- New Zealand

- /

- Food

- /

- NZSE:NZK

New Zealand King Salmon Investments Leads The Charge With These 3 Penny Stocks

Reviewed by Simply Wall St

Global markets have recently experienced a boost, driven by cooling inflation and strong bank earnings in the U.S., while European stocks have risen on hopes of continued interest rate cuts. In this context, penny stocks—often representing smaller or newer companies—remain an intriguing area for investors seeking growth opportunities at lower price points. By focusing on those with solid financials and clear growth potential, investors can find promising candidates among these under-the-radar companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.67 | HK$42.25B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.97 | HK$615.75M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £147.58M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.065 | £778.12M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Stelrad Group (LSE:SRAD) | £1.415 | £180.2M | ★★★★★☆ |

Click here to see the full list of 5,722 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

New Zealand King Salmon Investments (NZSE:NZK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: New Zealand King Salmon Investments Limited, with a market cap of NZ$126.47 million, is involved in the farming, processing, and sale of salmon products across New Zealand and various international markets including North America, Australia, Japan, and Europe.

Operations: The company's revenue is primarily derived from its food processing segment, which generated NZ$197.26 million.

Market Cap: NZ$126.47M

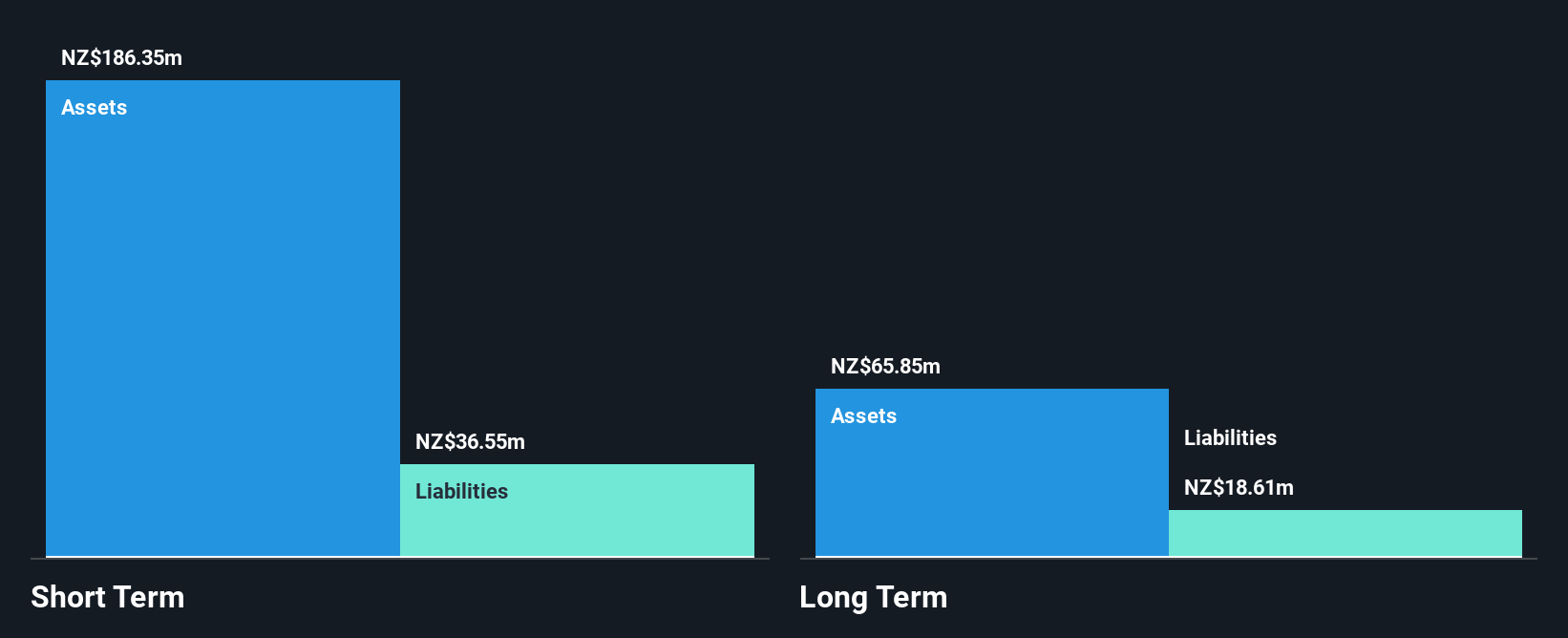

New Zealand King Salmon Investments Limited, with a market cap of NZ$126.47 million, presents a mixed picture for investors. The company trades significantly below its estimated fair value and holds more cash than debt, indicating strong financial health. Its short-term assets comfortably cover both short- and long-term liabilities. However, profit margins have declined from the previous year, and earnings growth has been negative recently. Despite stable weekly volatility and no significant shareholder dilution over the past year, future earnings are expected to decline by 3.5% annually over the next three years while revenue is forecasted to grow modestly at 4.86% per year.

- Jump into the full analysis health report here for a deeper understanding of New Zealand King Salmon Investments.

- Explore New Zealand King Salmon Investments' analyst forecasts in our growth report.

Steve Leung Design Group (SEHK:2262)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Steve Leung Design Group Limited offers interior design services in the People’s Republic of China, Hong Kong, and internationally, with a market cap of HK$479.39 million.

Operations: The company's revenue is derived from three main segments: Interior Design Services generating HK$197.35 million, Interior Decorating and Furnishing Services contributing HK$104.94 million, and Product Design Services adding HK$57.80 million.

Market Cap: HK$479.39M

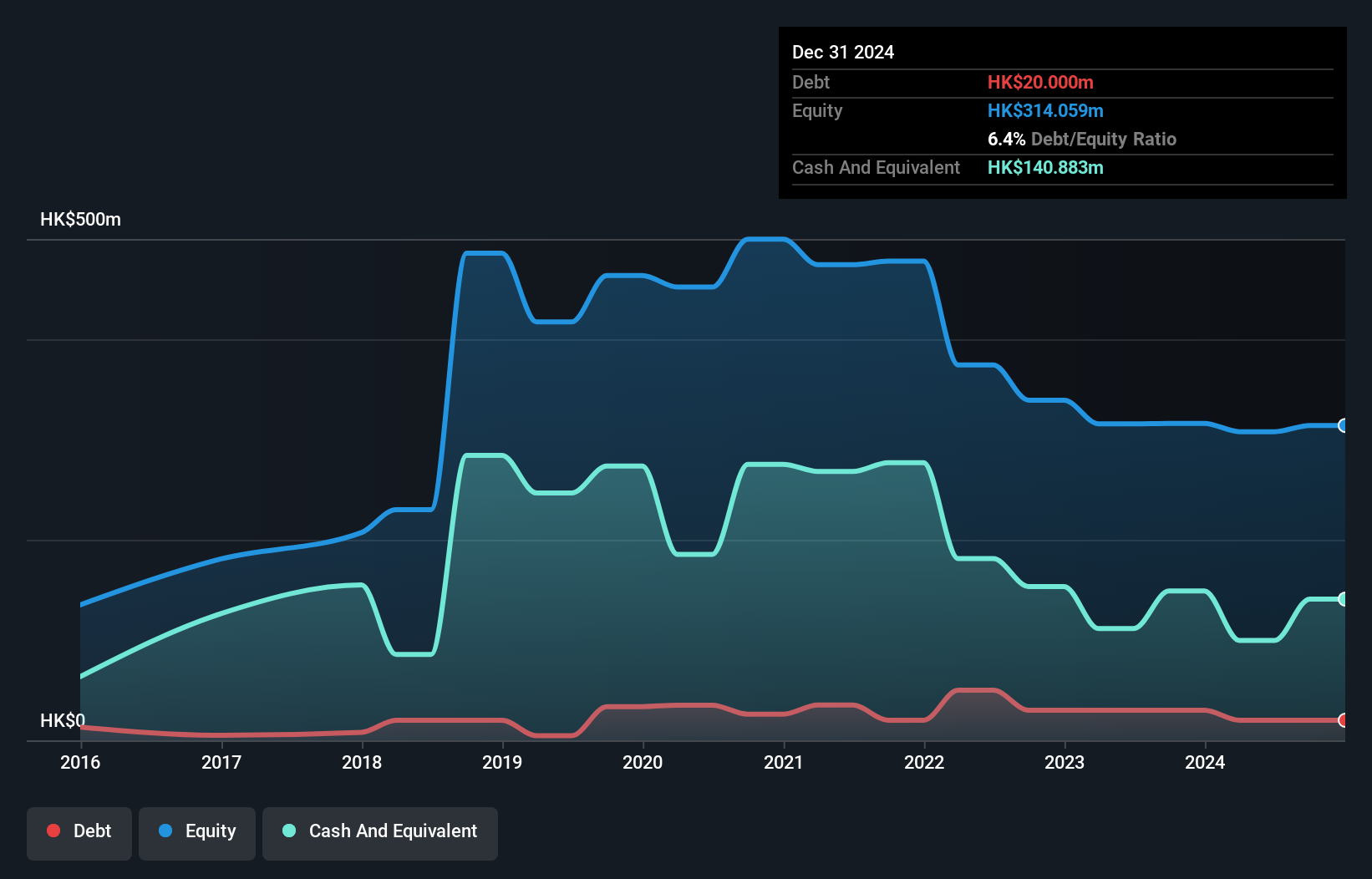

Steve Leung Design Group Limited, with a market cap of HK$479.39 million, faces challenges as it remains unprofitable and has seen earnings decline by 56.7% annually over the past five years. Despite this, the company benefits from experienced management and board teams, with average tenures of 4.8 and 6.6 years respectively. Financially, its debt is well covered by operating cash flow at 114.6%, and it holds more cash than total debt, indicating financial stability despite interest coverage issues (0.1x EBIT). The company's short-term assets exceed both short- and long-term liabilities significantly, providing liquidity assurance amidst high share price volatility.

- Get an in-depth perspective on Steve Leung Design Group's performance by reading our balance sheet health report here.

- Assess Steve Leung Design Group's previous results with our detailed historical performance reports.

Nex Point (SET:NEX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nex Point Public Company Limited offers installation and consulting services for computer systems in Thailand and has a market cap of THB1.32 billion.

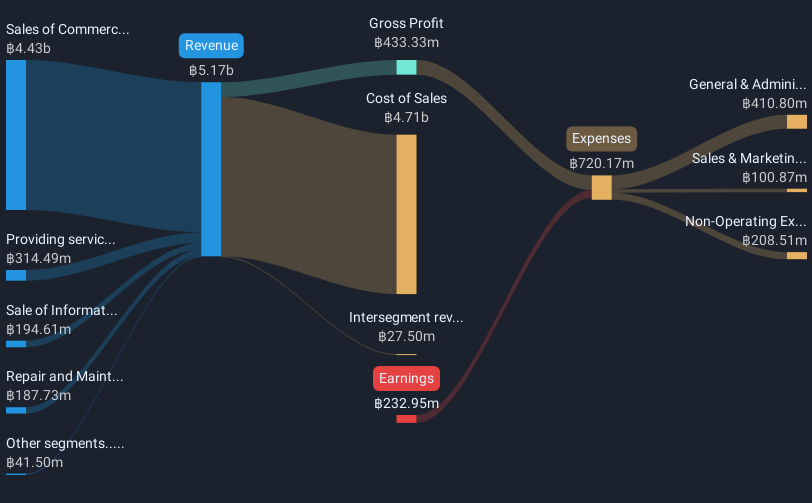

Operations: Nex Point's revenue is primarily derived from the sales of commercial electric vehicles (THB4.43 billion), supplemented by providing services and consultation for information technology and communications (THB314.49 million), cross-border transportation (THB41.43 million), sale of IT equipment (THB194.61 million), and repair and maintenance services for commercial vehicles (THB187.73 million).

Market Cap: THB1.32B

Nex Point Public Company Limited, with a market cap of THB1.32 billion, is navigating financial challenges as it remains unprofitable despite reducing losses by 50.1% annually over five years. The company's revenue primarily stems from commercial electric vehicle sales (THB4.43 billion) and IT services (THB314.49 million). While its short-term assets exceed liabilities, providing liquidity, Nex Point's share price has been highly volatile recently. The company has more cash than debt and recently increased its registered capital significantly through a rights offering priced at THB1 per share, aiming to stabilize finances amidst executive changes in the CFO position.

- Take a closer look at Nex Point's potential here in our financial health report.

- Review our historical performance report to gain insights into Nex Point's track record.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 5,719 Penny Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Zealand King Salmon Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:NZK

New Zealand King Salmon Investments

Engages in the farming, processing, and sale of salmon products in New Zealand, North America, Australia, Japan, Europe, China, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives