In a landscape where major U.S. stock indexes are hitting record highs, the Russell 2000 Index has recently faced a decline, highlighting the mixed performance across different market segments. With growth stocks significantly outpacing value stocks and economic indicators like job growth showing resilience, investors may find opportunities in lesser-known small-cap companies that have yet to capture widespread attention. In such an environment, identifying promising stocks involves looking for those with strong fundamentals and potential for growth amidst broader market shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Rimoni Industries | NA | 4.80% | 4.03% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Terminal X Online | 20.33% | 18.40% | 20.81% | ★★★★★☆ |

| Primadaya Plastisindo | 10.46% | 15.41% | 23.92% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Digital Value (BIT:DGV)

Simply Wall St Value Rating: ★★★★★☆

Overview: Digital Value S.p.A. offers IT solutions and services within Italy, with a market capitalization of €246.94 million.

Operations: Digital Value S.p.A. generates revenue through its IT solutions and services in Italy. The company has a market capitalization of €246.94 million.

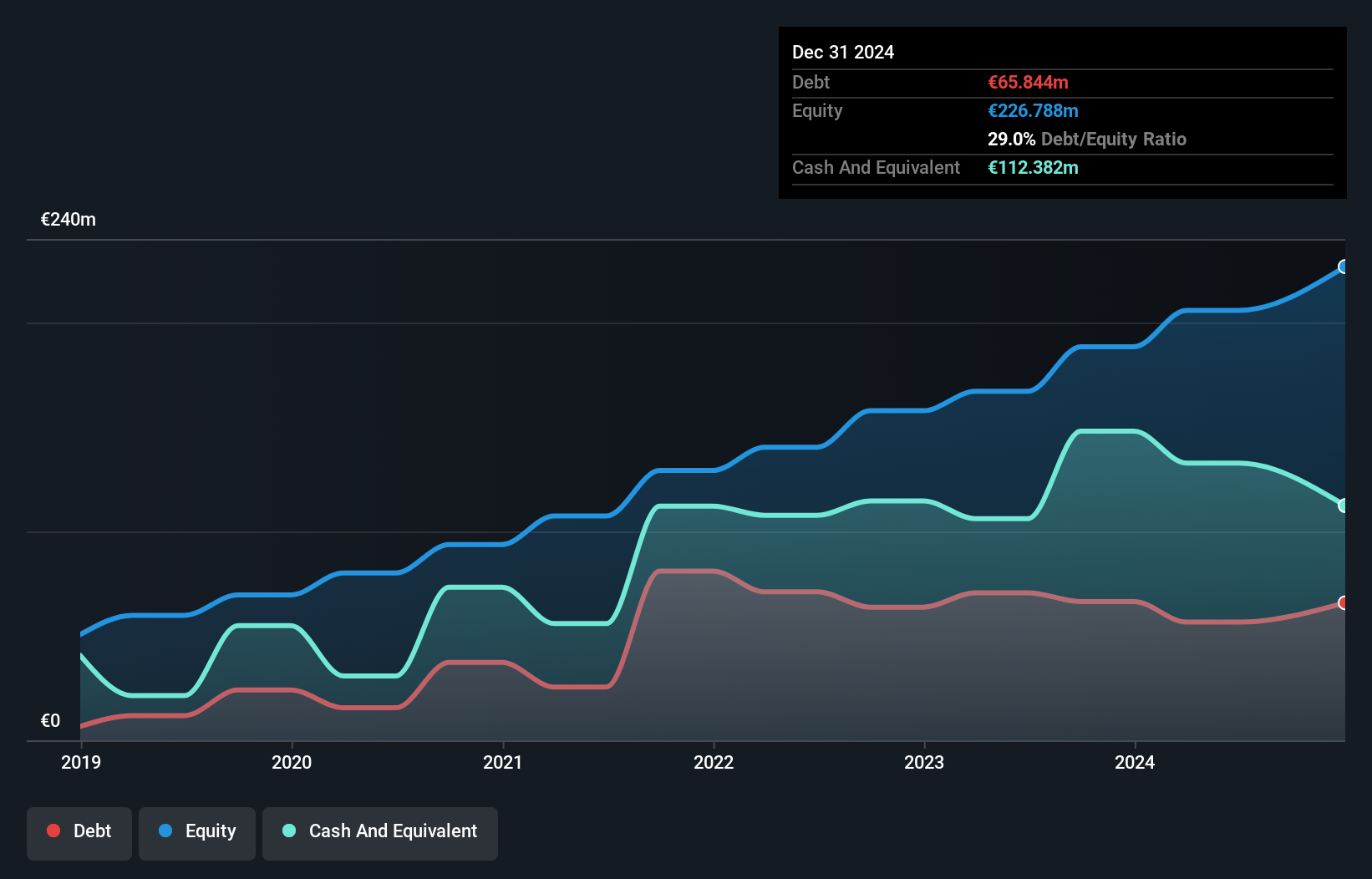

Digital Value, a promising player in the tech sector, has shown impressive growth, with earnings rising by 27.6% over the past year and outpacing the IT industry's 22.7% growth rate. The company's net income for the first half of 2024 was €22.31 million, up from €17.08 million in the previous year, reflecting its strong performance despite a volatile share price recently observed over three months. Trading at a significant discount of 83% below estimated fair value indicates potential upside for investors seeking undervalued opportunities in this space. Additionally, Digital Value's debt management appears prudent with interest payments well-covered by EBIT at 14.5 times and more cash than total debt on hand suggesting financial stability amidst growth prospects forecasted at an annual rate of 17.82%.

- Unlock comprehensive insights into our analysis of Digital Value stock in this health report.

Assess Digital Value's past performance with our detailed historical performance reports.

Net Holding (IBSE:NTHOL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Net Holding A.S. operates in the tourism, publication, and holding sectors across Turkey, Croatia, Bulgaria, Montenegro, and the Turkish Republic of Northern Cyprus with a market capitalization of TRY22.96 billion.

Operations: Net Holding A.S. generates revenue primarily from its operations in the tourism and publication sectors across multiple countries. The company has shown a net profit margin of 15% in recent periods, reflecting its profitability trends.

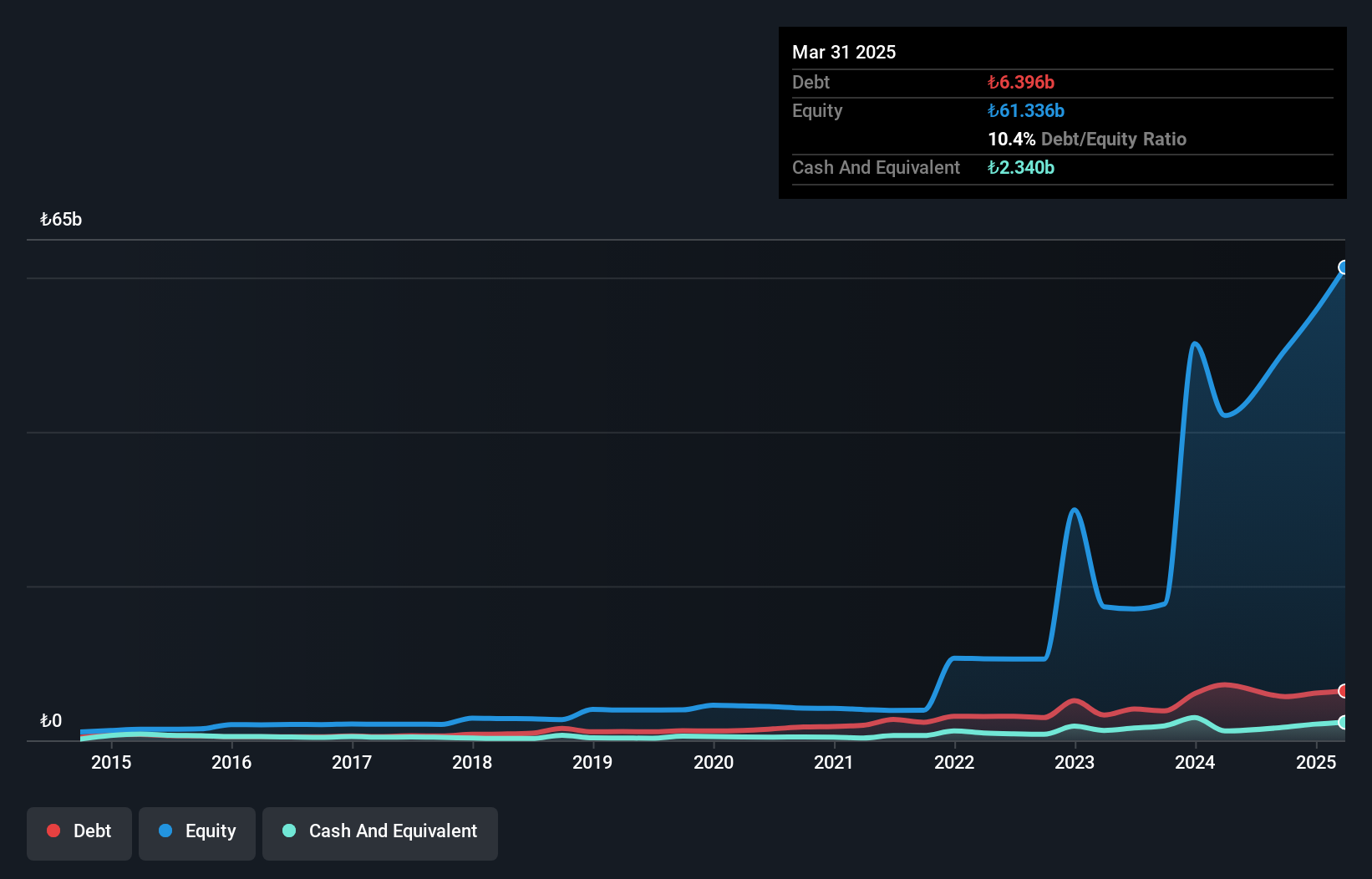

Net Holding, a player in the hospitality sector, has shown remarkable earnings growth of 125.3% over the past year, outpacing the industry's 13.2%. Its debt to equity ratio has impressively decreased from 31.5% to 11.2% over five years, reflecting solid financial management with a satisfactory net debt to equity ratio at 7.8%. Despite a volatile share price recently and negative free cash flow, its price-to-earnings ratio stands attractively low at 6.2x compared to the market's 16.1x, suggesting potential undervaluation for investors seeking opportunities in smaller companies within this industry space.

- Take a closer look at Net Holding's potential here in our health report.

Evaluate Net Holding's historical performance by accessing our past performance report.

Jinxi Axle (SHSE:600495)

Simply Wall St Value Rating: ★★★★★★

Overview: Jinxi Axle Company Limited focuses on the research, development, and manufacturing of railway vehicles and accessories, as well as precision forging and casting products in China, with a market cap of CN¥5.23 billion.

Operations: Jinxi Axle generates revenue primarily from the manufacturing of railway vehicles and accessories, alongside precision forging and casting products. The company's financial performance is highlighted by its gross profit margin trends, which provide insights into its cost efficiency and pricing strategies.

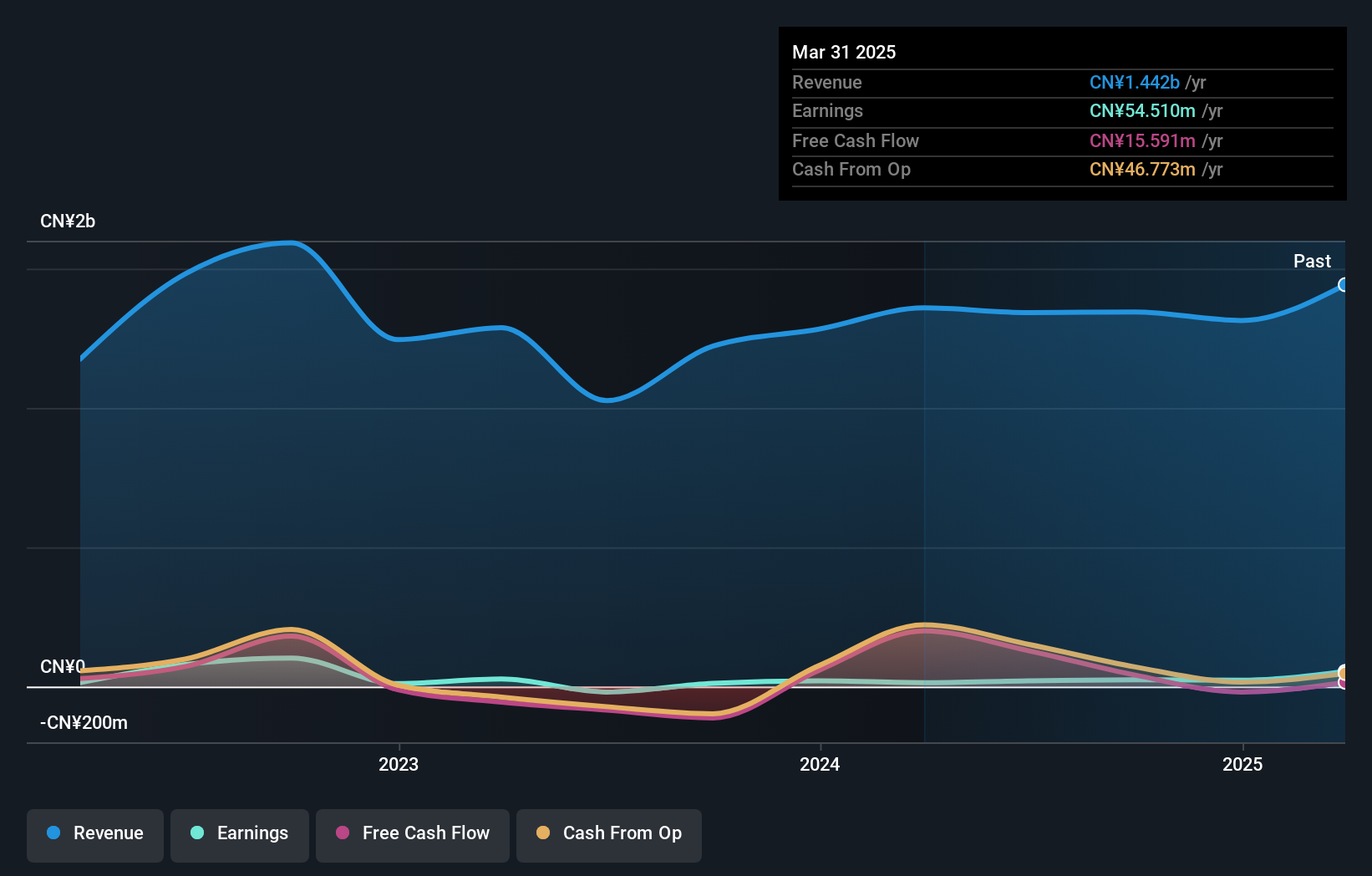

Jinxi Axle, a smaller player in the machinery sector, reported impressive earnings growth of 113% over the past year, far outpacing the industry's -0.4%. This growth was partly influenced by a significant one-off gain of CN¥23.8M, impacting its recent financials. Despite this boost, Jinxi has seen a 7.9% annual decline in earnings over five years. The company remains debt-free and enjoys positive free cash flow, suggesting financial stability without concerns about interest payments. Recent results show sales reaching CN¥872.96M for nine months ending September 2024, with net income rising to CN¥6M from CN¥2.2M last year.

- Click here and access our complete health analysis report to understand the dynamics of Jinxi Axle.

Review our historical performance report to gain insights into Jinxi Axle's's past performance.

Make It Happen

- Get an in-depth perspective on all 4648 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600495

Jinxi Axle

Engages in the research, development, and manufacturing of railway vehicles and related accessories, precision forging, and precision casting products in China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives