- Netherlands

- /

- Capital Markets

- /

- ENXTAM:VLK

Undiscovered Gems with Strong Potential To Watch This August 2024

Reviewed by Simply Wall St

As global markets react positively to the Federal Reserve's announcement of upcoming interest rate cuts, small-cap stocks have notably outperformed their larger counterparts, buoyed by broad-based gains across major indices. This optimistic sentiment provides a fertile ground for identifying lesser-known stocks with strong potential. In this environment, a good stock is often characterized by solid fundamentals and growth prospects that align well with current economic conditions. Here are three undiscovered gems worth watching this August 2024.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Petrol d.d | 42.18% | 17.56% | -0.49% | ★★★★★★ |

| Mobile Telecommunications | NA | 3.85% | -0.40% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Formula Systems (1985) | 35.62% | 10.91% | 13.89% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 8.04% | -3.72% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Capricorn Group | 63.66% | 7.59% | 9.16% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Sociedad Comercial del Plata (BASE:COME)

Simply Wall St Value Rating: ★★★★★☆

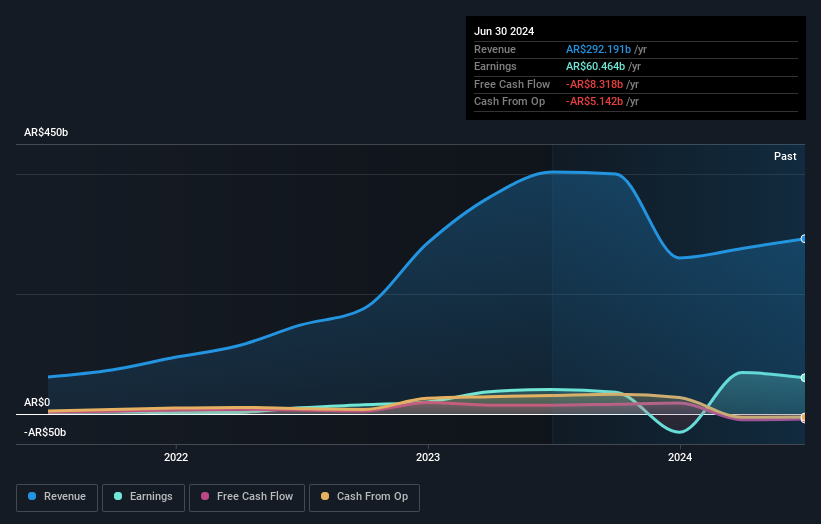

Overview: Sociedad Comercial del Plata S.A. operates in construction, energy, agribusiness, transport and infrastructure, and real estate sectors in Argentina and internationally with a market cap of ARS796.91 billion.

Operations: The company generates revenue primarily from construction (ARS56.89 billion) and oil and by-products (ARS159.98 billion). Segment adjustments amount to ARS75.26 billion, while central administration contributes ARS63.62 million.

Sociedad Comercial del Plata (SCP) has shown impressive growth, with earnings jumping 47.8% over the past year, outpacing the Oil and Gas industry’s 30.4%. The company's price-to-earnings ratio of 13.6x is notably below the AR market average of 19x, suggesting potential undervaluation. SCP's debt to equity ratio has improved from 6.3% to 4.1% over five years, reflecting better financial health. Recent earnings for H1 2024 reported net income at ARS119,889 million compared to ARS29,057 million a year ago, highlighting significant profitability gains.

- Unlock comprehensive insights into our analysis of Sociedad Comercial del Plata stock in this health report.

Learn about Sociedad Comercial del Plata's historical performance.

Van Lanschot Kempen (ENXTAM:VLK)

Simply Wall St Value Rating: ★★★★★☆

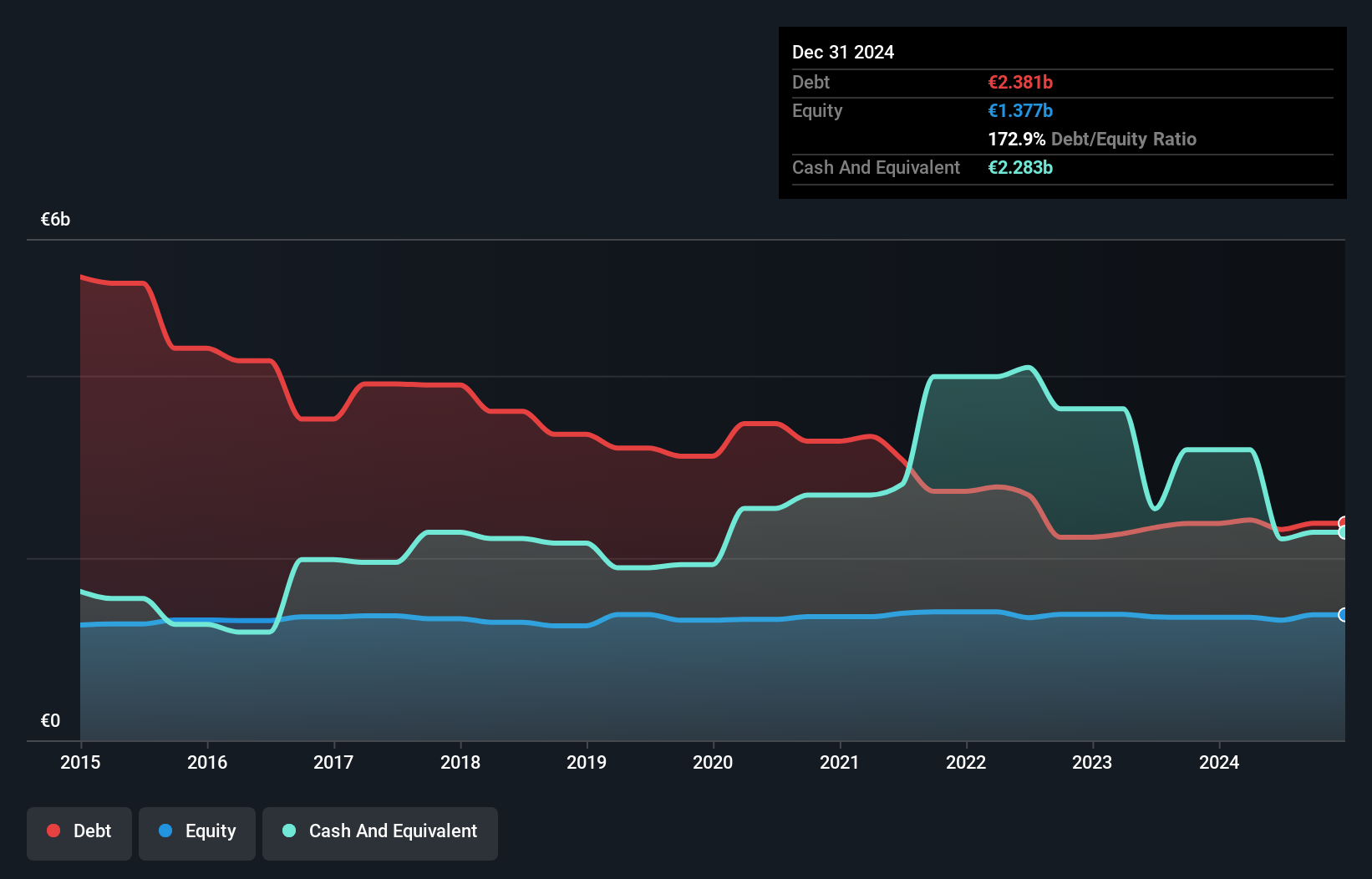

Overview: Van Lanschot Kempen NV provides various financial services in the Netherlands and internationally, with a market cap of €1.77 billion.

Operations: Van Lanschot Kempen NV generates revenue primarily from investment banking clients, contributing €46.50 million. The company has a market cap of €1.77 billion and also reports segment adjustments amounting to €600.40 million.

Van Lanschot Kempen, with total assets of €16.8B and equity of €1.3B, has shown robust earnings growth of 71.3% over the past year, outpacing the Capital Markets industry's 15.4%. Total deposits stand at €12.8B while loans are at €9.2B, with a net interest margin of 1.2%. The company reported half-year net income of €68.8M for June 2024, up from €48.4M in the previous year, reflecting strong performance amidst a challenging market environment.

- Click to explore a detailed breakdown of our findings in Van Lanschot Kempen's health report.

Assess Van Lanschot Kempen's past performance with our detailed historical performance reports.

Lotus's Retail Growth Freehold and Leasehold Property Fund (SET:LPF)

Simply Wall St Value Rating: ★★★★☆☆

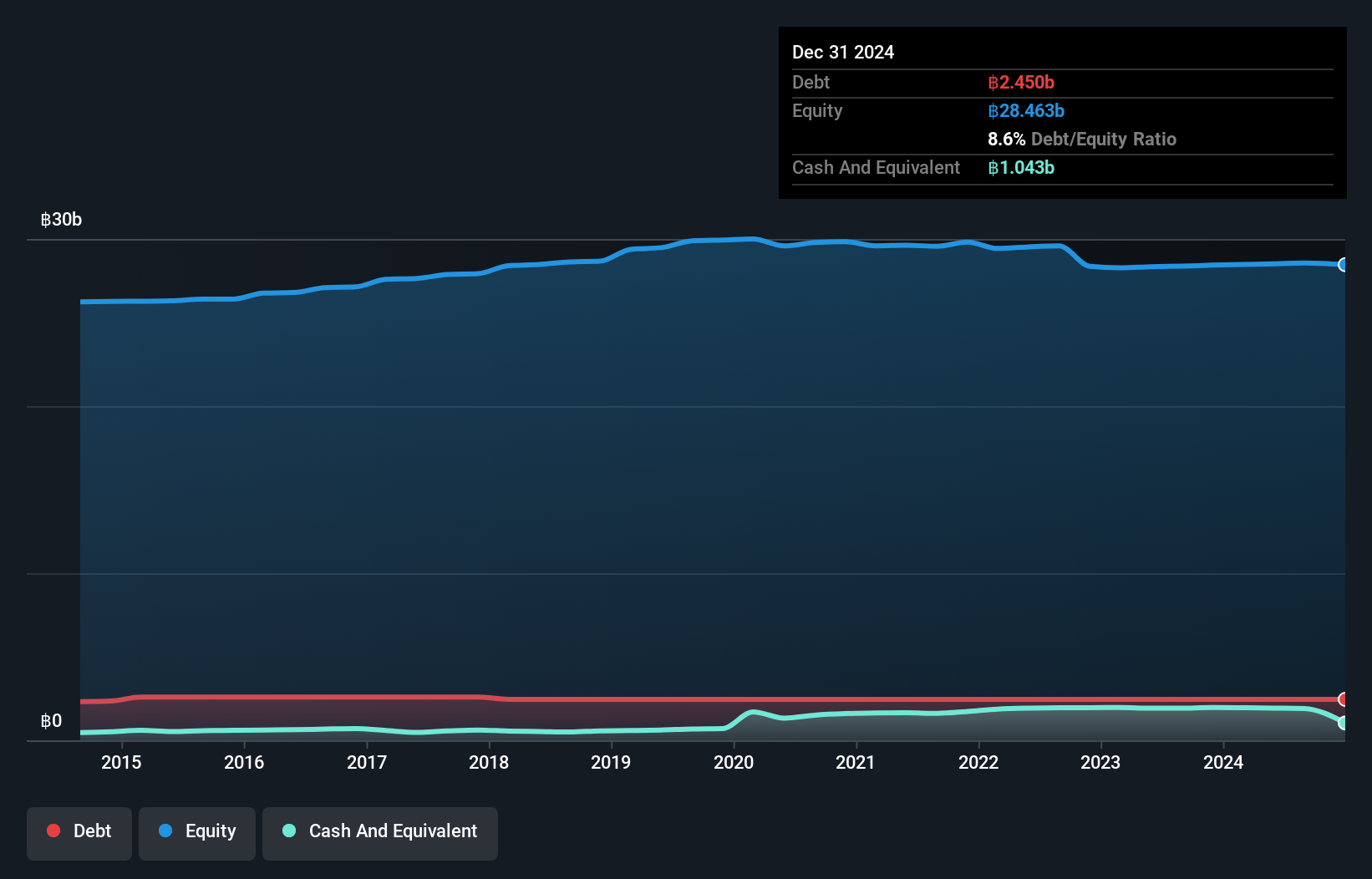

Overview: Lotus's Retail Growth Freehold and Leasehold Property Fund (SET:LPF) specializes in investments in freehold and leasehold of 17 shopping malls anchored by a Tesco Lotus hypermarket, with a market cap of THB31.55 billion.

Operations: LPF generates revenue primarily from its investments in 17 shopping malls, totaling THB2.94 billion. The fund's market cap stands at THB31.55 billion.

Lotus's Retail Growth Freehold and Leasehold Property Fund has shown impressive earnings growth of 197.4% over the past year, outperforming the Retail REITs industry’s 15.8%. EBIT covers interest payments by a robust 21.9x, indicating strong financial health. Trading at 20% below its estimated fair value, it presents an attractive investment opportunity. Despite a slight increase in debt to equity ratio from 8.3% to 8.6%, the net debt to equity remains satisfactory at just 1.8%.

Key Takeaways

- Click through to start exploring the rest of the 4906 Undiscovered Gems With Strong Fundamentals now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:VLK

Van Lanschot Kempen

Provides various financial services in the Netherlands and internationally.

Solid track record with excellent balance sheet.