In November 2024, global markets have been buoyed by the recent U.S. election results, with major indices like the S&P 500 and Russell 2000 experiencing significant gains amid expectations of economic growth driven by policy changes. As investors navigate this dynamic landscape, identifying high-growth tech stocks involves assessing factors such as innovation potential and adaptability to regulatory shifts, which are crucial in leveraging current market optimism.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Travere Therapeutics | 31.19% | 72.58% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1276 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Hana Microelectronics (SET:HANA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hana Microelectronics Public Company Limited, along with its subsidiaries, is involved in the manufacturing and trading of electronic components and has a market capitalization of approximately THB26.78 billion.

Operations: Hana Microelectronics focuses on manufacturing and trading electronic components. The company operates through various revenue streams, primarily driven by its diverse product offerings in the electronics sector.

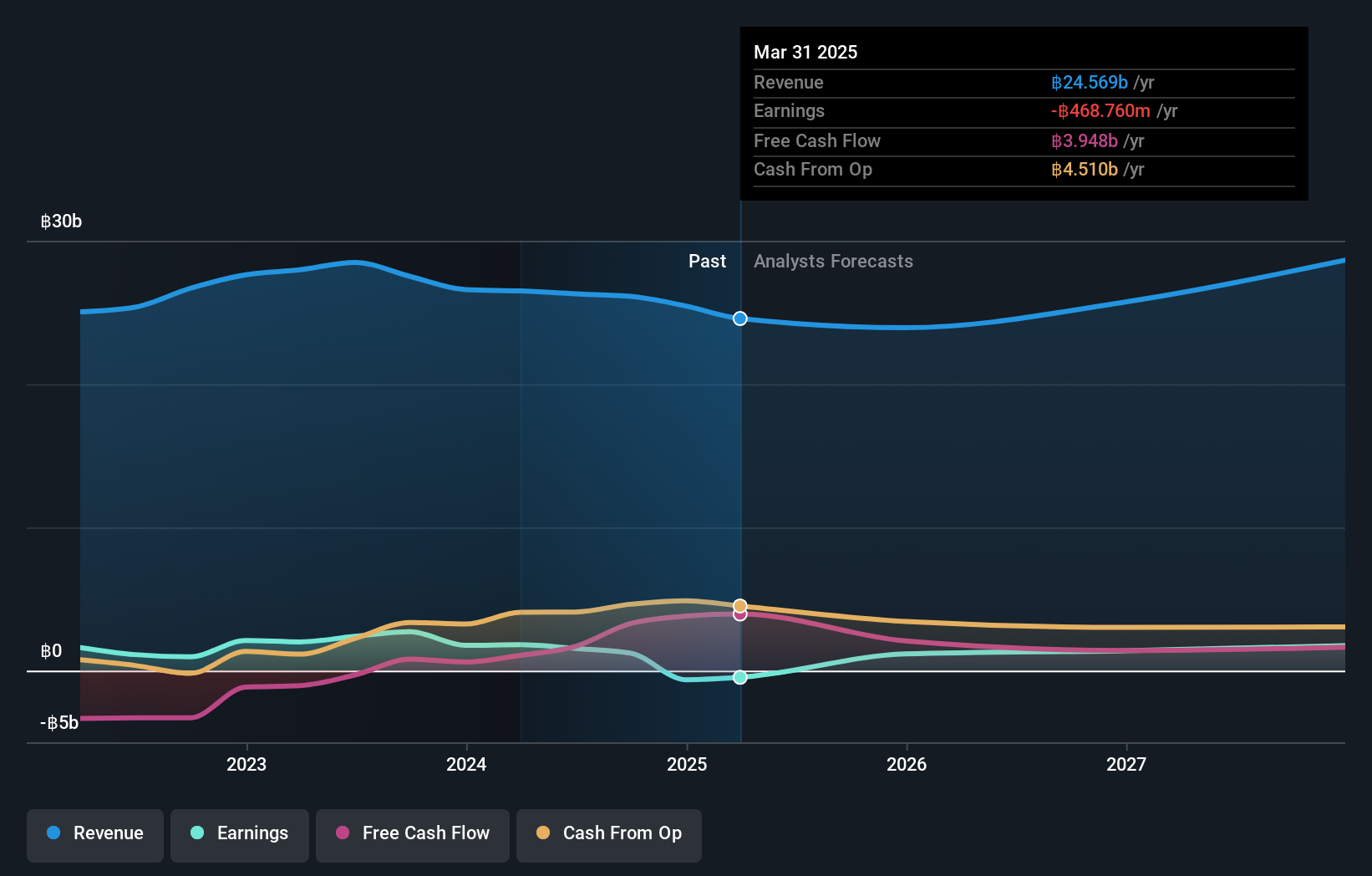

Hana Microelectronics, despite a challenging fiscal year with a net income drop to THB 405.85 million from THB 733.9 million, is poised for recovery with projected earnings growth of 23.2% annually. This outlook surpasses the Thai market's average of 16.9%, highlighting its resilience and potential in a competitive sector. Notably, its R&D commitment, crucial for maintaining technological edge, remains robust, aligning with an industry where innovation directly correlates to market success. However, revenue growth at 6.9% lags behind the more aggressive industry benchmarks but still edges out the local market forecast of 6.6%. This mixed financial landscape underscores Hana's need to enhance operational efficiencies and possibly rethink strategic initiatives to harness fuller growth potentials.

Micro-Star International (TWSE:2377)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Micro-Star International Co., Ltd. is a global manufacturer and seller of motherboards, interface cards, notebook computers, and other electronic products with a market cap of NT$144.47 billion.

Operations: The company generates its revenue primarily from the Computer and Peripherals Segment, which accounts for NT$195.51 billion.

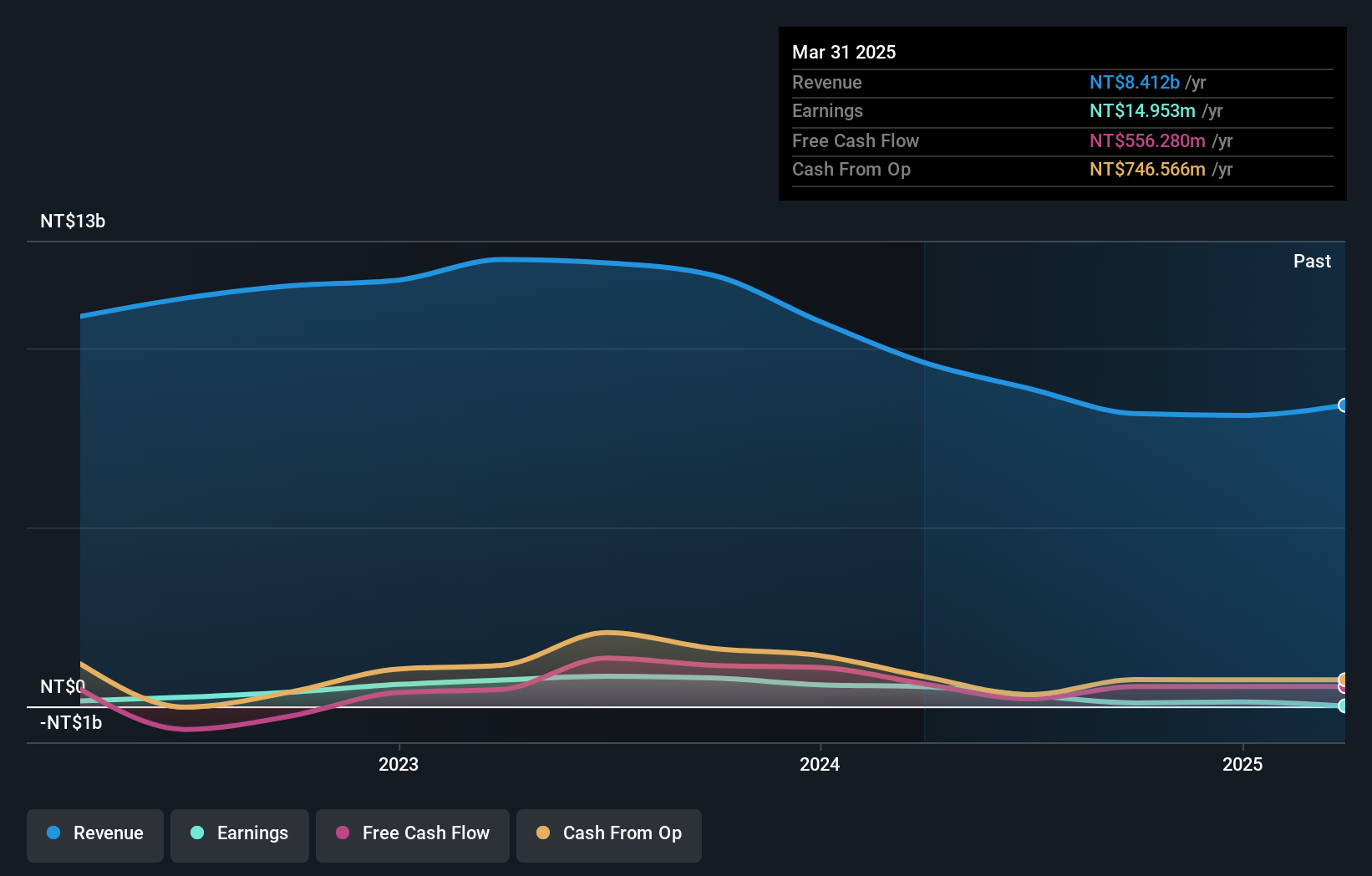

Micro-Star International's recent financial performance reveals a nuanced trajectory in the competitive tech landscape. Despite a dip in net income to TWD 1,732.03 million from TWD 2,349.7 million for Q3 2024, the company's sales increased to TWD 52.09 billion from TWD 48.92 billion year-over-year, signaling robust market demand. This growth is underpinned by a strong commitment to R&D with expenditures aligning closely with revenue trends; however, earnings are forecasted to surge by an impressive 28% annually over the next three years, outpacing the TW market's average of 19.4%. Such dynamic growth prospects are tempered by slower-than-market expected revenue increases at just over 10% per year, suggesting potential areas for strategic enhancement to harness full growth potentials and maintain competitiveness in evolving tech sectors.

- Unlock comprehensive insights into our analysis of Micro-Star International stock in this health report.

Evaluate Micro-Star International's historical performance by accessing our past performance report.

Nidec Chaun-Choung Technology (TWSE:6230)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nidec Chaun-Choung Technology Corporation specializes in the processing, manufacturing, and trading of heat dissipation components and thermal management products both in Taiwan and internationally, with a market cap of NT$17.61 billion.

Operations: The company generates revenue primarily through its production and sales of heat dissipation components and thermal management products across various markets. A notable trend is observed in the gross profit margin, which has shown variability over recent periods, reflecting changes in cost efficiency and pricing strategies.

Nidec Chaun-Choung Technology's recent financial snapshot indicates a challenging quarter with sales dropping to TWD 2,143.63 million from TWD 2,846.67 million year-over-year and shifting from a net profit to a loss of TWD 31.78 million. Despite these setbacks, the company is poised for substantial recovery with projected earnings growth of 111.7% annually over the next three years, significantly outpacing the TW market average growth of 19.4%. This optimistic outlook is bolstered by an aggressive R&D investment strategy which remains critical in navigating through current market adversities and fostering innovation in their tech offerings.

Taking Advantage

- Click through to start exploring the rest of the 1273 High Growth Tech and AI Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hana Microelectronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:HANA

Hana Microelectronics

Engages in the manufacture and trading of electronic components.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives