- South Africa

- /

- Capital Markets

- /

- JSE:KST

Three Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets reach record highs, buoyed by China's robust stimulus measures and optimism in the technology sector, investors are increasingly looking for opportunities beyond the well-trodden paths of large-cap stocks. In this environment, small-cap companies can offer compelling growth potential due to their agility and often untapped market niches. Identifying a good stock in such conditions involves looking for strong fundamentals, innovative business models, and sectors poised to benefit from current economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Chobe Holdings | 0.02% | 12.71% | 17.19% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Transnational Corporation of Nigeria | 44.55% | 26.40% | 54.06% | ★★★★★☆ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

PSG Financial Services (JSE:KST)

Simply Wall St Value Rating: ★★★★☆☆

Overview: PSG Financial Services Limited, with a market cap of ZAR23.77 billion, offers a range of financial services and products through its subsidiaries in South Africa and Namibia.

Operations: PSG Financial Services Limited generates revenue primarily from its Wealth (ZAR4.48 billion), Insure (ZAR1.42 billion), and Asset Management (ZAR1.34 billion) segments. The company’s financial data indicates that the Wealth segment contributes the largest portion of revenue among its divisions.

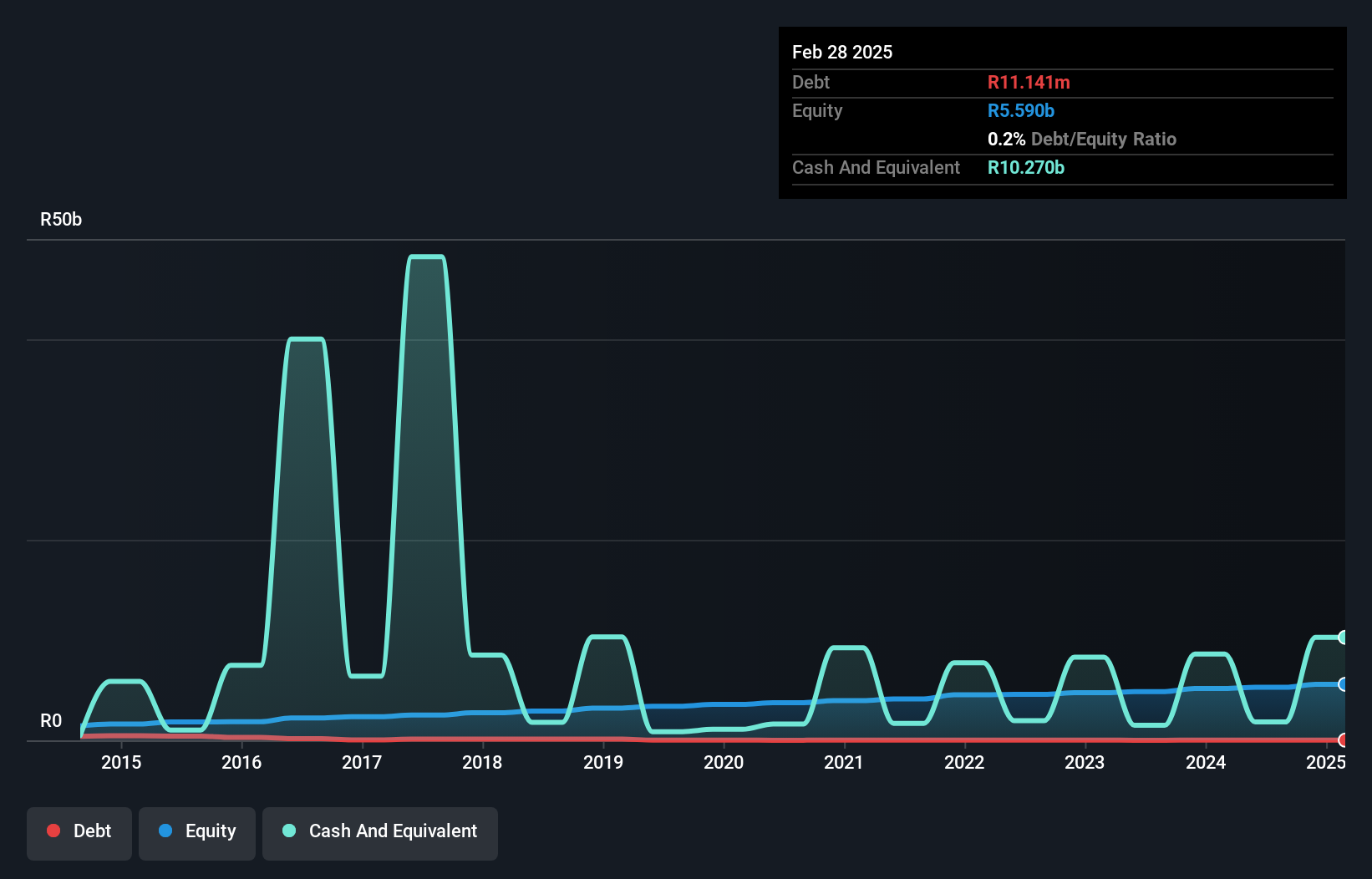

Earnings for PSG Financial Services grew by 8.8% over the past year, surpassing the Capital Markets industry average of 3.8%. Their debt to equity ratio has impressively reduced from 3.9 to 0.2 over five years, indicating better financial health. The company also repurchased shares in 2024, reflecting confidence in its valuation and future prospects. Recent guidance projects earnings per share between A$0.48 and A$0.49 for the six months ending August 2024, suggesting continued strong performance.

- Unlock comprehensive insights into our analysis of PSG Financial Services stock in this health report.

Understand PSG Financial Services' track record by examining our Past report.

Carote (SEHK:2549)

Simply Wall St Value Rating: ★★★★★☆

Overview: Carote Ltd, an investment holding company with a market cap of HK$3.10 billion, provides a range of kitchenware products to brand-owners and retailers under the CAROTE brand.

Operations: Carote Ltd generates revenue primarily from its ODM Business (CN¥210.80 million) and Branded Business (CN¥1583.40 million).

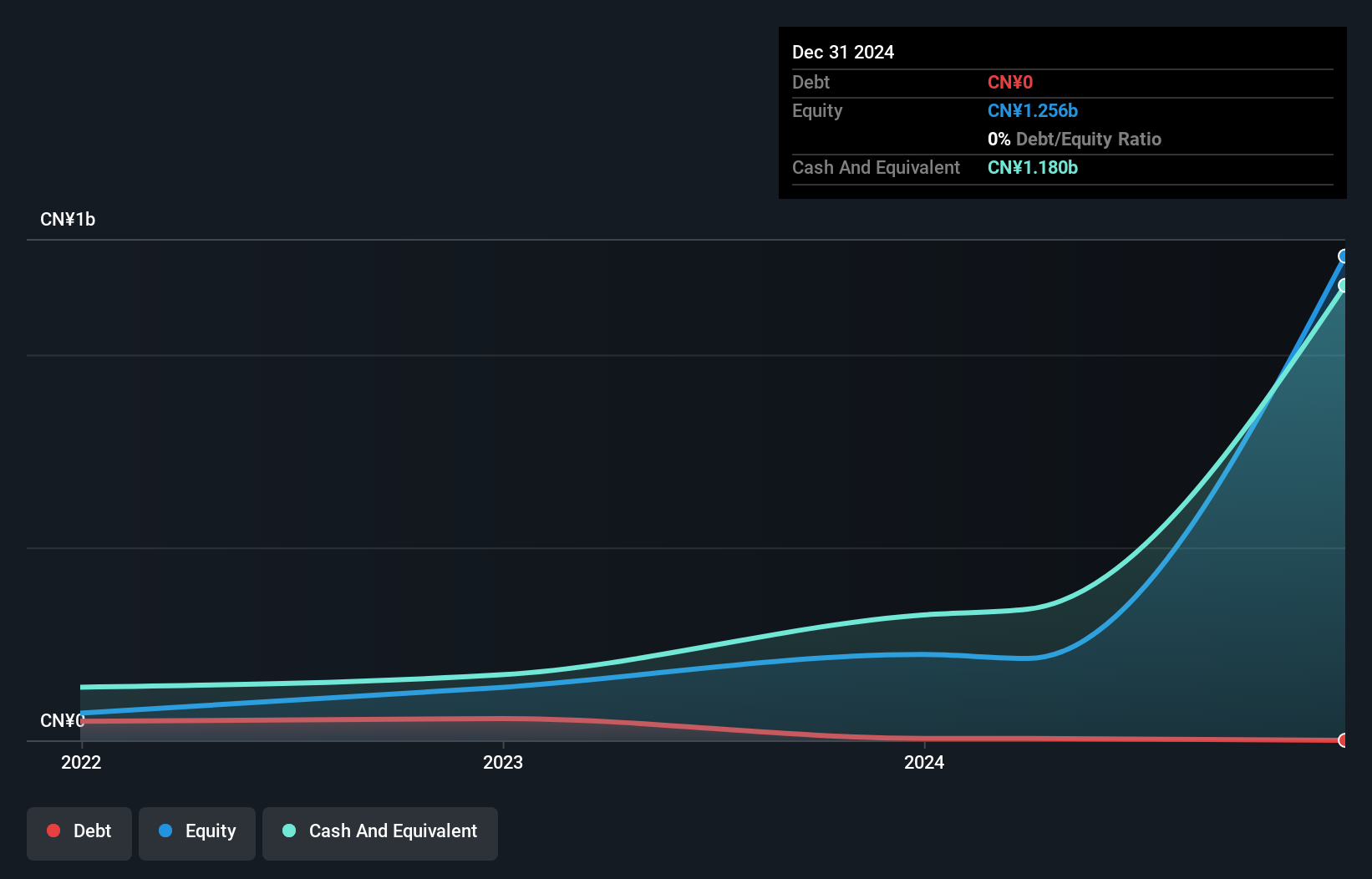

Carote's recent IPO raised HKD 750.62 million, issuing 64.93 million shares at HKD 5.78 each with a slight discount per share of HKD 0.14, indicating strong market interest. Over the past year, Carote's earnings surged by an impressive 92%, significantly outpacing the Consumer Durables industry growth of 20%. The company is trading at a substantial discount to its estimated fair value and has consistently positive free cash flow, which stood at US$391.17 million in March 2024.

- Get an in-depth perspective on Carote's performance by reading our health report here.

Review our historical performance report to gain insights into Carote's's past performance.

Cal-Comp Electronics (Thailand) (SET:CCET)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cal-Comp Electronics (Thailand) Public Company Limited, along with its subsidiaries, manufactures electronic products globally and has a market cap of THB42.01 billion.

Operations: Cal-Comp Electronics (Thailand) generates revenue primarily from computer peripherals (THB153.65 billion) and telecommunication products (THB21.12 billion), with additional income from services (THB1.52 billion).

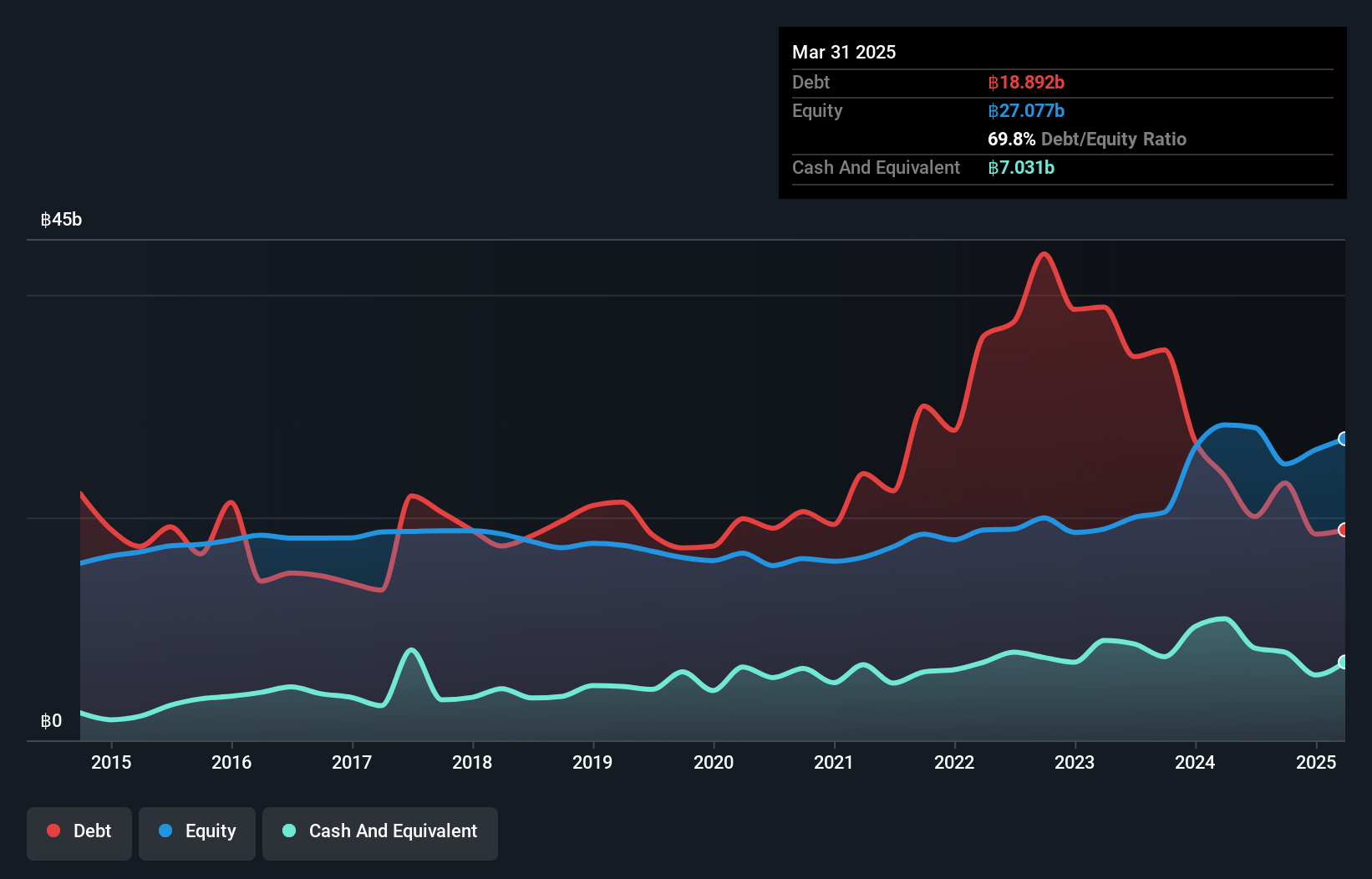

CCET's recent performance reveals a mixed bag of results. The company reported a significant one-off loss of THB754.5M, impacting its financials for the last 12 months ending June 30, 2024. However, earnings surged by 58.6% over the past year, outpacing the electronic industry's growth rate of 12%. Despite high net debt to equity ratio at 42%, interest payments are well covered with EBIT at 3.5x coverage. Trading at nearly two-thirds below estimated fair value suggests potential undervaluation for investors seeking opportunities in this space.

- Click to explore a detailed breakdown of our findings in Cal-Comp Electronics (Thailand)'s health report.

Learn about Cal-Comp Electronics (Thailand)'s historical performance.

Seize The Opportunity

- Click this link to deep-dive into the 4794 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About JSE:KST

PSG Financial Services

Provides various financial services and products in South Africa and Namibia.

Outstanding track record with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion