Exploring Cal-Comp Electronics Thailand And 2 Other Promising Small Caps In Asia

Reviewed by Simply Wall St

As global markets navigate through mixed economic signals and geopolitical tensions, small-cap stocks have shown resilience, particularly in the U.S., where smaller-cap indexes outperformed other segments. In this environment of cautious optimism and strategic positioning, identifying promising small-cap opportunities in Asia can offer unique growth prospects for investors willing to explore beyond the mainstream.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Anpec Electronics | NA | 1.77% | 4.97% | ★★★★★★ |

| DoshishaLtd | NA | 2.69% | 2.22% | ★★★★★★ |

| Advancetek EnterpriseLtd | 43.92% | 38.91% | 59.75% | ★★★★★★ |

| Episil-Precision | 19.76% | 0.57% | 16.64% | ★★★★★★ |

| Wholetech System Hitech | 3.31% | 15.16% | 19.61% | ★★★★★☆ |

| Top Union Electronics | 2.12% | 8.34% | 19.44% | ★★★★★☆ |

| DorightLtd | 5.31% | 15.47% | 9.44% | ★★★★★☆ |

| Qingdao Daneng Environmental Protection Equipment | 65.76% | 31.58% | 23.66% | ★★★★☆☆ |

| Lucky Cement | 61.41% | 4.55% | 15.65% | ★★★★☆☆ |

| Zhejiang Risun Intelligent TechnologyLtd | 27.20% | 20.30% | -23.01% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Cal-Comp Electronics (Thailand) (SET:CCET)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cal-Comp Electronics (Thailand) Public Company Limited, along with its subsidiaries, is engaged in the global manufacturing of electronic products and has a market capitalization of approximately THB56.95 billion.

Operations: Cal-Comp Electronics (Thailand) generates revenue primarily from computer peripherals, contributing THB164.49 billion, and telecommunication products, adding THB20.57 billion. Service income accounts for an additional THB1.75 billion in revenue. The company's financial performance is influenced by segment adjustments and eliminations that affect overall reported figures.

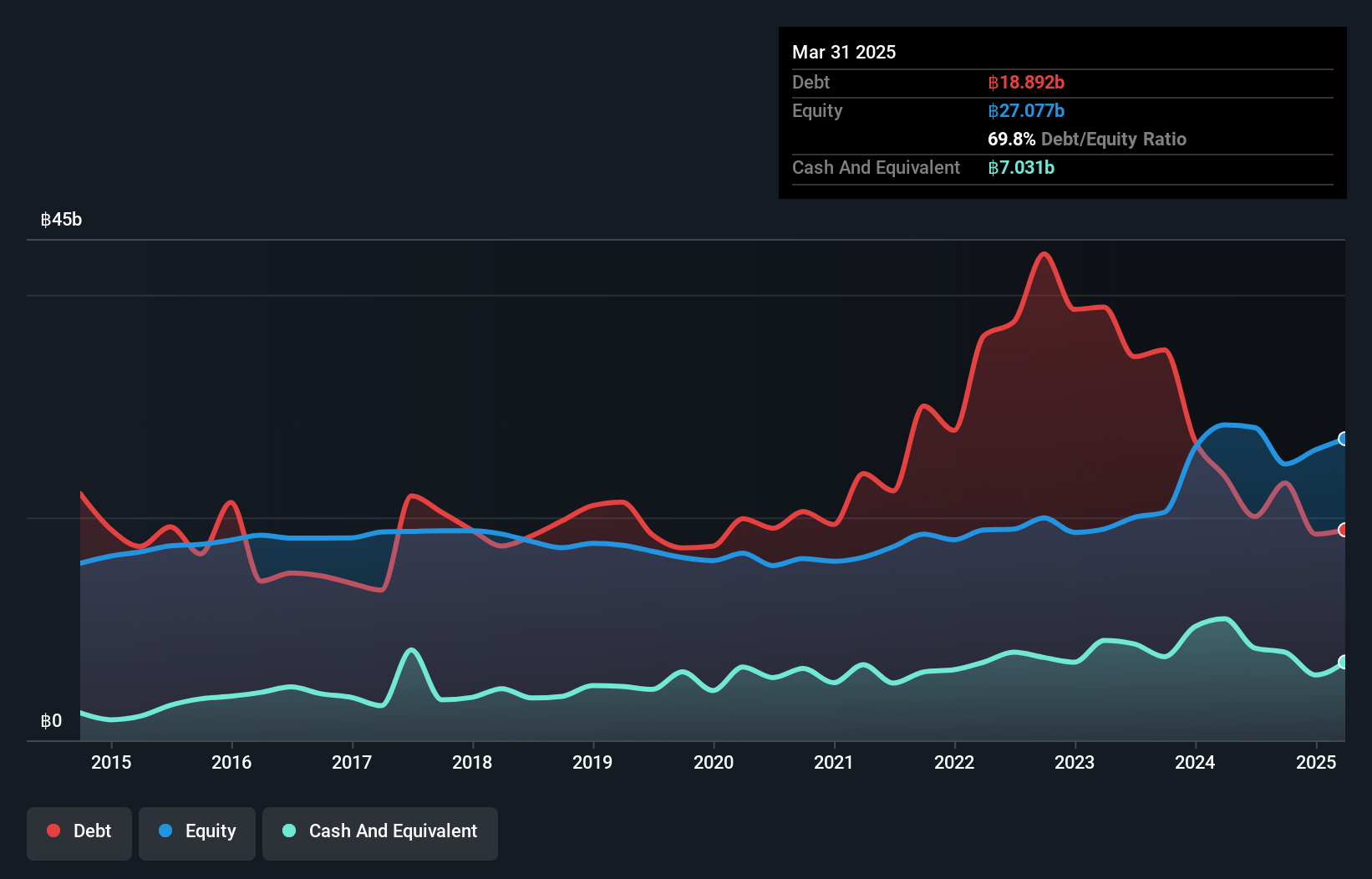

Cal-Comp Electronics (Thailand) seems to be making strides in the electronics sector with earnings growth of 89.7% over the past year, significantly outpacing the industry's 9.7%. Despite a high net debt to equity ratio of 43.8%, which has improved from 118.5% five years ago, interest payments are well covered by EBIT at an impressive 8.3x coverage. Trading at about 30.6% below its estimated fair value, Cal-Comp appears attractive for those eyeing undervalued opportunities in Asia's market landscape, although its share price has been volatile recently and sales saw a dip compared to April last year.

Shanghai Hajime Advanced Material Technology (SZSE:301000)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Hajime Advanced Material Technology Co., Ltd. specializes in the development and production of advanced materials for industrial applications, with a market cap of CN¥11.46 billion.

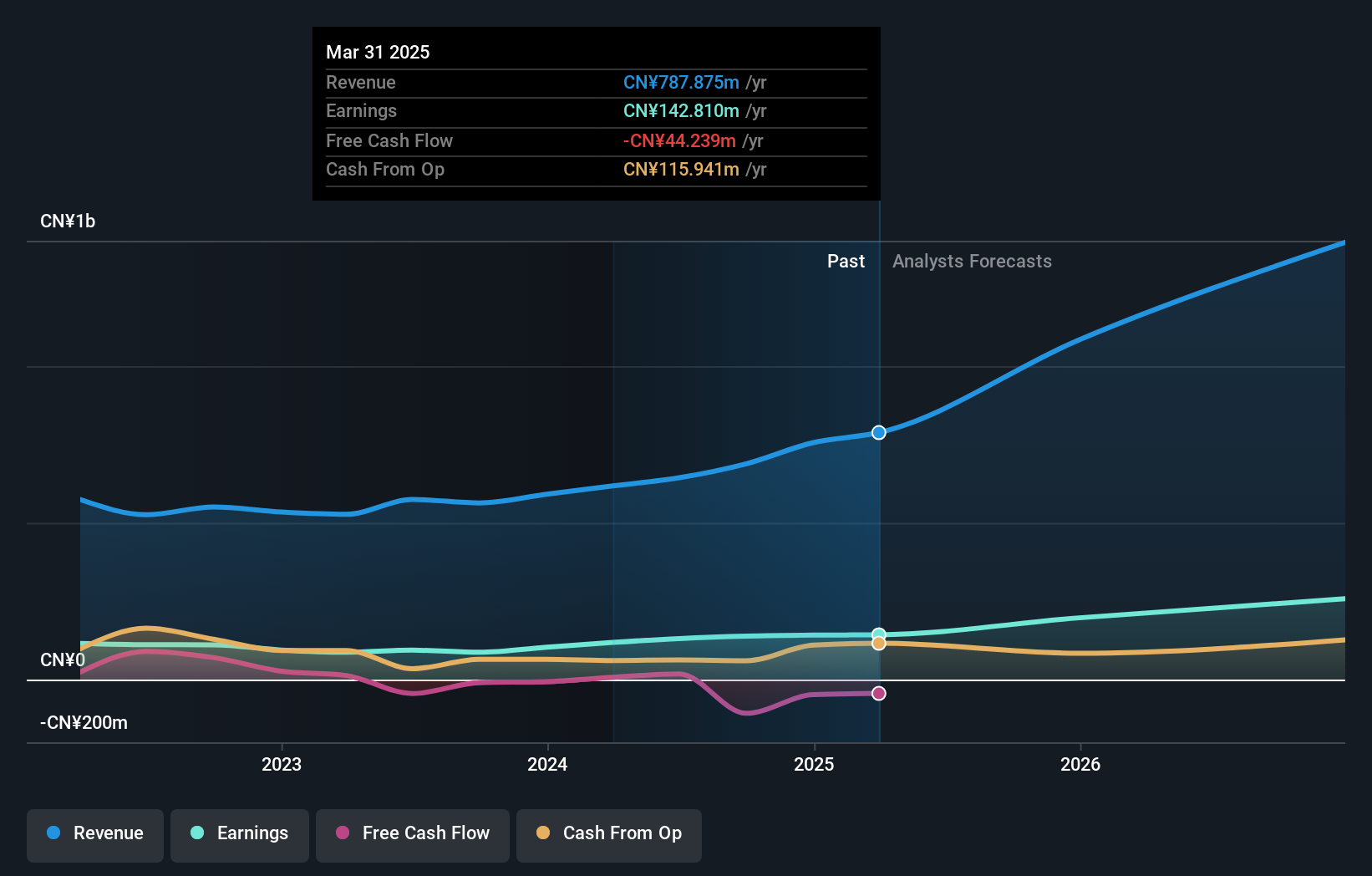

Operations: The company generates revenue primarily from its Machinery & Industrial Equipment segment, totaling CN¥787.87 million.

Shanghai Hajime Advanced Material Technology is making waves with its robust earnings growth of 20.5% over the past year, outpacing the Chemicals industry average of 4%. Despite a highly volatile share price recently, this debt-free company has shown resilience, reporting net income of CNY 141.8 million for 2024 compared to CNY 103.31 million in the previous year. While free cash flow remains negative, capital expenditure has been significant at CNY -157.87 million as of December 2024, indicating ongoing investments in growth and development. The firm’s proactive dividend policy further underscores its commitment to shareholder returns amidst these dynamics.

- Click here and access our complete health analysis report to understand the dynamics of Shanghai Hajime Advanced Material Technology.

Learn about Shanghai Hajime Advanced Material Technology's historical performance.

All Ring Tech (TPEX:6187)

Simply Wall St Value Rating: ★★★★★☆

Overview: All Ring Tech Co., Ltd. specializes in the design, manufacture, and assembly of automation machines in Taiwan and China, with a market cap of NT$38.24 billion.

Operations: All Ring Tech generates revenue primarily from the design, manufacture, and assembly of automation machines. The company's financial performance is highlighted by a market cap of NT$38.24 billion.

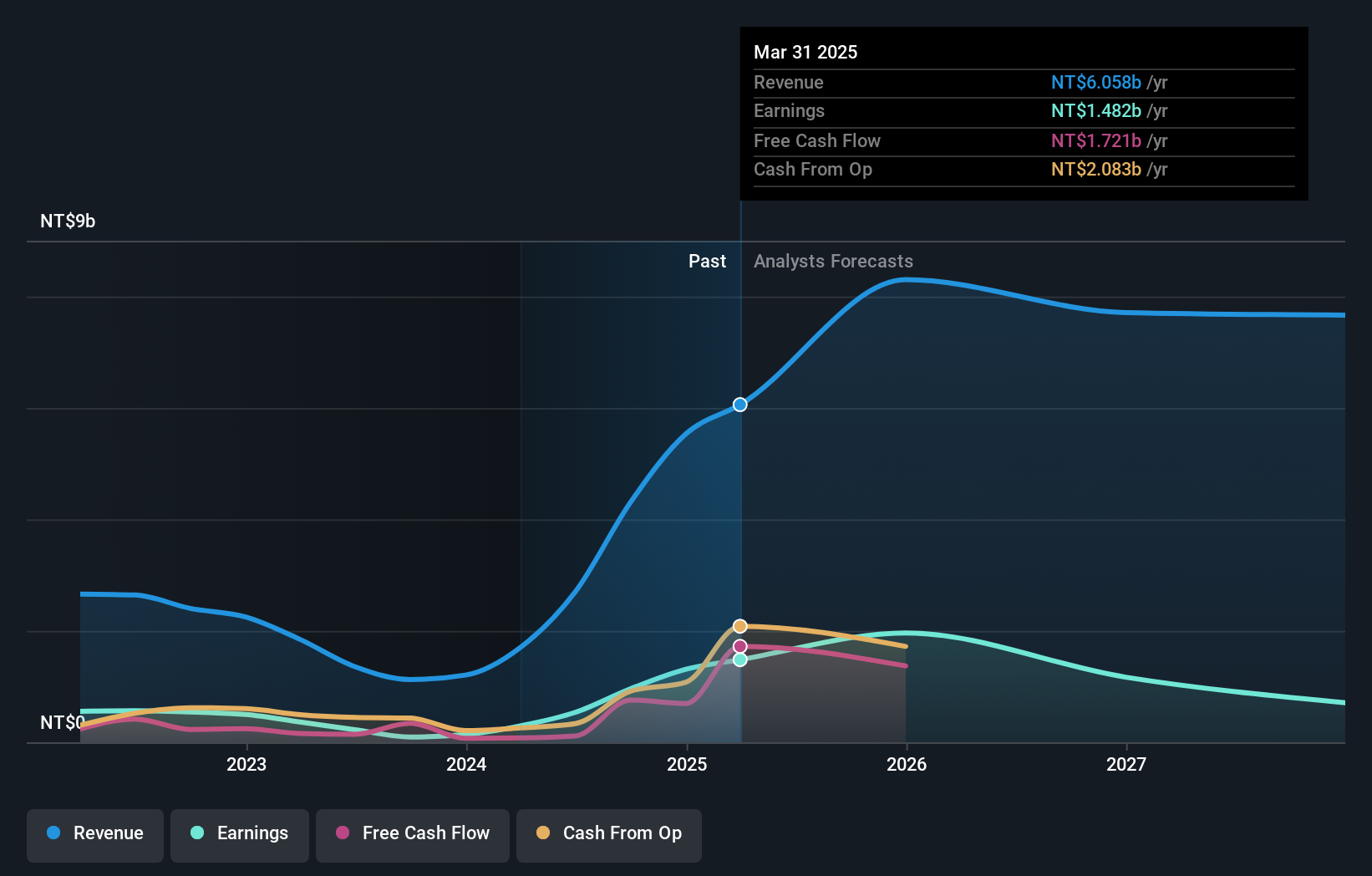

All Ring Tech, a dynamic player in the tech sector, recently showcased impressive growth with earnings surging by 402% over the past year, outpacing its industry peers. The company's financial health appears robust as it holds more cash than total debt and boasts high-quality earnings. Despite a volatile share price in recent months, All Ring Tech's strategic moves include a significant cash dividend of TWD 980 million set for August 2025 and adjustments to convertible bond terms. With Q1 2025 sales at TWD 1.25 billion and net income reaching TWD 342 million, their trajectory seems promising amidst ongoing market activities.

- Take a closer look at All Ring Tech's potential here in our health report.

Review our historical performance report to gain insights into All Ring Tech's's past performance.

Next Steps

- Navigate through the entire inventory of 2639 Asian Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301000

Shanghai Hajime Advanced Material Technology

Shanghai Hajime Advanced Material Technology Co., Ltd.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives