Middle East's Undiscovered Gems Featuring 3 Promising Stocks

Reviewed by Simply Wall St

As global recession fears loom due to escalating trade tensions, most Gulf markets have experienced declines, with key indices such as Dubai's main share index and Abu Dhabi's index seeing significant drops. Despite this challenging environment, the Middle East continues to offer opportunities for discerning investors who seek stocks with strong fundamentals and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Sure Global Tech | NA | 13.90% | 18.91% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.77% | -3.48% | -12.95% | ★★★★★★ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Bati Ege Gayrimenkul Yatirim Ortakligi (IBSE:BEGYO)

Simply Wall St Value Rating: ★★★★★★

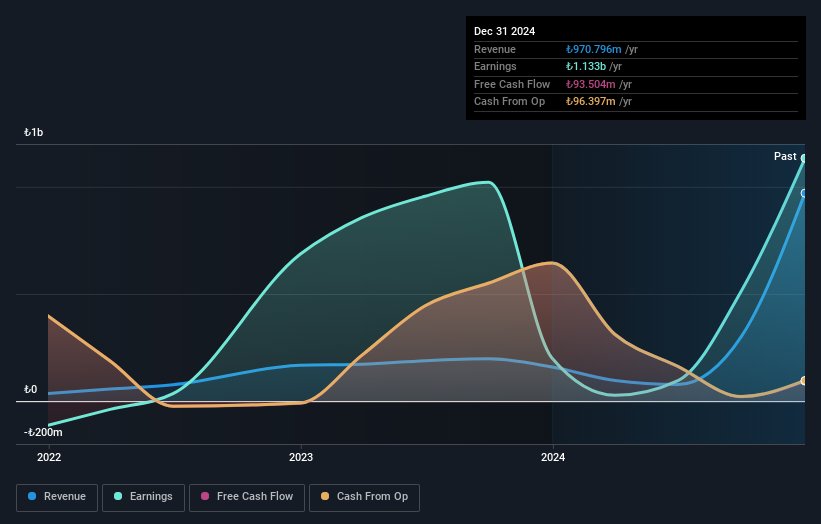

Overview: Bati Ege Gayrimenkul Yatirim Ortakligi A.S. is an investment company focusing on the real estate sector in Denizli and the Aegean Region, with a market capitalization of TRY13.16 billion.

Operations: BEGYO generates revenue primarily from house sales, which contribute TRY893.61 million, and rent income amounting to TRY77.18 million.

Bati Ege Gayrimenkul Yatirim Ortakligi showcases remarkable growth, with earnings surging by 467% over the past year, significantly outpacing the REITs industry average. The company is debt-free, eliminating concerns about interest coverage and enhancing its financial stability. Its price-to-earnings ratio of 11.6x suggests it offers good value compared to the TR market's 17.5x. Recent financial results highlight a substantial increase in sales to TRY 970.8 million from TRY 159.31 million last year, while net income jumped to TRY 1,133.3 million from TRY 199.89 million, reflecting robust operational performance and profitability improvement.

Sun Tekstil Sanayi ve Ticaret (IBSE:SUNTK)

Simply Wall St Value Rating: ★★★★★★

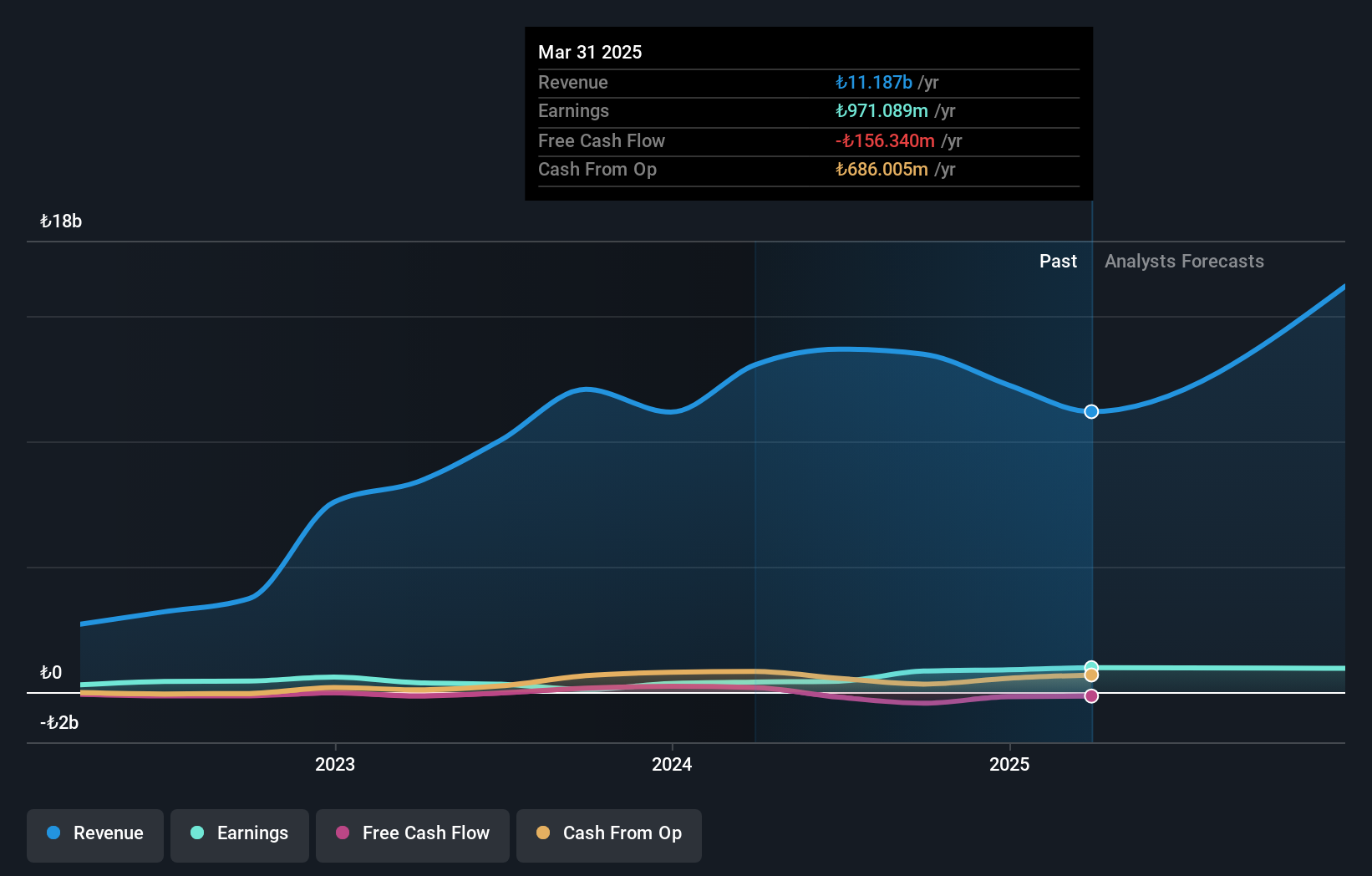

Overview: Sun Tekstil Sanayi ve Ticaret A.S. is engaged in the design, production, and sale of knit fabrics and ready-made womenswear garments both in Turkey and internationally, with a market capitalization of TRY17.30 billion.

Operations: Sun Tekstil generates revenue primarily from ready-made garments, contributing TRY9.27 billion, and fabric production, adding TRY3.09 billion. The company experiences eliminations amounting to -TRY110.48 million in its financials.

Sun Tekstil Sanayi ve Ticaret, a notable player in the textile industry, has shown impressive financial resilience. Its earnings surged by 161.7% last year, significantly outpacing the luxury sector's -48% performance. The company's debt-to-equity ratio has improved dramatically from 107.1% to 23.5% over five years, indicating prudent financial management. With a price-to-earnings ratio of 19.4x below the industry average of 27.5x, it offers potential value for investors seeking growth at an attractive valuation. Despite high volatility in its share price recently, Sun Tekstil's robust net income increase from TRY 341.56 million to TRY 893.74 million underscores its strong operational footing and strategic direction moving forward.

- Dive into the specifics of Sun Tekstil Sanayi ve Ticaret here with our thorough health report.

Gain insights into Sun Tekstil Sanayi ve Ticaret's past trends and performance with our Past report.

Aura Investments (TASE:AURA)

Simply Wall St Value Rating: ★★★★☆☆

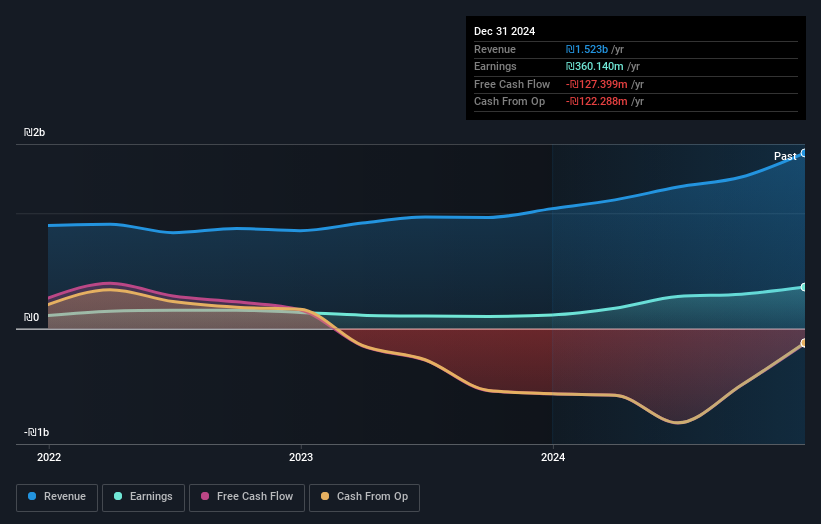

Overview: Aura Investments Ltd. is involved in the identification, initiation, planning, and construction of residential real estate projects both in Israel and internationally, with a market capitalization of approximately ₪4.82 billion.

Operations: Aura's primary revenue stream is from residential construction, generating approximately ₪1.52 billion. The company focuses on real estate development projects, with a significant portion of its income derived from this sector.

Aura Investments has shown impressive growth, with earnings surging 206% over the past year, outpacing the real estate industry's 36.2%. However, a significant one-off gain of ₪159.9 million influenced these results. The company's debt situation has improved as its debt to equity ratio decreased from 328% to 180.4% in five years, yet it remains high at a net debt to equity ratio of 169.8%. Interest payments are well covered by EBIT at 7.6 times coverage, but operating cash flow struggles to cover debt adequately. Recent financials show revenue climbing from ILS1 billion to ILS1.52 billion and net income rising from ILS118 million to ILS360 million annually as of December 2024.

- Click here and access our complete health analysis report to understand the dynamics of Aura Investments.

Assess Aura Investments' past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Get an in-depth perspective on all 243 Middle Eastern Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bati Ege Gayrimenkul Yatirim Ortakligi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:BEGYO

Bati Ege Gayrimenkul Yatirim Ortakligi

An investment company, invests in the real estate sector in Denizli and the rest of Aegean Region.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives