Middle East Undiscovered Gems Featuring Three Promising Stocks

Reviewed by Simply Wall St

As most Gulf markets have settled higher, buoyed by a temporary U.S.-China trade truce and steady oil supplies, investors are cautiously optimistic about the region's economic prospects. In this environment, identifying promising stocks involves looking for companies that can leverage regional stability and global economic trends to enhance their growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Hitit Bilgisayar Hizmetleri (IBSE:HTTBT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hitit Bilgisayar Hizmetleri A.S. offers airline and travel IT and software solutions globally under the Crane brand, with a market capitalization of TRY13 billion.

Operations: Hitit Bilgisayar Hizmetleri A.S. generates revenue primarily from its airline and travel IT and software solutions offered under the Crane brand. The company's financial performance is characterized by a focus on optimizing its cost structure to enhance profitability, with particular attention to maintaining competitive pricing in the market.

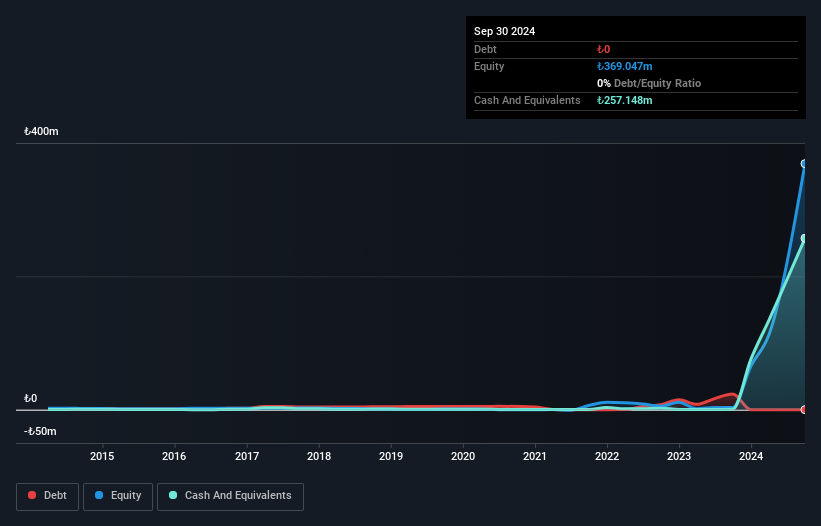

Hitit Bilgisayar Hizmetleri, a small player in the Middle East tech scene, reported impressive growth with sales jumping to TRY 345 million for Q1 2025 from TRY 216 million a year ago. Net income also rose to TRY 66 million compared to TRY 45 million previously. Despite a debt-to-equity ratio increase from 7.6% to 14.7% over five years, the company holds more cash than total debt and boasts high-quality non-cash earnings. While its earnings growth of 111% lagged behind the software industry’s pace, it remains profitable with a P/E ratio of 43.7x below industry average.

- Take a closer look at Hitit Bilgisayar Hizmetleri's potential here in our health report.

Gain insights into Hitit Bilgisayar Hizmetleri's past trends and performance with our Past report.

Lydia Yesil Enerji Kaynaklari (IBSE:LYDYE)

Simply Wall St Value Rating: ★★★★★★

Overview: Lydia Yesil Enerji Kaynaklari A.S. is involved in the production and sale of electricity and heat energy in Turkey, with a market cap of TRY28.02 billion.

Operations: Lydia Yesil Enerji Kaynaklari generates revenue primarily from the sale of electricity and heat energy. The company reports a gross profit margin of 32.5%.

Lydia Yesil Enerji Kaynaklari, a nimble player in the energy sector, has shown remarkable earnings growth of 1333% over the past year, outpacing its industry peers. Despite this impressive performance, revenue remains modest at TRY55 million. The company is debt-free now compared to a hefty debt-to-equity ratio of 423.8% five years ago, which suggests prudent financial management. However, shareholders faced significant dilution recently. With net income soaring to TRY960 million from TRY67 million last year and inclusion in the FTSE All-World Index, Lydia Yesil seems poised for further attention despite its volatile share price history.

Al Masane Al Kobra Mining (SASE:1322)

Simply Wall St Value Rating: ★★★★★★

Overview: Al Masane Al Kobra Mining Company operates in the Kingdom of Saudi Arabia, focusing on the production of non-ferrous metal ores and precious metals, with a market capitalization of SAR5.38 billion.

Operations: Al Masane Al Kobra Mining generates revenue primarily from its Al Masane Mine and Mount Guyan Mine, with contributions of SAR350.52 million and SAR256.61 million, respectively. The company's financial performance is influenced by these revenue streams, along with a segment adjustment of SAR258.79 million.

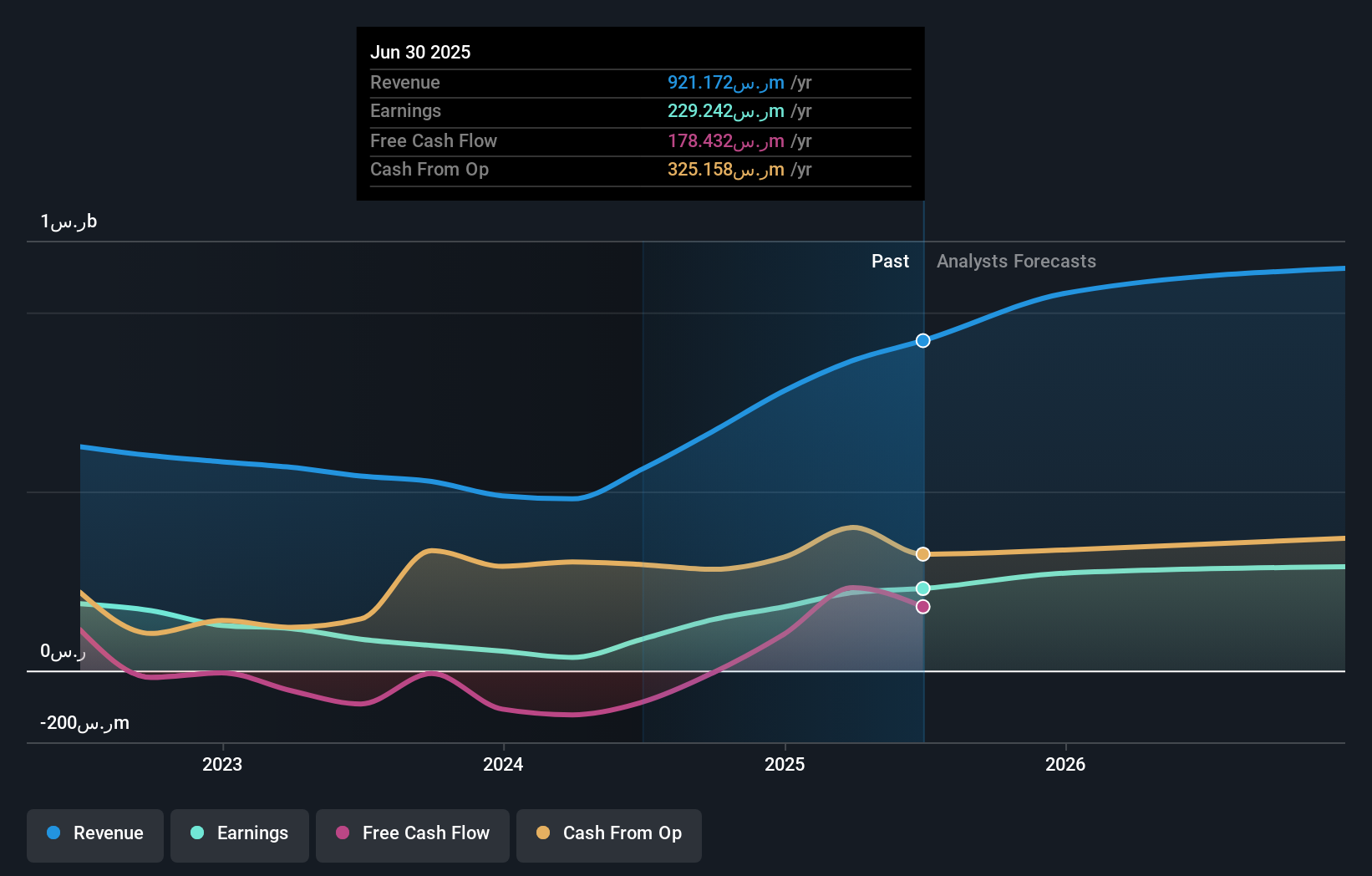

Al Masane Al Kobra Mining, a notable player in the Middle East mining sector, has shown impressive growth with earnings surging by 491.6% over the past year, outpacing industry averages. The company's net income for Q1 2025 reached SAR 55.24 million, up from SAR 15.13 million a year earlier, reflecting its robust financial health and strategic positioning in the market. Additionally, it reported sales of SAR 219.77 million for the same quarter compared to SAR 134.5 million previously. With a debt-to-equity ratio reduced to just 3.7%, Al Masane is well-poised for future expansion initiatives like its recent strategic consortium aimed at exploring mineral resources across Saudi Arabia's Nuqrah VMS Belt.

Where To Now?

- Unlock our comprehensive list of 248 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hitit Bilgisayar Hizmetleri might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:HTTBT

Hitit Bilgisayar Hizmetleri

Provides airline and travel IT and software solutions under the Crane brand in Turkey and internationally.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives