As global markets continue to navigate a complex landscape marked by rising inflation and fluctuating interest rates, U.S. stock indexes have climbed toward record highs, with the Nasdaq Composite leading gains. In this context, investors often seek opportunities that combine potential growth with financial resilience. Penny stocks, though an outdated term for some, remain relevant as they represent smaller or newer companies that can offer significant growth potential when supported by strong financial health. Let's explore several penny stocks that stand out for their robust balance sheets and long-term promise.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.86 | HK$44.31B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.32 | MYR890.29M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.22 | THB2.53B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.865 | £468.01M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.00 | £319.11M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.956 | £152.99M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$145.87M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.185 | £307.32M | ★★★★☆☆ |

Click here to see the full list of 5,694 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Cairo Communication (BIT:CAI)

Simply Wall St Financial Health Rating: ★★★★☆☆

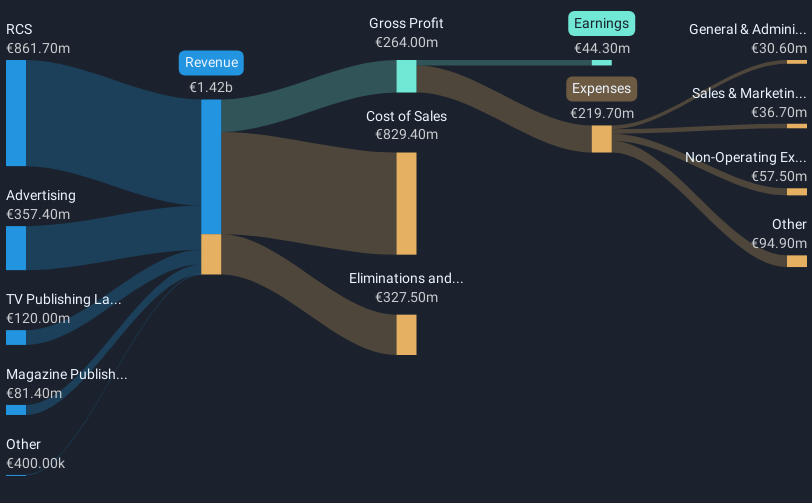

Overview: Cairo Communication S.p.A. is a communication company operating mainly in Italy and Spain, with a market cap of €356.87 million.

Operations: The company's revenue is primarily derived from RCS (€861.7 million), advertising (€357.4 million), magazine publishing through Cairo Editore (€81.4 million), and TV publishing via La7 and network operations (€120 million).

Market Cap: €356.87M

Cairo Communication S.p.A. presents a compelling case within the penny stock category, with its market cap at €356.87 million and diverse revenue streams across RCS, advertising, magazine publishing, and TV operations. The company has demonstrated financial resilience by reducing its debt to equity ratio from 28.5% to 5.9% over five years and maintaining more cash than total debt. Earnings have grown significantly at 28% over the past year, surpassing both its historical average and industry growth rates. However, short-term assets do not cover liabilities (€54M vs €62.5M), posing potential liquidity challenges despite strong earnings growth and stable weekly volatility (3%).

- Dive into the specifics of Cairo Communication here with our thorough balance sheet health report.

- Learn about Cairo Communication's future growth trajectory here.

First Shanghai Investments (SEHK:227)

Simply Wall St Financial Health Rating: ★★★★☆☆

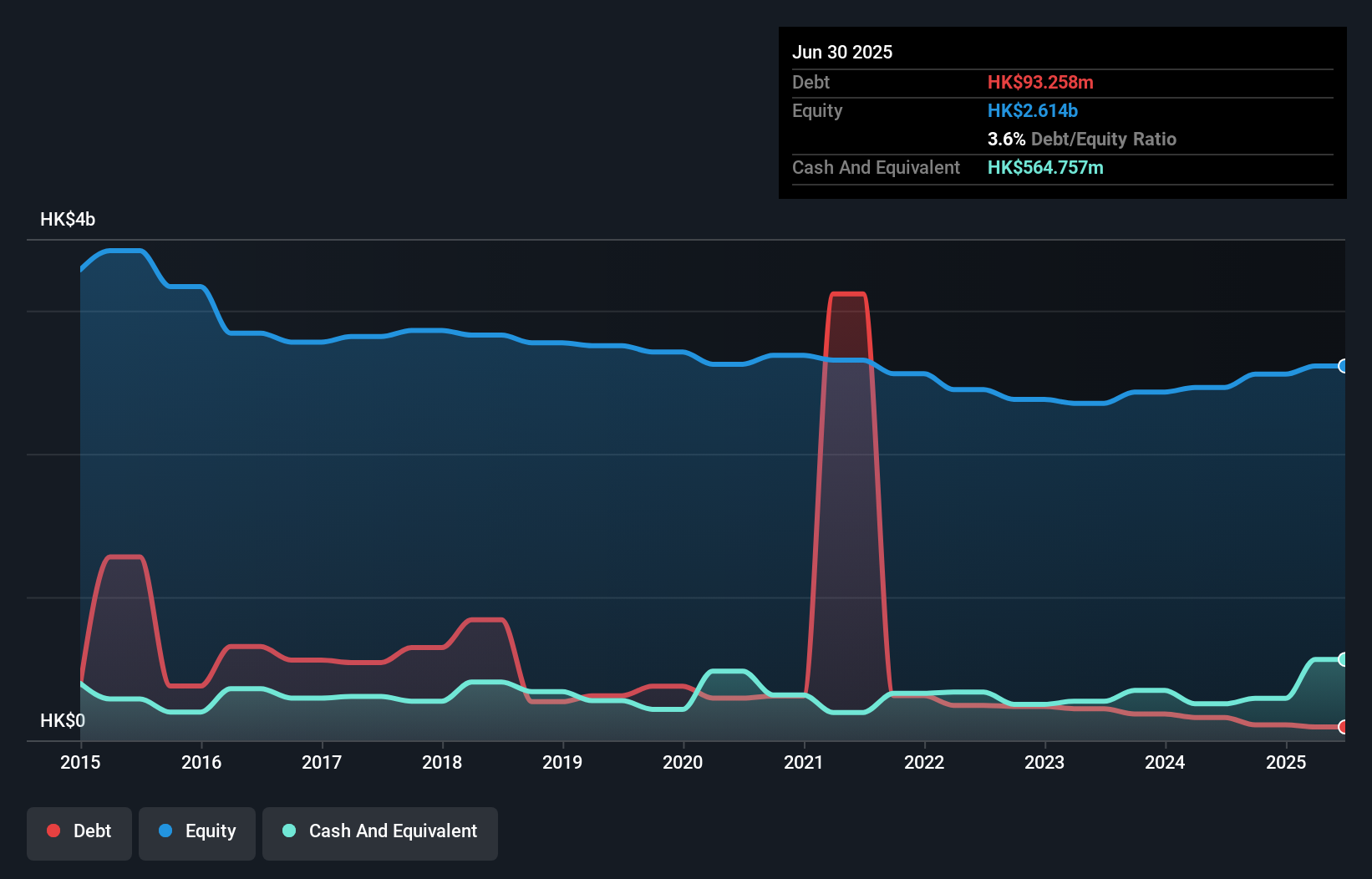

Overview: First Shanghai Investments Limited is an investment holding company involved in financial services, direct investments, and property and hotel development across Hong Kong, the People’s Republic of China, and France with a market cap of HK$635.30 million.

Operations: The company generates revenue through its financial services (HK$151.04 million), property development (HK$56.18 million), and property investment and hotel segments (HK$150.92 million).

Market Cap: HK$635.3M

First Shanghai Investments Limited, with a market cap of HK$635.30 million, has become profitable in the past year, highlighting its potential within the penny stock segment. The company benefits from diverse revenue streams across financial services (HK$151.04 million), property development (HK$56.18 million), and property investment and hotel segments (HK$150.92 million). Its strong liquidity position is evidenced by short-term assets of HK$4.1 billion exceeding both short-term liabilities of HK$2.8 billion and long-term liabilities of HK$105.1 million. Despite low return on equity at 2.4% and negative operating cash flow, debt management remains prudent with more cash than total debt and reduced debt-to-equity ratio over five years to 6.5%.

- Click to explore a detailed breakdown of our findings in First Shanghai Investments' financial health report.

- Understand First Shanghai Investments' track record by examining our performance history report.

Thai Eastern Group Holdings (SET:TEGH)

Simply Wall St Financial Health Rating: ★★★★☆☆

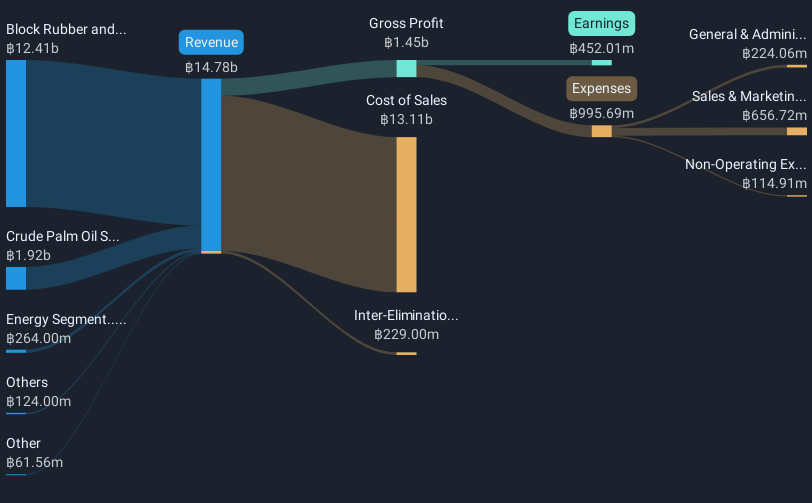

Overview: Thai Eastern Group Holdings Public Company Limited operates in the rubber, palm oil, renewable energy and organic waste management, and logistics sectors in Thailand and internationally, with a market cap of approximately THB3.74 billion.

Operations: The company's revenue is primarily derived from its Block Rubber and Concentrated Latex Segment at THB12.41 billion, followed by the Crude Palm Oil Segment generating THB1.92 billion, and the Energy Segment contributing THB264 million.

Market Cap: THB3.74B

Thai Eastern Group Holdings, with a market cap of THB3.74 billion, presents a mixed picture in the penny stock landscape. The company shows potential through its diverse revenue streams, primarily from Block Rubber and Concentrated Latex (THB12.41 billion) and Crude Palm Oil (THB1.92 billion). Despite a low return on equity at 12.7%, earnings growth has accelerated significantly by 46.2% over the past year, surpassing industry averages. However, concerns arise from negative operating cash flow and high net debt to equity ratio at 114.9%. Short-term assets comfortably cover both short-term and long-term liabilities, providing some financial stability amidst volatility concerns.

- Click here and access our complete financial health analysis report to understand the dynamics of Thai Eastern Group Holdings.

- Evaluate Thai Eastern Group Holdings' prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Dive into all 5,694 of the Penny Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thai Eastern Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:TEGH

Thai Eastern Group Holdings

Engages in the rubber, palm oil, renewable energy and organic waste management, and logistics businesses in Thailand and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives