- United Arab Emirates

- /

- Industrials

- /

- DFM:DIC

Middle Eastern Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

Most Gulf stock markets have recently experienced declines due to concerns over U.S. tariffs and weaker oil prices, overshadowing some strong corporate earnings in the region. Despite these challenges, the concept of penny stocks remains intriguing for investors seeking affordable entry points with potential growth opportunities. These smaller or newer companies can offer significant returns when backed by solid financials, and this article will explore three such promising Middle Eastern penny stocks worth watching.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.453 | ₪15.42M | ✅ 0 ⚠️ 5 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.99 | SAR1.6B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪3.881 | ₪272.95M | ✅ 4 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.60 | AED3.2B | ✅ 3 ⚠️ 3 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY2.45 | TRY2.64B | ✅ 2 ⚠️ 1 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.27 | AED676.89M | ✅ 0 ⚠️ 4 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.45 | AED398.48M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.83 | AED12.16B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.789 | AED467.14M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.574 | ₪191.36M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 75 stocks from our Middle Eastern Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Dubai Investments PJSC (DFM:DIC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dubai Investments PJSC operates in property, investment, manufacturing, contracting, and services sectors both in the UAE and internationally, with a market cap of AED12.16 billion.

Operations: The company's revenue is derived from property (AED2.14 billion), manufacturing, contracting and services (AED1.39 billion), and investments (AED272.75 million).

Market Cap: AED12.16B

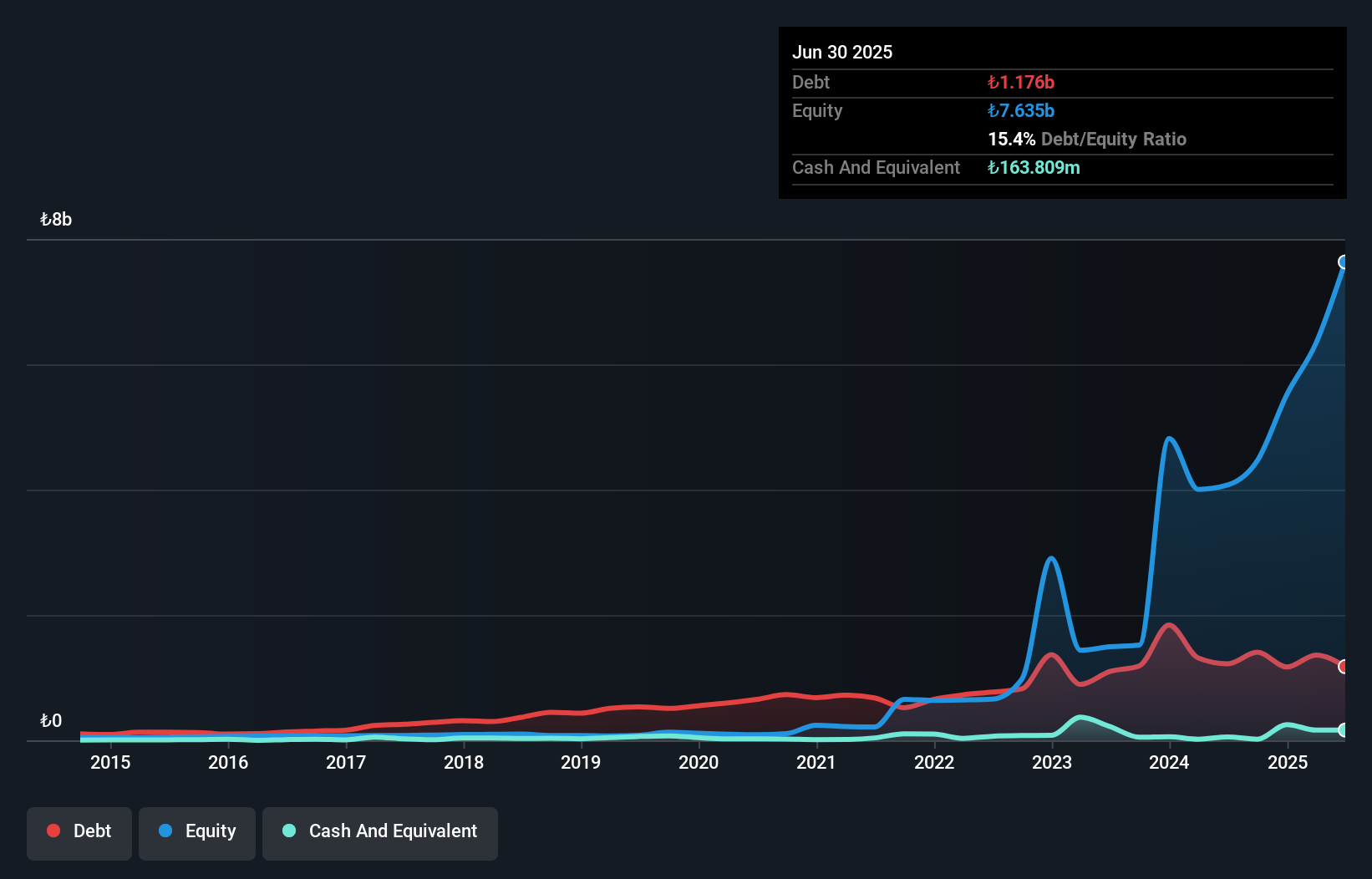

Dubai Investments PJSC, with a market cap of AED12.16 billion, operates across diverse sectors, including property and manufacturing. Recent earnings show growth in revenue to AED822.91 million and net income to AED170.89 million for Q1 2025. The company maintains a strong balance sheet with short-term assets exceeding liabilities and a satisfactory net debt-to-equity ratio of 14.4%. However, interest payments are not well covered by EBIT, and future earnings are forecasted to decline by an average of 15.2% annually over the next three years despite past growth driven by one-off gains impacting financial results significantly.

- Click here and access our complete financial health analysis report to understand the dynamics of Dubai Investments PJSC.

- Gain insights into Dubai Investments PJSC's future direction by reviewing our growth report.

Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret A.S. operates in the manufacturing sector, specializing in vehicle-mounted equipment, with a market cap of TRY2.64 billion.

Operations: The company's revenue from vehicle equipment manufacturing totals TRY1.36 billion.

Market Cap: TRY2.64B

Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret A.S., with a market cap of TRY2.64 billion, has demonstrated significant earnings growth, reporting Q1 2025 net income of TRY350.24 million, up from TRY231.09 million the previous year. Despite low return on equity at 10.5%, the company has reduced its debt to equity ratio from a very large figure to 21.5% over five years and maintains healthy short-term asset coverage for liabilities. However, interest payments remain inadequately covered by EBIT (1.9x), though operating cash flow sufficiently covers debt obligations at 163.3%. The board's average tenure is considered experienced at 5.8 years.

- Take a closer look at Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret's potential here in our financial health report.

- Review our historical performance report to gain insights into Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret's track record.

Human Xtensions (TASE:HUMX-M)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Human Xtensions Ltd. is a medical robotics company based in Israel that develops, manufactures, markets, and sells modular medical devices for minimally invasive surgical operations, with a market cap of ₪7.71 million.

Operations: The company's revenue of ₪0.67 million is derived from the development, production, marketing, and sale of medical equipment.

Market Cap: ₪7.71M

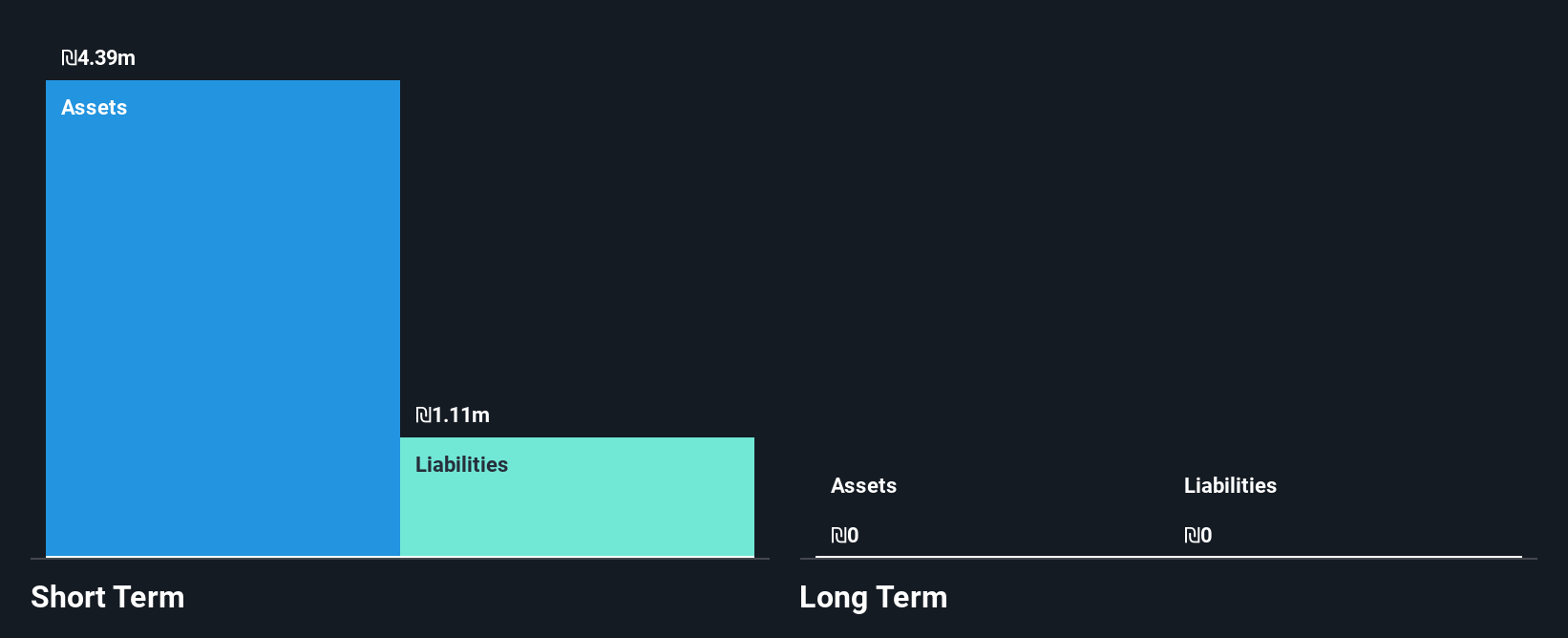

Human Xtensions Ltd., a medical robotics company, has a market cap of ₪7.71 million and is pre-revenue with sales under US$1 million. The company benefits from having no debt and short-term assets exceeding liabilities by ₪2.9 million, but it faces challenges with less than one year of cash runway and high share price volatility over the past three months. Despite being unprofitable, it has managed to reduce losses at 6.5% annually over five years. The board is experienced with an average tenure of 4.4 years, though management experience data is lacking.

- Get an in-depth perspective on Human Xtensions' performance by reading our balance sheet health report here.

- Gain insights into Human Xtensions' historical outcomes by reviewing our past performance report.

Where To Now?

- Dive into all 75 of the Middle Eastern Penny Stocks we have identified here.

- Ready To Venture Into Other Investment Styles? These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:DIC

Dubai Investments PJSC

Engages in property, investment, manufacturing, contracting, and services businesses in the United Arab Emirates and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives