As global markets continue to respond to the anticipation of a Federal Reserve rate cut and enthusiasm around artificial intelligence, major U.S. stock indexes have reached new record highs, reflecting a buoyant market sentiment despite elevated inflation and labor market concerns. In this environment, identifying promising high-growth tech stocks involves looking for companies that are well-positioned to capitalize on technological advancements and AI trends while navigating economic uncertainties effectively.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 31.53% | 46.86% | ★★★★★★ |

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 33.58% | 44.17% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| KebNi | 21.99% | 63.71% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| CD Projekt | 35.15% | 43.54% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We'll examine a selection from our screener results.

SVI (SET:SVI)

Simply Wall St Growth Rating: ★★★★☆☆

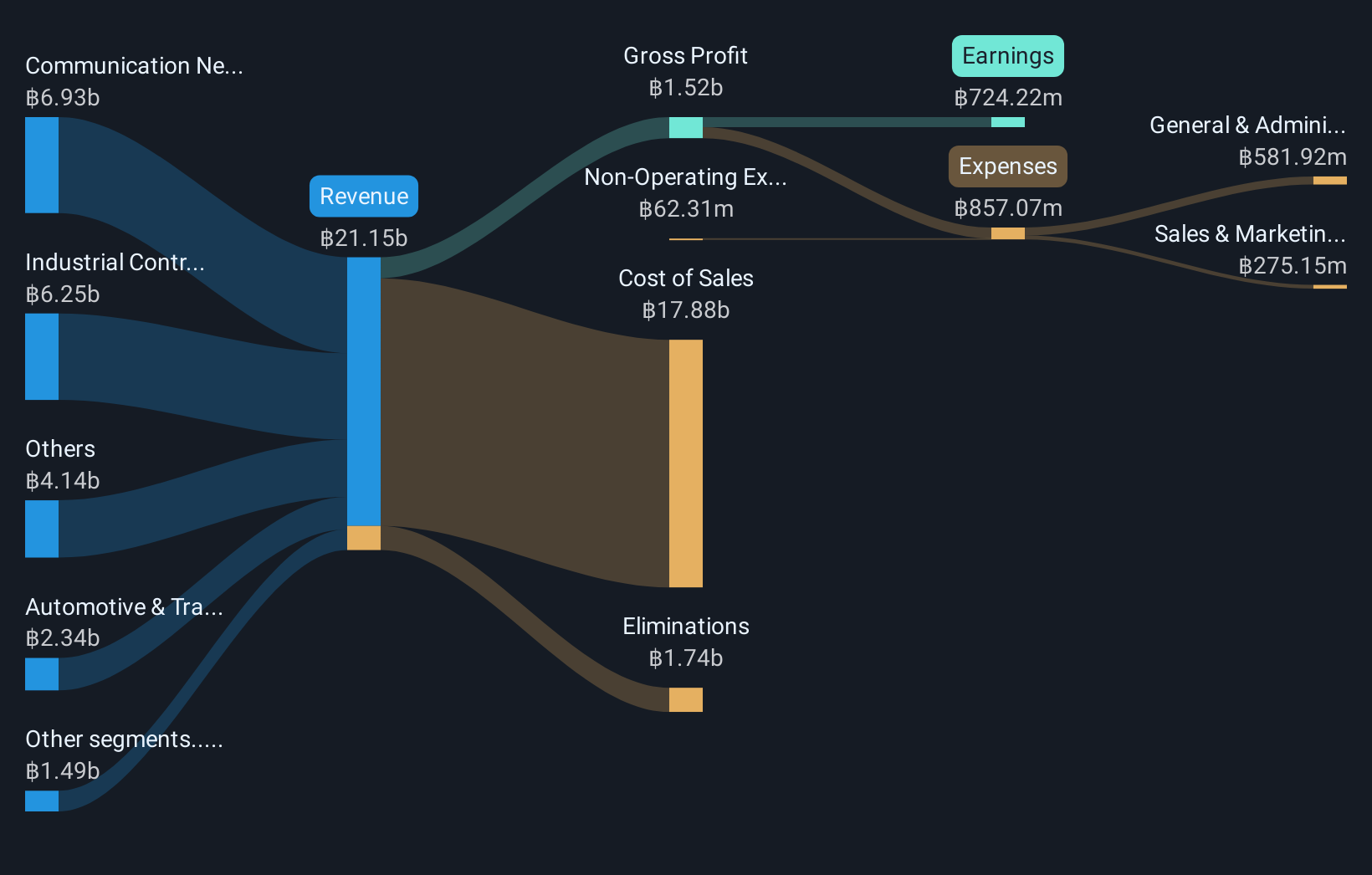

Overview: SVI Public Company Limited, along with its subsidiaries, offers electronic manufacturing services across Asia and Europe, with a market capitalization of THB12.92 billion.

Operations: SVI focuses on electronic manufacturing services, primarily serving the communication network and industrial control system sectors, which generate THB6.93 billion and THB6.25 billion in revenue respectively. The company also has significant operations in the automotive & transportation sector with revenues of THB2.34 billion.

SVI, amidst a challenging year with earnings shrinking by 48%, still projects an optimistic future with expected annual earnings growth of 24.5%. This forecast surpasses the Thai market's average of 11.3% and is coupled with a revenue increase prediction of 7.8% per year, outpacing the market's growth rate of 5.6%. Recent executive changes and a significant drop in net income from THB 578.34 million to THB 91.08 million in Q2 highlight potential volatility but also possibly a fresh strategic direction under new leadership, aiming to revitalize its operational dynamics in an industry where innovation determines longevity.

- Navigate through the intricacies of SVI with our comprehensive health report here.

Evaluate SVI's historical performance by accessing our past performance report.

Fixstars (TSE:3687)

Simply Wall St Growth Rating: ★★★★☆☆

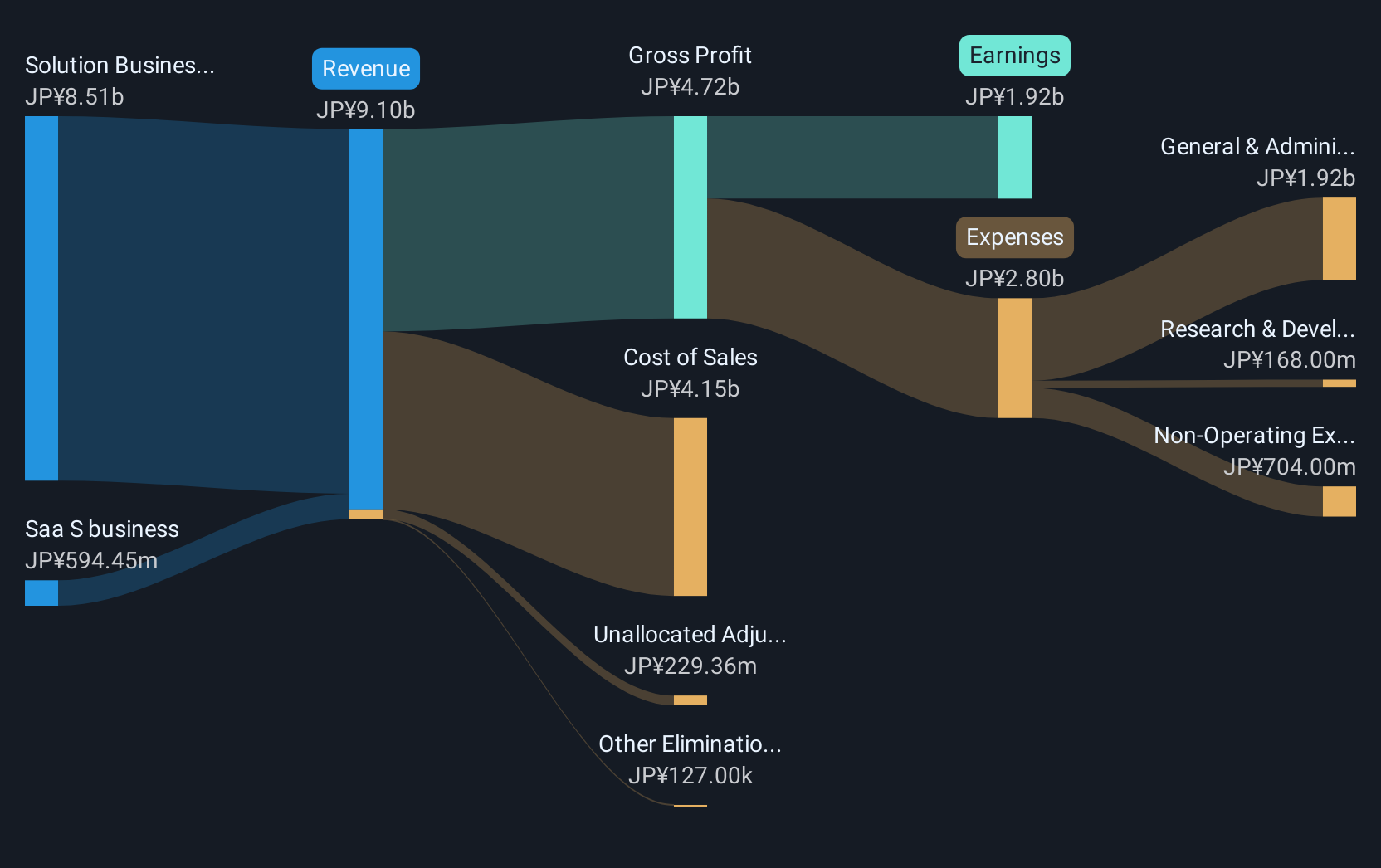

Overview: Fixstars Corporation is a software company operating in Japan and internationally, with a market cap of approximately ¥57.70 billion.

Operations: The company generates revenue primarily from its SaaS business, contributing ¥665.51 million, and its Solution Business, which brings in ¥8.86 billion.

With a robust 19.1% annual revenue growth, Fixstars outpaces Japan's market average of 4.4%, showcasing its strong position in the competitive software industry. This growth is complemented by an impressive earnings increase of 33.4% over the past year, significantly higher than the industry's 17.9%. The company’s recent launch of Fixstars AIBooster highlights its commitment to innovation, particularly in AI workload optimization—a critical area as businesses increasingly rely on efficient AI infrastructure management to control rising GPU costs. This strategic focus not only enhances Fixstars' product offerings but also positions it well for sustained growth amidst evolving technological demands.

- Dive into the specifics of Fixstars here with our thorough health report.

Understand Fixstars' track record by examining our Past report.

Docebo (TSX:DCBO)

Simply Wall St Growth Rating: ★★★★★☆

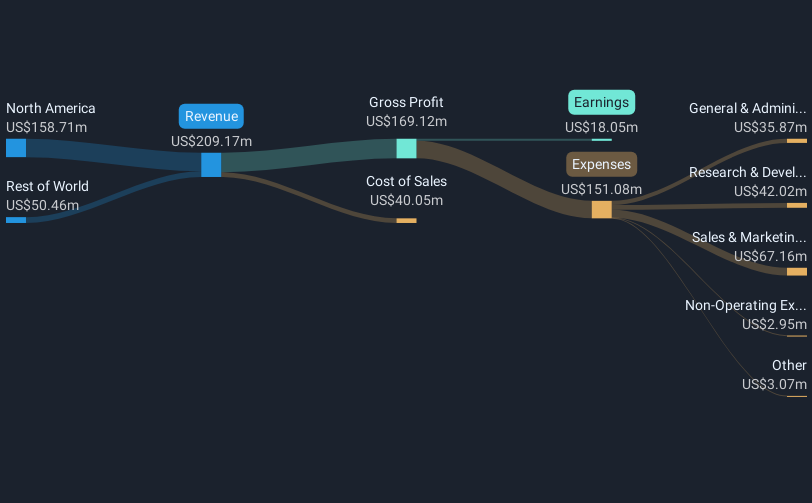

Overview: Docebo Inc. develops and provides a learning management platform for training across North America and internationally, with a market capitalization of CA$1.18 billion.

Operations: The company generates revenue primarily from its educational software segment, amounting to CA$230.50 million.

Docebo's recent performance and strategic maneuvers underscore its adaptability in the evolving e-learning sector. Despite a dip in net income to $3.08 million from $4.7 million in Q2, the company has maintained a steady sales increase, up to $60.73 million from $53.05 million year-over-year, reflecting an enduring demand for its educational platforms. Furthermore, Docebo's commitment to shareholder returns is evident from its aggressive share repurchase strategy, buying back shares worth CAD 71.82 million since last year, enhancing shareholder value amidst market fluctuations. This approach, coupled with an expected revenue growth of 10% to 11% for the fiscal year and robust subscription growth projections between 10.75% and 11.75%, positions Docebo as a resilient contender navigating through competitive pressures while capitalizing on long-term trends towards digital learning solutions.

- Unlock comprehensive insights into our analysis of Docebo stock in this health report.

Gain insights into Docebo's historical performance by reviewing our past performance report.

Summing It All Up

- Gain an insight into the universe of 249 Global High Growth Tech and AI Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DCBO

Docebo

Develops and provides a learning management platform for training in North America and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives