- Israel

- /

- Electronic Equipment and Components

- /

- TASE:TLSY

Undiscovered Gems in Middle East Featuring 3 Promising Stocks

Reviewed by Simply Wall St

In recent times, Middle Eastern markets have experienced a retreat, largely influenced by fluctuating oil prices and global economic factors such as U.S. monetary policy shifts. Despite this challenging backdrop, there remain opportunities for discerning investors to uncover potential gems in the region's stock market; identifying promising stocks often involves looking for companies with strong fundamentals and resilience amidst broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Sönmez Filament Sentetik Iplik ve Elyaf Sanayi | NA | 54.80% | 42.62% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 38.36% | 57.78% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Gedik Yatirim Menkul Degerler (IBSE:GEDIK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gedik Yatirim Menkul Degerler A.S. is an investment banking company operating in Turkey and internationally, with a market capitalization of TRY12.69 billion.

Operations: Gedik Yatirim generates revenue primarily from brokerage activities, totaling TRY274.80 million. The company's financial performance is closely tied to its ability to efficiently manage these operations within the competitive investment banking sector.

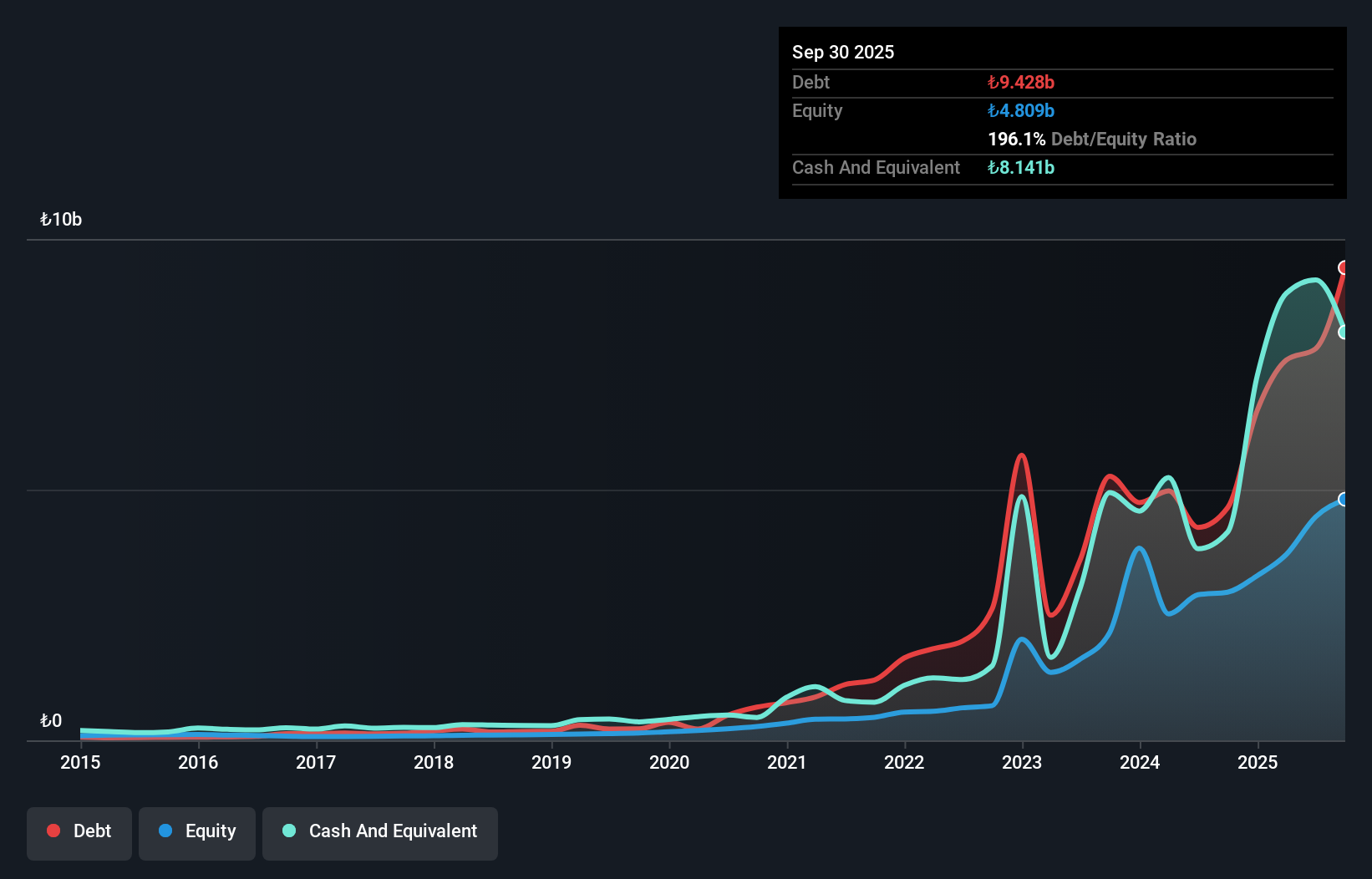

Gedik Yatirim Menkul Degerler has shown remarkable growth, with earnings increasing by 156% over the past year, significantly outpacing the Capital Markets industry's 18.5%. The company's price-to-earnings ratio stands at a favorable 10x compared to the TR market's 17.6x, suggesting potential value. Over five years, Gedik has reduced its debt to equity ratio from 240% to a satisfactory 196%, indicating improved financial health. Despite not being free cash flow positive, Gedik reported a net income of TRY1.21 billion for nine months in 2025, up from TRY300 million the previous year, reflecting strong performance and recovery.

Africa Israel Residences (TASE:AFRE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Africa Israel Residences Ltd focuses on developing and selling residential units under the Savyonim brand in Israel, with a market capitalization of ₪3.40 billion.

Operations: Revenue from Africa Israel Residences Ltd primarily comes from the promotion of projects, totaling ₪1.13 billion, and the initiation of rental housing at ₪22.56 million. The company has a market capitalization of approximately ₪3.40 billion.

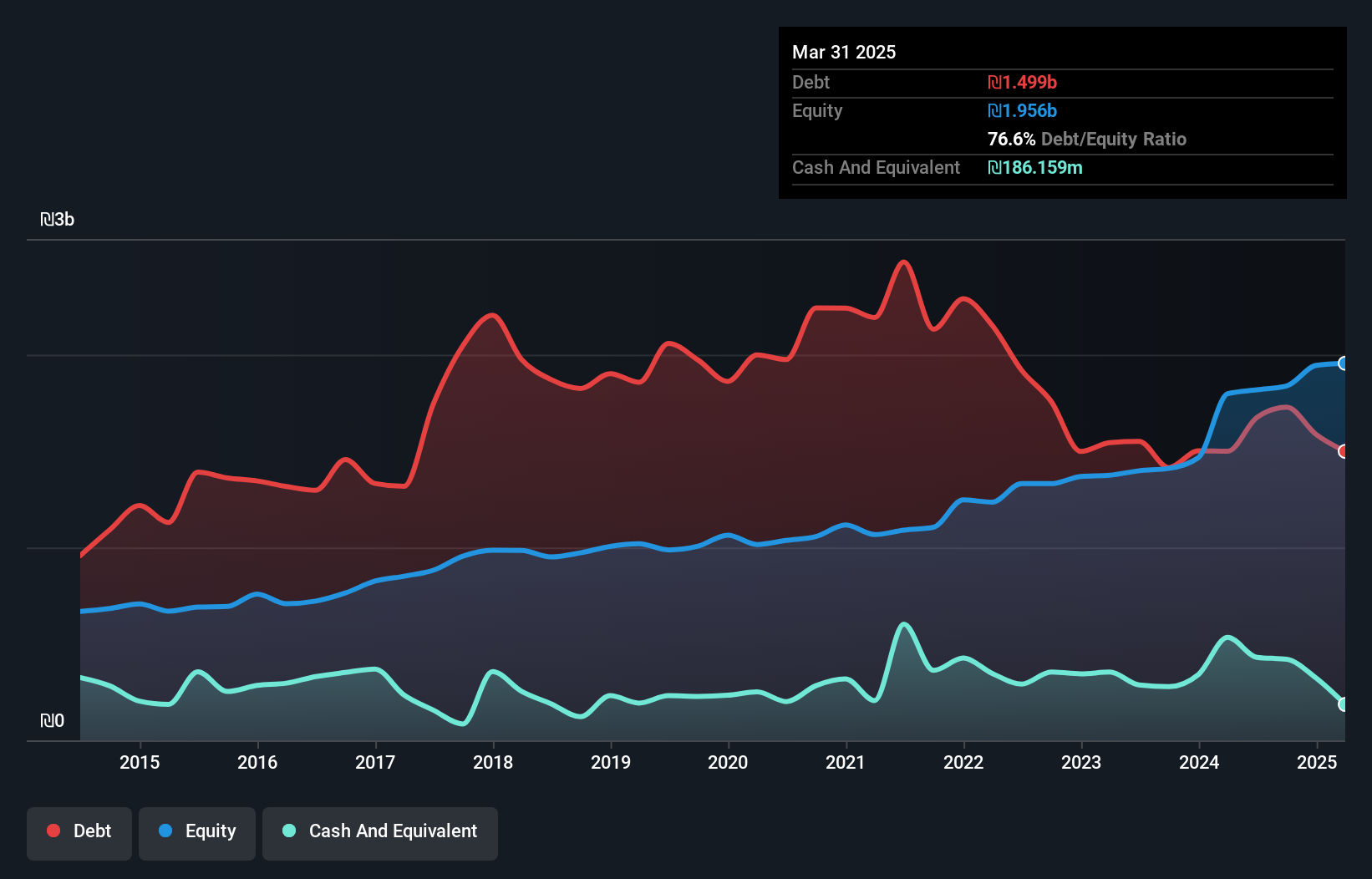

Africa Israel Residences, a player in the Middle East real estate scene, has shown notable earnings growth of 31.4% over the past year, outpacing its industry peers. However, its net debt to equity ratio stands at a high 72.4%, reflecting significant leverage despite a reduction from 190.5% five years ago. The company's interest payments are well-covered by EBIT with a coverage ratio of 3.6x, indicating manageable debt servicing costs for now. Recent financial results reveal sales of ₪216 million and net income of ₪21 million for Q2 2025, both lower than last year's figures due to large one-off gains impacting earnings stability.

- Take a closer look at Africa Israel Residences' potential here in our health report.

Evaluate Africa Israel Residences' historical performance by accessing our past performance report.

Telsys (TASE:TLSY)

Simply Wall St Value Rating: ★★★★★★

Overview: Telsys Ltd. is engaged in the marketing and distribution of electronic components and open tools within Israel, with a market capitalization of approximately ₪1.84 billion.

Operations: The company generates revenue primarily from its SOM Sector and Distribution segments, with revenues of ₪277.49 million and ₪143.68 million, respectively.

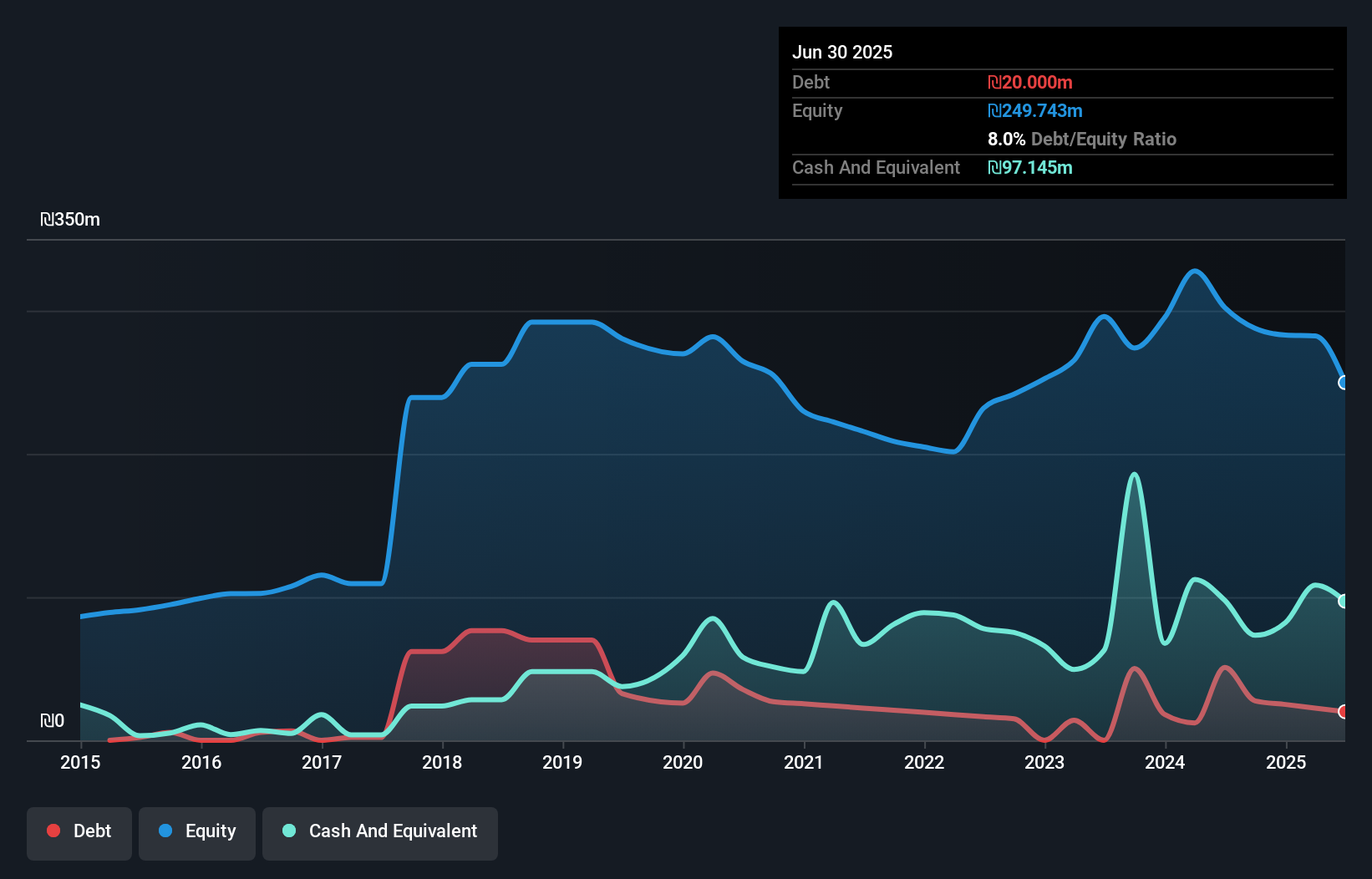

With a debt to equity ratio dropping from 13.4% to 8% over five years, Telsys showcases financial discipline. Its price-to-earnings ratio of 16.6x is slightly below the electronic industry average of 17.2x, suggesting potential value for investors seeking bargains in this sector. Earnings have impressively grown by 25.5% annually over the past five years, although recent growth at just 0.4% lags behind the industry’s pace of 1.6%. Despite being removed from the TA-125 Index recently, Telsys remains profitable with a positive free cash flow and high-quality earnings that bolster its robust financial position in an evolving market landscape.

Seize The Opportunity

- Navigate through the entire inventory of 188 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telsys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TLSY

Telsys

Telsys Ltd. markets and distributes electronic components and open tools in Israel.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success