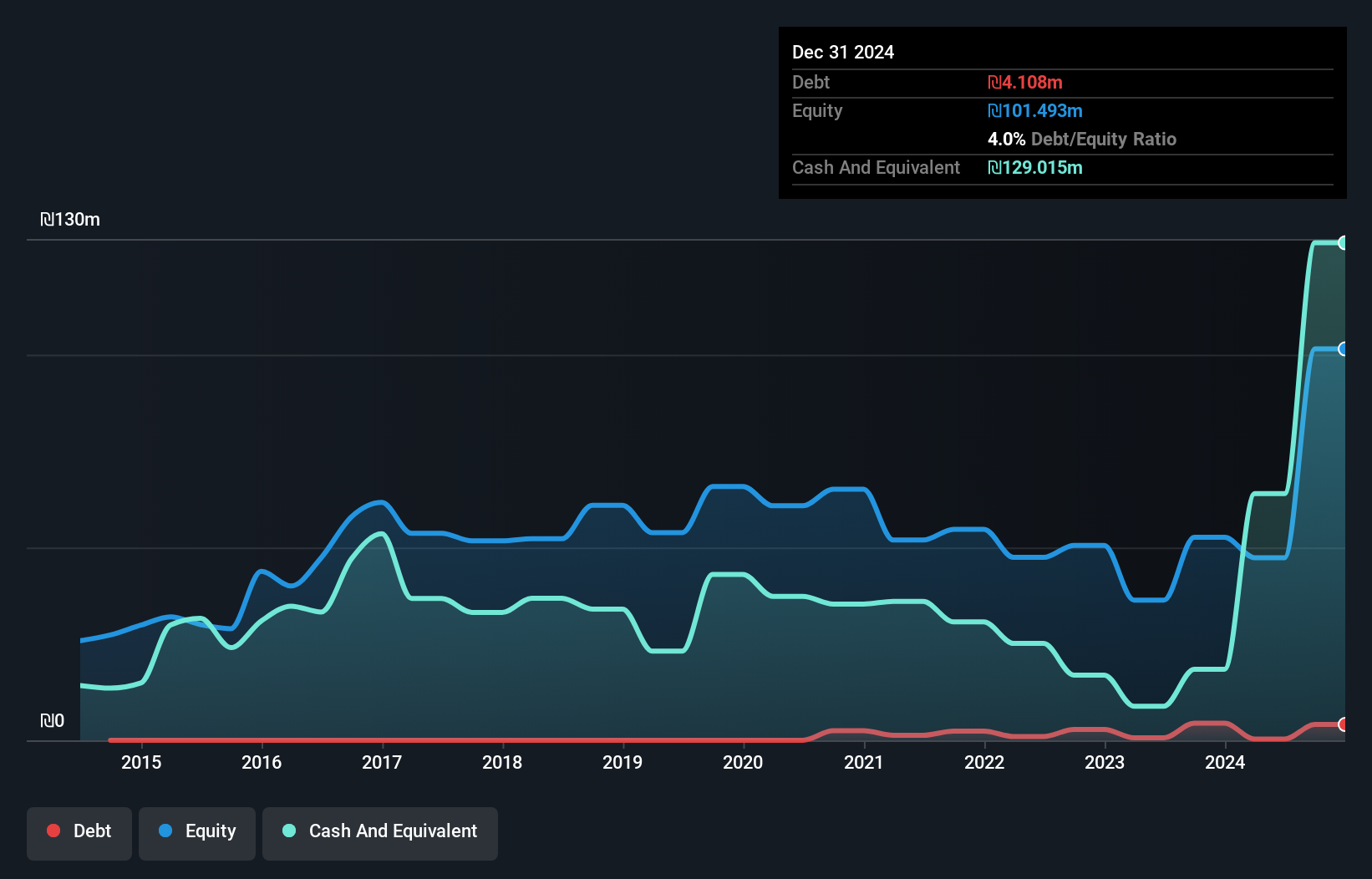

Overview: Aryt Industries Ltd. operates through its subsidiaries to develop, produce, and market electronic thunderbolt for the defense sector in Israel, with a market cap of ₪4.32 billion.

Operations: Aryt generates revenue primarily from its detonators segment, which contributed ₪252.36 million. The company's gross profit margin is noteworthy at 45%.

Aryt Industries has shown impressive growth, with earnings skyrocketing by 578.7% over the past year, far outpacing the Aerospace & Defense industry average of 45.3%. The company is debt-free and trades at a significant discount of 57.5% below its estimated fair value, making it an attractive proposition for investors seeking undervalued opportunities. Recent financial results highlight robust performance, with sales reaching ILS 155 million and net income hitting ILS 95.79 million for the half-year ending June 2025. Aryt's addition to the S&P Global BMI Index further underscores its growing prominence in the market landscape.

- Click here to discover the nuances of Aryt Industries with our detailed analytical health report.

Review our historical performance report to gain insights into Aryt Industries''s past performance.

Taking Advantage

- Get an in-depth perspective on all 211 Middle Eastern Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ANSGR

Anadolu Anonim Türk Sigorta Sirketi

Engages in the insurance business in Turkey.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives