- Turkey

- /

- Capital Markets

- /

- IBSE:GEDIK

3 Middle Eastern Dividend Stocks Yielding Up To 14%

Reviewed by Simply Wall St

In recent weeks, most Gulf markets have experienced downward pressure due to weak oil prices and concerns over global economic slowdowns, impacting investor sentiment across the region. Despite these challenges, dividend stocks remain an attractive option for investors seeking consistent income streams, particularly in uncertain market conditions where stable returns are highly valued.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.53% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 9.52% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.12% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.34% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.68% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.53% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 3.84% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.22% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 8.10% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.27% | ★★★★★☆ |

Click here to see the full list of 70 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

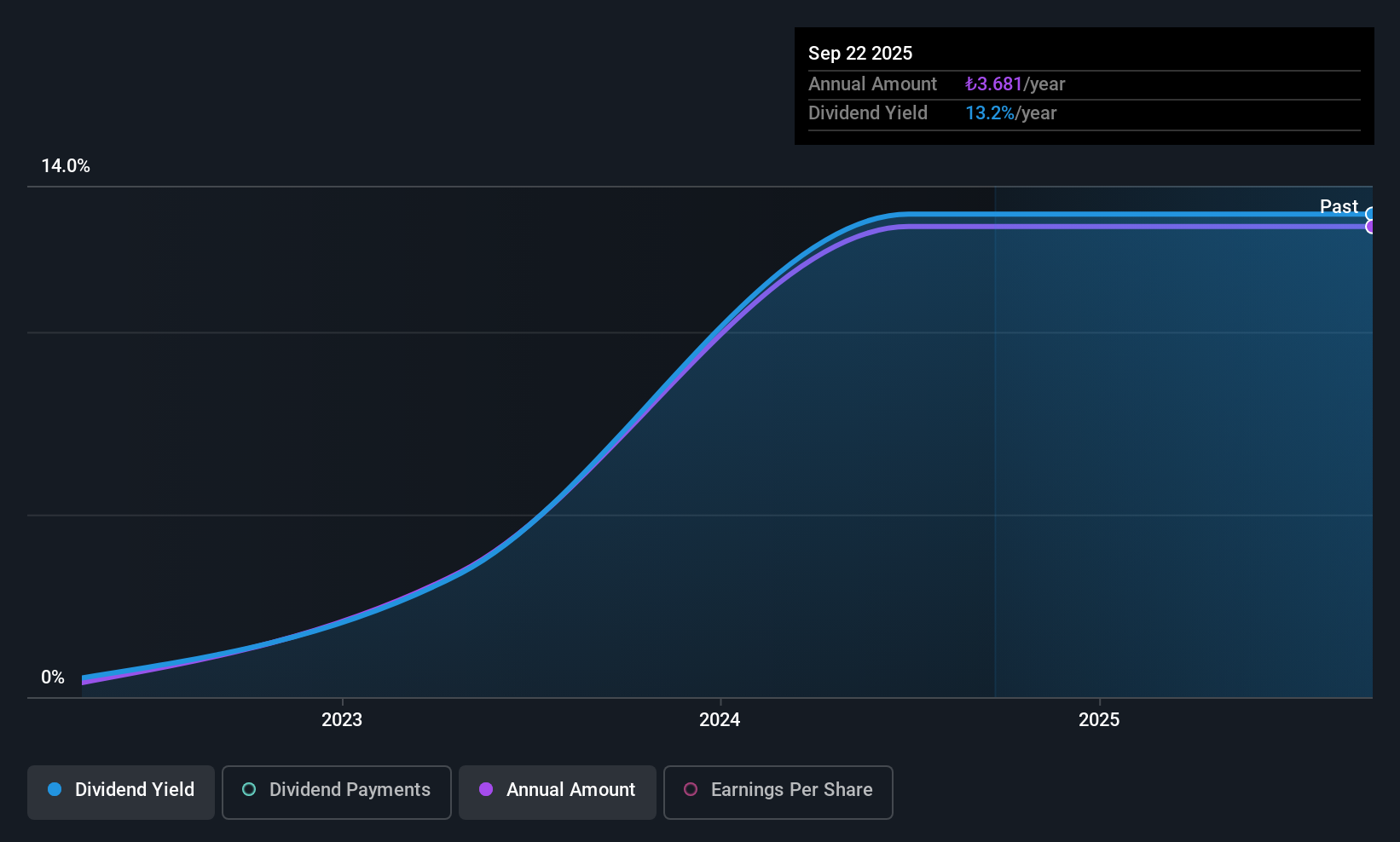

Ayen Enerji (IBSE:AYEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ayen Enerji A.S., along with its subsidiaries, is involved in the production, distribution, and trading of electricity in Turkey and internationally, with a market cap of TRY7.13 billion.

Operations: Ayen Enerji A.S. generates revenue primarily from its Non-Regulated Utility segment, amounting to TRY6.36 billion.

Dividend Yield: 14.1%

Ayen Enerji's dividend profile shows promise, with dividends covered by earnings and cash flows, reflecting payout ratios of 57.3% and 61.8%, respectively. Despite only four years of dividend history, payments have been stable and growing. However, recent financial results indicate declining sales and net income for the second quarter of 2025 compared to the previous year. Trading at a discount to its estimated fair value might appeal to investors seeking high yields in the Turkish market.

- Click here to discover the nuances of Ayen Enerji with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Ayen Enerji shares in the market.

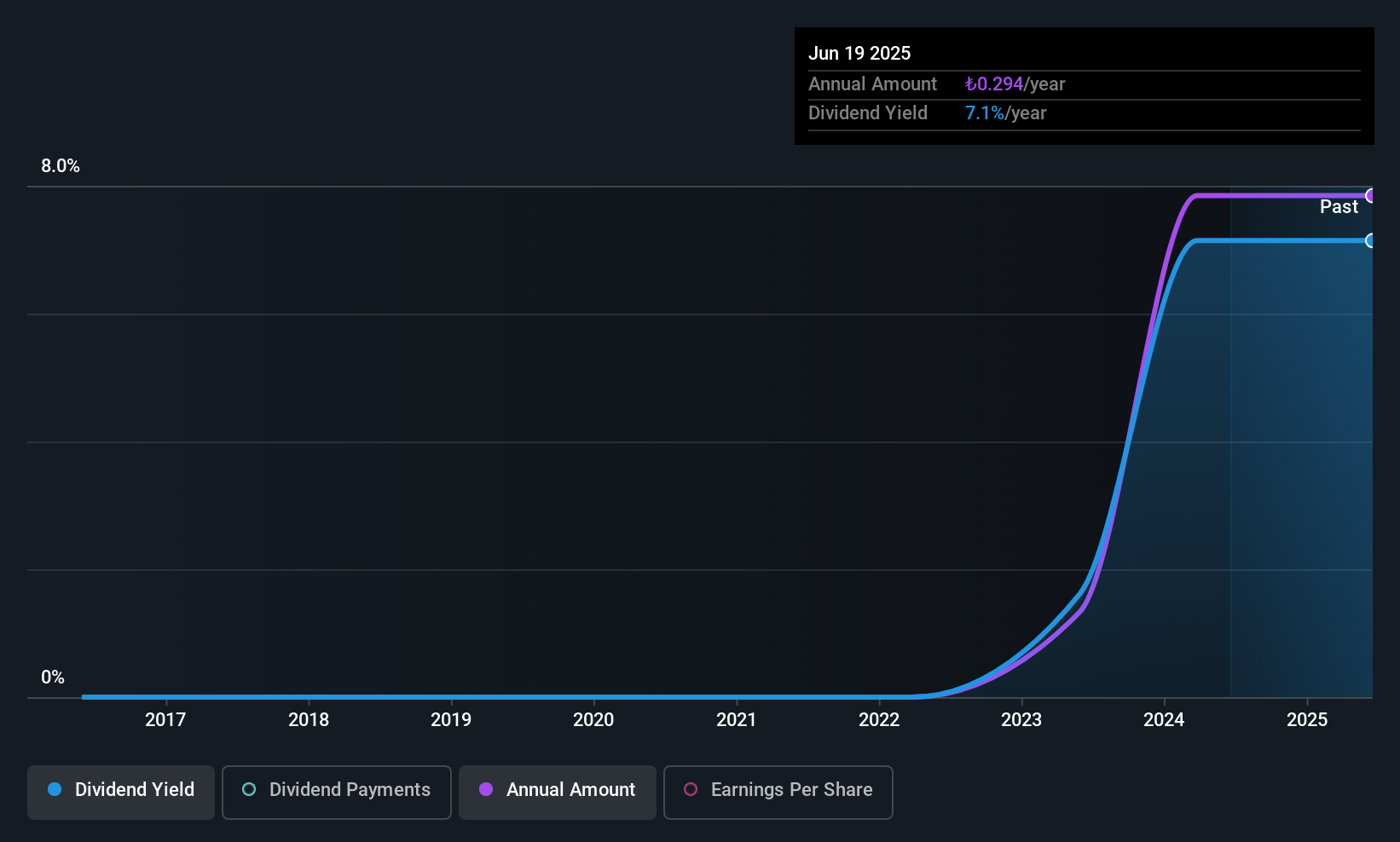

Gedik Yatirim Menkul Degerler (IBSE:GEDIK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gedik Yatirim Menkul Degerler A.S. is an investment banking company operating in Turkey and internationally, with a market cap of TRY13.42 billion.

Operations: Gedik Yatirim Menkul Degerler A.S. generates revenue primarily through its brokerage activities, amounting to TRY133.48 billion.

Dividend Yield: 4%

Gedik Yatirim Menkul Degerler's dividend payments are well-supported by earnings and cash flows, with payout ratios of 85.8% and 64.8%, respectively. Despite a short dividend history of two years, the company has maintained stable and growing dividends, offering a yield of 4.05%, placing it among the top quartile in Turkey's market. Recent earnings reports show significant growth, with net income reaching TRY 976.89 million in Q2 2025 from TRY 327.18 million year-on-year, suggesting robust financial health supporting its dividend strategy.

- Delve into the full analysis dividend report here for a deeper understanding of Gedik Yatirim Menkul Degerler.

- Our comprehensive valuation report raises the possibility that Gedik Yatirim Menkul Degerler is priced higher than what may be justified by its financials.

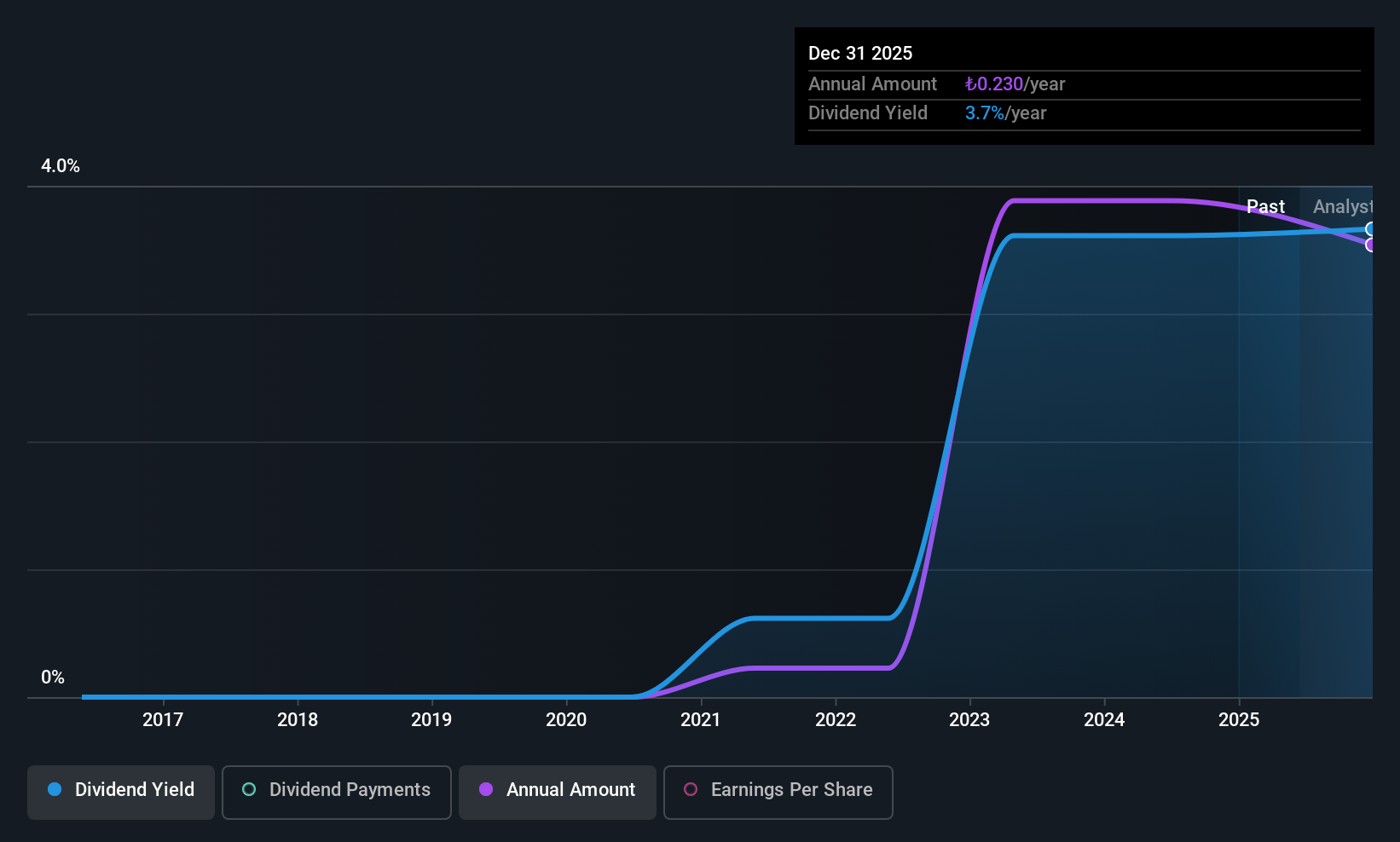

Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi (IBSE:INDES)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi is a distributor of IT products in Turkey with a market cap of TRY5.73 billion.

Operations: Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi generates revenue from two main segments: Information Technologies and Telecom, which accounts for TRY65.35 billion, and Logistics and Rental, contributing TRY362.78 million.

Dividend Yield: 4.4%

Indeks Bilgisayar's dividend payments are well-covered, with a low payout ratio of 26.1% and cash payout ratio of 8.8%, indicating sustainability from both earnings and cash flows. The dividend yield at 4.44% is competitive in Turkey's market, though the company has a short history of four years in paying dividends. Recent financials show declining net income and profit margins, alongside its removal from the S&P Global BMI Index, which may impact investor sentiment.

- Get an in-depth perspective on Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi's performance by reading our dividend report here.

- The analysis detailed in our Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Gain an insight into the universe of 70 Top Middle Eastern Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:GEDIK

Gedik Yatirim Menkul Degerler

Provides investment banking company in Turkey and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives