Undiscovered Gems with Potential to Explore This November 2024

Reviewed by Simply Wall St

As global markets face headwinds from rising U.S. Treasury yields and tepid economic growth, small-cap stocks have struggled to keep pace with their larger counterparts, as evidenced by the recent performance of indices like the S&P MidCap 400 and Russell 2000. In this environment, identifying undiscovered gems—stocks with strong fundamentals and potential for growth—can be particularly rewarding for investors looking to navigate these challenging market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| ZHEJIANG DIBAY ELECTRICLtd | 24.08% | 7.75% | 1.96% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Zahrat Al Waha For Trading | 80.05% | 4.97% | -15.99% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

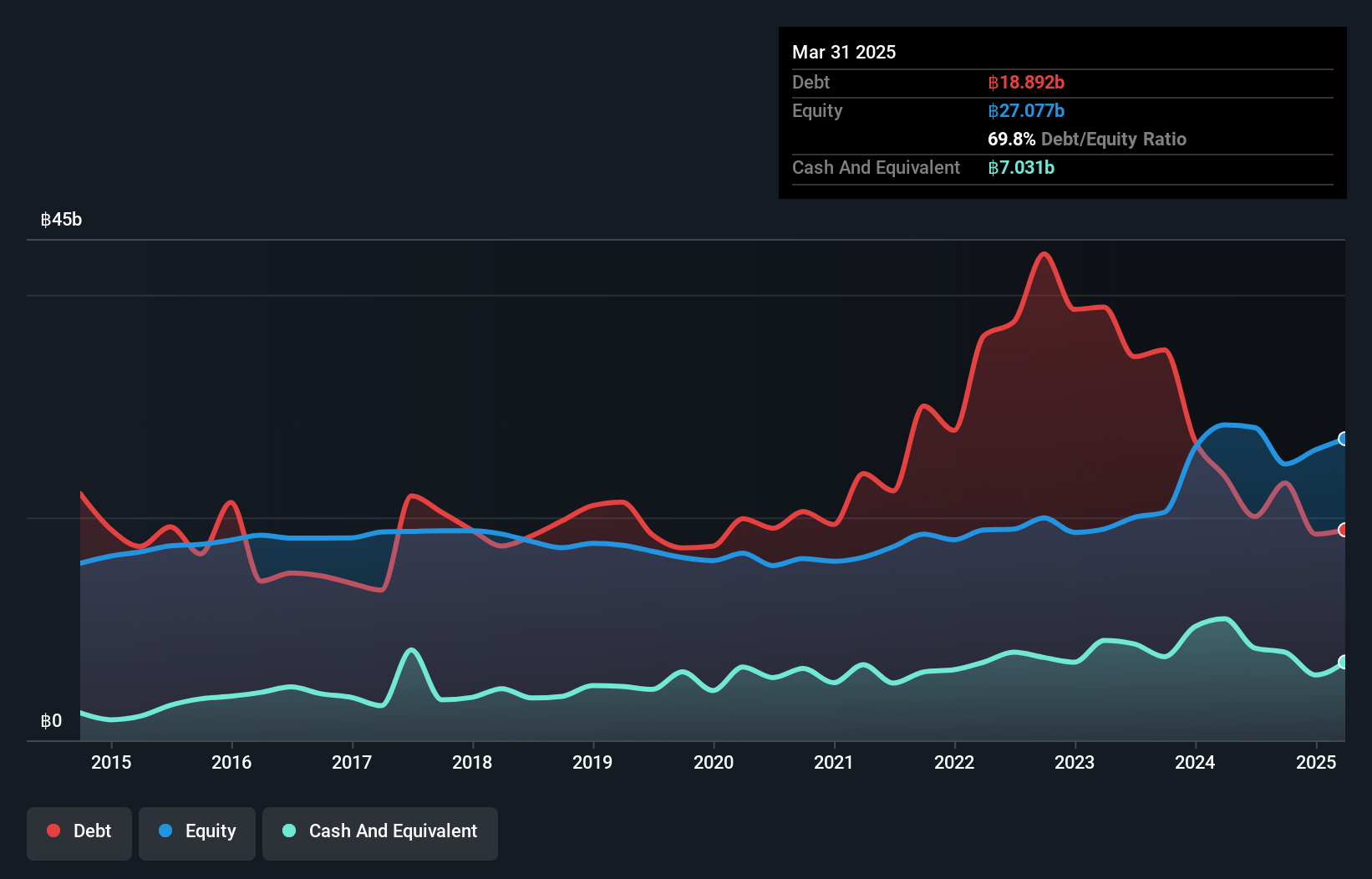

Cal-Comp Electronics (Thailand) (SET:CCET)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cal-Comp Electronics (Thailand) Public Company Limited, with a market cap of approximately THB55.91 billion, operates globally in the manufacturing of electronic products through its subsidiaries.

Operations: Cal-Comp Electronics (Thailand) generates revenue primarily from computer peripherals and telecommunication products, amounting to THB153.65 billion and THB21.12 billion respectively. The service income contributes an additional THB1.52 billion to the company's total revenue stream.

Cal-Comp Electronics (Thailand) has shown a robust earnings growth of 58.6% over the past year, outpacing the electronics industry average of 12%. Despite trading at 56.5% below its estimated fair value, the company's net debt to equity ratio is high at 42%, although it has decreased from 108.8% in five years. The firm reported sales of US$487.95 million for September 2024, up from US$396.52 million a year ago, but year-to-date sales fell to US$3 billion from US$3.19 billion previously. A one-off loss of THB754.5M affected recent financial results, yet free cash flow remains positive.

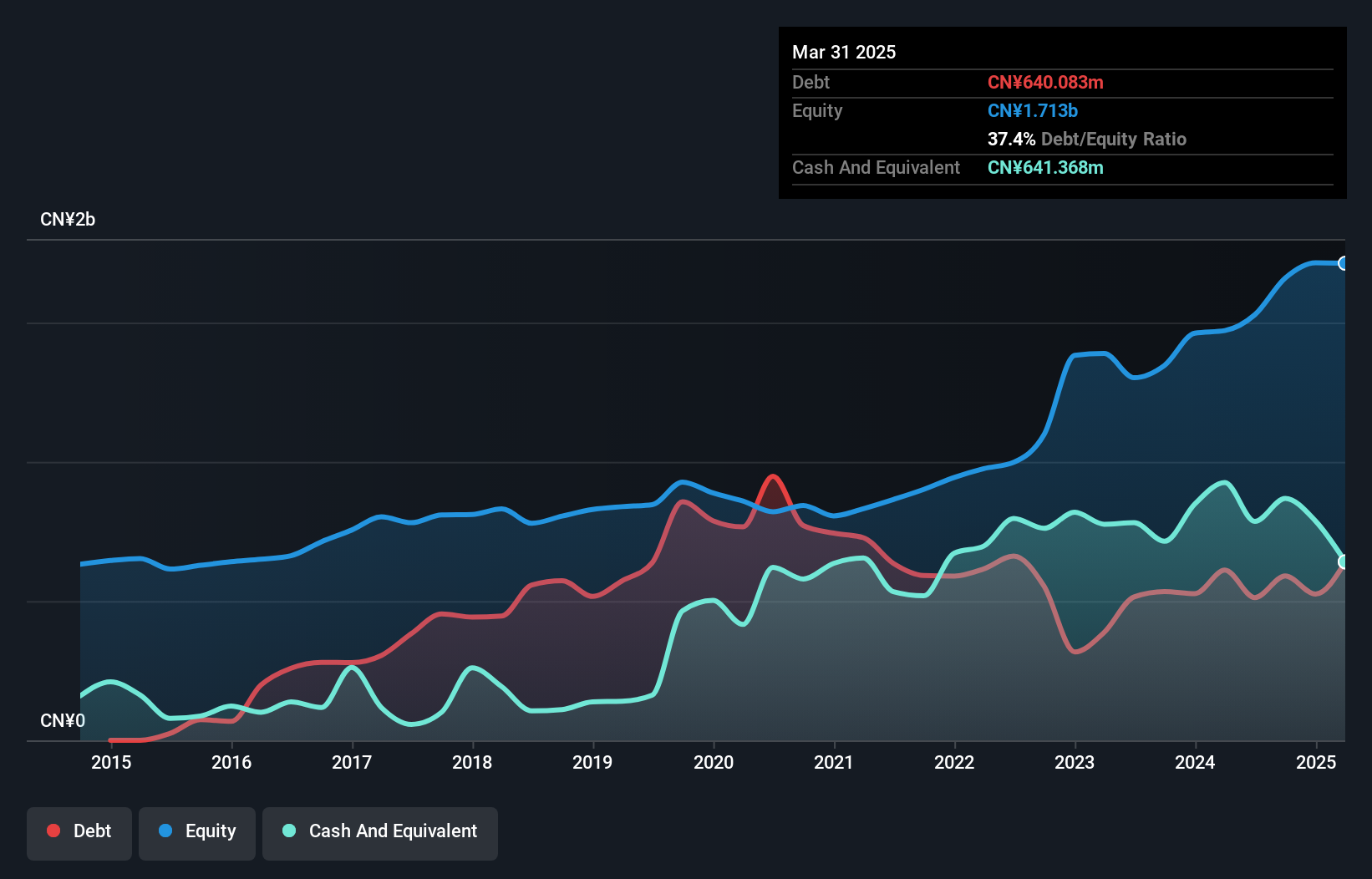

Tibet Weixinkang Medicine (SHSE:603676)

Simply Wall St Value Rating: ★★★★★★

Overview: Tibet Weixinkang Medicine Co., Ltd. focuses on the research, development, production, and sale of chemical drugs and bulk drugs in China with a market capitalization of CN¥4.33 billion.

Operations: Tibet Weixinkang Medicine Co., Ltd. generates revenue primarily from the sale of chemical and bulk drugs in China. The company's financial performance is reflected in its market capitalization of CN¥4.33 billion, indicating its scale within the industry.

Tibet Weixinkang Medicine, a smaller player in the pharmaceutical sector, shows promising financial health with earnings growth of 4.6% over the past year, surpassing industry averages. The company's debt to equity ratio has impressively dropped from 8% to just 0.2% in five years, indicating effective debt management. Despite sales decreasing to CNY 994 million for the first nine months of 2024 from CNY 1.06 billion last year, net income rose to CNY 243 million from CNY 210 million. Trading at a significant discount of nearly two-thirds below estimated fair value suggests potential upside for investors seeking undervalued opportunities.

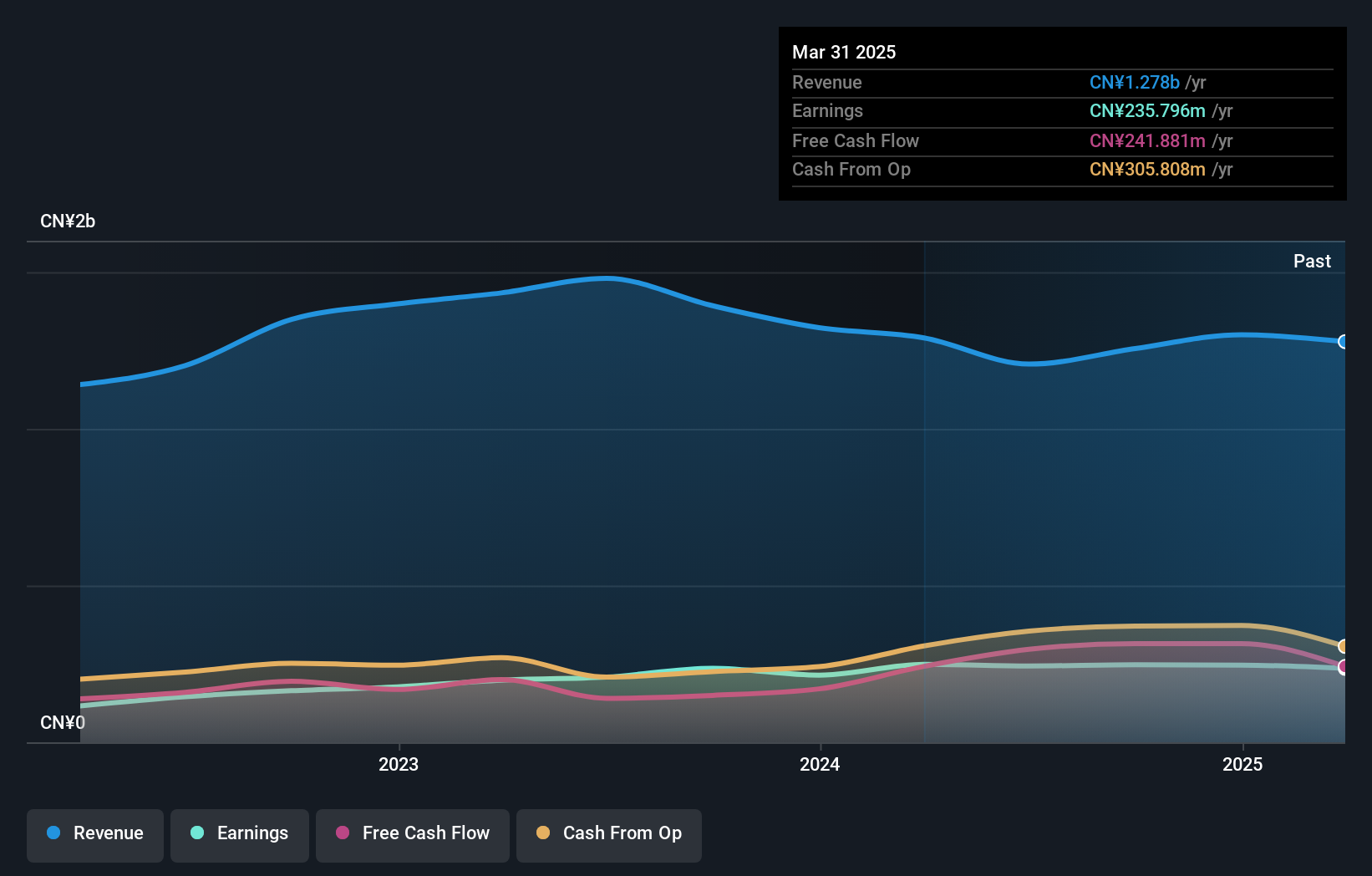

ZheJiang Haers Vacuum ContainersLtd (SZSE:002615)

Simply Wall St Value Rating: ★★★★★★

Overview: ZheJiang Haers Vacuum Containers Co., Ltd. operates in the manufacturing and sale of vacuum containers, with a market cap of CN¥3.86 billion.

Operations: Haers Vacuum Containers generates revenue primarily from the sale of vacuum containers, contributing significantly to its financial performance. The company has experienced fluctuations in its net profit margin, which impacts overall profitability.

Haers Vacuum Containers, a nimble player in the market, has demonstrated impressive earnings growth of 80% over the past year, outpacing the Consumer Durables sector's -2.1%. The company reported sales of CNY 2.37 billion for the first nine months of 2024, up from CNY 1.71 billion a year prior, with net income rising to CNY 224.93 million from CNY 152.98 million. Trading at a value perceived to be below fair estimates by about 15%, Haers also boasts an improved debt-to-equity ratio down to 35.5% over five years and maintains positive free cash flow, suggesting robust financial health and potential for continued growth.

- Delve into the full analysis health report here for a deeper understanding of ZheJiang Haers Vacuum ContainersLtd.

Understand ZheJiang Haers Vacuum ContainersLtd's track record by examining our Past report.

Next Steps

- Delve into our full catalog of 4734 Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tibet Weixinkang Medicine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603676

Tibet Weixinkang Medicine

Engages in the research and development, production, and sale of chemical drugs and their bulk drugs in China.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives