- Taiwan

- /

- Construction

- /

- TWSE:2597

Discover These 3 Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

In the wake of a U.S. election that buoyed investor sentiment, small-cap stocks have shown notable resilience, with the Russell 2000 Index leading gains despite not reaching record highs. As markets react to potential policy shifts and rate cuts, identifying stocks with strong fundamentals and growth potential becomes crucial for investors looking to capitalize on these dynamic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Lion Capital | NA | 21.26% | 24.46% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.07% | 35.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Aksa Akrilik Kimya Sanayii (IBSE:AKSA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aksa Akrilik Kimya Sanayii A.S., along with its subsidiaries, is engaged in the manufacturing and sale of textiles, chemicals, and other industrial products both in Turkey and internationally, with a market capitalization of TRY33.84 billion.

Operations: Aksa generates revenue primarily from its textiles and chemicals segments, contributing significantly to its overall financial performance. The company has experienced fluctuations in its net profit margin, reflecting variations in cost management and market conditions.

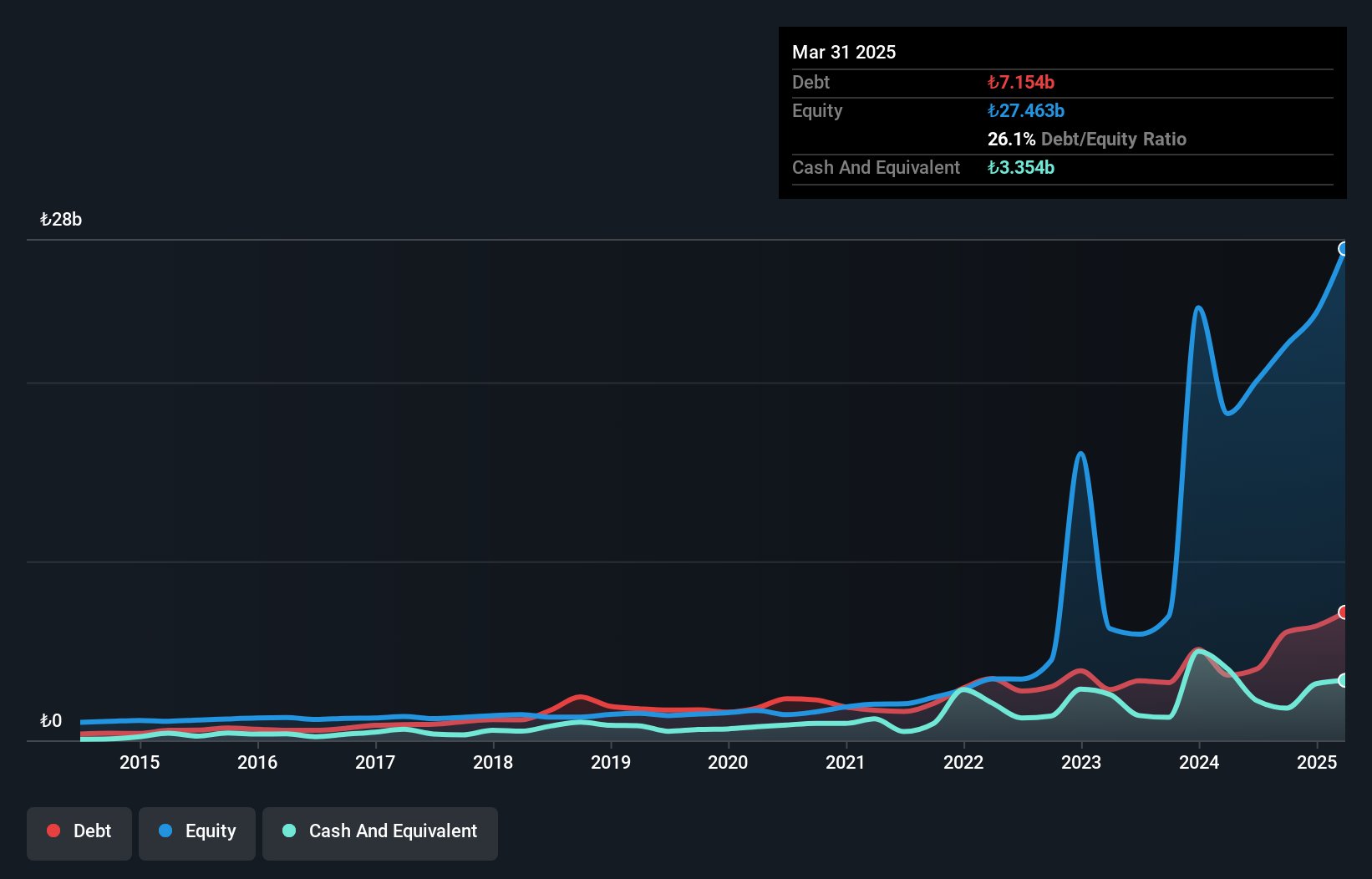

Aksa Akrilik Kimya Sanayii, a dynamic player in its industry, has shown resilience with earnings growth of 11.1% over the past year, outpacing the luxury sector's -4.4%. Its debt to equity ratio improved significantly from 115.3% to 27.4% over five years, reflecting strong financial management. Despite a drop in sales for the third quarter of 2024 to TRY 6 billion from TRY 7.7 billion last year, net income rebounded to TRY 286 million compared to a loss previously recorded. With an attractive P/E ratio of 12x below market average and EBIT covering interest payments by nearly 33 times, Aksa presents intriguing investment potential amidst challenging conditions.

Selçuk Ecza Deposu Ticaret ve Sanayi (IBSE:SELEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Selçuk Ecza Deposu Ticaret ve Sanayi A.S., along with its subsidiary, functions as a pharmacy depot in Turkey and has a market capitalization of TRY40.68 billion.

Operations: SELEC generates revenue primarily from its operations as a pharmacy depot in Turkey. The company has a market capitalization of TRY40.68 billion.

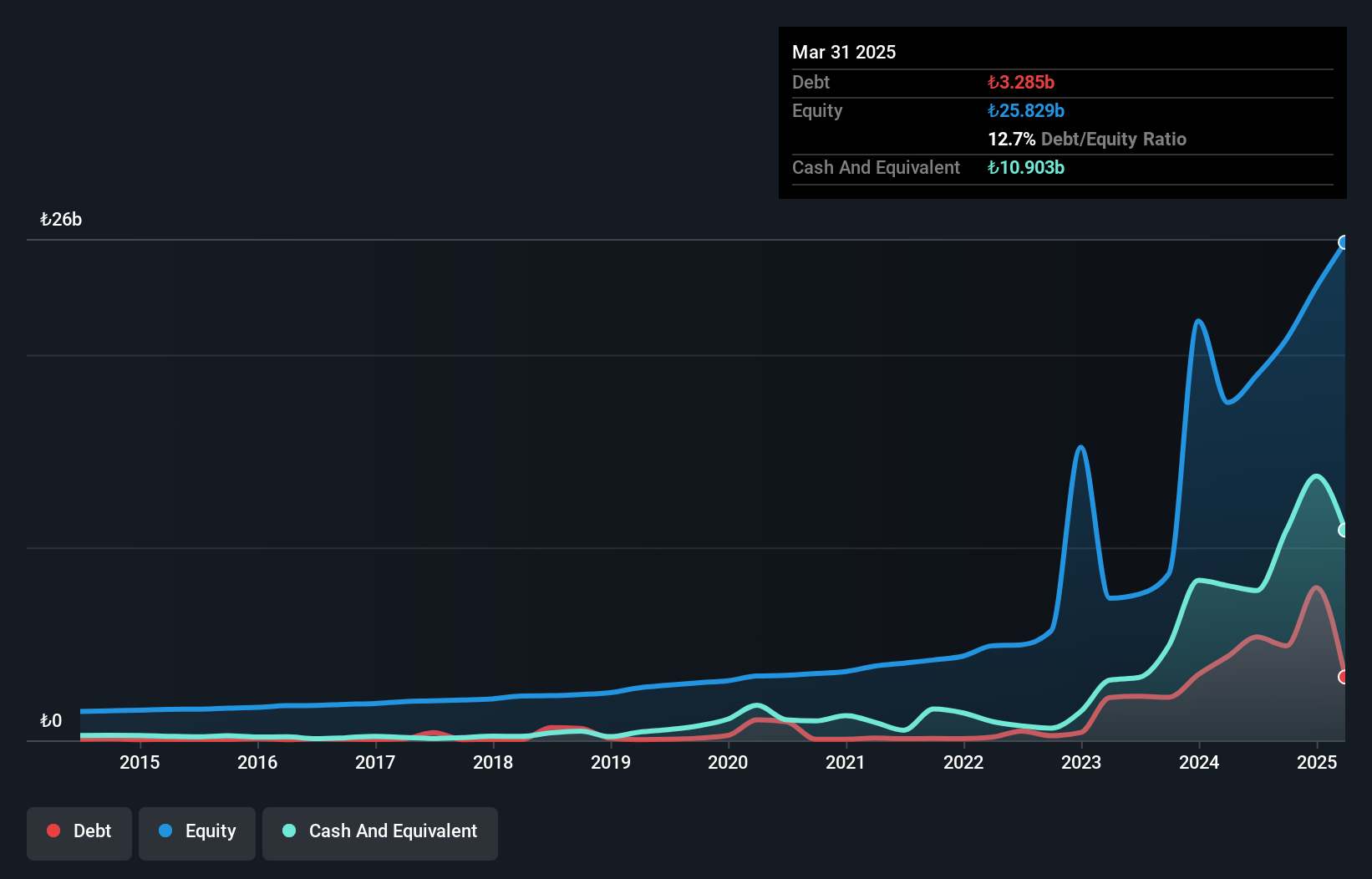

Selçuk Ecza, a notable player in the healthcare sector, has shown impressive earnings growth of 365% over the past year, outpacing industry averages. Despite this surge, its debt to equity ratio increased from 3.8% to 23.5% over five years, indicating a rise in leverage. The company reported TRY 29.67 billion in sales for Q3 2024 with net income at TRY 204.7 million compared to a loss last year, reflecting improved profitability despite volatile share prices recently. While earnings have dipped by an average of 6.7% annually over five years, recent performance suggests potential for recovery and stability moving forward.

Ruentex Engineering & Construction (TWSE:2597)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ruentex Engineering & Construction Co., Ltd. operates in the construction and engineering industry, focusing on various segments such as interior decoration design and construction materials, with a market cap of NT$36.38 billion.

Operations: Ruentex Engineering & Construction generates revenue primarily from its Construction Division, which contributed NT$18.36 billion, and the Construction Materials Business Segment, adding NT$4.30 billion. The Interior Decoration Design Segment also plays a role with NT$1.80 billion in revenue.

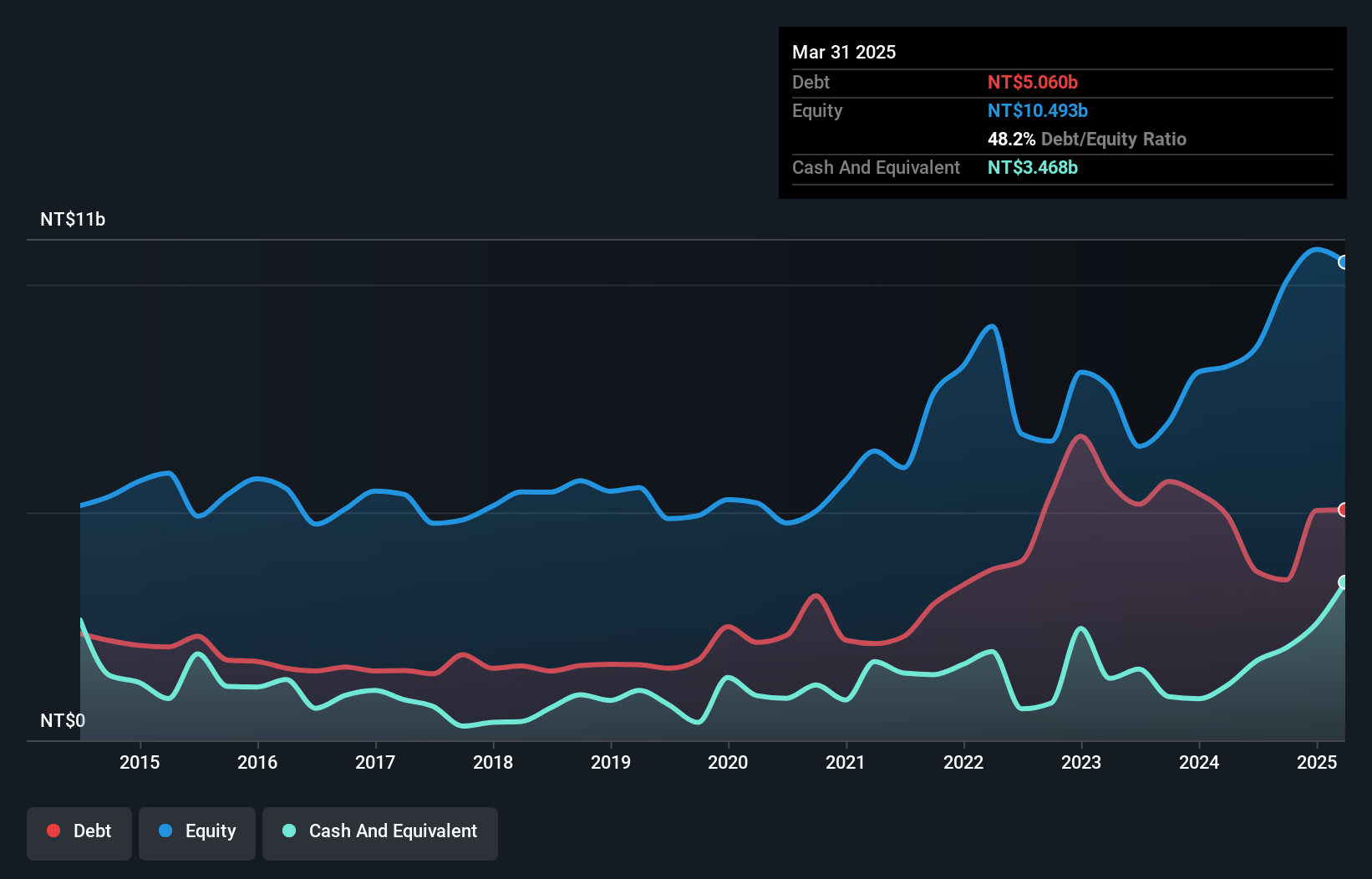

Ruentex Engineering & Construction, a notable player in the construction industry, has shown impressive growth with earnings rising by 23.9% over the past year, outpacing the industry's 7.1%. The company trades at 18.3% below its estimated fair value and boasts high-quality earnings, which is appealing for potential investors. Despite an increase in its debt to equity ratio from 32.5% to 42.8% over five years, it remains satisfactory at a net debt to equity of 22.6%. Recent reports indicate robust financial health with Q2 sales reaching TWD 6.74 billion and net income climbing to TWD 630 million compared to last year's figures.

- Click here and access our complete health analysis report to understand the dynamics of Ruentex Engineering & Construction.

Learn about Ruentex Engineering & Construction's historical performance.

Summing It All Up

- Get an in-depth perspective on all 4676 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2597

Ruentex Engineering & Construction

Ruentex Engineering & Construction Co., Ltd.

Outstanding track record with excellent balance sheet and pays a dividend.