Undiscovered Gems in the Middle East to Explore This September 2025

Reviewed by Simply Wall St

As Middle Eastern markets navigate geopolitical tensions and fluctuating oil prices, recent events have led to cautious sentiment among investors, with key indices like Qatar's benchmark index experiencing slight declines. In this environment, identifying promising stocks often involves looking for companies that demonstrate resilience and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

Ege Profil Ticaret ve Sanayi Anonim Sirketi (IBSE:EGPRO)

Simply Wall St Value Rating: ★★★★★★

Overview: Ege Profil Ticaret ve Sanayi Anonim Sirketi is a company that manufactures and distributes plastic pipes, spare parts, and various profiles and plastic goods both in Turkey and internationally, with a market capitalization of TRY13.68 billion.

Operations: EGPRO generates its revenue primarily from the Building Products segment, which accounts for TRY9.12 billion. The company's financial performance is characterized by a net profit margin trend that warrants attention for further analysis.

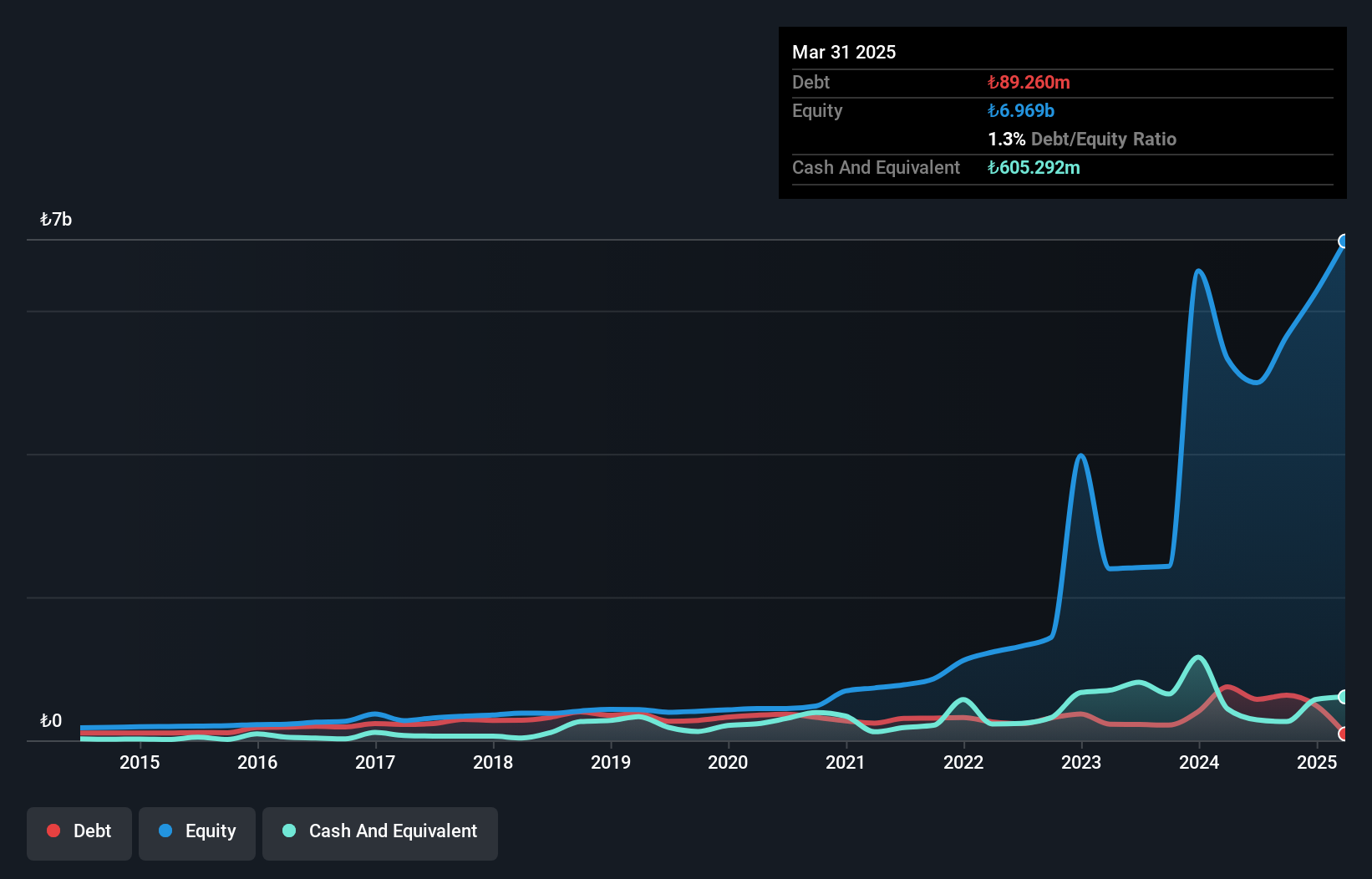

Ege Profil, a notable player in the Middle East's building industry, shows promising financial health with its debt to equity ratio dropping from 82.3% to 3.8% over five years, highlighting effective debt management. Despite a dip in recent sales and net income—TRY 2,680 million and TRY 188.99 million respectively for Q2—the company remains profitable with earnings growth of 7.8%, outpacing the industry's -11.7%. Its price-to-earnings ratio of 21x undercuts the TR market average of 23x, suggesting potential value for investors seeking quality earnings amidst a challenging sector backdrop.

- Delve into the full analysis health report here for a deeper understanding of Ege Profil Ticaret ve Sanayi Anonim Sirketi.

Learn about Ege Profil Ticaret ve Sanayi Anonim Sirketi's historical performance.

Fourth Milling (SASE:2286)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fourth Milling Company operates in the Kingdom of Saudi Arabia, focusing on the production, packaging, and sale of flour and its byproducts, animal feed, and bran products with a market cap of SAR2.03 billion.

Operations: The company generates revenue primarily from its food processing segment, amounting to SAR637.41 million.

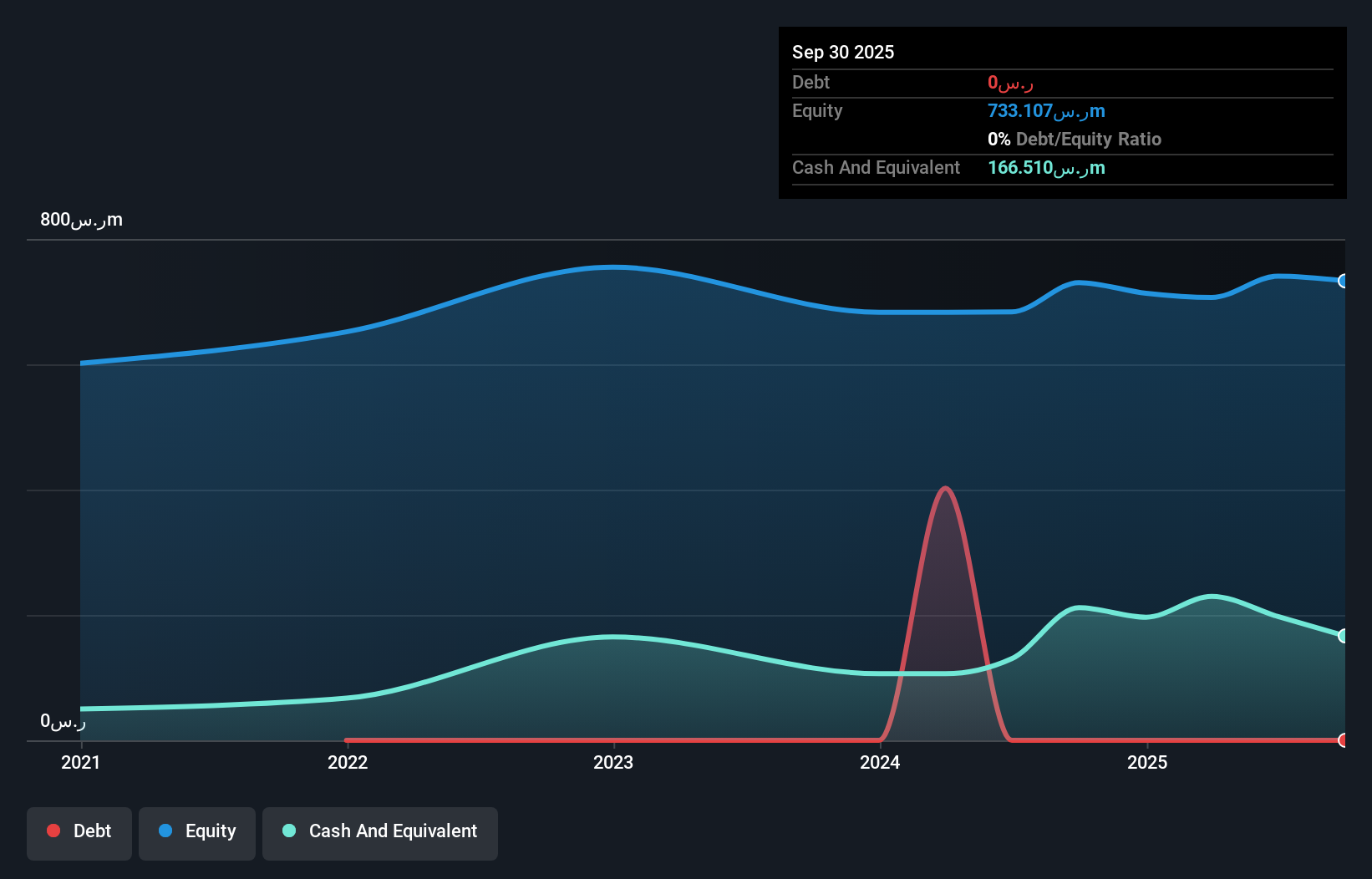

Fourth Milling, a nimble player in the food sector, boasts impressive financial health with no debt and positive free cash flow. Over the past year, earnings have surged by 13%, outpacing the broader industry growth of 4.1%. Trading at a significant discount of 35.7% to its estimated fair value, it presents an attractive opportunity for investors seeking undervalued assets. Recent developments include a strategic expansion into Al-Kharj with new flour mill and feed plant projects, signaling potential future growth. The company also reported steady sales and income increases for Q2 2025 compared to last year, reinforcing its solid performance trajectory.

- Get an in-depth perspective on Fourth Milling's performance by reading our health report here.

Examine Fourth Milling's past performance report to understand how it has performed in the past.

National Agricultural Development (SASE:6010)

Simply Wall St Value Rating: ★★★★★★

Overview: The National Agricultural Development Company focuses on the production of agricultural and livestock products both in Saudi Arabia and internationally, with a market capitalization of SAR6.27 billion.

Operations: Revenue is primarily generated from Dairy and Food (SAR3.07 billion), followed by Agriculture (SAR245.54 million) and Protein (SAR242.15 million). The net profit margin provides insight into the company's profitability trends over time.

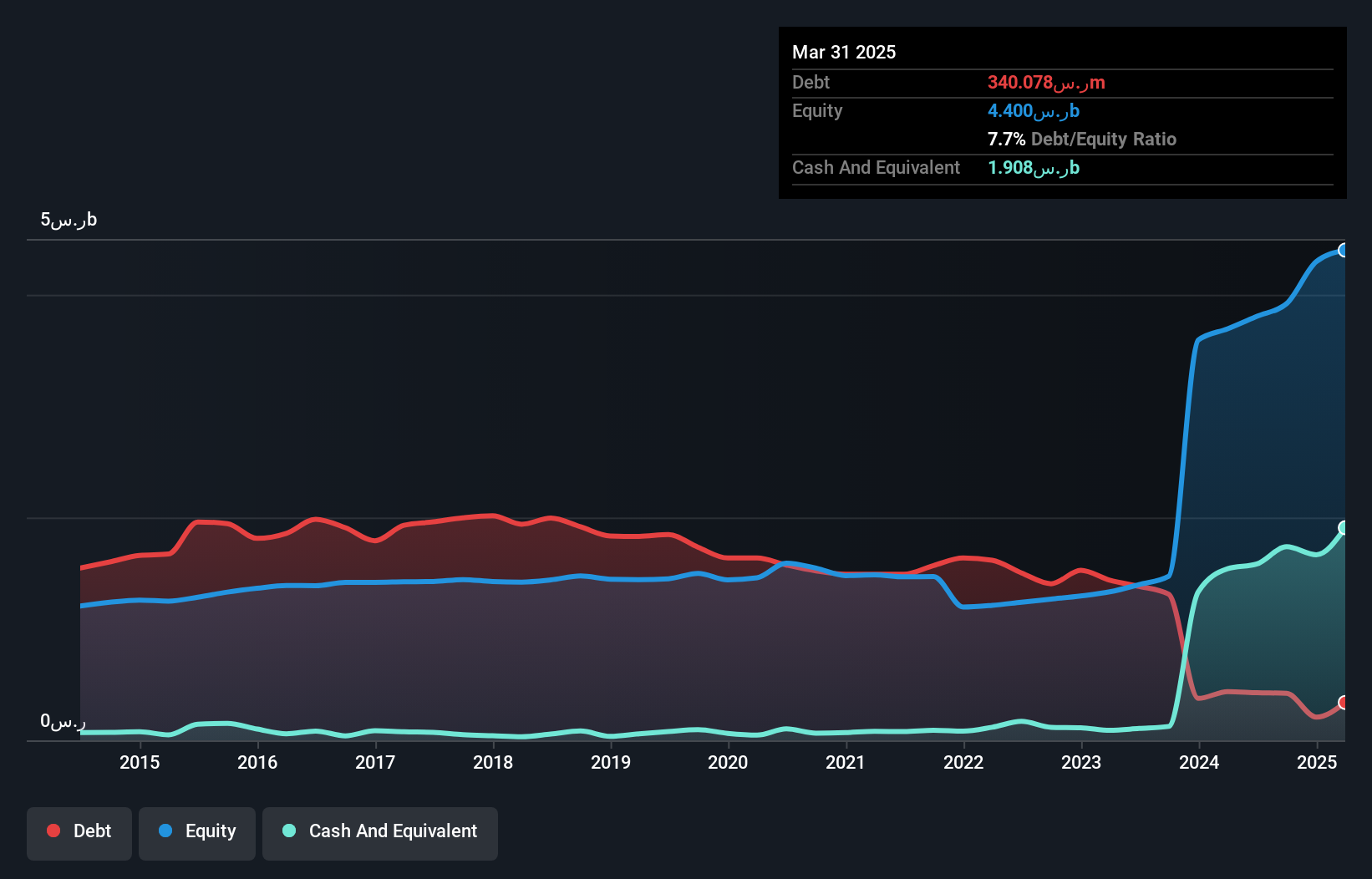

National Agricultural Development, a smaller player in the Middle Eastern market, has shown strong financial performance recently. Its earnings grew by 89% over the past year, significantly outpacing the food industry average of 4%. The company reported a net income of SAR 115.26 million for Q2 2025, slightly up from SAR 111.88 million in the previous year. With a debt to equity ratio reduced from 98.9% to just 6.2% over five years and interest payments covered by EBIT at a solid rate of 24 times, it appears financially robust despite forecasts suggesting an average earnings decline of nearly 9% annually for three years ahead.

Next Steps

- Embark on your investment journey to our 202 Middle Eastern Undiscovered Gems With Strong Fundamentals selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ege Profil Ticaret ve Sanayi Anonim Sirketi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:EGPRO

Ege Profil Ticaret ve Sanayi Anonim Sirketi

Produces and sells plastic pipes, spare parts, and various profiles and plastic goods in Turkey an internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives