Global's Leading Growth Stocks With Insider Ownership November 2025

Reviewed by Simply Wall St

As global markets navigate the aftermath of the longest U.S. government shutdown in history and grapple with concerns over elevated valuations, investors are increasingly cautious about growth-oriented stocks, particularly those linked to artificial intelligence. Amidst this backdrop, insider ownership in growth companies can serve as a reassuring indicator of confidence from those closest to the business operations and strategic direction.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Pharma Mar (BME:PHM) | 12% | 42.6% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 31.1% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| CD Projekt (WSE:CDR) | 29.7% | 51% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 30.3% |

Underneath we present a selection of stocks filtered out by our screen.

Haci Ömer Sabanci Holding (IBSE:SAHOL)

Simply Wall St Growth Rating: ★★★★★☆

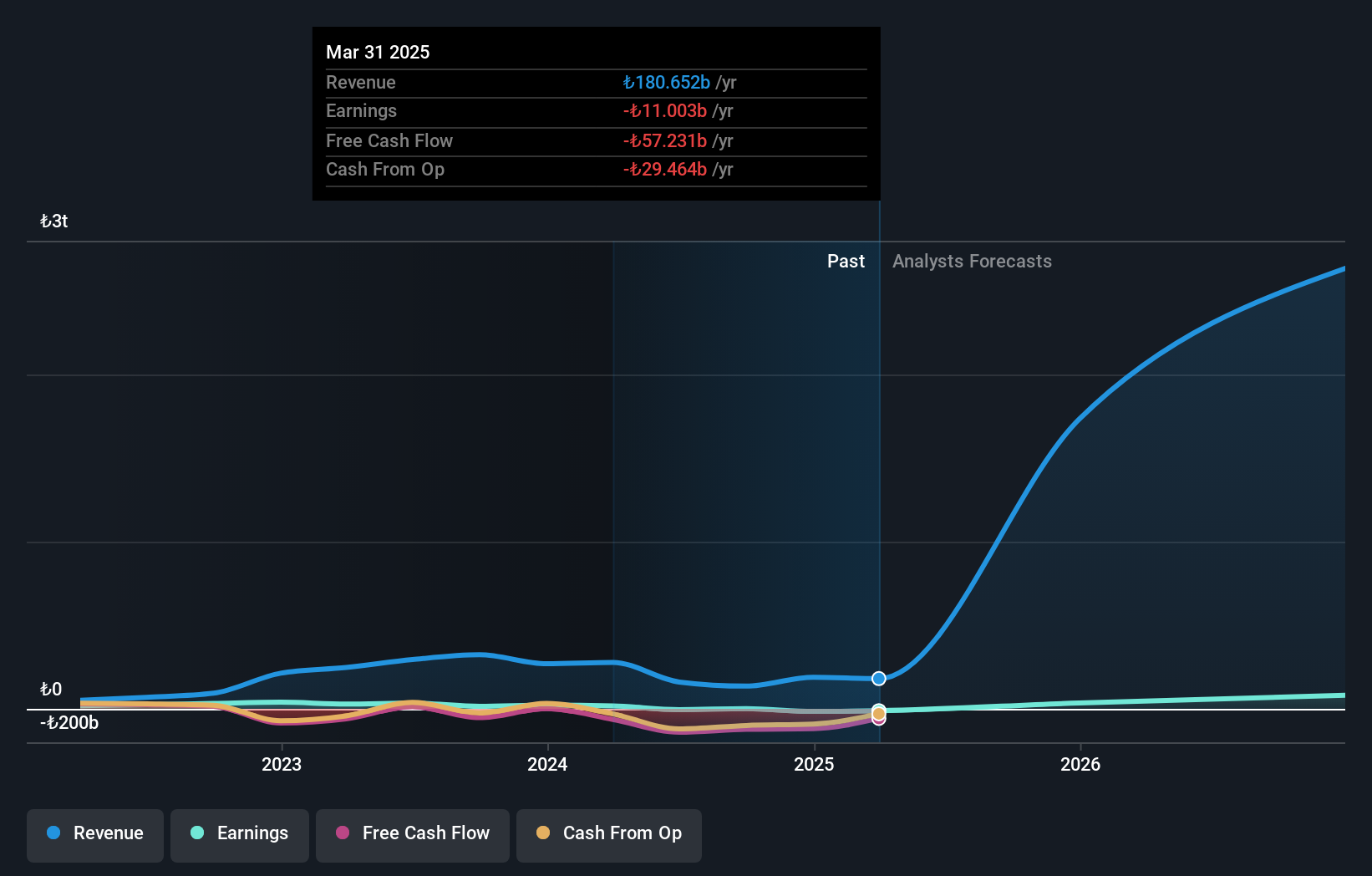

Overview: Haci Ömer Sabanci Holding A.S. operates primarily in the finance, manufacturing, and trading sectors worldwide, with a market cap of TRY163.30 billion.

Operations: The company's revenue is primarily derived from banking (TRY689.53 billion), energy (TRY249.82 billion), digital (TRY74.25 billion), financial services (TRY53.29 billion), and material technologies (TRY80.40 billion) sectors worldwide.

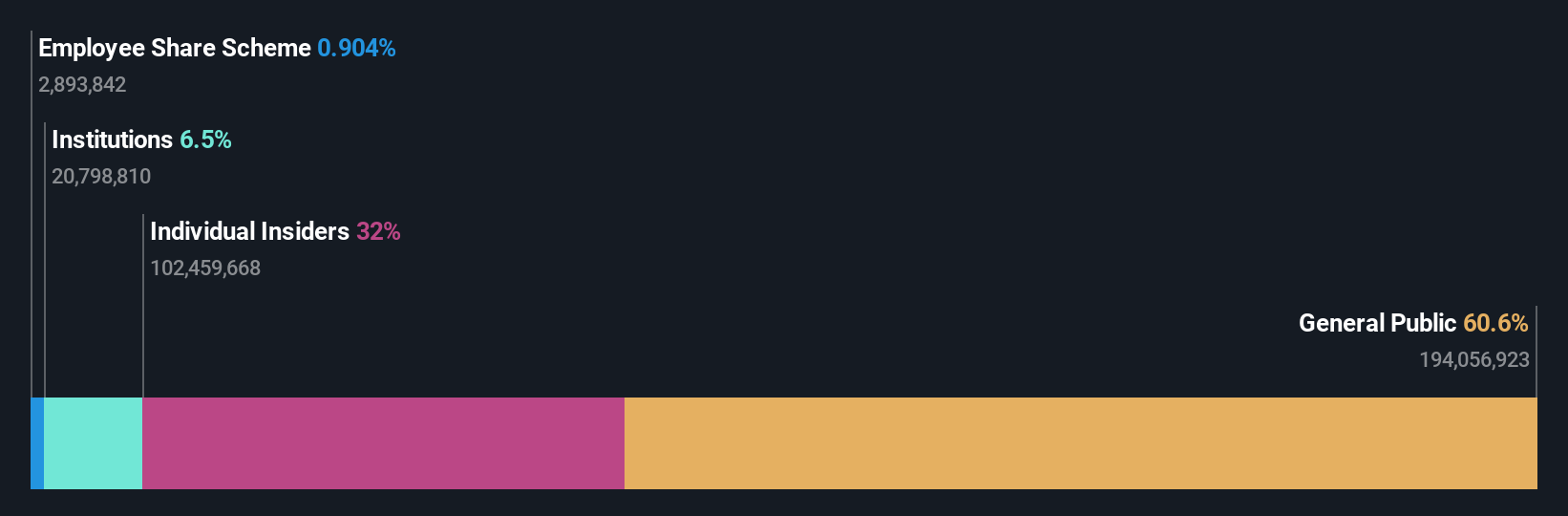

Insider Ownership: 20.7%

Haci Ömer Sabanci Holding shows promising growth potential, with revenue expected to grow 56.2% annually, outpacing the Turkish market's 25%. Recent earnings indicate a significant recovery from losses, reporting TRY 678.8 million net income for Q3 2025. Despite low forecasted return on equity of 8%, profitability is anticipated within three years, above average market growth. Insider ownership remains high without substantial recent trading activity, and strategic divestments may enhance focus on core profitable segments.

- Unlock comprehensive insights into our analysis of Haci Ömer Sabanci Holding stock in this growth report.

- In light of our recent valuation report, it seems possible that Haci Ömer Sabanci Holding is trading behind its estimated value.

EmbedWay Technologies (Shanghai) (SHSE:603496)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EmbedWay Technologies (Shanghai) Corporation provides network visibility, intelligent system platforms, and intelligent computing solutions and services in China with a market cap of CN¥9.39 billion.

Operations: The company generates revenue primarily from the Computer, Communication, and Other Electronic Equipment Manufacturing segment, amounting to CN¥975.02 million.

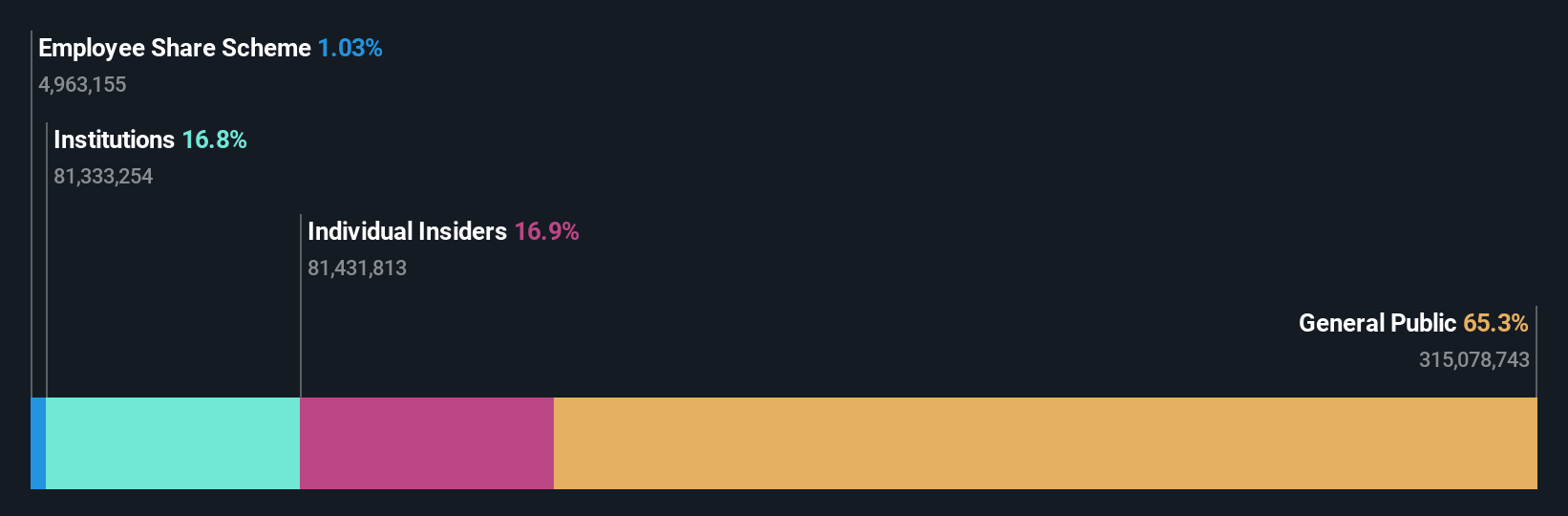

Insider Ownership: 32%

EmbedWay Technologies (Shanghai) is expected to achieve profitability within three years, with revenue projected to grow 32.7% annually, surpassing the Chinese market's growth rate. Despite trading at 71.5% below estimated fair value and a low forecasted return on equity of 12.9%, its earnings are anticipated to increase by 73.78% per year. Recent earnings show a decline in sales and net income compared to last year, while insider ownership remains high without significant recent trading activity.

- Click here and access our complete growth analysis report to understand the dynamics of EmbedWay Technologies (Shanghai).

- According our valuation report, there's an indication that EmbedWay Technologies (Shanghai)'s share price might be on the expensive side.

Beijing SuperMap Software (SZSE:300036)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing SuperMap Software Co., Ltd. offers geographic information system and spatial intelligence software products and services both in China and internationally, with a market cap of CN¥9.18 billion.

Operations: Revenue segments for Beijing SuperMap Software Co., Ltd. are not provided in the given text.

Insider Ownership: 15.5%

Beijing SuperMap Software is forecast to achieve profitability in three years, with earnings expected to grow 93.36% annually, outpacing the Chinese market's revenue growth rate of 14.4%. Recent earnings indicate an increase in net income to CNY 42.96 million for the nine months ended September 2025, compared to CNY 26.31 million a year earlier. Despite slower revenue growth at 15.1% annually and low projected return on equity of 7.5%, insider ownership remains significant without notable recent trading activity.

- Click here to discover the nuances of Beijing SuperMap Software with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Beijing SuperMap Software's current price could be inflated.

Taking Advantage

- Reveal the 834 hidden gems among our Fast Growing Global Companies With High Insider Ownership screener with a single click here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Haci Ömer Sabanci Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:SAHOL

Haci Ömer Sabanci Holding

Operates primarily in the finance, manufacturing, and trading sectors worldwide.

High growth potential with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives