- Japan

- /

- Electronic Equipment and Components

- /

- TSE:2760

3 Prominent Dividend Stocks Yielding Up To 6%

Reviewed by Simply Wall St

As global markets navigate uncertainties surrounding tariff policies and mixed economic signals, investors are increasingly seeking stability amid fluctuating indices. With U.S. stocks ending the week lower due to tariff concerns and job growth falling short of expectations, dividend stocks have become an attractive option for those looking to generate income in a volatile environment. A good dividend stock typically offers a reliable yield and has a history of consistent payouts, making it appealing during times when market conditions are unpredictable.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.22% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.33% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.47% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.85% | ★★★★★★ |

Click here to see the full list of 1962 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

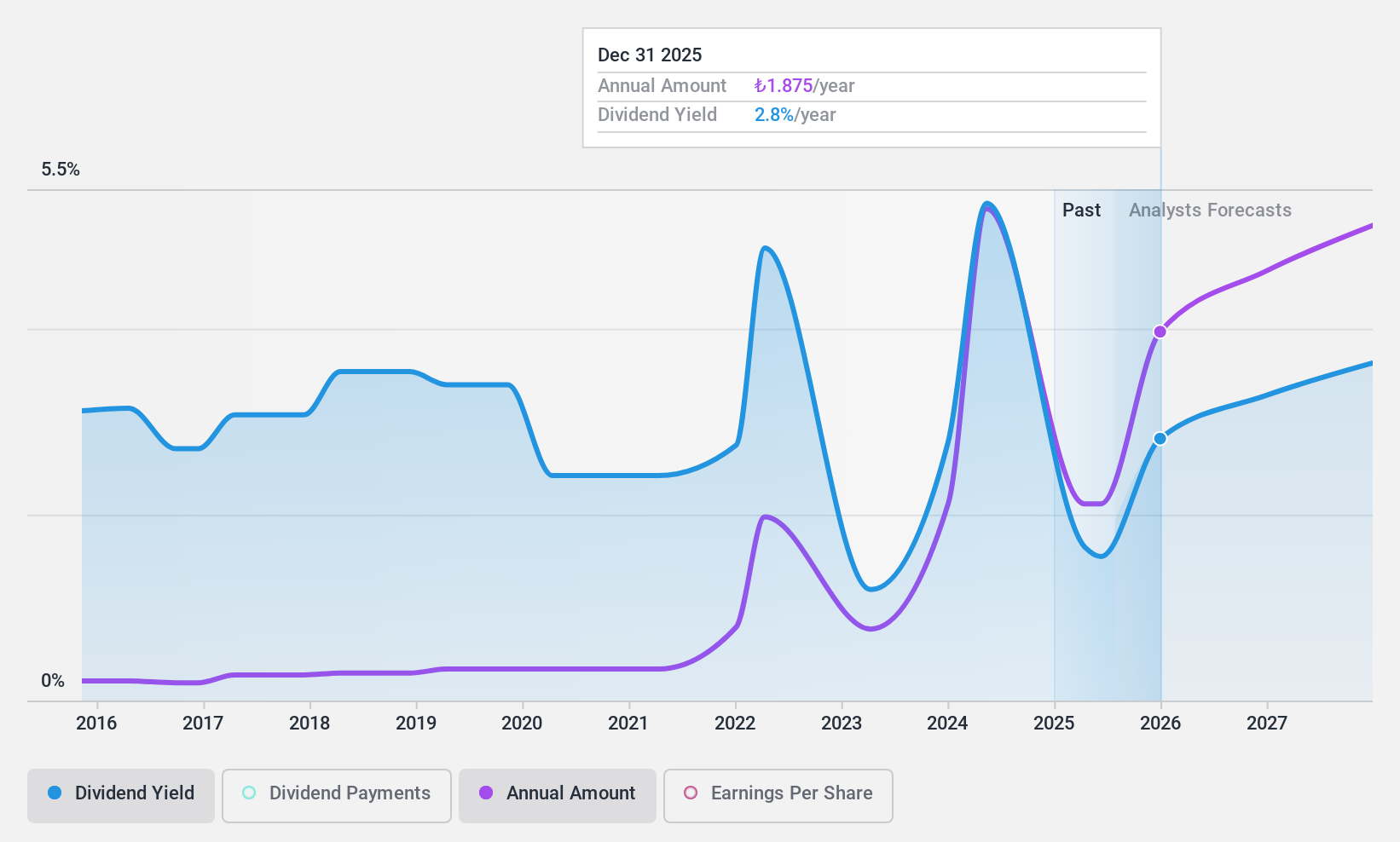

Enka Insaat ve Sanayi (IBSE:ENKAI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Enka Insaat ve Sanayi A.S., along with its subsidiaries, is a construction company operating in Turkey, Russia, Kazakhstan, Georgia, Europe, and internationally with a market cap of TRY289.39 billion.

Operations: Enka Insaat ve Sanayi A.S. generates its revenue through diverse construction operations across Turkey, Russia, Kazakhstan, Georgia, Europe, and other international markets.

Dividend Yield: 5.1%

Enka Insaat ve Sanayi offers a dividend yield of 5.06%, placing it in the top quartile of Turkish dividend payers, yet its sustainability is questionable. The company's payout ratio suggests dividends are well covered by earnings at 30.2%, but not by free cash flow, with a high cash payout ratio of 295.5%. Despite earnings growth averaging 42.2% annually over five years, dividends have been unreliable and volatile over the past decade.

- Dive into the specifics of Enka Insaat ve Sanayi here with our thorough dividend report.

- The valuation report we've compiled suggests that Enka Insaat ve Sanayi's current price could be inflated.

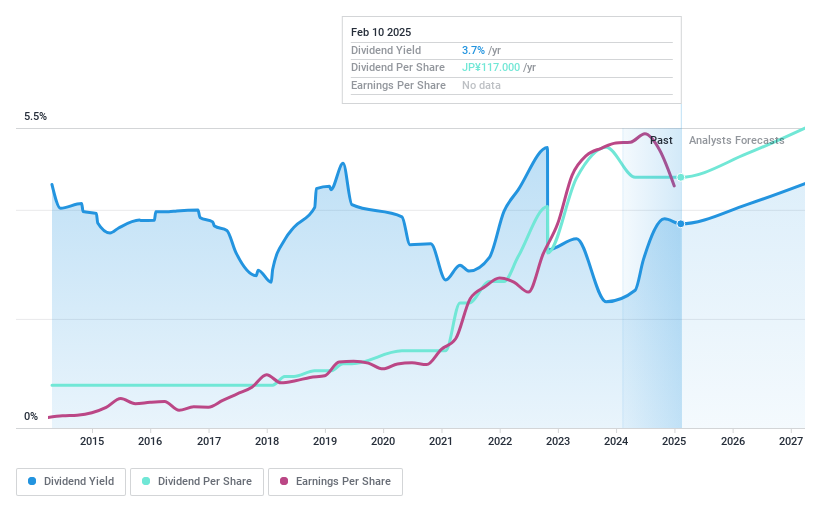

Tokyo Electron Device (TSE:2760)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tokyo Electron Device Limited is a technology trading company involved in electronic components and computer networks businesses globally, with a market cap of ¥95.72 billion.

Operations: Tokyo Electron Device Limited generates revenue from its electronic components and computer networks operations on a global scale.

Dividend Yield: 3.7%

Tokyo Electron Device's dividends, while covered by earnings and cash flows with payout ratios of 44.6% and 39.1% respectively, have been volatile over the past decade, lacking consistent growth. The dividend yield of 3.74% is slightly below the top quartile in Japan. Despite trading at a discount to estimated fair value, high debt levels pose potential risks to dividend sustainability. Recent board discussions on an employee shareholding plan may indicate strategic shifts impacting future payouts.

- Click to explore a detailed breakdown of our findings in Tokyo Electron Device's dividend report.

- Our comprehensive valuation report raises the possibility that Tokyo Electron Device is priced lower than what may be justified by its financials.

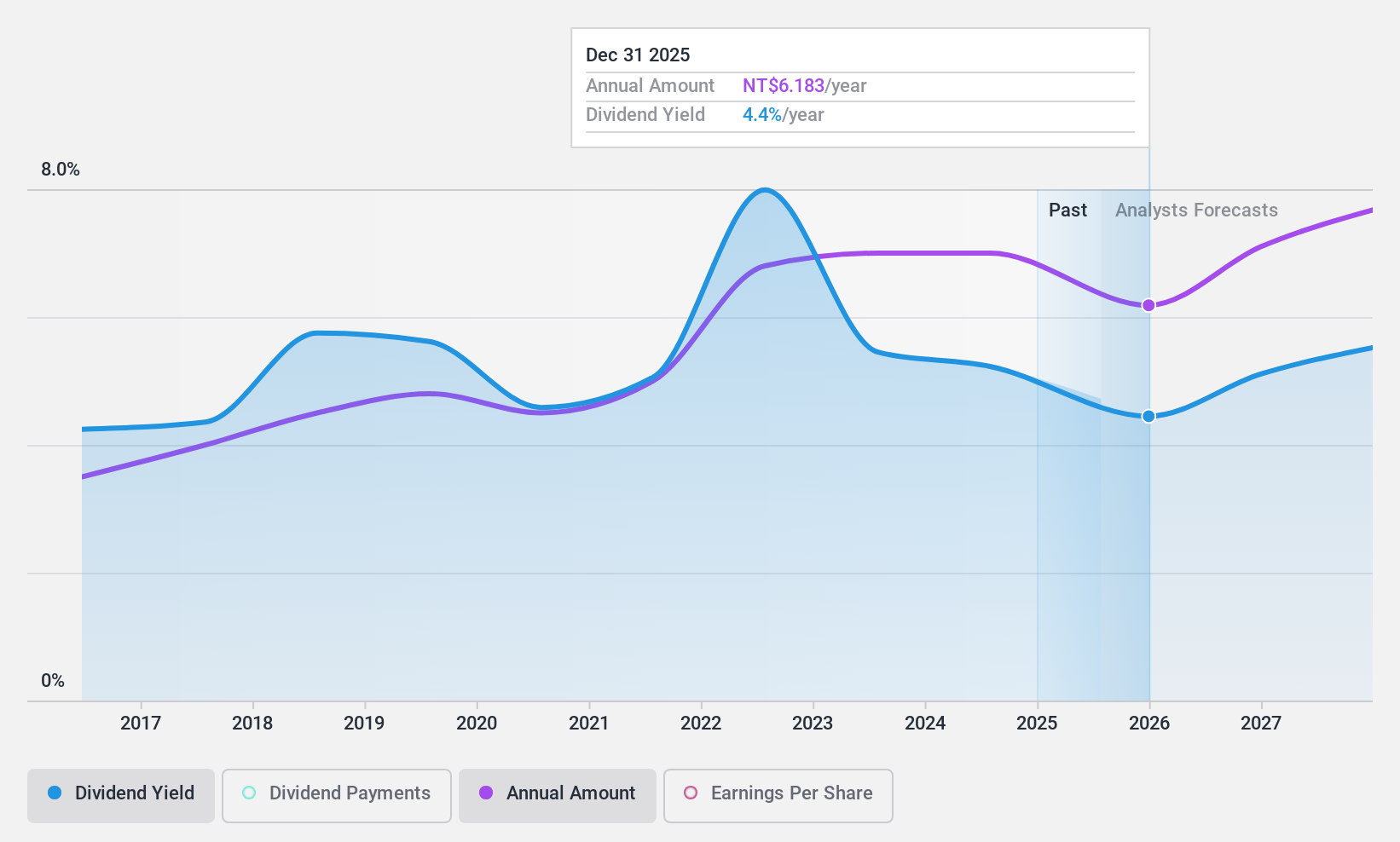

Powertech Technology (TWSE:6239)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Powertech Technology Inc. is involved in the research, design, development, assembly, manufacturing, packaging, testing, and sale of integrated circuit products across Taiwan and various international markets with a market cap of NT$84.82 billion.

Operations: Powertech Technology Inc.'s revenue from its semiconductor segment amounts to NT$75.25 billion.

Dividend Yield: 6%

Powertech Technology's dividend payments have been stable and growing over the past decade, supported by a payout ratio of 56.7% and a cash payout ratio of 43.1%, ensuring coverage by earnings and cash flows. The dividend yield is an attractive 6.03%, placing it in the top quartile of Taiwan's market, though recent delisting from OTC Equity due to inactivity might affect liquidity perceptions among investors.

- Click here to discover the nuances of Powertech Technology with our detailed analytical dividend report.

- According our valuation report, there's an indication that Powertech Technology's share price might be on the cheaper side.

Next Steps

- Navigate through the entire inventory of 1962 Top Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo Electron Device might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2760

Tokyo Electron Device

A technology trading company, engages in the electronic components and computer networks businesses worldwide.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives