As Middle East equities rise in anticipation of strong earnings, with Dubai recently retreating from a 17-year high, the region's market dynamics are capturing global investor attention. In such an environment, identifying promising stocks involves looking for companies that demonstrate resilience and potential growth amidst fluctuating indices and economic indicators.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Besler Gida Ve Kimya Sanayi ve Ticaret Anonim Sirketi | 40.12% | 43.54% | 38.87% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 1.05% | 36.24% | 62.23% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Aksigorta (IBSE:AKGRT)

Simply Wall St Value Rating: ★★★★★★

Overview: Aksigorta A.S. offers a range of life and non-life insurance products and services to both retail and business clients in Turkey, with a market capitalization of TRY11.70 billion.

Operations: Aksigorta generates revenue primarily from its Motor Vehicles (Automotive Insurance) and Motor Vehicles Liability (Compulsory Traffic) segments, contributing TRY5.28 billion and TRY3.86 billion, respectively. The company's other significant revenue streams include Fire insurance at TRY2.58 billion and Other Accident insurance at TRY1.61 billion.

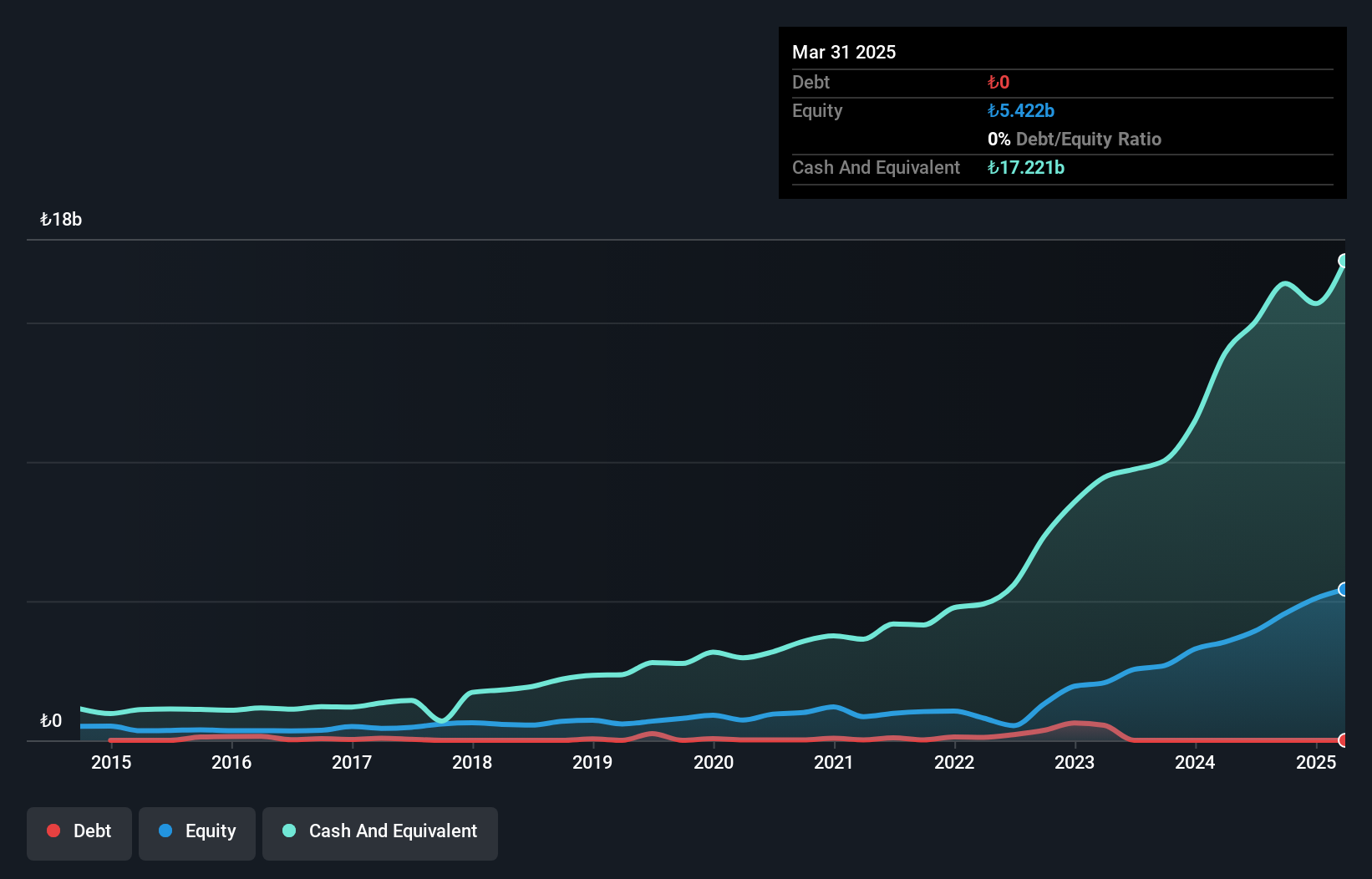

Aksigorta, a player in the insurance sector, showcases impressive earnings growth of 45.5% over the past year, outpacing the industry average of 36.5%. With no debt on its books, it stands out as financially robust compared to five years ago when its debt-to-equity ratio was at 2%. The company's price-to-earnings ratio is an attractive 6x, significantly lower than the TR market's average of 20x. Aksigorta's high-quality earnings and positive free cash flow further enhance its profile as a compelling investment opportunity in the Middle East insurance landscape.

- Navigate through the intricacies of Aksigorta with our comprehensive health report here.

Explore historical data to track Aksigorta's performance over time in our Past section.

Hitit Bilgisayar Hizmetleri (IBSE:HTTBT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hitit Bilgisayar Hizmetleri A.S. offers airline and travel IT and software solutions globally under the Crane brand, with a market cap of TRY13.50 billion.

Operations: Hitit Bilgisayar Hizmetleri generates revenue primarily from its Software & Programming segment, amounting to TRY1.25 billion. The company's financial performance is reflected in its net profit margin, which provides insight into profitability relative to its total revenue.

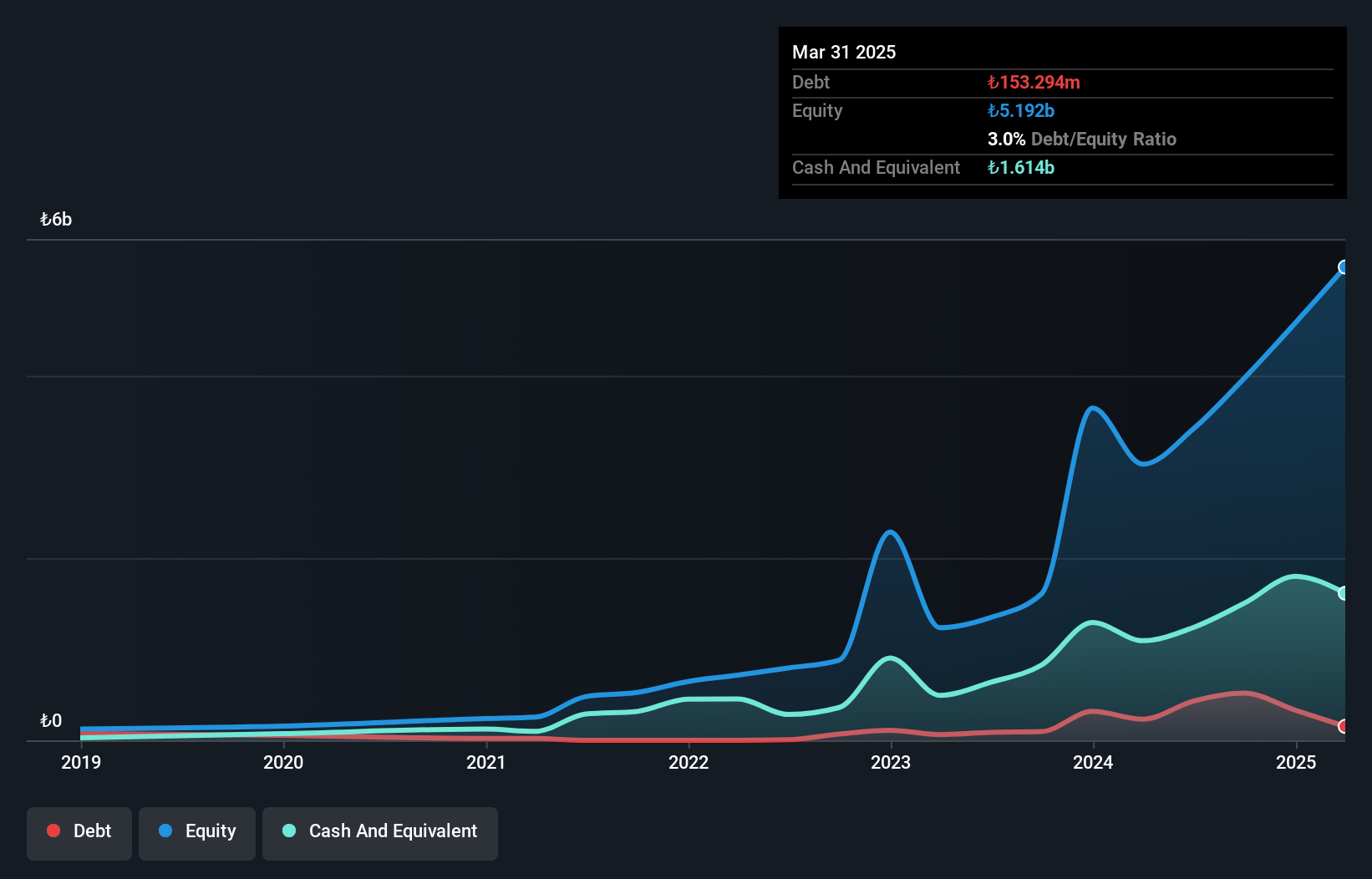

Hitit Bilgisayar Hizmetleri, a promising name in the Middle East tech landscape, has seen its earnings grow by 111% over the past year, outpacing the software industry's 22% growth. Despite a rise in debt-to-equity ratio from 7.6% to 14.7% over five years, it holds more cash than total debt, indicating financial resilience. Recent results for Q1 2025 showed sales at TRY 345.09 million and net income reaching TRY 65.73 million compared to TRY 215.83 million and TRY 44.88 million respectively last year; basic EPS improved to TRY 0.2191 from TRY 0.1496 previously.

Kalekim Kimyevi Maddeler Sanayi Ve Ticaret Anonim Sirketi (IBSE:KLKIM)

Simply Wall St Value Rating: ★★★★★★

Overview: Kalekim Kimyevi Maddeler Sanayi Ve Ticaret Anonim Sirketi operates in the construction chemicals sector both in Turkey and internationally, with a market capitalization of TRY13.48 billion.

Operations: Kalekim generates revenue primarily from its Ceramic Applications segment, contributing TRY4.52 billion, and Concrete Chemicals segment, adding TRY1.77 billion. The Paint-Plaster and Water Isolation segments contribute TRY460.45 million and TRY454.62 million, respectively.

Kalekim, a notable player in the chemicals sector, has seen its debt to equity ratio shrink from 26.6% to 3% over five years, highlighting improved financial stability. Despite a dip in first-quarter sales to TRY 1.77 billion from TRY 1.99 billion the previous year, earnings per share held steady at TRY 0.3 due to high-quality earnings and effective cost management. With earnings growth of 15.8%, outpacing industry averages, Kalekim is trading slightly below fair value estimates and boasts more cash than total debt—a promising sign for future expansion and resilience against market fluctuations.

Taking Advantage

- Discover the full array of 222 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kalekim Kimyevi Maddeler Sanayi Ve Ticaret Anonim Sirketi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:KLKIM

Kalekim Kimyevi Maddeler Sanayi Ve Ticaret Anonim Sirketi

Operates in the construction chemicals sector in Turkey and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives