- Saudi Arabia

- /

- Insurance

- /

- SASE:8250

3 Undiscovered Gems in Middle East Stocks with Promising Potential

Reviewed by Simply Wall St

The Middle East stock markets have recently experienced turbulence, with Gulf indices sliding amid escalating geopolitical tensions between Israel and Iran, raising concerns about potential disruptions in the region's energy exports. Despite these challenges, opportunities remain for investors seeking unique prospects in this dynamic landscape, where identifying stocks with strong fundamentals and resilience to market volatility can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Mackolik Internet Hizmetleri Ticaret | 0.14% | 25.61% | 36.34% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Lila Kagit Sanayi Ve Ticaret (IBSE:LILAK)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lila Kagit Sanayi Ve Ticaret A.S. is a company that produces and sells roll papers primarily in Turkey, with a market capitalization of TRY13.19 billion.

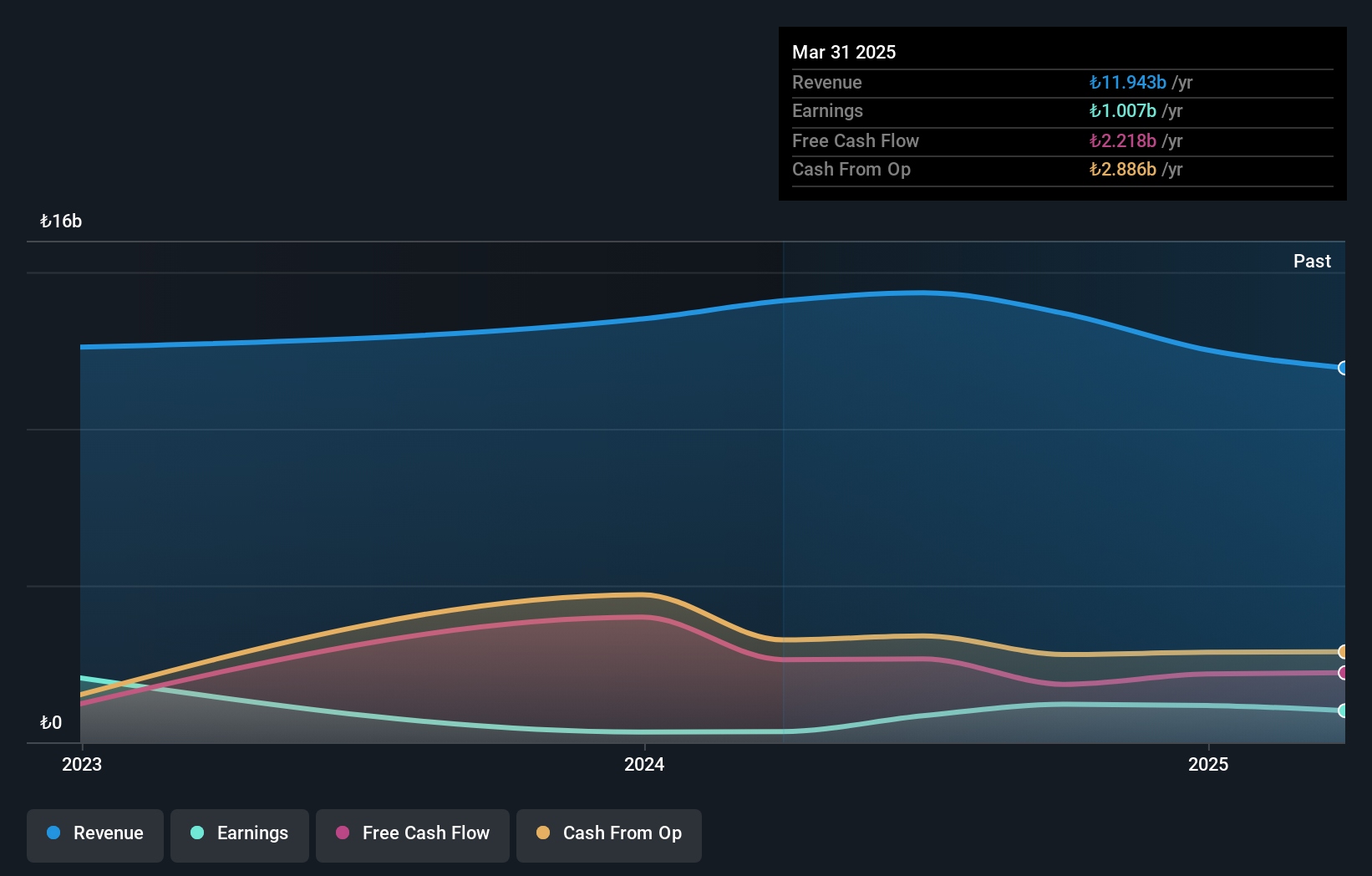

Operations: Lila Kagit generates revenue primarily from its Paper & Paper Products segment, which reported TRY11.94 billion. The company's financial performance is significantly influenced by this segment's contribution to overall revenue.

Lila Kagit, a notable player in the household products sector, has demonstrated impressive earnings growth of 195.8% over the past year, outpacing its industry peers' 4.4%. Despite this growth, recent financial results show a net loss of TRY 0.92 million for Q1 2025 compared to a profit of TRY 167.16 million in the same period last year. The company trades at approximately 34.9% below its estimated fair value and maintains more cash than total debt, indicating robust financial health despite earnings declining by an average of 5.1% annually over the past five years.

Gulf Insurance Group (SASE:8250)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gulf Insurance Group offers a range of insurance and reinsurance products and services in Saudi Arabia, with a market capitalization of SAR1.26 billion.

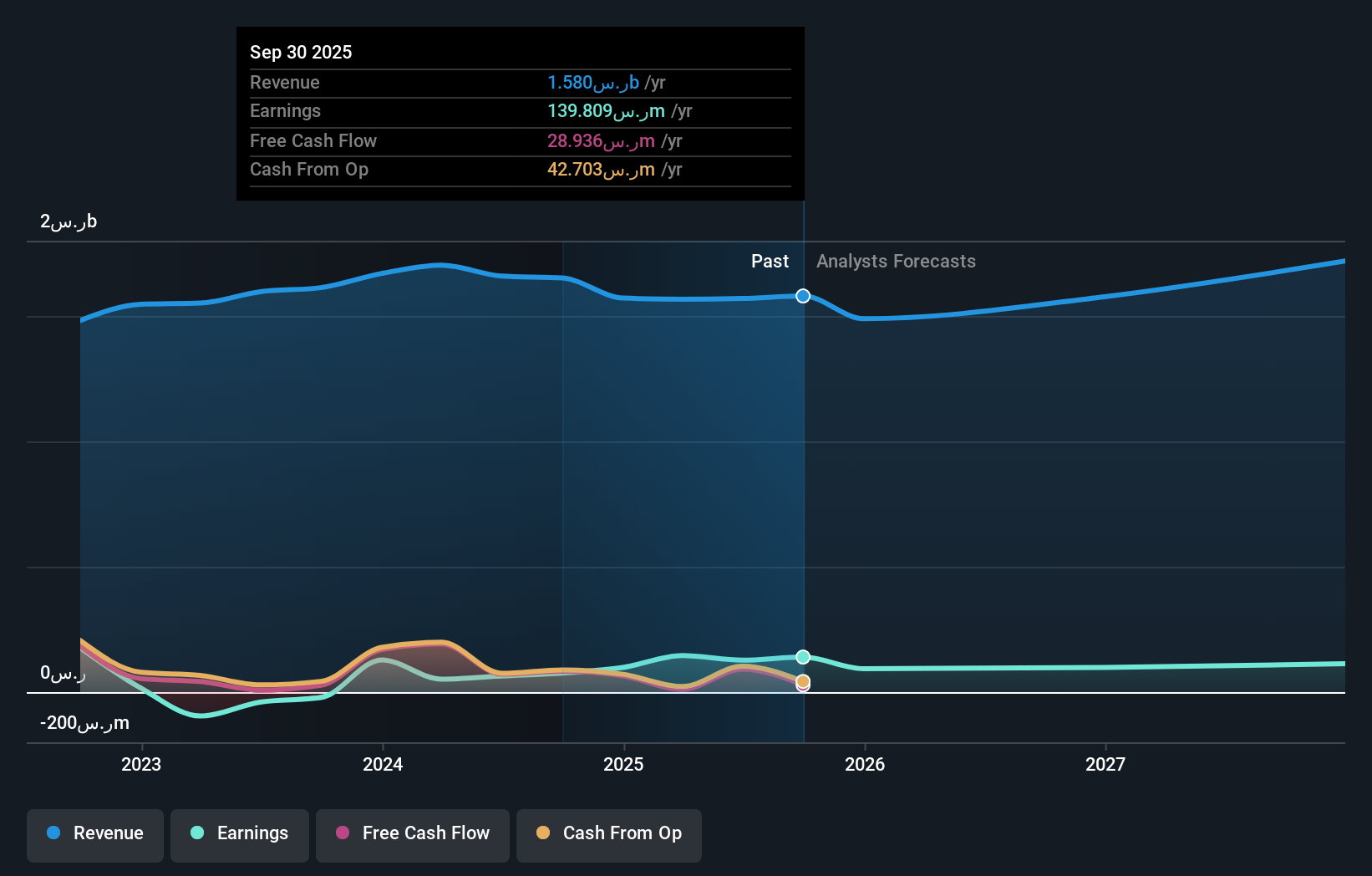

Operations: Gulf Insurance Group generates revenue primarily from its health, vehicle, and property and casualty insurance segments, with SAR416.16 million, SAR622.08 million, and SAR348.26 million respectively. The vehicle insurance segment is the largest contributor to revenue.

Gulf Insurance Group, a promising player in the Middle East insurance sector, has shown impressive earnings growth of 181.9% over the past year, outpacing its industry peers who saw a -16.7% change. With a price-to-earnings ratio of 8.8x, it trades attractively compared to the Saudi Arabian market average of 20.9x, highlighting its value potential. The company is debt-free and boasts high-quality non-cash earnings while remaining free cash flow positive. Recent developments include reporting SAR 27 million net income for Q1 2025 and approving a SAR 63 million dividend distribution for fiscal year-end December 2024 at their recent meeting in Riyadh.

- Unlock comprehensive insights into our analysis of Gulf Insurance Group stock in this health report.

El Al Israel Airlines (TASE:ELAL)

Simply Wall St Value Rating: ★★★★★☆

Overview: El Al Israel Airlines Ltd., along with its subsidiaries, operates in the passenger and cargo transportation sector, with a market capitalization of ₪7.22 billion.

Operations: El Al generates revenue primarily from passenger aircraft services, contributing $3.12 billion, and cargo aircraft services, adding $252.80 million. The company also reports other income of $90.70 million.

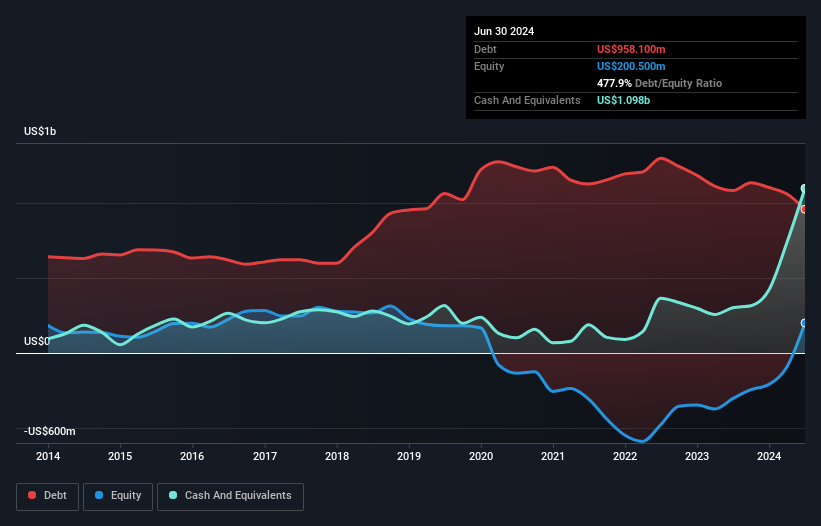

El Al Israel Airlines has been flying high with a notable 143% earnings growth over the past year, outpacing its industry peers. Despite recent shareholder dilution, the company is trading at a significant discount to its estimated fair value, suggesting potential upside. The airline's interest payments are comfortably covered by EBIT at 23.6 times, indicating strong financial health. Recent results show sales of US$773.7 million and net income of US$92.8 million for Q1 2025, reflecting solid operational performance compared to last year’s figures. With more cash than debt and positive free cash flow, El Al seems well-positioned for future growth opportunities in the Middle East aviation market.

Summing It All Up

- Access the full spectrum of 220 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:8250

Gulf Insurance Group

Provides insurance and reinsurance products and services for corporates, SMEs, and individual customers in the Kingdom of Saudi Arabia.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives