- Taiwan

- /

- Consumer Durables

- /

- TPEX:6275

Top Dividend Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary, rate cuts, and political uncertainty, investors are keenly watching economic indicators and interest rate forecasts. Amid these conditions, dividend stocks often attract attention for their potential to provide steady income streams in volatile times. In this context, identifying strong dividend stocks involves looking for companies with solid fundamentals and a history of reliable payouts that can withstand market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.96% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.78% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.48% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.62% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.85% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.79% | ★★★★★☆ |

Click here to see the full list of 1968 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

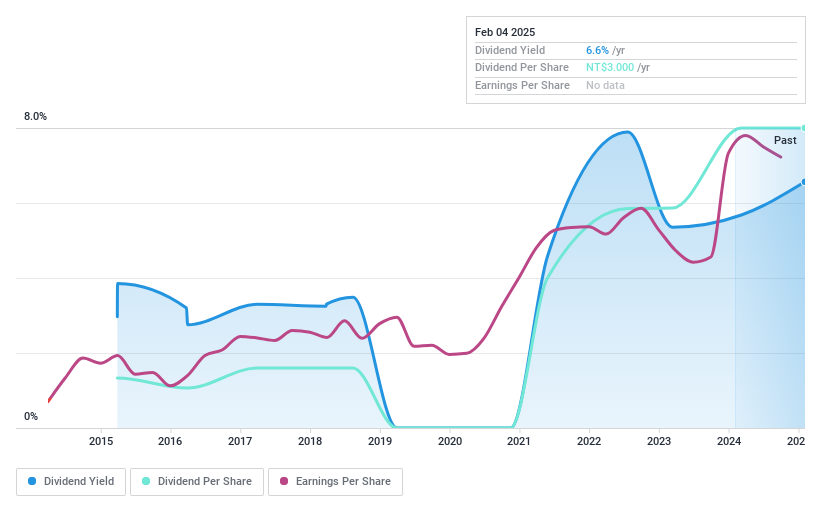

KCE Electronics (SET:KCE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KCE Electronics Public Company Limited, along with its subsidiaries, is engaged in the global manufacturing and distribution of electric printed circuit boards (PCBs) under the KCE trademark, with a market capitalization of THB27.66 billion.

Operations: KCE Electronics generates revenue through three main segments: the Printed Circuit Board Business at THB17.38 billion, the Prepreg and Laminate Business at THB3.16 billion, and the Chemical Business at THB925.40 million.

Dividend Yield: 5.2%

KCE Electronics' dividends are well-covered by both earnings and cash flows, with payout ratios of 83.1% and 43%, respectively. However, the dividend yield of 5.2% is below the top tier in Thailand's market, and past payments have been volatile and unreliable. Despite a recent decline in quarterly revenue to THB 3.85 billion from THB 4.42 billion year-over-year, KCE's earnings per share for nine months increased to THB 1.16 from THB 1.05 previously.

- Delve into the full analysis dividend report here for a deeper understanding of KCE Electronics.

- Our expertly prepared valuation report KCE Electronics implies its share price may be lower than expected.

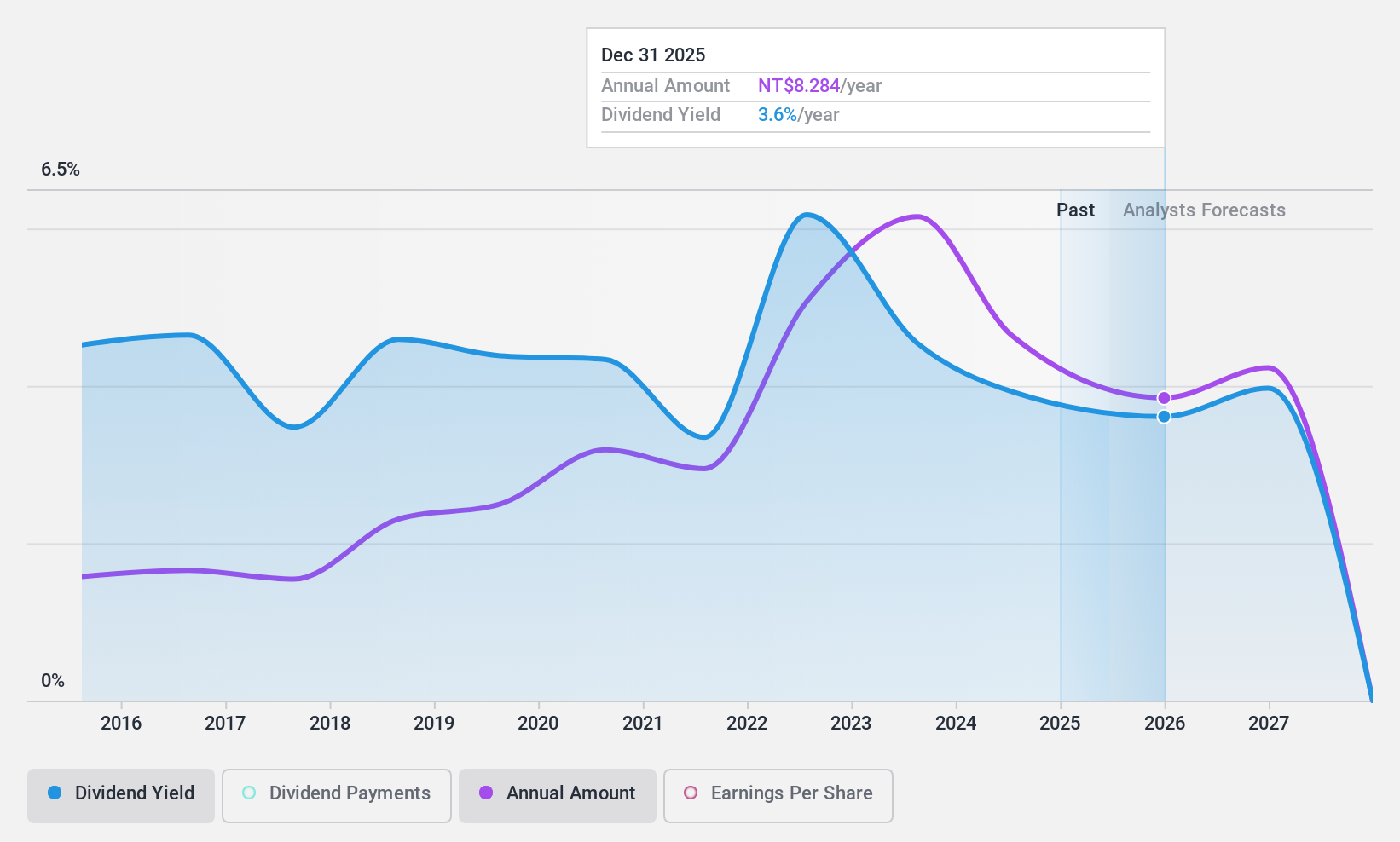

Innodisk (TPEX:5289)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Innodisk Corporation is engaged in the research, development, manufacturing, and sale of industrial embedded storage devices across various global markets, with a market cap of NT$19.23 billion.

Operations: Innodisk Corporation generates revenue from its research and development of various industrial memory storage devices, amounting to NT$8.82 billion.

Dividend Yield: 4.7%

Innodisk's dividend yield of 4.65% ranks in the top 25% of Taiwan's market, yet its sustainability is questionable as dividends exceed free cash flow. The payout ratio stands at 82.3%, indicating coverage by earnings, but past payments have been volatile and unreliable. Despite trading below fair value and analyst targets suggesting potential price appreciation, recent earnings have declined with net income falling to TWD 188.62 million from TWD 306.46 million year-over-year for Q3 2024.

- Get an in-depth perspective on Innodisk's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Innodisk shares in the market.

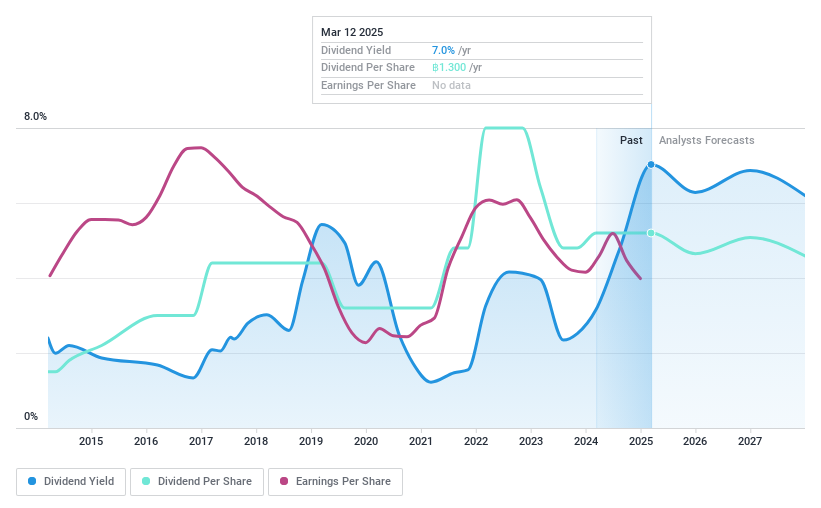

Yen Sun Technology (TPEX:6275)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yen Sun Technology Corporation manufactures and sells home appliances and electronic cooling products across various international markets, with a market cap of NT$36.10 billion.

Operations: Yen Sun Technology's revenue is divided into two main segments: the Home Electric Appliance Division, which generated NT$581.17 million, and the Electronic Heat Transfer Department, contributing NT$3.16 billion.

Dividend Yield: 6.4%

Yen Sun Technology's dividend yield of 6.39% is among Taiwan's top 25%, yet its sustainability is concerning due to a high cash payout ratio of 407.3%. Although the payout ratio of 74.7% suggests earnings coverage, dividends have been volatile over the past decade with significant annual drops, making them unreliable. Recent Q3 results show sales growth but a decline in net income to TWD 60.89 million from TWD 66.86 million year-over-year, highlighting potential challenges for dividend stability.

- Navigate through the intricacies of Yen Sun Technology with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Yen Sun Technology is trading beyond its estimated value.

Taking Advantage

- Reveal the 1968 hidden gems among our Top Dividend Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6275

Yen Sun Technology

Manufactures and sells home appliances and electronic cooling products In Taiwan, Germany, the United States, Mainland China, Japan, South Korea, and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives