- United States

- /

- Entertainment

- /

- NYSE:SPOT

3 Undervalued Stocks With Discounts Up To 41.4%

Reviewed by Simply Wall St

As global markets navigate mixed performance and subdued inflation, investors are increasingly turning their attention to value stocks, which have recently outperformed growth shares. In this environment, identifying undervalued stocks can be a strategic move for those looking to capitalize on market inefficiencies and secure potential long-term gains.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trisul (BOVESPA:TRIS3) | R$4.62 | R$9.22 | 49.9% |

| EnomotoLtd (TSE:6928) | ¥1472.00 | ¥2940.28 | 49.9% |

| WuXi XDC Cayman (SEHK:2268) | HK$19.64 | HK$39.16 | 49.8% |

| STAAR Surgical (NasdaqGM:STAA) | US$33.09 | US$65.91 | 49.8% |

| Manorama Industries (BSE:541974) | ₹836.80 | ₹1665.51 | 49.8% |

| WEX (NYSE:WEX) | US$191.02 | US$379.69 | 49.7% |

| AK Medical Holdings (SEHK:1789) | HK$4.16 | HK$8.32 | 50% |

| Carter Bankshares (NasdaqGS:CARE) | US$17.30 | US$34.56 | 49.9% |

| Hiconics Eco-energy Technology (SZSE:300048) | CN¥4.34 | CN¥8.65 | 49.8% |

| Cellnex Telecom (BME:CLNX) | €34.93 | €69.52 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Turkiye Garanti Bankasi (IBSE:GARAN)

Overview: Turkiye Garanti Bankasi A.S. offers a range of banking products and services in Turkey, with a market cap of TRY471.66 billion.

Operations: The company's revenue segments include Retail Banking (TRY95.70 billion), Investment Banking (-TRY98.03 billion), and Corporate and Commercial Banking (TRY111.49 billion).

Estimated Discount To Fair Value: 41.4%

Turkiye Garanti Bankasi appears undervalued based on cash flows, trading at TRY 112.3, which is 41.4% below its estimated fair value of TRY 191.5. Recent earnings show significant growth with Q2 net income at TRY 21.87 billion compared to TRY 18.22 billion a year ago and strong revenue forecasts of 27.1% per year, outpacing the market's growth rate of 24.1%. However, it has an unstable dividend track record and slower expected earnings growth than the TR market.

- Our growth report here indicates Turkiye Garanti Bankasi may be poised for an improving outlook.

- Take a closer look at Turkiye Garanti Bankasi's balance sheet health here in our report.

Western Digital (NasdaqGS:WDC)

Overview: Western Digital Corporation develops, manufactures, and sells data storage devices and solutions globally, with a market cap of $22.53 billion.

Operations: Western Digital's revenue segments include $6.32 billion from Hard Disk Drives (HDD) and $6.69 billion from Flash-Based Products.

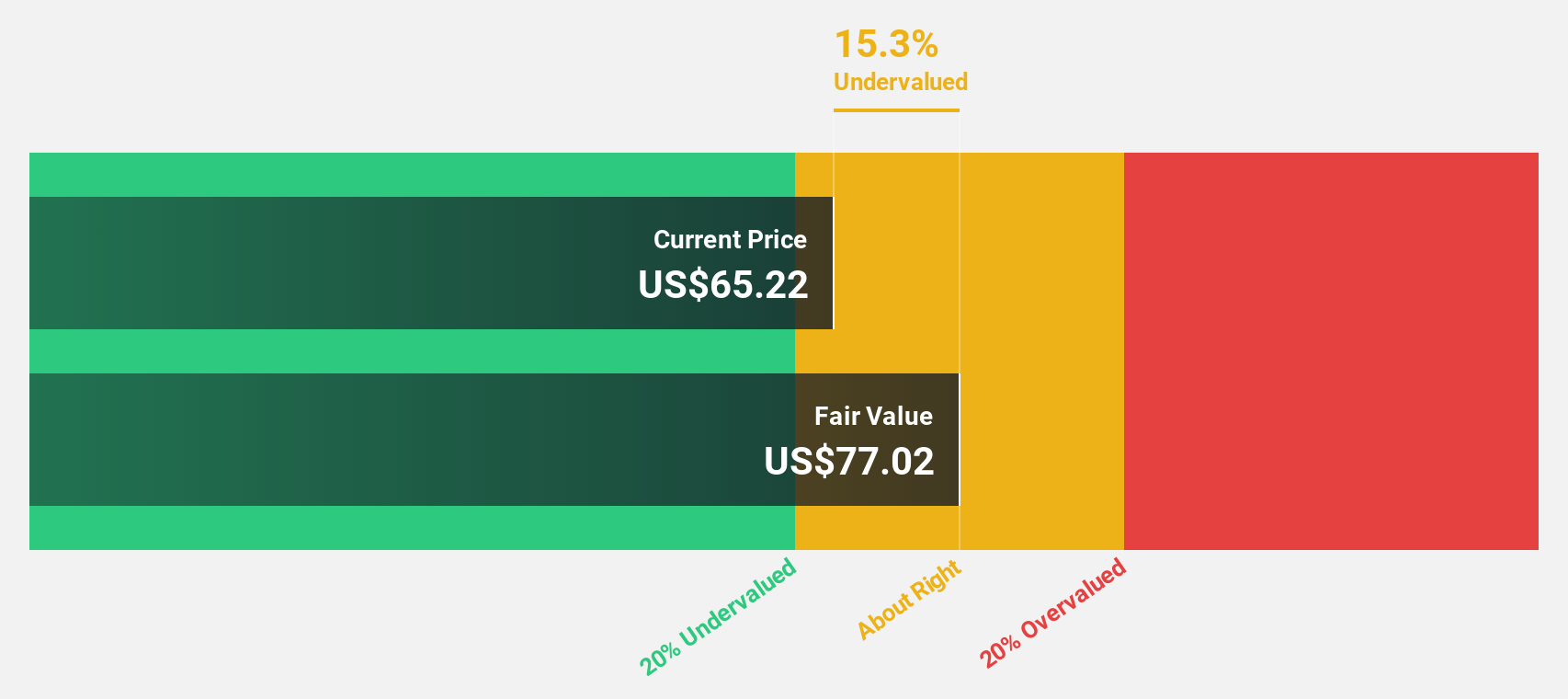

Estimated Discount To Fair Value: 25.4%

Western Digital is trading at US$65.59, significantly below its estimated fair value of US$87.9, indicating it may be undervalued based on cash flows. Despite recent insider selling and interest payments not being well covered by earnings, the company reported strong Q4 earnings with sales of US$3.76 billion and a net income turnaround to US$330 million from a loss last year. Revenue is forecasted to grow 11.2% annually, outpacing the broader market's 8.7%.

- Our earnings growth report unveils the potential for significant increases in Western Digital's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Western Digital.

Spotify Technology (NYSE:SPOT)

Overview: Spotify Technology S.A., with a market cap of $68.85 billion, offers global audio streaming subscription services through its subsidiaries.

Operations: Spotify's revenue segments include €12.68 billion from Premium subscriptions and €1.79 billion from Ad-Supported services.

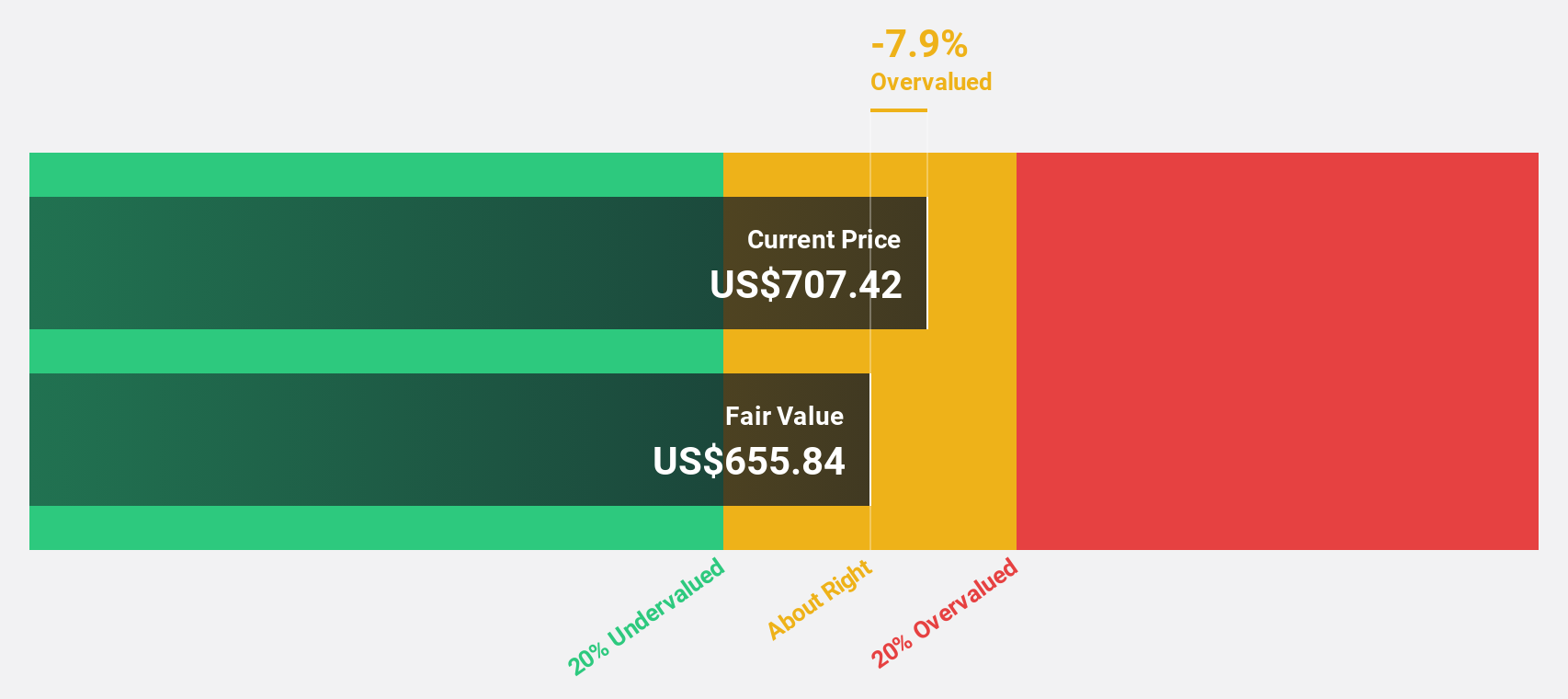

Estimated Discount To Fair Value: 25.1%

Spotify Technology, trading at US$342.88, is significantly below its estimated fair value of US$457.63, suggesting it may be undervalued based on cash flows. The company recently reported a net income of EUR 274 million for Q2 2024, a significant turnaround from a loss last year. Earnings are forecast to grow 29.6% annually, outpacing the market's 15%. Additionally, Spotify has expanded its content offerings by integrating Cineverse Corp.'s extensive video library into its platform.

- In light of our recent growth report, it seems possible that Spotify Technology's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Spotify Technology stock in this financial health report.

Next Steps

- Explore the 967 names from our Undervalued Stocks Based On Cash Flows screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with excellent balance sheet.