As the Middle Eastern markets experience a boost from rate cut optimism and favorable U.S. inflation data, investors are increasingly eyeing dividend stocks as a stable income source amidst this positive economic backdrop. In such an environment, selecting dividend stocks with strong fundamentals and attractive yields can be a prudent strategy for those looking to benefit from both capital appreciation and steady income streams.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi Telecom (SASE:7010) | 9.32% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.20% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.42% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.54% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.51% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.92% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 8.00% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.34% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.37% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.83% | ★★★★★☆ |

Click here to see the full list of 69 stocks from our Top Middle Eastern Dividend Stocks screener.

We'll examine a selection from our screener results.

Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi (IBSE:AVPGY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi operates in real estate development, leasing, and business administration in Turkey, with a market cap of TRY23.58 billion.

Operations: Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi generates revenue from two main segments: Residential and Office Project at TRY2.25 billion, and Office and Shopping Centers for Rent at TRY2.10 billion.

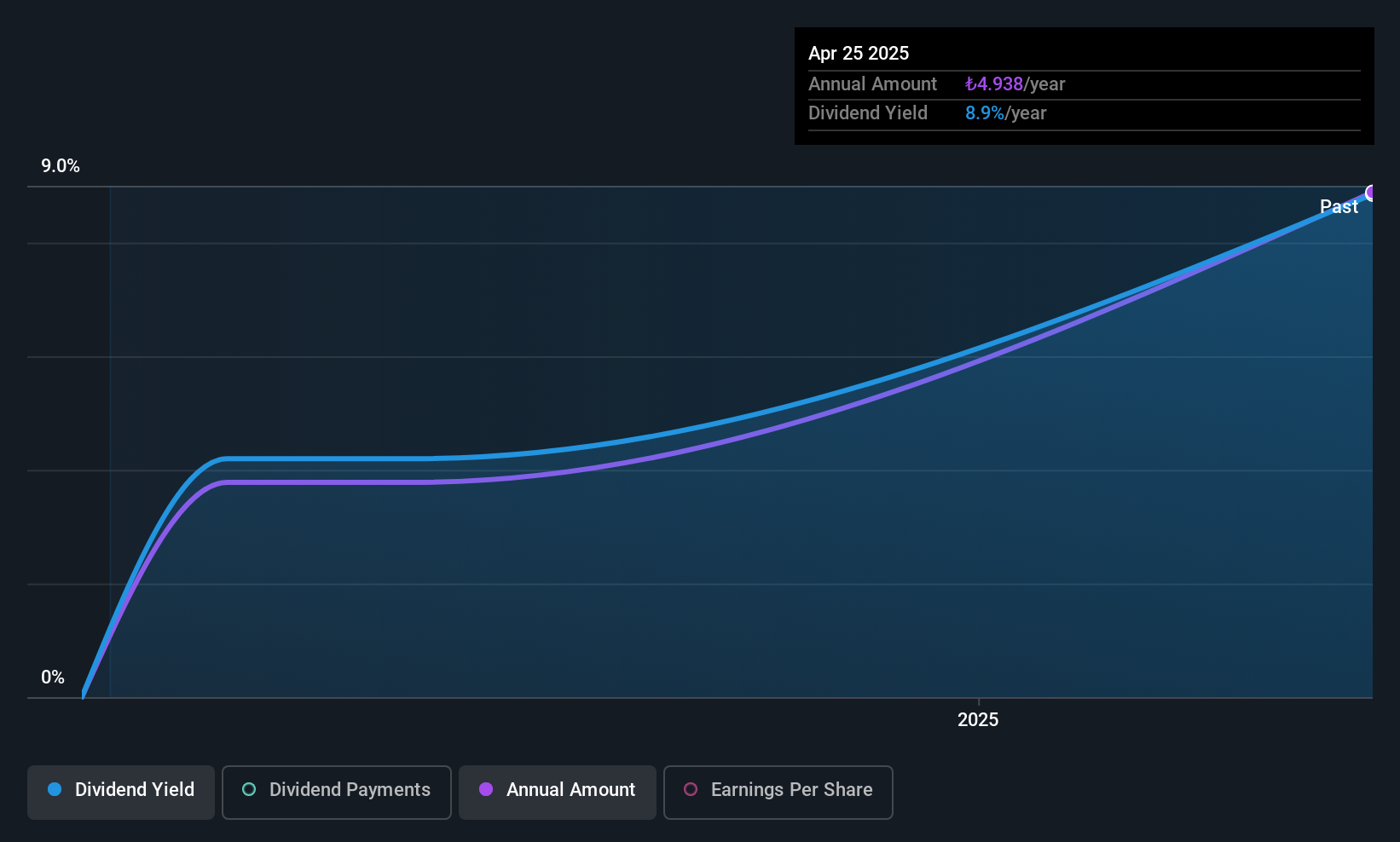

Dividend Yield: 8.4%

Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi offers a promising dividend yield of 8.38%, placing it in the top quartile of Turkish dividend payers. The company's dividends are well-covered by earnings, with a payout ratio of 28.2%, and cash flows, with a cash payout ratio of 65.7%. However, it's too early to assess the reliability and growth potential of these dividends as they have only recently commenced. Despite trading at 89.3% below estimated fair value, recent earnings show significant volatility with net income dropping sharply year-over-year for both quarterly and six-month periods ending June 2025.

- Unlock comprehensive insights into our analysis of Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi stock in this dividend report.

- In light of our recent valuation report, it seems possible that Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi is trading behind its estimated value.

Ege Profil Ticaret ve Sanayi Anonim Sirketi (IBSE:EGPRO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ege Profil Ticaret ve Sanayi Anonim Sirketi is engaged in the production and sale of plastic pipes, spare parts, and various profiles and plastic goods both in Turkey and internationally, with a market cap of TRY14.39 billion.

Operations: Ege Profil Ticaret ve Sanayi Anonim Sirketi generates revenue primarily from its Building Products segment, amounting to TRY9.12 billion.

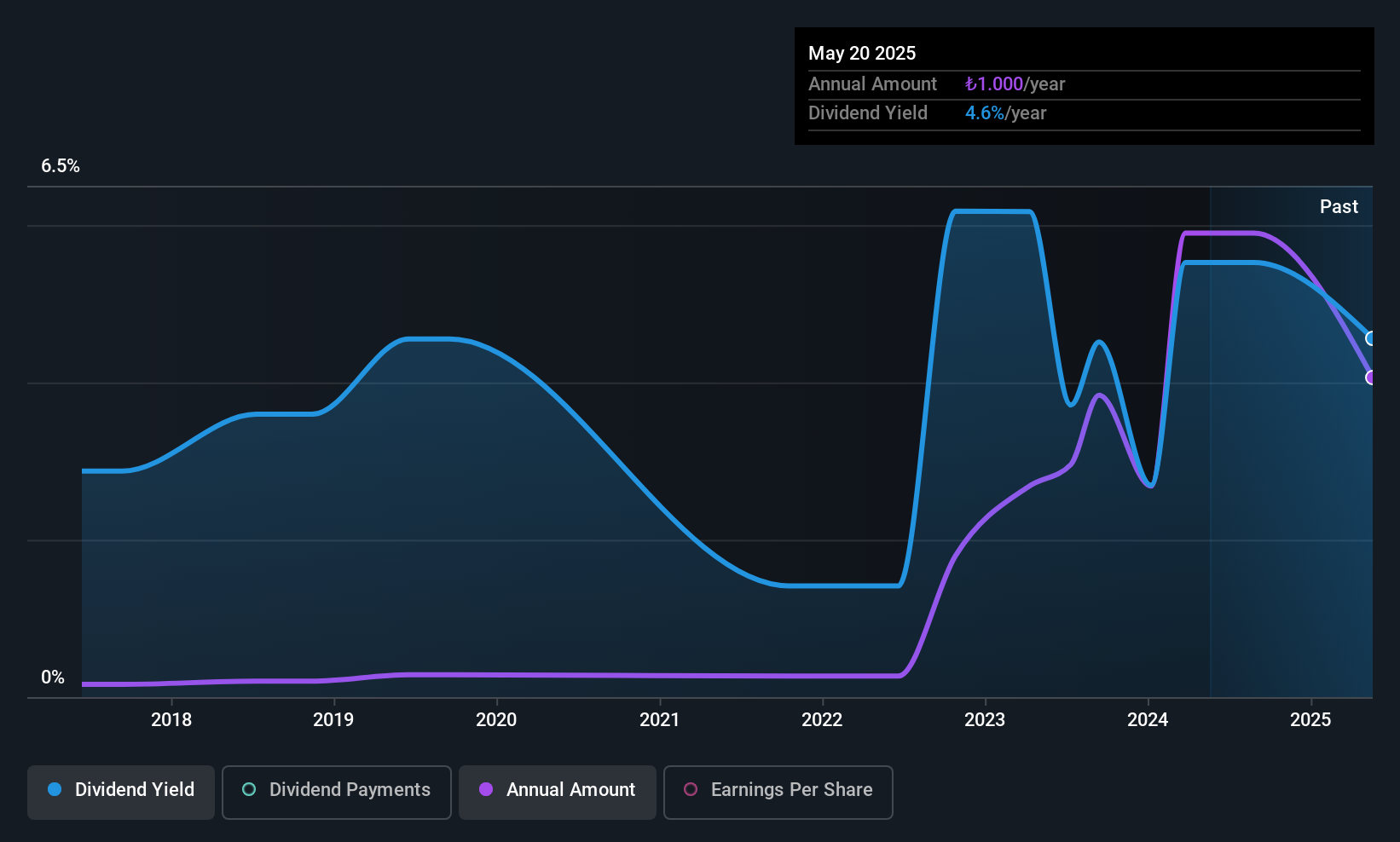

Dividend Yield: 3.8%

Ege Profil Ticaret ve Sanayi Anonim Sirketi's dividend yield of 3.79% ranks in the top 25% of Turkish dividend payers, though its track record is unstable with volatile payments over nine years. Despite a high payout ratio of 84.4%, dividends are supported by earnings and cash flows, evidenced by a cash payout ratio of 35.5%. Recent earnings showed declines, with second-quarter net income at TRY 188.99 million compared to TRY 283.96 million last year.

- Delve into the full analysis dividend report here for a deeper understanding of Ege Profil Ticaret ve Sanayi Anonim Sirketi.

- According our valuation report, there's an indication that Ege Profil Ticaret ve Sanayi Anonim Sirketi's share price might be on the expensive side.

Ayalon Insurance (TASE:AYAL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ayalon Insurance Company Ltd, with a market cap of ₪1.90 billion, operates in Israel through its subsidiaries offering a range of insurance products.

Operations: Ayalon Insurance Company Ltd's revenue segments include Health at ₪638.15 million, General Insurance - Compulsory Vehicle Insurance at ₪335.99 million, General Insurance - Property Branches and Others at ₪424.26 million, General Insurance - Automobile Property Insurance at ₪704.65 million, and Life Insurance and Long-Term Savings - Life Insurance at ₪1.19 billion.

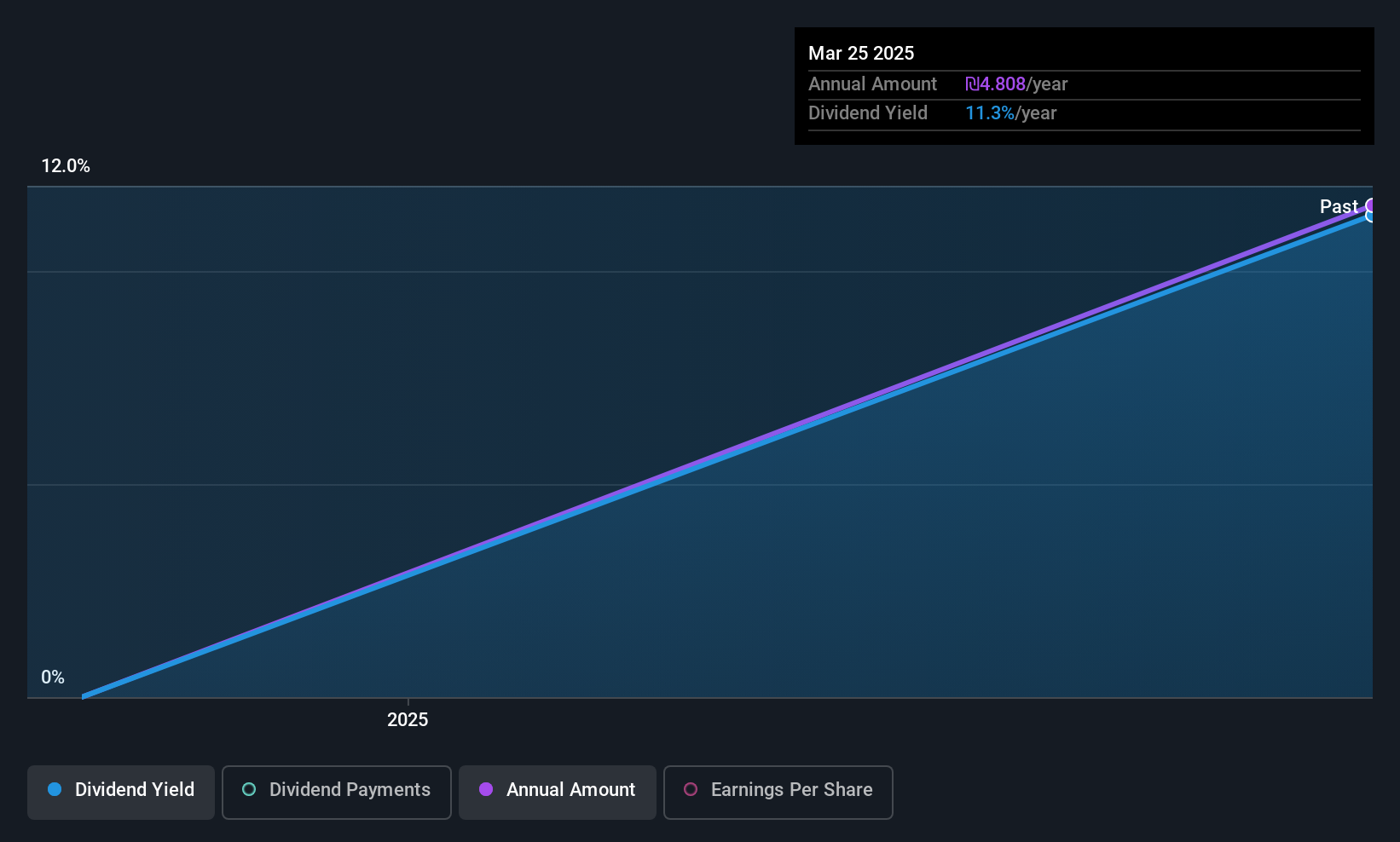

Dividend Yield: 6.9%

Ayalon Insurance's dividend yield of 6.89% places it among the top 25% in Israel, though it's too early to assess stability as dividends have just begun. The company's payouts are well-supported by earnings and cash flows, with payout ratios of 30.9% and 38.8%, respectively. Recent inclusion in the S&P Global BMI Index and a private placement raising NIS 150 million highlight its growing market presence amidst volatile share price movements.

- Click here and access our complete dividend analysis report to understand the dynamics of Ayalon Insurance.

- Our comprehensive valuation report raises the possibility that Ayalon Insurance is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 66 Top Middle Eastern Dividend Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ege Profil Ticaret ve Sanayi Anonim Sirketi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:EGPRO

Ege Profil Ticaret ve Sanayi Anonim Sirketi

Produces and sells plastic pipes, spare parts, and various profiles and plastic goods in Turkey an internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives