- Japan

- /

- Capital Markets

- /

- TSE:8707

Top Dividend Stocks To Consider In October 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of rising U.S. Treasury yields and tepid economic growth, investors are increasingly focused on strategies that provide stability amid uncertainty. In this environment, dividend stocks can offer a reliable income stream, making them an attractive option for those looking to balance potential market volatility with steady returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.08% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.93% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.90% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.55% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.60% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.35% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.87% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 2013 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Haci Ömer Sabanci Holding (IBSE:SAHOL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Haci Ömer Sabanci Holding A.S. is a global conglomerate with operations in finance, manufacturing, and trading sectors, boasting a market cap of TRY179.90 billion.

Operations: Haci Ömer Sabanci Holding A.S. generates revenue primarily from its banking segment at TRY438.35 billion, followed by the energy sector with TRY171.88 billion, digital operations contributing TRY52.22 billion, and financial services at TRY41.51 billion.

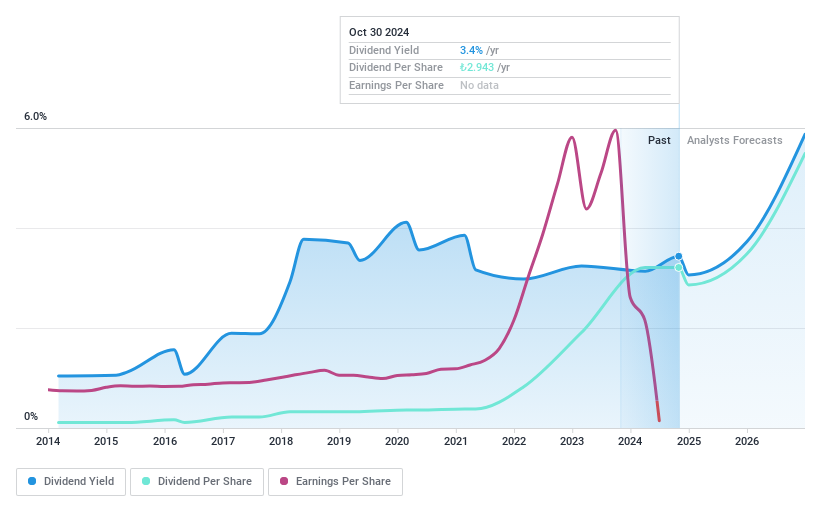

Dividend Yield: 3.4%

Haci Ömer Sabanci Holding's dividend yield of 3.44% ranks in the top 25% of Turkish market payers, yet its dividends have shown volatility over the past decade. Despite forecasts for significant earnings growth, recent financials reveal a net loss and shareholder dilution, raising concerns about dividend sustainability. The company's payout ratio is low at 15.5%, suggesting potential coverage improvements, but current dividends are not fully supported by earnings due to profitability issues and high non-performing loans at 2.2%.

- Take a closer look at Haci Ömer Sabanci Holding's potential here in our dividend report.

- Upon reviewing our latest valuation report, Haci Ömer Sabanci Holding's share price might be too pessimistic.

Yamato Kogyo (TSE:5444)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Yamato Kogyo Co., Ltd., with a market cap of ¥444.73 billion, operates through its subsidiaries to manufacture and sell steel products both in Japan and internationally.

Operations: Yamato Kogyo Co., Ltd.'s revenue is primarily derived from its Steel Business in Japan (¥67.36 billion), Track Equipment Business (¥7.74 billion), and Steel Business in Thailand (¥77.77 billion).

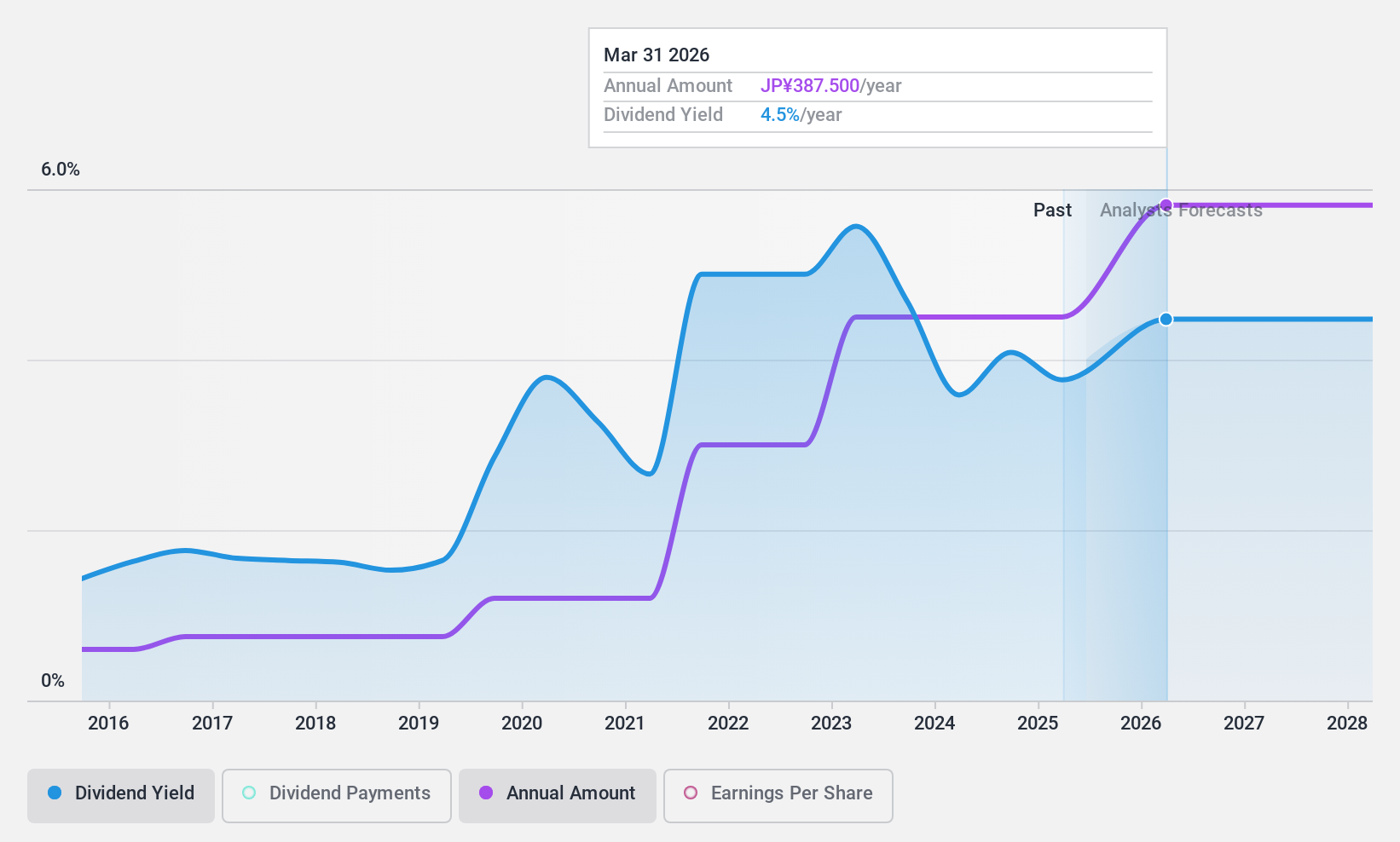

Dividend Yield: 4.1%

Yamato Kogyo offers a compelling dividend profile with stable and growing dividends over the past decade. Its payout ratios—27.6% for earnings and 26.5% for cash flow—indicate strong coverage, enhancing sustainability. The dividend yield of 4.09% is among the top quartile in Japan, offering attractive returns compared to peers while trading at 54% below estimated fair value. Despite revenue growth forecasts, anticipated earnings decline may impact future dividend growth potential but doesn't currently threaten payouts.

- Unlock comprehensive insights into our analysis of Yamato Kogyo stock in this dividend report.

- The valuation report we've compiled suggests that Yamato Kogyo's current price could be quite moderate.

IwaiCosmo Holdings (TSE:8707)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IwaiCosmo Holdings, Inc., along with its subsidiaries, offers financial services leveraging information technology in Japan and has a market cap of ¥48.20 billion.

Operations: IwaiCosmo Holdings, Inc. generates its revenue through various financial services facilitated by information technology within Japan.

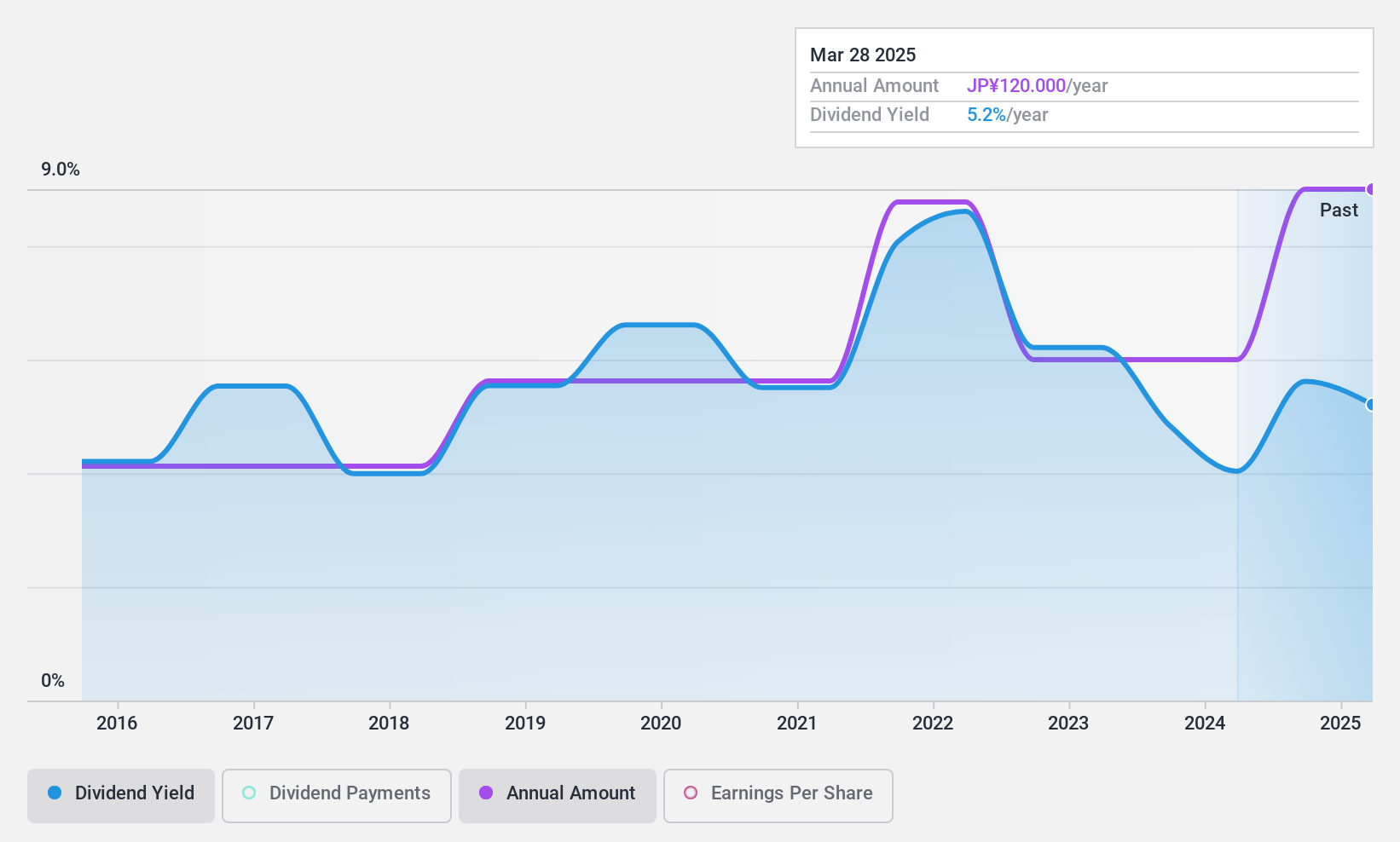

Dividend Yield: 5.7%

IwaiCosmo Holdings' dividend yield of 5.73% ranks in Japan's top quartile, yet its sustainability is questionable due to a high cash payout ratio of 270.5%, indicating dividends aren't well-covered by cash flows. Despite earnings growth of 45.1% last year and a low payout ratio of 37.6%, dividends have been volatile over the past decade, impacting reliability. The stock trades at a discount relative to its estimated fair value and peers, offering potential value despite concerns.

- Click here and access our complete dividend analysis report to understand the dynamics of IwaiCosmo Holdings.

- Our expertly prepared valuation report IwaiCosmo Holdings implies its share price may be lower than expected.

Where To Now?

- Get an in-depth perspective on all 2013 Top Dividend Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8707

IwaiCosmo Holdings

Provides financial services using information technology in Japan.

Undervalued with solid track record and pays a dividend.